Eurusd lagging proxy trade MT4

$27,000 Original price was: $27,000.$29Current price is: $29.

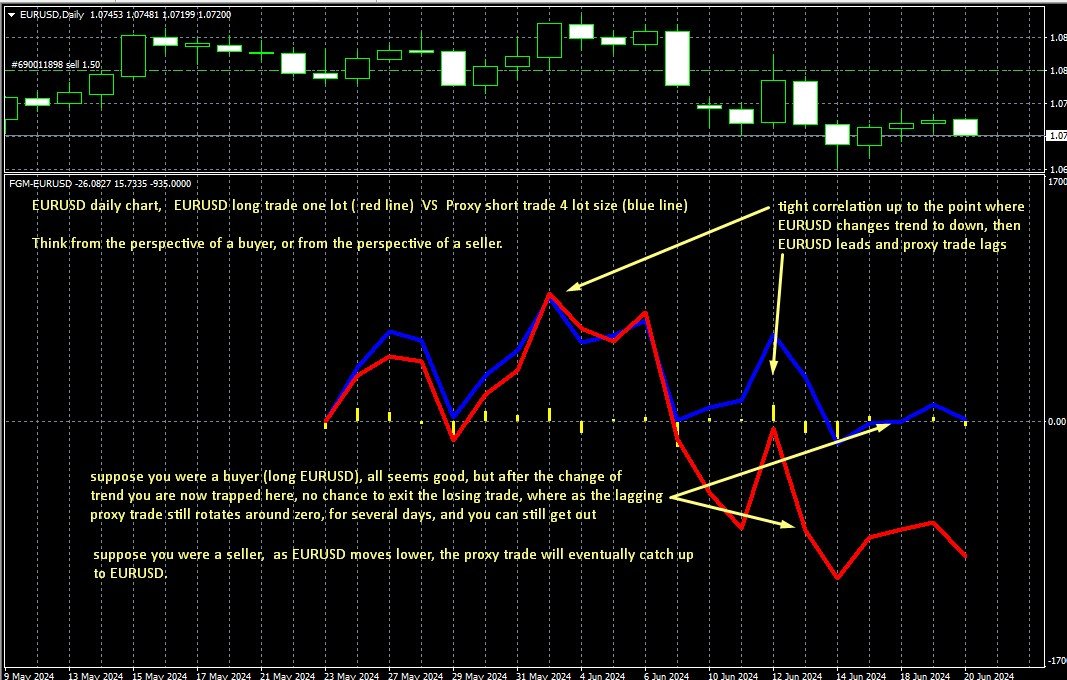

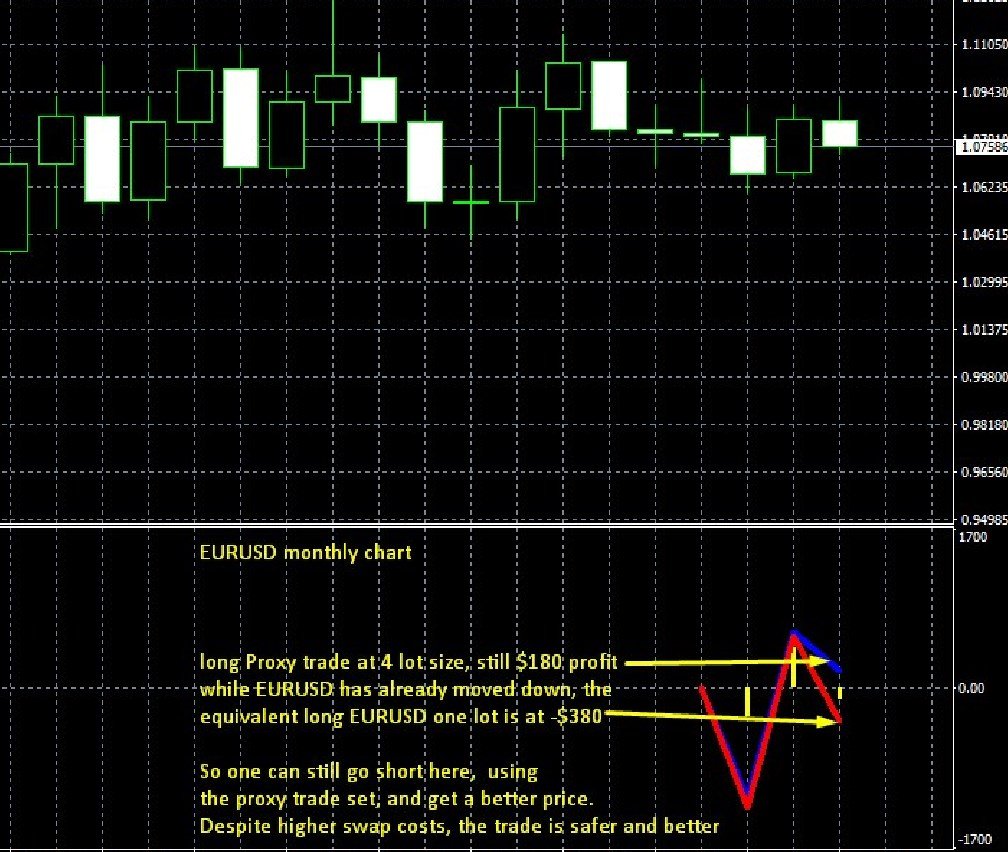

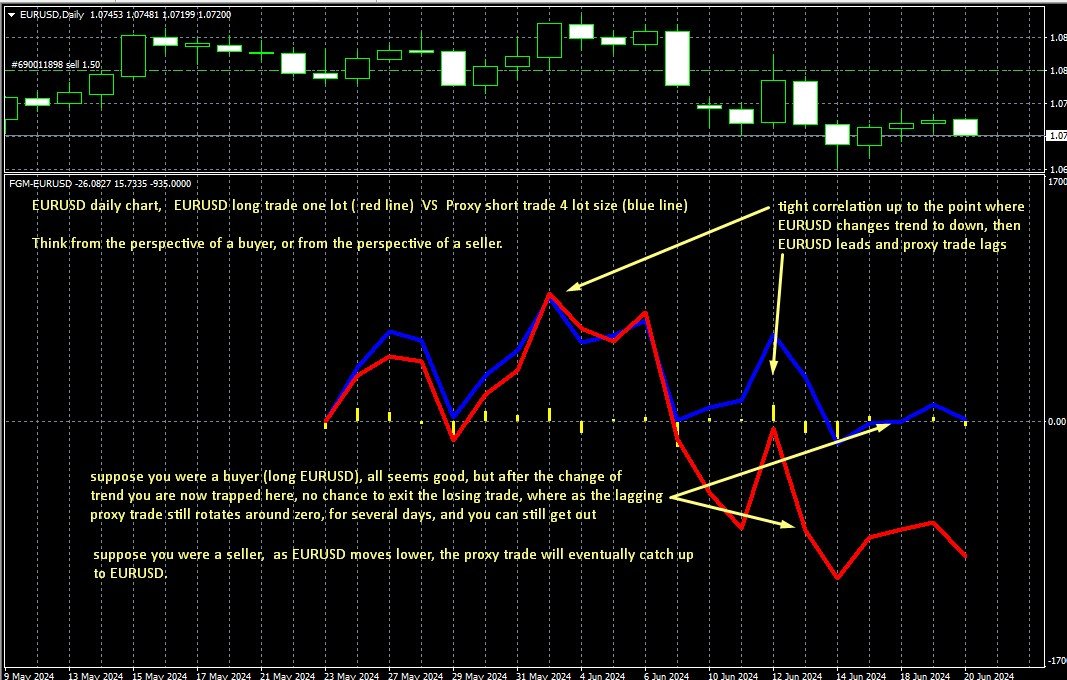

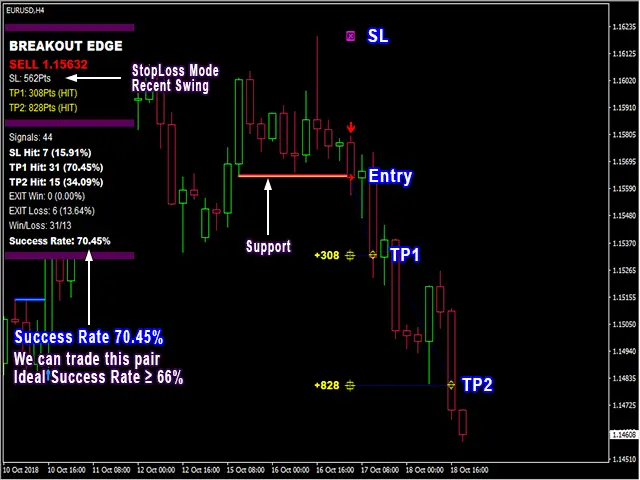

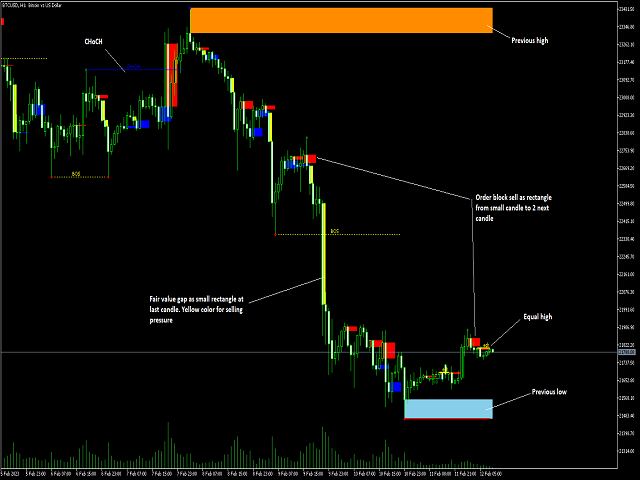

The EURUSD Lagging Proxy Trade on MT4 is a unique trading strategy leveraging a set of four currency pairs that tend to lag behind EURUSD. It allows traders to capitalize on delayed price movements for greater flexibility and risk management. Users receive a trading indicator, support, and signal guidance for effective trading.

Advantages of EURUSD Lagging Proxy Trade in MT4

The EURUSD lagging proxy trade strategy is an innovative approach akin to hedge fund methodologies, offering several significant advantages for traders looking to maximize their profitability and minimize risks.

1. Time for Adjustment

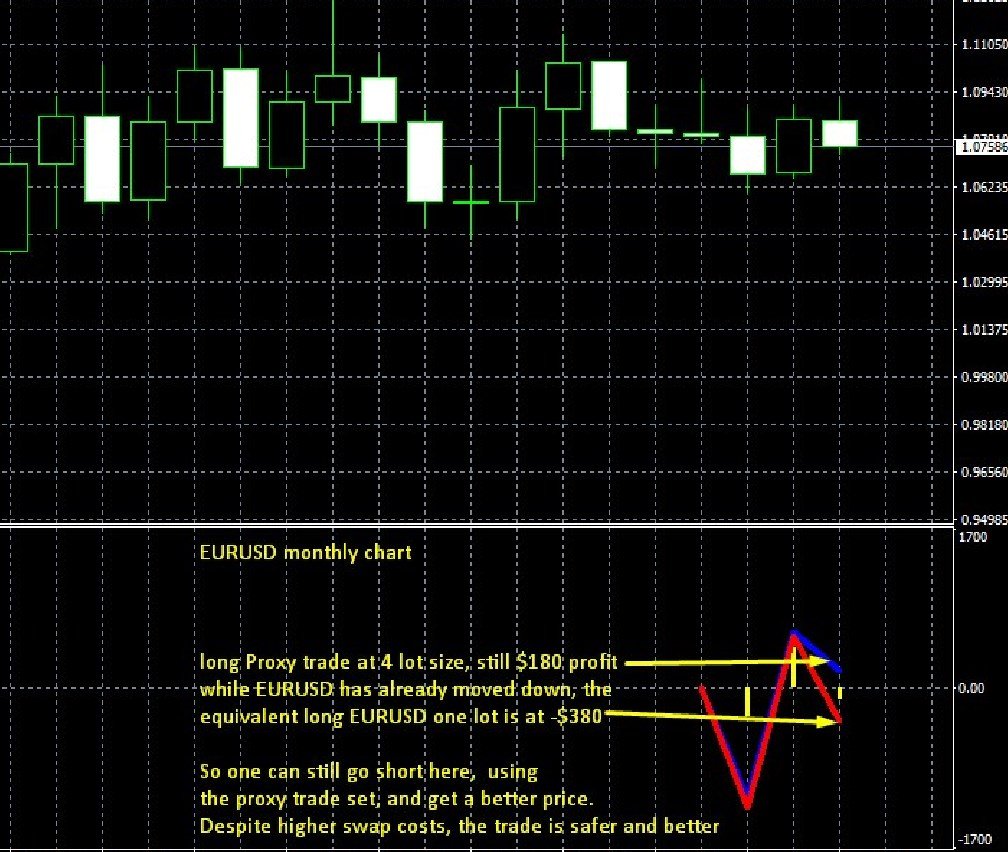

When EURUSD experiences a sudden intraday or daily trend reversal, it can move quickly, sometimes by 200 pips or more. The lagging nature of the proxy trade means that it will not react immediately, allowing traders to adjust their positions before the proxy catches up. This provides a unique opportunity to manage trades more effectively than by trading EURUSD alone.

2. Reduced Risk of Liquidity Issues

The lagging proxy trade operates on a hedge fund strategy designed for slower, high-probability small profits. This approach minimizes the risks associated with liquidity issues, particularly when trading larger accounts, as slow trading tends to have less volatility.

3. Dynamic Correlation Offering Ultra Low Risk Trades

The dynamic correlation between EURUSD and the proxy trade can produce ultra-low risk opportunities. Traders can execute divergence-convergence strategies that typically yield profitability around 6%, reducing the overall risk involved in trading.

4. Flexibility with Directionless Approach

This strategy encourages a directionless approach to trading, allowing traders to focus on the overall movement and correlation without being overly reliant on predicting the direction of EURUSD. This lends a strategic edge to implementing trades without being confined to directional limits.

5. Mitigation of Adverse Market Moves

The lagging proxy trade is particularly forgiving of mistakes and adverse market movements. While a direct trade on EURUSD might show substantial profits—or losses—the proxy trade may remain static or only slightly negative during turbulent periods, providing a buffer. As time goes on, it often aligns with profit levels observed in EURUSD, compensating for initial divergences.

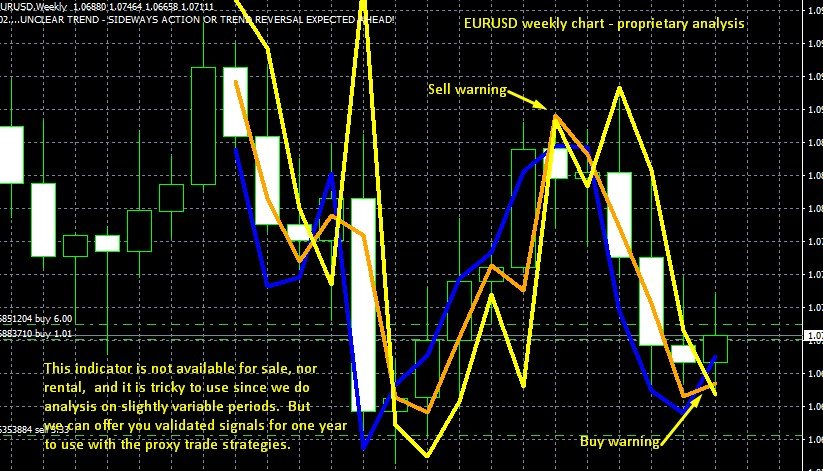

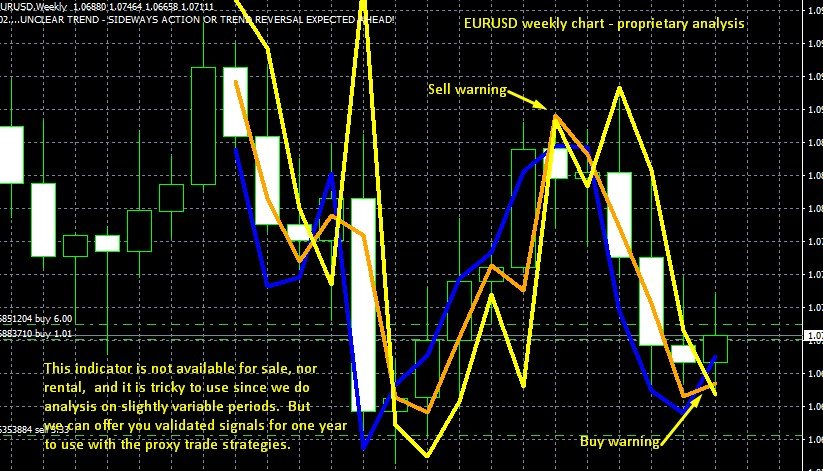

6. Additional Signals and Insights

Purchasing this product not only grants access to the lagging proxy trade indicator but also includes a year’s worth of signals that provide insights into EURUSD direction. This bonus allows traders to explore a wider range of trading strategies while utilizing the proxy trade for insulation against market fluctuations.

7. Unique Trading Techniques

The concept of using a proxy trade to offset losses in EURUSD positions is a unique technique. By taking opposing positions, traders can safeguard against potential losses while still engaging actively in the market. Even if profits are lower on a conventional trade, the offset can lead to overall failure mitigation.

Conclusion

In summary, the EURUSD lagging proxy trade strategy emerges as a robust and flexible trading approach, combining intriguing market dynamics with practical risk management. With features resembling hedge fund strategies, traders can benefit from its adaptability, effectiveness, and comprehensive support. This makes it a compelling choice for both novice and experienced traders seeking to explore innovative trading methodologies.

#eurusd, #hedgefund, #bankstrategy

Reviews

There are no reviews yet.