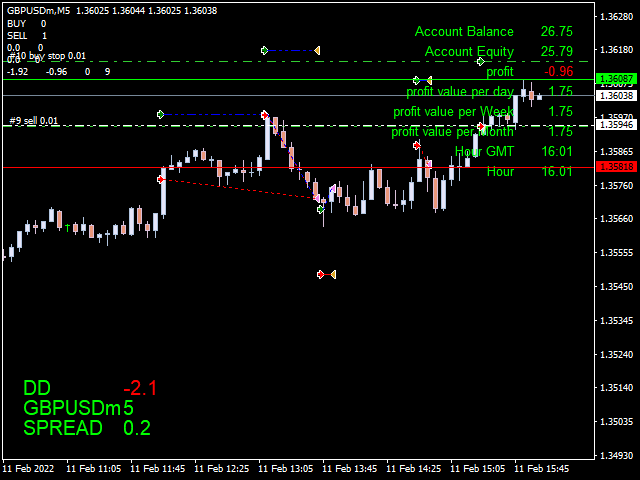

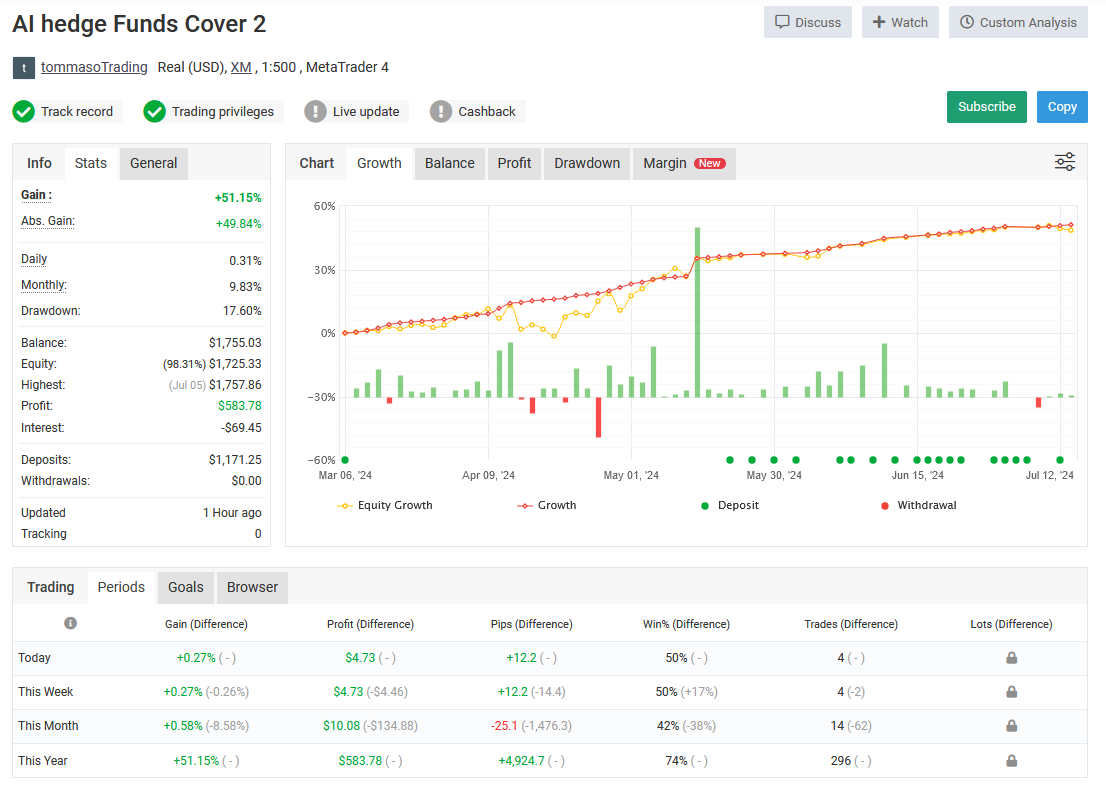

Daily Candles on the lower time frames chart MT4

$30 Original price was: $30.$29Current price is: $29.

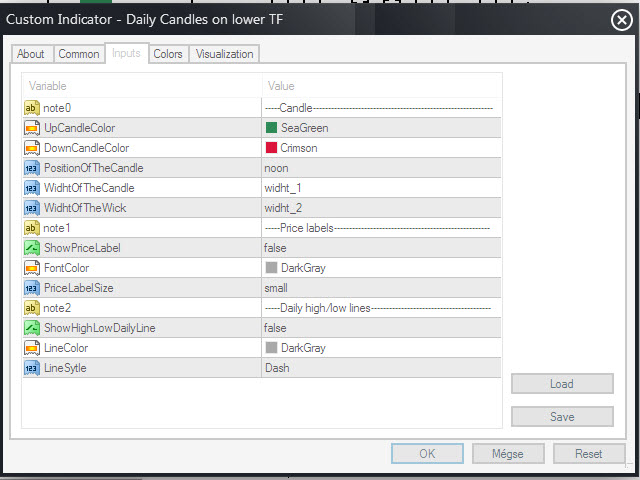

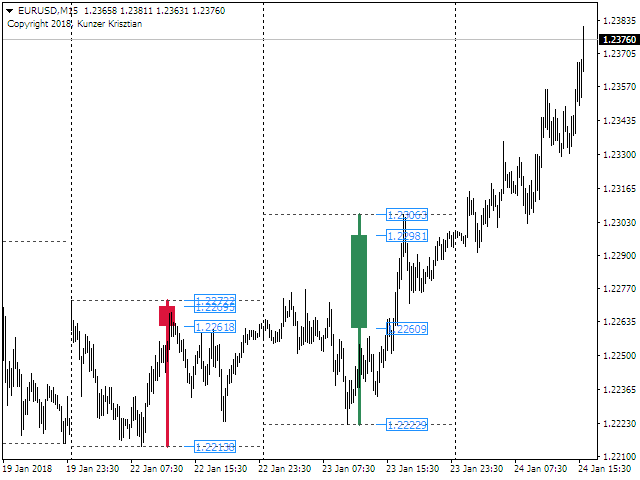

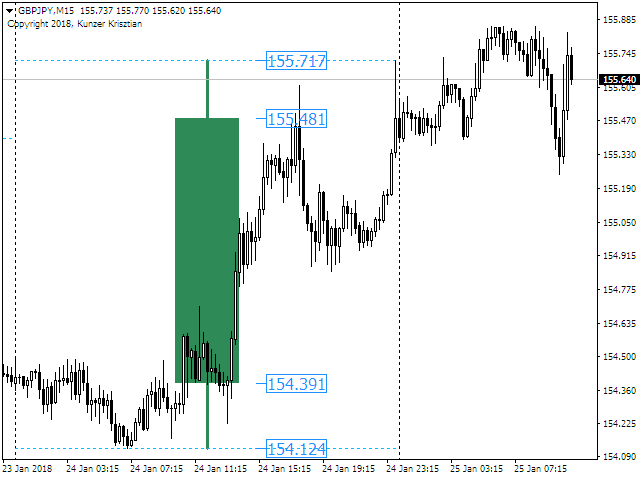

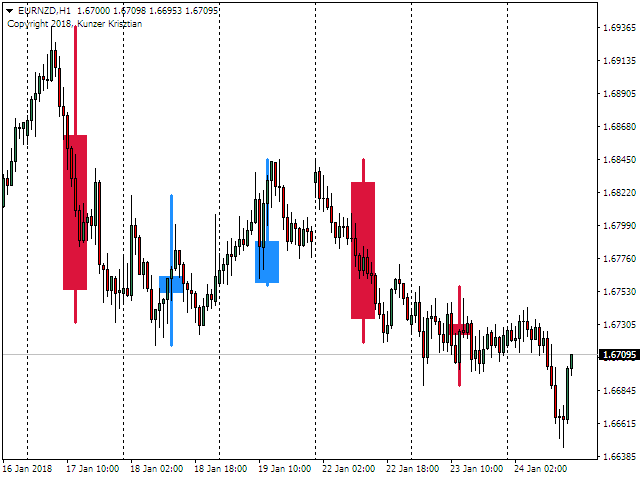

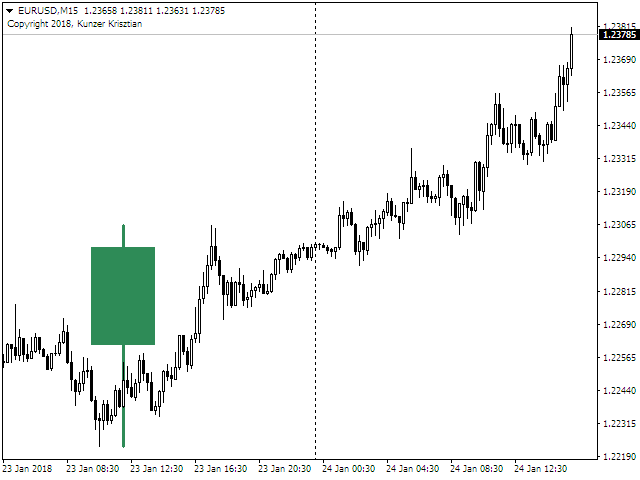

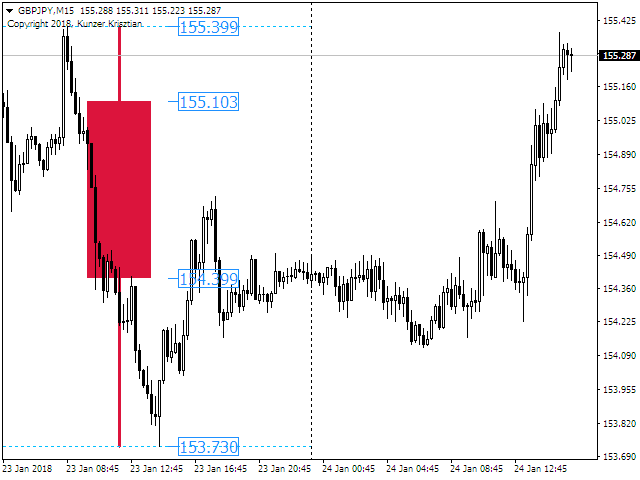

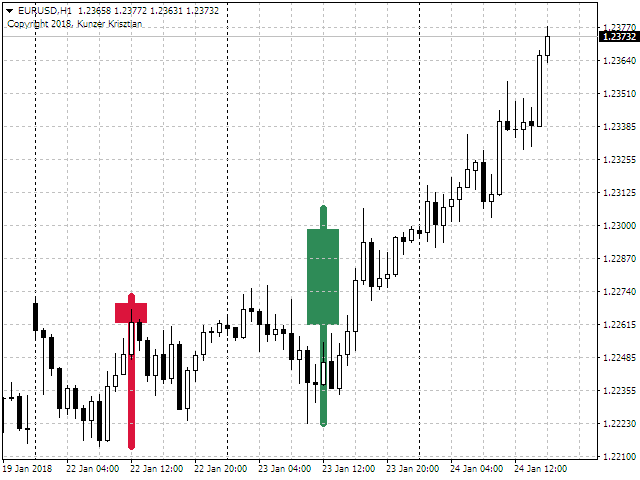

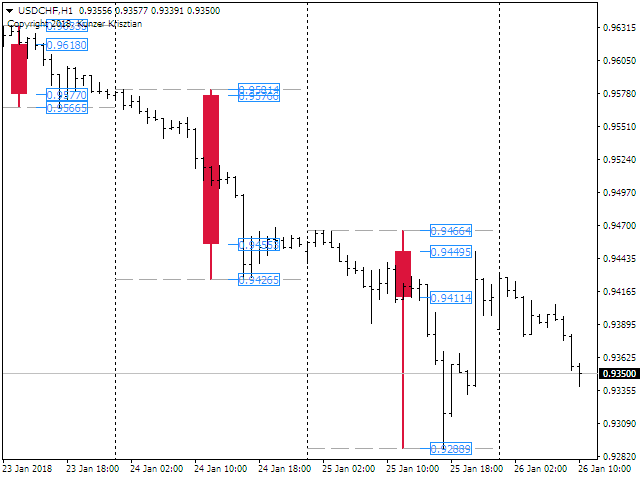

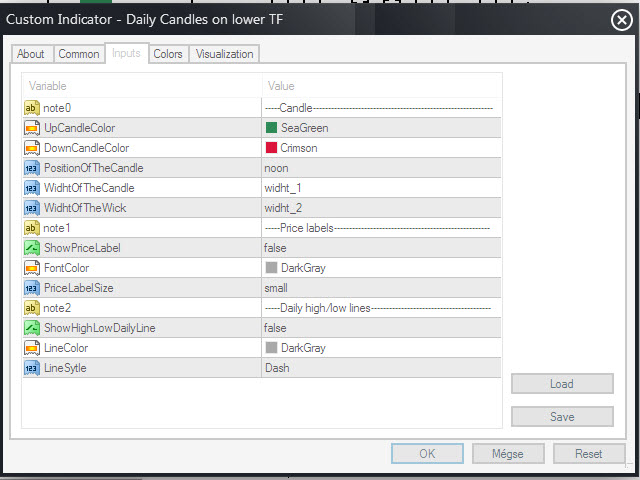

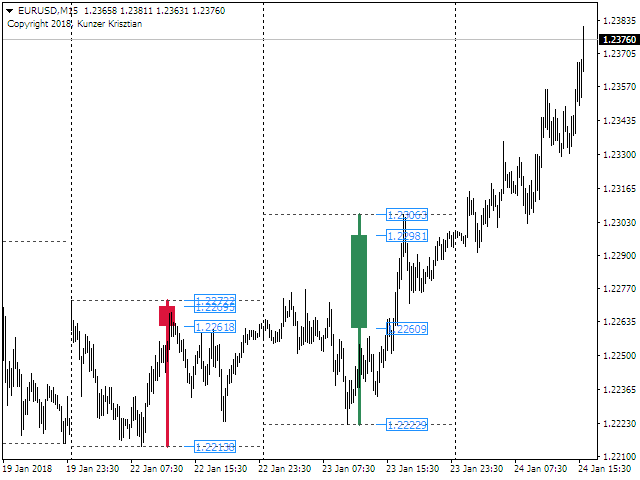

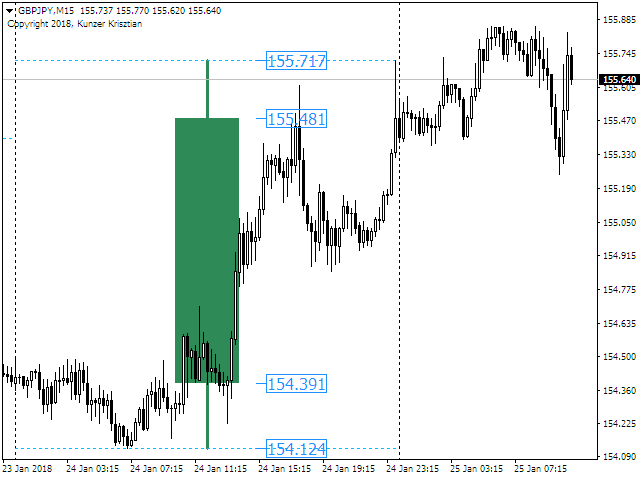

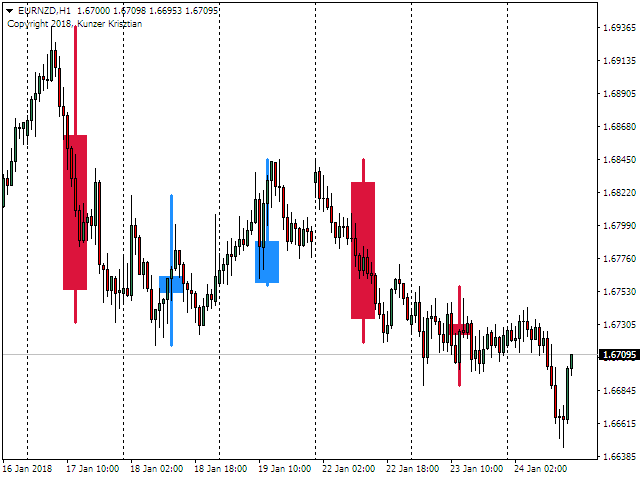

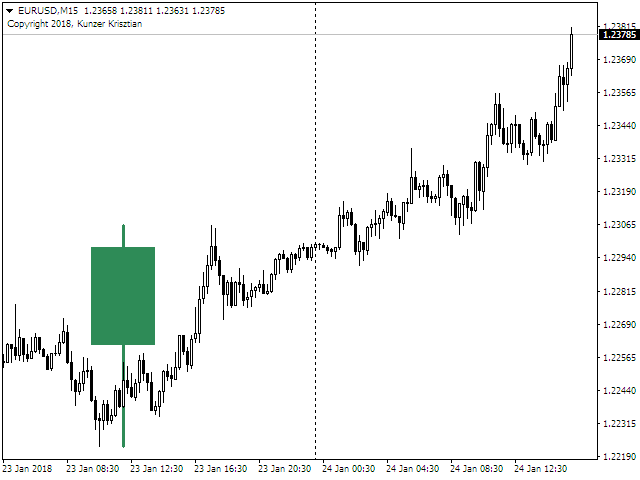

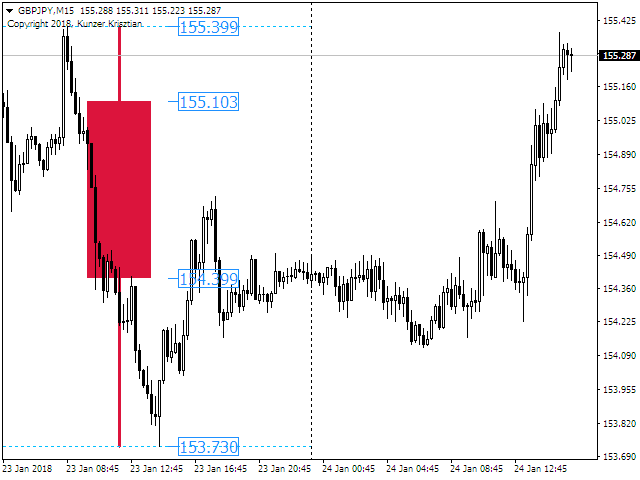

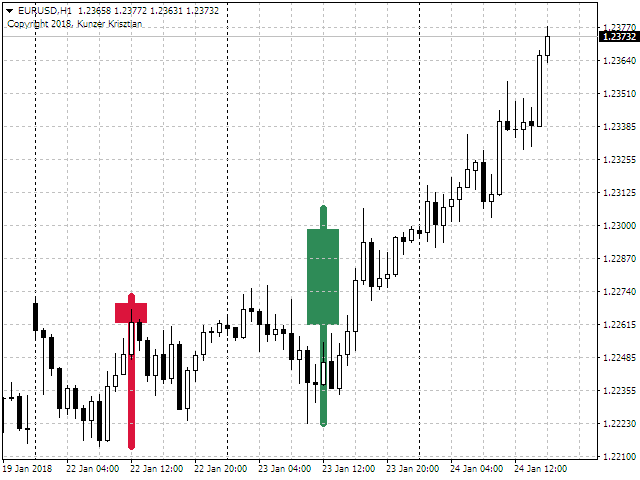

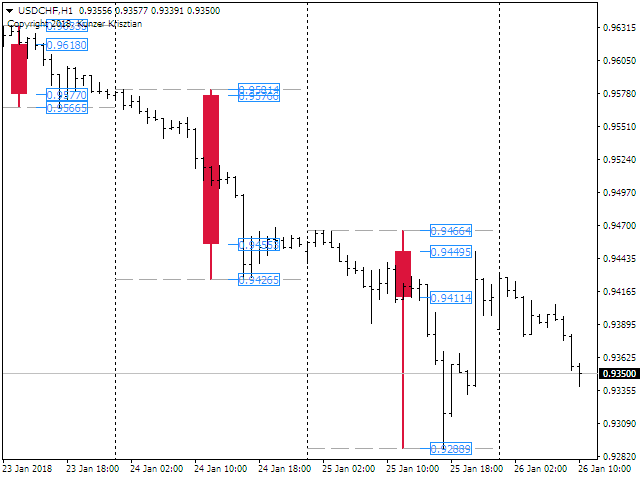

The Daily Candles indicator for MT4 displays the previous day’s daily candles on lower timeframes, enhancing day trading and scalping strategies. Users can customize candle colors, positions, and label visibility for High, Low, Open, and Close, making it easier to identify key price levels on M1 to H4 charts.

Advantages of Daily Candles on Lower Time Frame Charts

The Daily Candles on Lower Timeframes indicator is an essential tool for traders looking to optimize their trading strategies. By allowing users to visualize daily candle patterns on lower timeframes, this indicator offers numerous advantages that can enhance trading decision-making:

- Clearer Context: Incorporating daily candles into lower timeframe charts provides a broader market context. This helps traders better understand the prevailing market trends and makes it easier to spot potential reversal points when trading on M1, M5, or M15 charts.

- Improved Decision-Making: By observing the daily high, low, open, and close from the previous day, traders can make more informed decisions. This data is crucial for day traders and scalpers who require precise entry and exit points.

- Visual Clarity: The ability to customize candle colors and display will let traders adapt the view according to their preferences. Whether it is using bold colors for bullish and bearish candles or sizing the price labels appropriately, traders can create a visually appealing and informative chart layout.

- Dynamic Support and Resistance Levels: Daily high and low lines serve as dynamic support and resistance levels, offering additional insights into potential price action. Understanding these key levels can help traders identify breakout or reversal opportunities.

- Flexibility Across Timeframes: The indicator can be used across a range of timeframes (M1, M5, M15, M30, H1, H4) without losing its effectiveness. This has significant implications for different trading styles, whether it’s day trading, scalping, or swing trading.

- Efficient Strategy Development: By analyzing daily patterns on shorter charts, traders can refine their strategies more effectively. This dual-timeframe analysis allows for better risk management and improved trading performance by taking advantage of daily trends within smaller price movements.

The integration of daily candles into lower timeframe trading can significantly enhance a trader’s market perspective, ultimately leading to more strategic and effective trading decisions. Explore how these advantages can transform your trading approach!

Reviews

There are no reviews yet.