Sale

Equity Protection MT4

$99 Original price was: $99.$29Current price is: $29.

SKU:

17395B0530164EB1

Categories: Trading Utilities

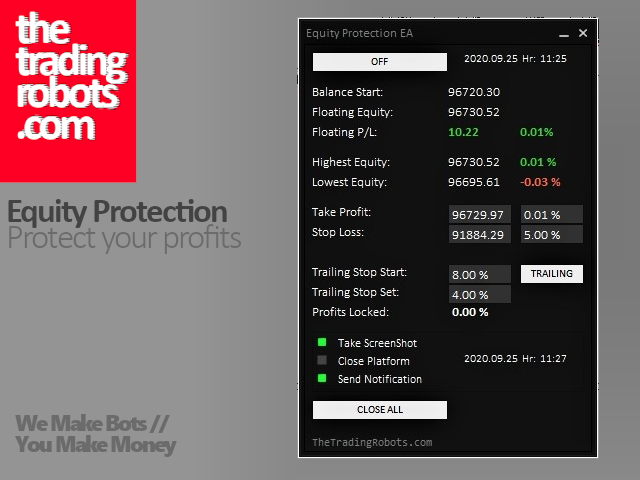

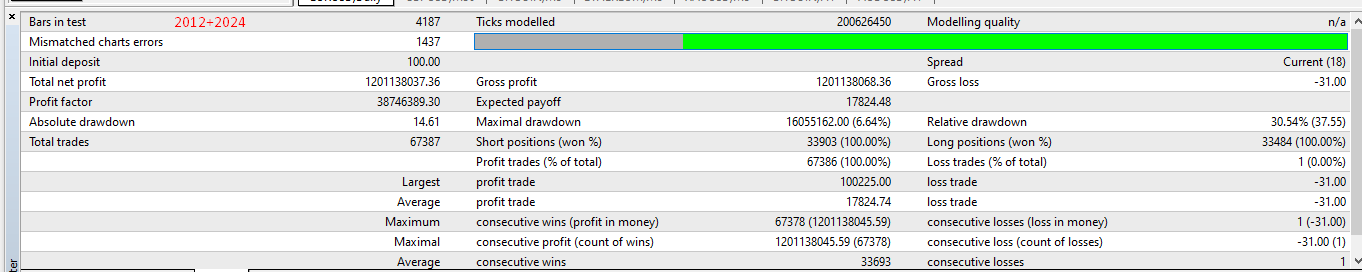

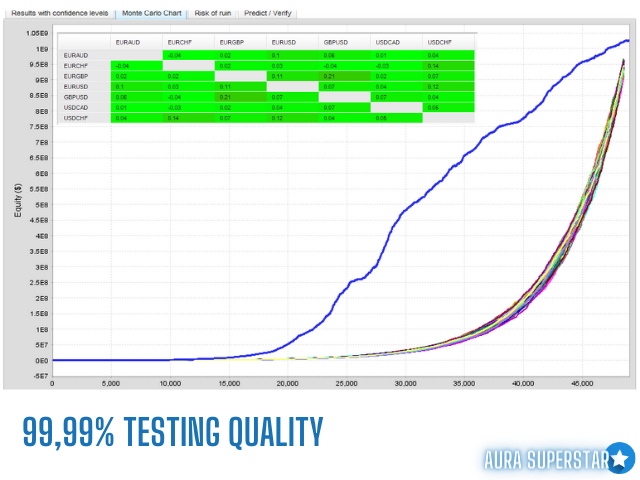

Equity Protection MT4 is an expert advisor for MetaTrader 4 that monitors and manages trading session results across various asset types. It allows users to close trades based on set profit/loss thresholds, implement trailing stops, and offers customizable notifications. It also records equity performance and can deactivate auto trading when specific limits are reached.

Advantages of Equity Protection MT4

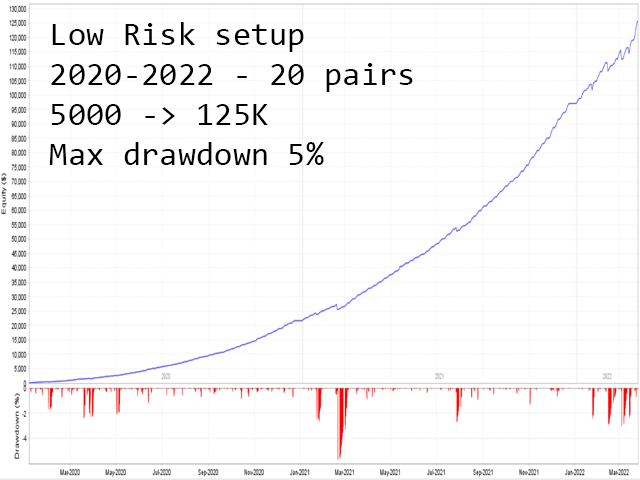

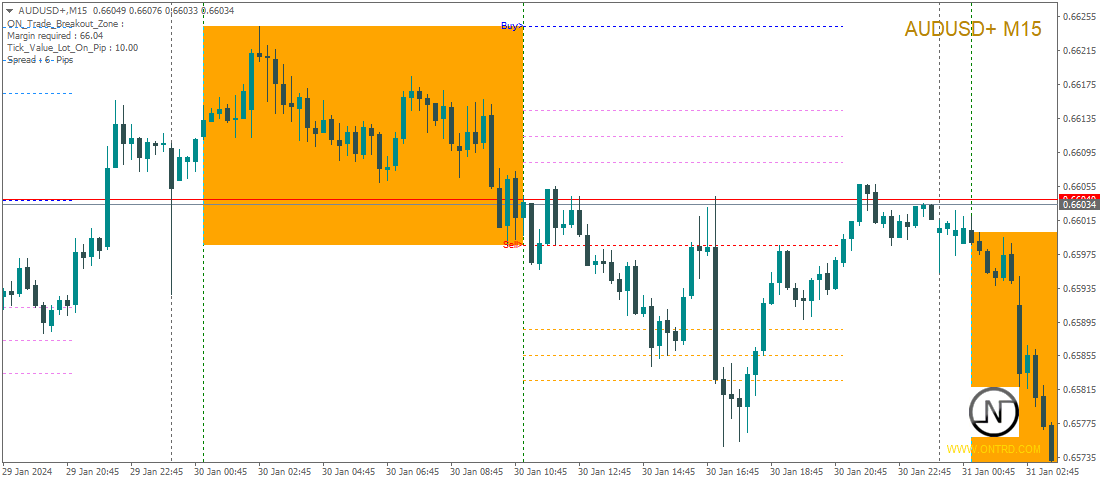

- Comprehensive Control: Offering full control over trading results, Equity Protection allows traders to manage their overall performance across various trading instruments, including forex symbols, indices, metals, and stocks, all through global equity metrics.

- Adaptive Closing Mechanism: The ability to close all trades based on predefined profit or loss thresholds offers traders enhanced risk management. This feature ensures that a trader can lock in profits or limit losses effectively.

- Flexible Settings: Customizable configuration options in both amount and percentage enable users to tailor the protection levels according to their individual trading strategies and risk tolerance.

- Operational Safety with Trailing Stops: By implementing global trailing stops, traders can safeguard their open positions against adverse market movements, protecting unrealized gains more effectively.

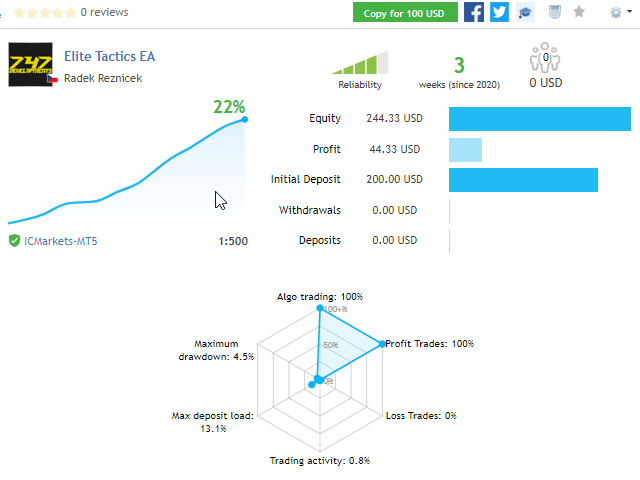

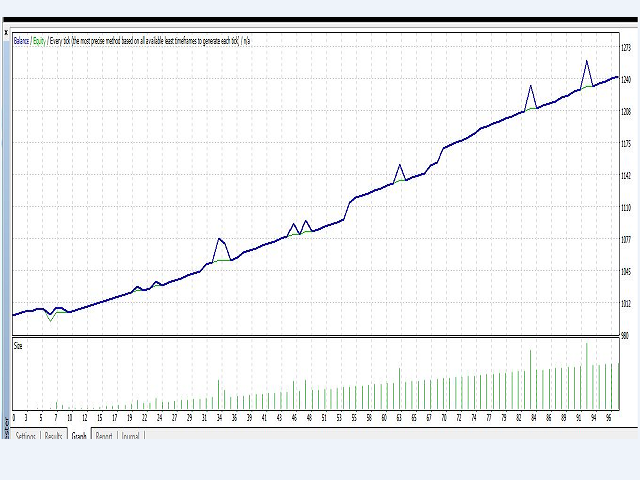

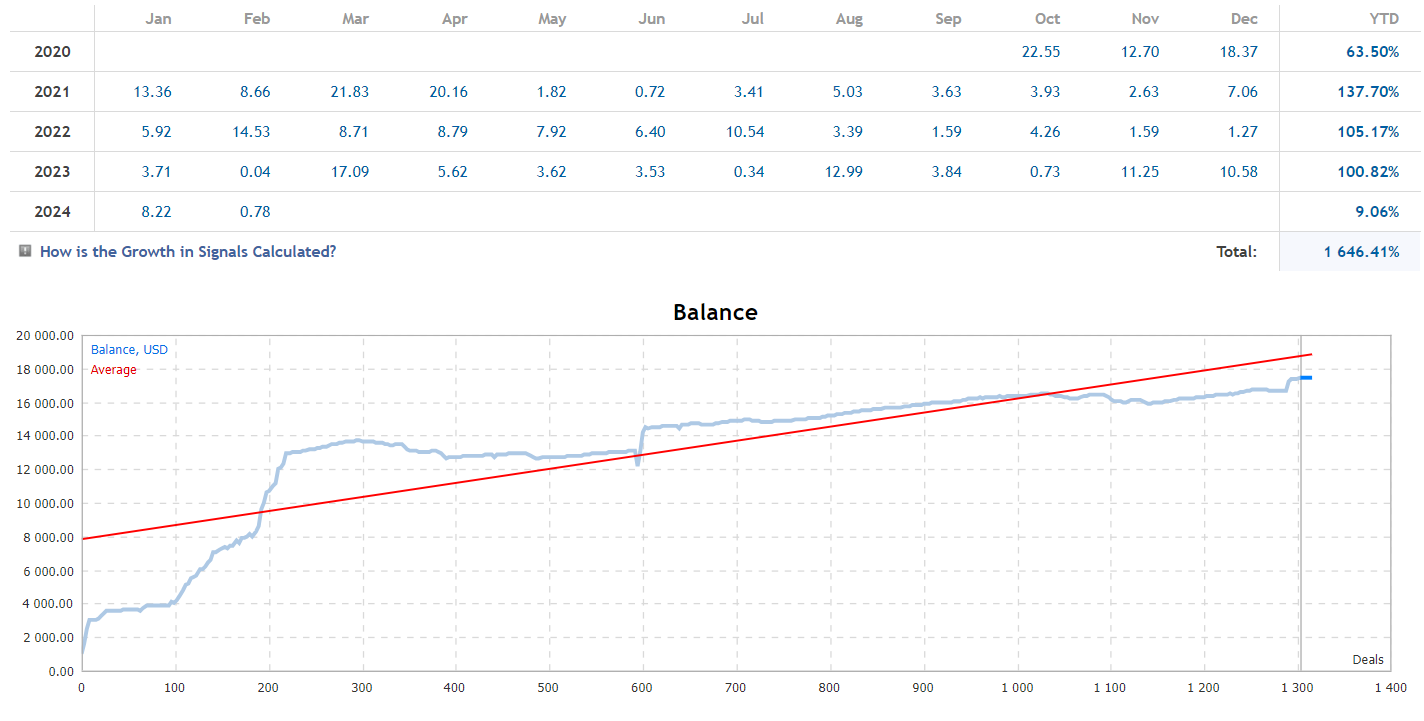

- Session Performance Tracking: With built-in logging that records achieved results, traders have access to both their peak equity and lower equity figures from a session, facilitating performance reviews and strategic adjustments.

- Independent Calculations: Performances and calculations are executed based on the balance at the time of login, ensuring that current market trades are not influenced by previous actions, creating an unbiased trading environment.

- Selective Trade Management: The option to close individual trades at a specified profit or loss percentage allows traders to manage their positions more granularly, optimizing overall profit potential while minimizing risks.

- Automated Platform Control: The software can automatically close the trading platform when either the take profit or stop loss is triggered, ensuring that a trader’s portfolio is managed without continuous oversight.

- Real-Time Notifications: With the capabilities to send push notifications and emails upon reaching take profit or stop loss levels, traders remain informed about their trading activities even when they are not actively monitoring their account.

- Pendings Management: The option to delete pending orders after TP/SL has been triggered keeps the trading environment clear and manageable, allowing traders to focus on executing new strategies rather than on removing obsolete orders.

- Graphical Record Keeping: The feature that allows for screenshots to be taken and saved when TP/SL levels are triggered ensures that users have a visual record of critical trading moments for further analysis.

- User-Friendly Interface: Customization options, such as adjustable font sizes and default settings for take profit and stop loss percentages, enhance usability, allowing traders to configure the EA to their preference easily.

- Controlled Autotrading: The ability to deactivate autotrading when global take profit or stop loss levels are reached prevents additional trades from being executed unintentionally, further protecting the account from unforeseen losses.

- Specific Direction Control: The EA can close all operations in one direction (e.g., all sales) when a certain percentage of the account is reached, offering precise control over open positions based on market movements.

- Regular Equity Reporting: Configurable reports about the current equity are generated at intervals decided by the user, allowing for continuous monitoring of account performance and trends.

Be the first to review “Equity Protection MT4” Cancel reply

Reviews

There are no reviews yet.