Consolidations Analysis MT4

$30 Original price was: $30.$29Current price is: $29.

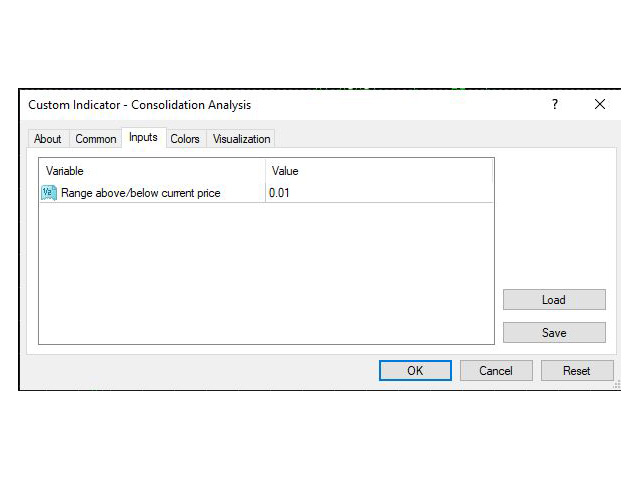

Consolidations Analysis MT4 identifies price ranges based on the current bid price and a specified parameter. It creates 10 bands above and below the bid, displaying the count of closed prices within each range. This analysis helps traders understand historical price consolidation, aiding in predicting future price movements.

Advantages of Consolidations Analysis MT4

Consolidations Analysis MT4 offers several benefits to traders looking for clarity and insight in their trading decisions. By analyzing consolidation ranges based on current bid prices, this tool enhances market analysis and trading strategies. Here are some key advantages:

1. Enhanced Market Structure Understanding

Consolidation analysis allows traders to visualize historical price consolidation levels. This understanding of past price behavior aids in predicting future market movements, enabling more informed trading decisions.

2. Customizable Input Parameters

The tool provides flexibility through customizable input parameters. Traders can adjust the default setting (e.g., .01) to match their trading style, whether they are focusing on scalping or longer-term positions, making it adaptable for various strategies.

3. Clear Visualization of Price Ranges

By showing 10 consolidation bands above and below the current bid price, the tool offers a clear visual representation of potential support and resistance levels. This can help traders identify key areas to enter or exit trades.

4. Historical Data Insights

The analysis counts closed prices within each defined range, presented conveniently on the screen. This historical data provides insights into price behavior over time, highlighting areas where price has previously consolidated, which is crucial for understanding market dynamics.

5. Strategic Trade Planning

With the information provided by the Consolidation Analysis tool, traders can plan their trades more strategically. Knowing where price has consolidated in the past allows traders to set entry and exit points with greater confidence, ultimately improving risk management.

6. Improved Risk Management

By understanding key consolidation levels, traders can make informed decisions on stop-loss and take-profit levels, thus enhancing their overall risk management strategies and potentially increasing profitability.

7. Timely Decision Making

Real-time analysis of consolidation levels allows traders to respond promptly to market changes. This agility in decision-making is crucial in the fast-paced trading environment, ensuring they capitalize on market opportunities as they arise.

Overall, Consolidations Analysis MT4 serves as a valuable tool for traders, enhancing their ability to assess market conditions and make more strategic trading decisions.

Reviews

There are no reviews yet.