AW Equity Protection MT4

$35 Original price was: $35.$29Current price is: $29.

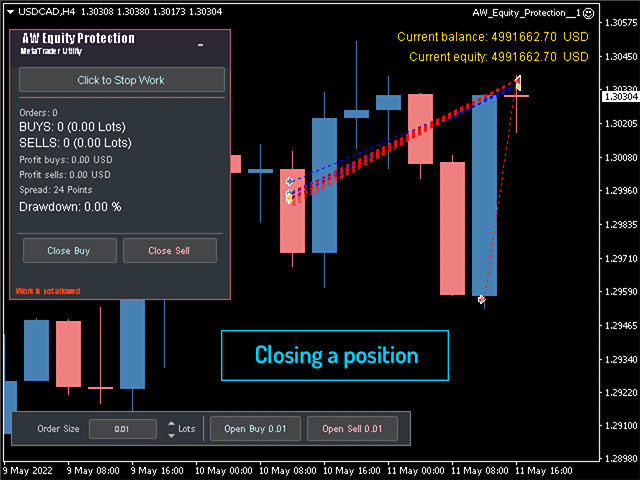

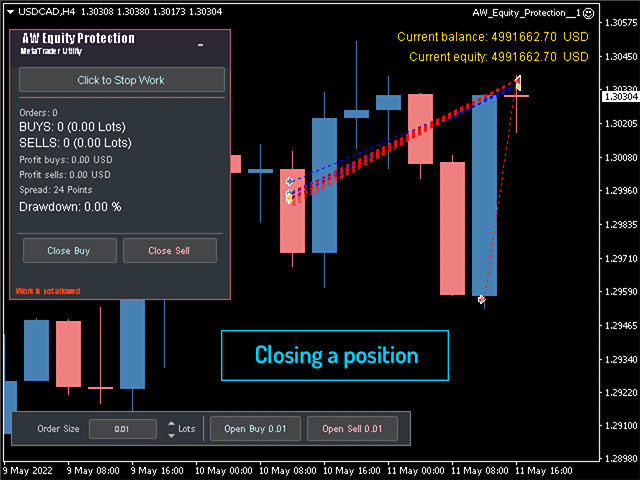

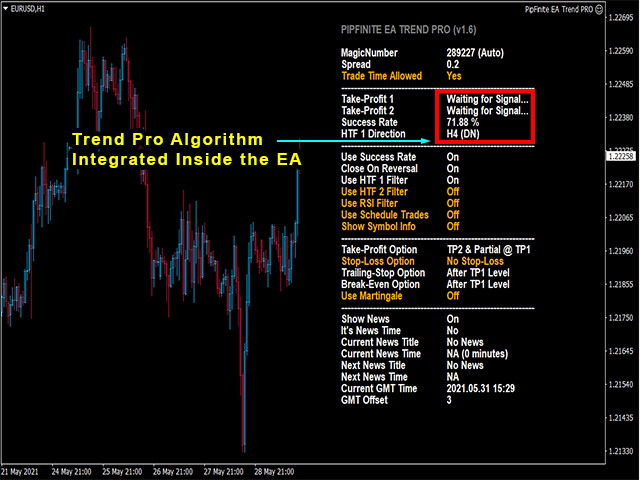

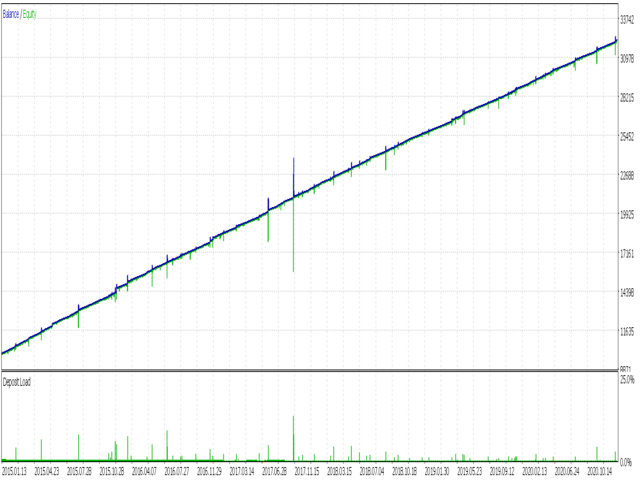

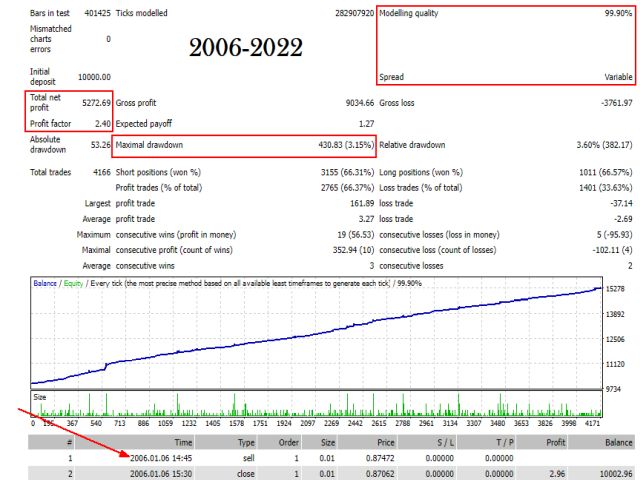

AW Equity Protection for MT4 is a utility that monitors and manages other expert advisors, aiming to prevent drawdowns. It can lock or close losing positions, delete pending orders, and send notifications. Operating from a single chart, it allows for customizable settings, making it easy to adapt to various trading strategies.

Advantages of AW Equity Protection for MT4

The AW Equity Protection utility offers several strategic advantages for traders using the MetaTrader 4 platform. Its primary function is to monitor the activities of other Expert Advisors (EAs) on various instruments, thereby assisting in the prevention of drawdowns on a trading account deposit. Here are some key benefits:

1. Proactive Drawdown Management

The utility actively analyzes the performance of other EAs in real-time. If the specified parameters are exceeded, Equity Protection can swiftly lock or close a losing position and notify the trader of this action. This proactive approach helps mitigate potential losses before they escalate.

2. Easy Implementation

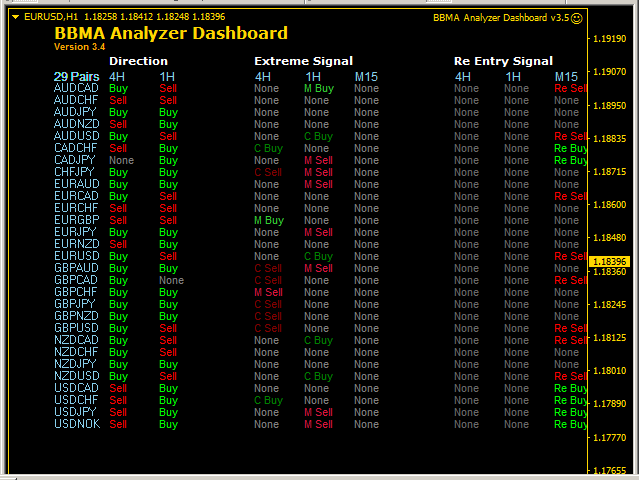

AW Equity Protection is designed for user-friendliness. It requires only a single chart upload to monitor all instruments across the account. This simplifies the process for traders who often juggle multiple positions across different currency pairs.

3. Customizable Settings

The utility allows for extensive customization, enabling users to choose specific magic numbers or apply its functions across all magic numbers. It can be set to work on the current symbol or across all symbols, offering flexibility to suit different trading strategies.

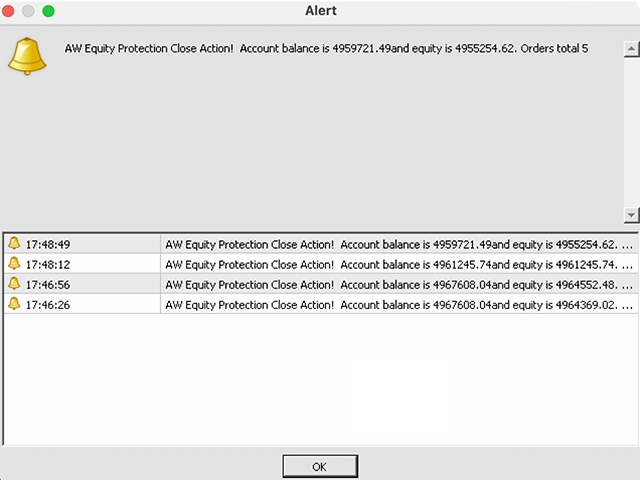

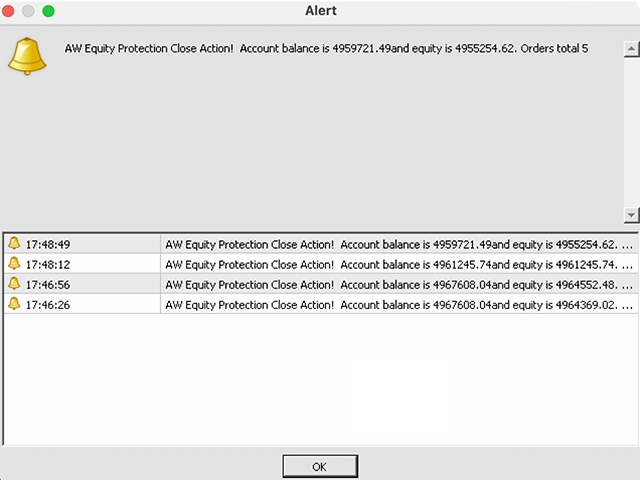

4. Notifications and Alerts

Traders can receive notifications via push messages, emails, or pop-up alerts whenever an action is taken on the account. This feature ensures that users remain informed about critical events and can react promptly, even when not actively monitoring the trading platform.

5. Control Over Other EAs

AW Equity Protection provides the option to disable other EAs on all symbols or just the current one when a certain loss threshold is reached. This capability is vital for managing risk and curbing further losses during adverse market conditions.

6. Management of Pending Orders

In addition to managing open positions, the utility can delete pending orders when a predefined loss is observed. This prevents unnecessary exposure to further risks and ensures that the trader’s account remains protected.

7. Manual Control Through Customizable Panels

The utility includes a customizable panel, enabling manual actions to be performed directly from the interface. Traders can adjust panel size, font, and other settings, providing a personalized and efficient trading experience.

8. Comprehensive Risk Management

By setting loss limits in both monetary terms and as percentages, traders can define their risk parameters. The utility acts according to these settings, ensuring that the account is safeguarded based on the trader’s risk tolerance.

Conclusion

Overall, AW Equity Protection for MT4 is an essential tool for traders looking to enhance their risk management strategies. Its ability to monitor multiple EAs, notify users promptly, and provide customizable features makes it a valuable asset in any trader’s toolkit.

Reviews

There are no reviews yet.