ATR Stop Loss MT4

$30 Original price was: $30.$29Current price is: $29.

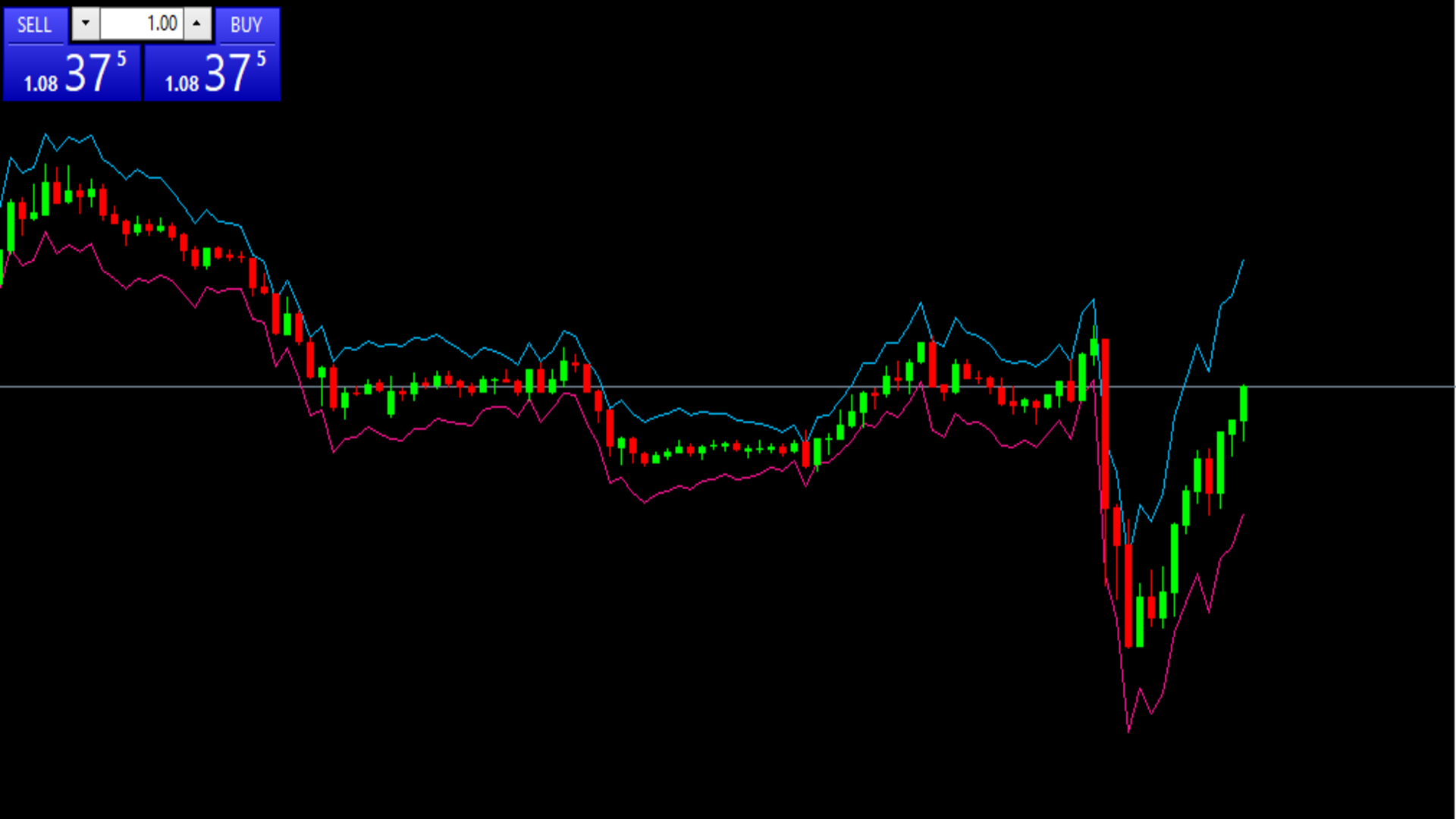

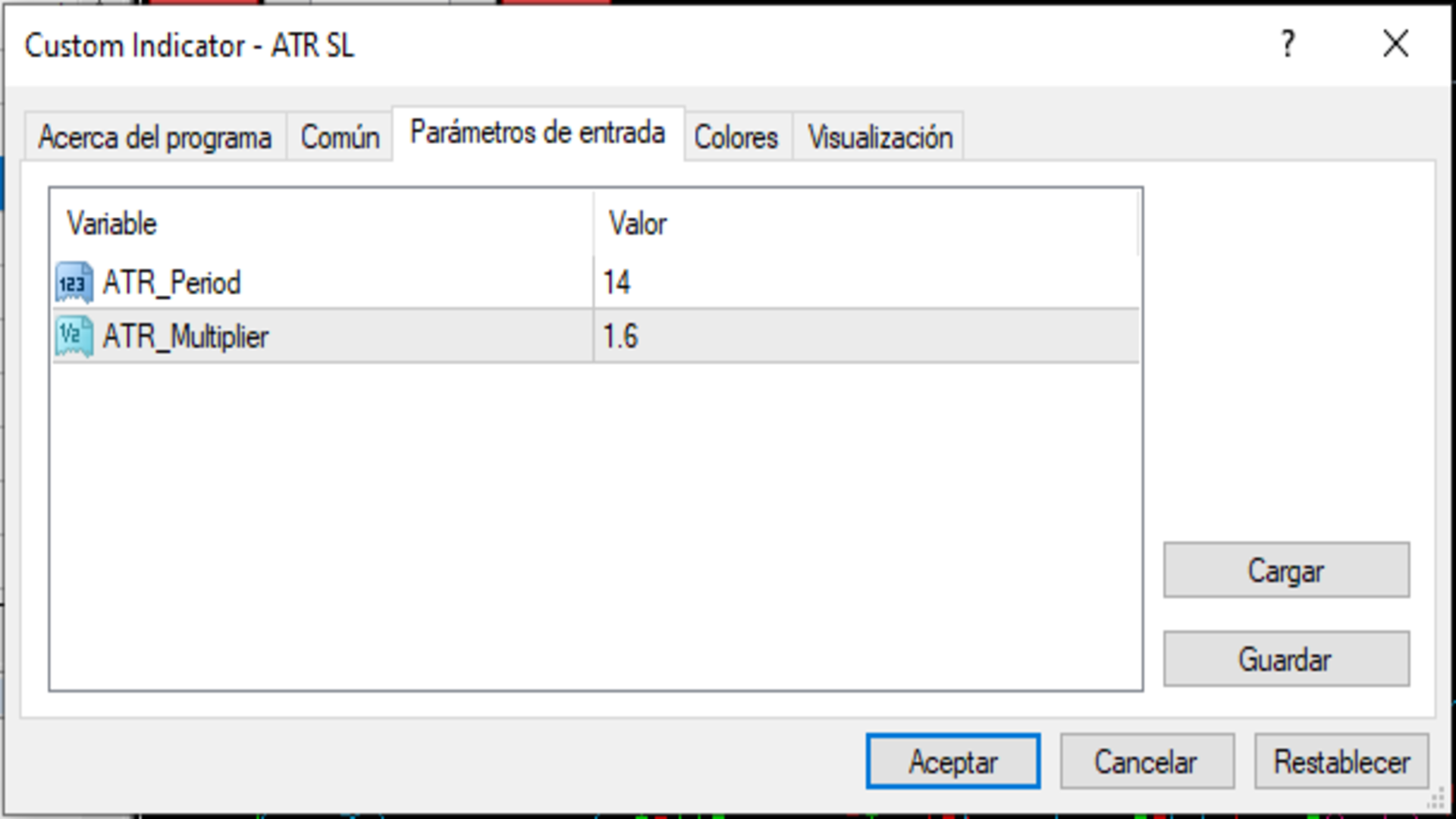

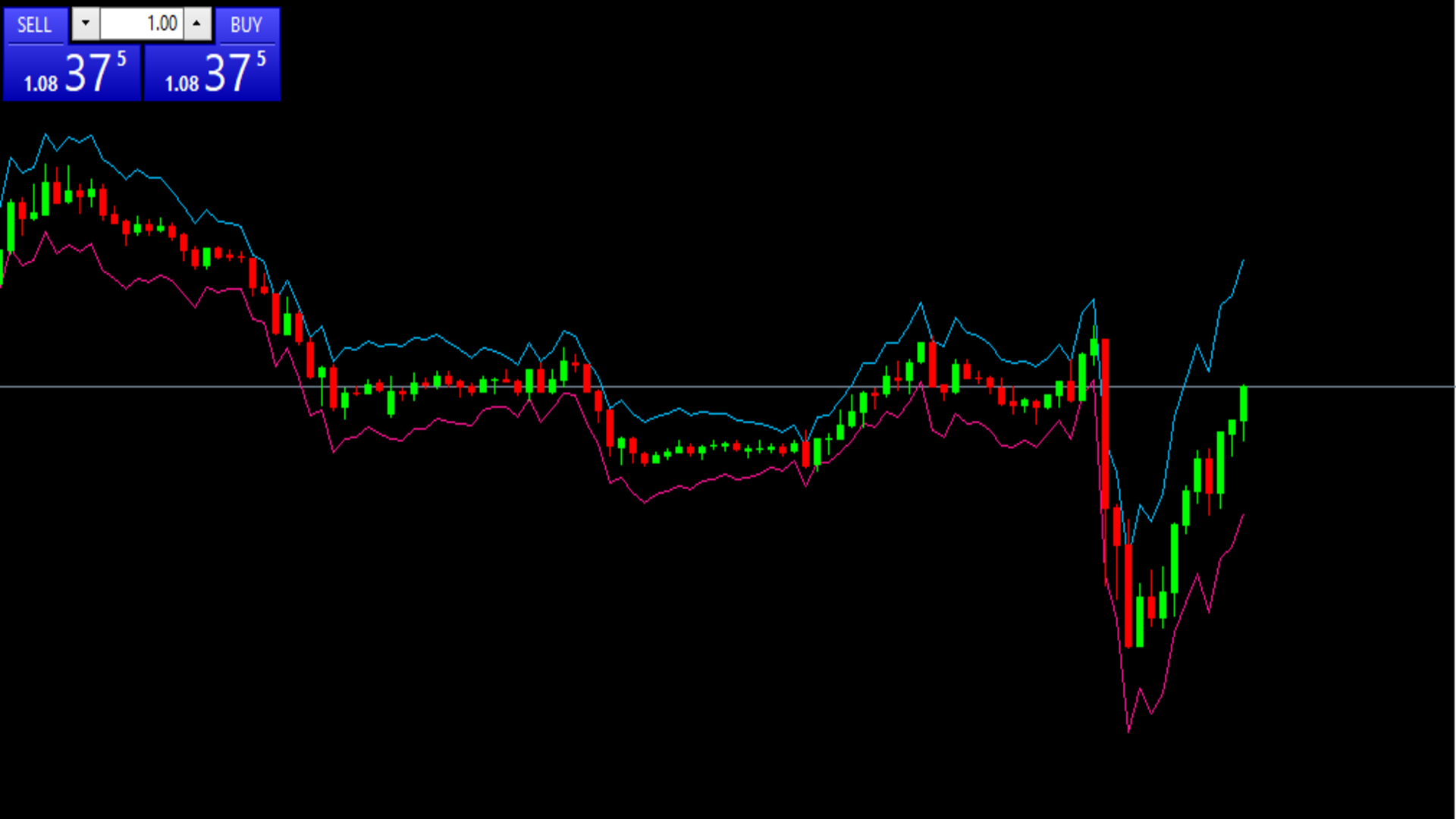

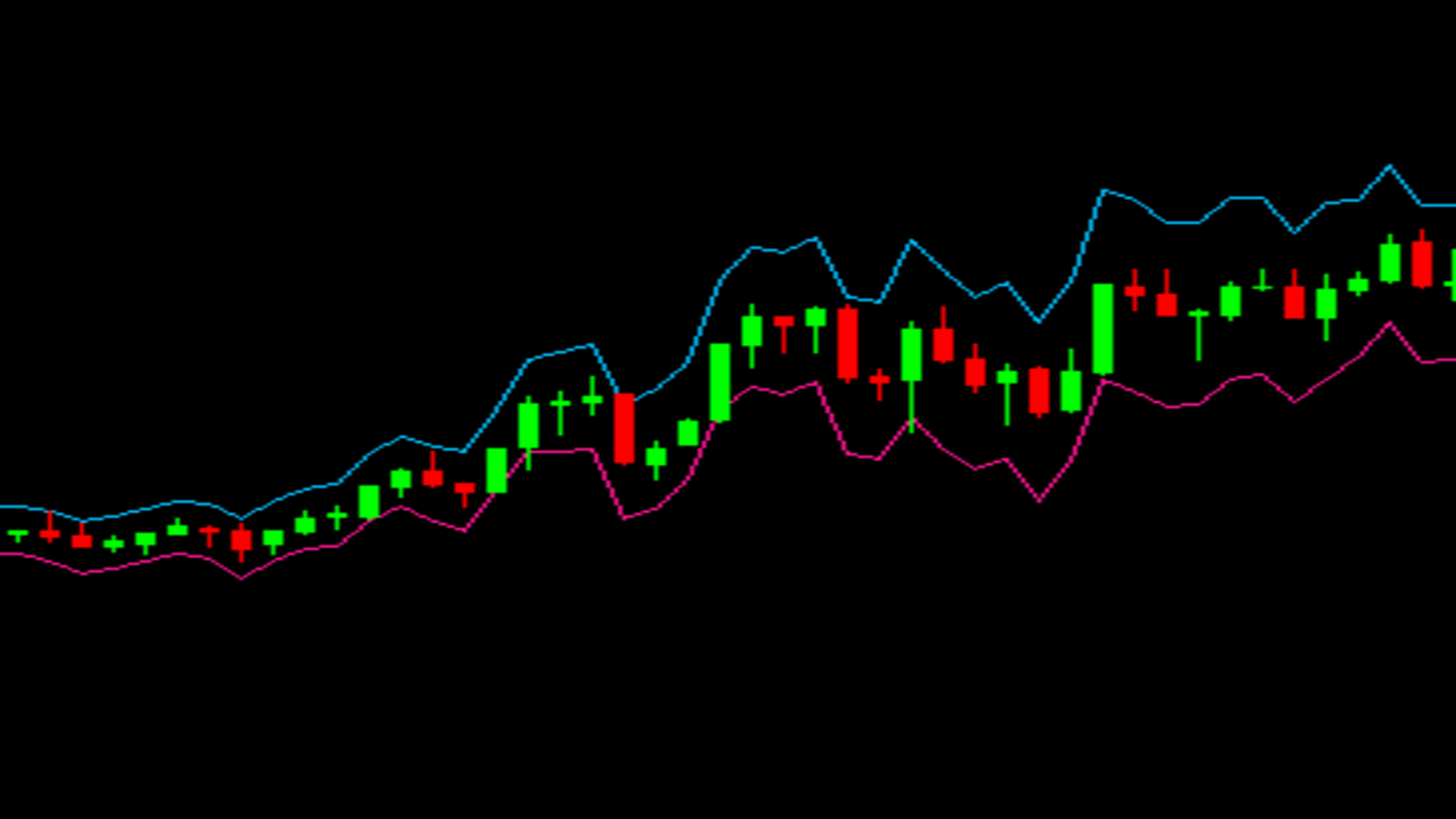

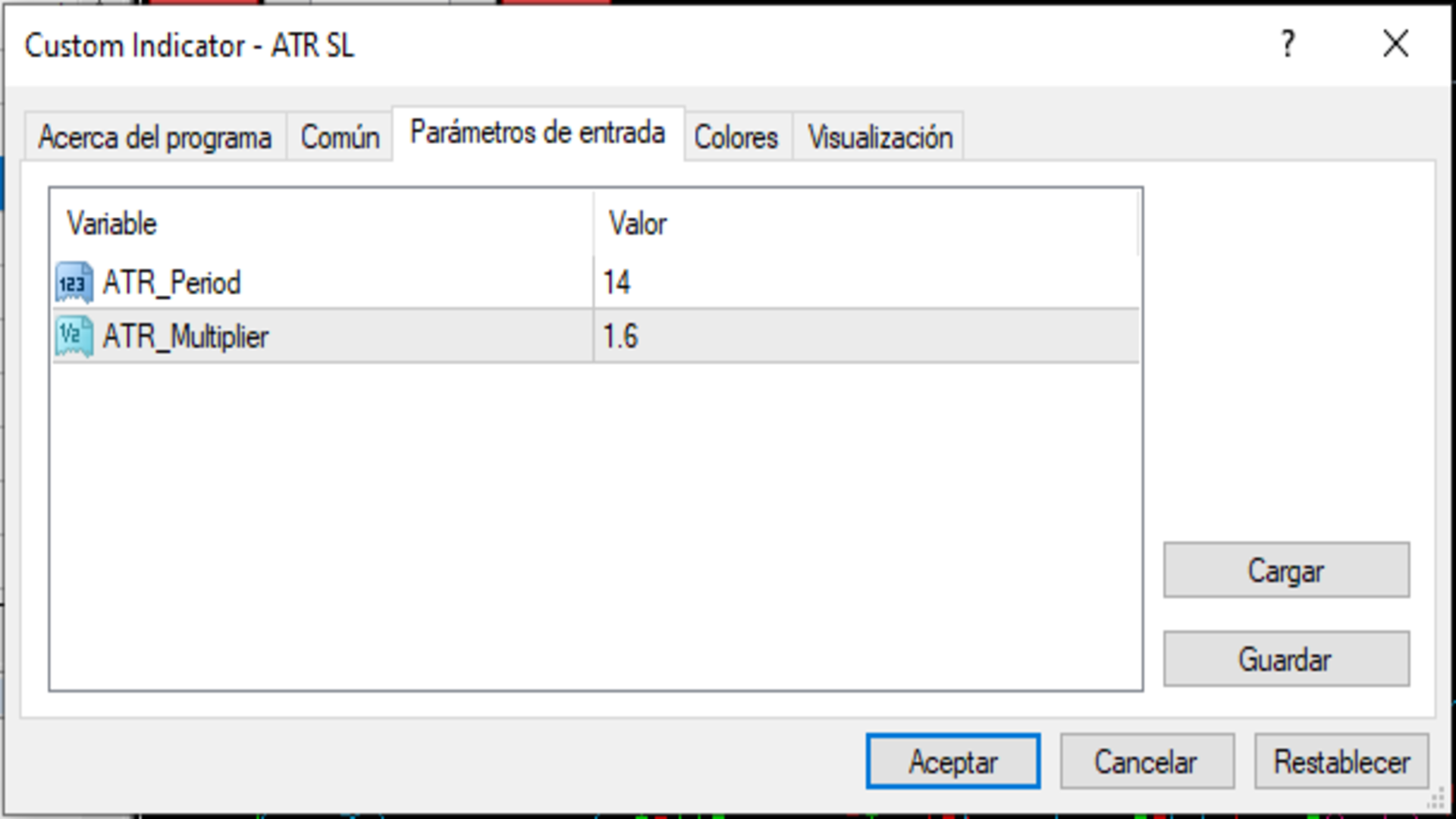

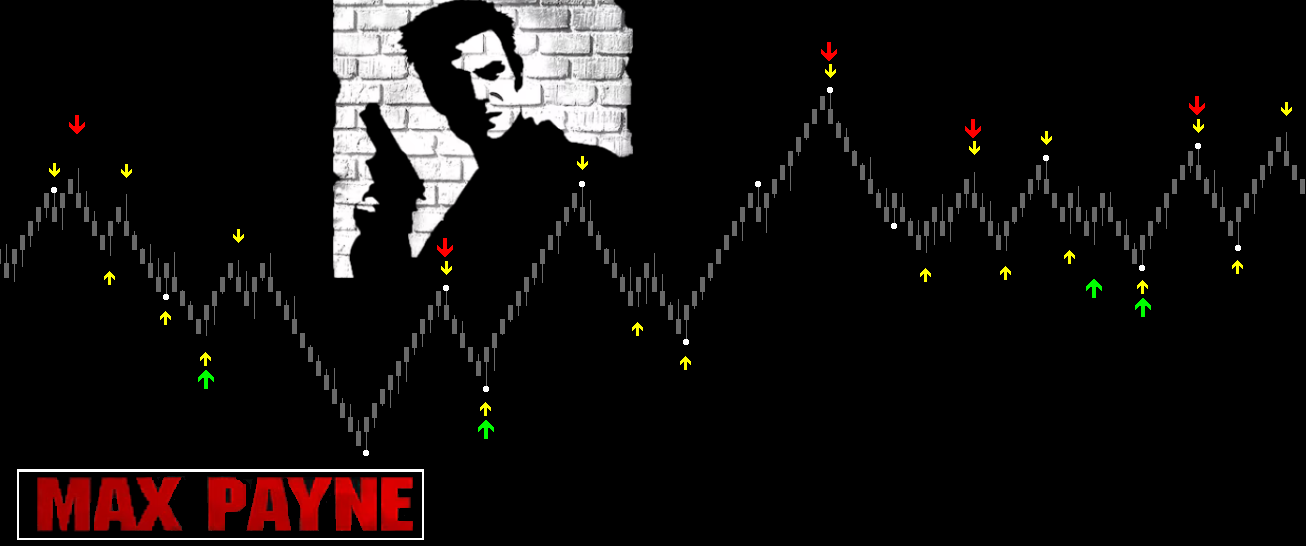

ATR Stop Loss MT4 is an indicator that utilizes the Average True Range (ATR) to determine optimal Stop Loss and Take Profit levels based on market volatility. It can be customized with an ATR period, multiplier, and color settings to suit individual trading styles, applicable across all timeframes and charts.

Advantages of ATR Stop Loss MT4

The ATR Stop Loss indicator for MetaTrader 4 (MT4) offers several significant advantages for traders of all experience levels. By leveraging the Average True Range (ATR) indicator, it provides a more adaptable approach to managing risk in volatile market conditions. Here are some key benefits:

1. Customizable Stop Loss and Take Profit Levels

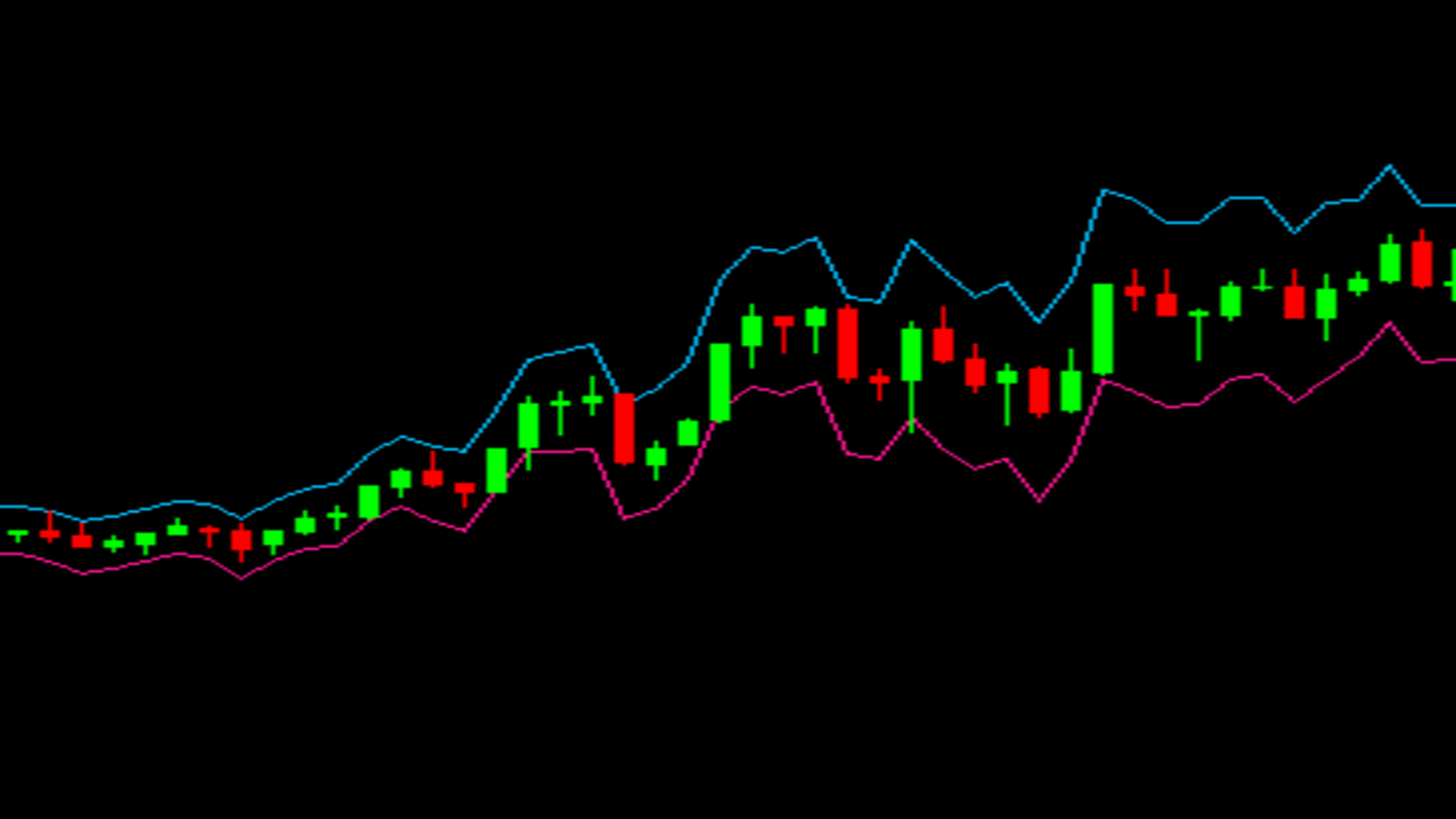

The ATR Stop Loss indicator calculates and visually represents optimal points for placing Stop Loss and Take Profit orders based on current market volatility. This dynamic approach helps traders navigate varying market conditions, enhancing their ability to enter and exit trades effectively.

2. Adaptability Across Temporalities and Charts

This indicator is versatile and can be applied to all timeframes and charts. Whether a trader is focusing on short-term scalping or long-term investing, the ATR Stop Loss adapts to their preferred trading style, providing relevant data on each chart.

3. Risk Management

Using the ATR Multiplier, traders can adjust their risk level. A lower multiplier may allow for higher potential profits but comes with increased risk, while a higher multiplier can offer greater safety in trade execution. This flexibility enables traders to tailor risk management strategies according to their individual preferences and market conditions.

4. Enhanced Visual Representation

The ability to customize indicator colors adds a personal touch to the trading experience. Traders can set their preferred color schemes to enhance chart readability and quickly identify Stop Loss and Take Profit levels.

5. Improved Decision Making

By basing Stop Loss and Take Profit levels on the ATR, traders can make more informed decisions that reflect actual market behavior rather than arbitrary levels. This leads to a more strategic approach to trading, reducing emotional decision-making and enhancing overall performance.

Conclusion

Incorporating the ATR Stop Loss indicator into your trading toolbox can significantly improve your risk management and trading strategy. Its customizable features, adaptability, and focus on market volatility position it as a valuable asset for both novice and experienced traders alike.

Reviews

There are no reviews yet.