Fast Sliding SMA algorithm MT5

$30 Original price was: $30.$29Current price is: $29.

The Fast Sliding SMA algorithm for MT5 is an efficient implementation of the Simple Moving Average (SMA) that utilizes a queue to achieve constant time complexity (O(1)) for adding and removing data points, contrast to the standard O(n). This optimization allows for rapid updates even with large datasets, aiding traders in trend analysis.

Advantages of the Fast Sliding SMA Algorithm in MT5

A Simple Moving Average (SMA) is an essential statistical indicator used in time series analysis. It represents the arithmetic mean of a sequence of values over a specified period, effectively smoothing short-term fluctuations in data. This smoothing helps traders and analysts identify the overall trend or changes in direction, ultimately leading to more informed decision-making.

The Fast Sliding SMA algorithm enhances the traditional SMA calculation by utilizing a queue, which yields significant advantages that are particularly beneficial for trading applications on the MetaTrader 5 (MT5) platform. Here are some notable benefits:

- Constant Time Performance: The Fast Sliding SMA algorithm achieves an impressive time complexity of O(1) for adding new elements and removing old ones from the queue. This ensures that the algorithm’s performance remains efficient, regardless of the specified window size.

- Efficient Update Operations: By leveraging a queue, the algorithm efficiently manages the addition of new elements and removal of outdated ones, minimizing the number of operations required for average updates. This efficiency is crucial when dealing with live market data.

- Optimized Window Management: The use of a queue provides effective window management for the moving average, eliminating the need to recalculate the entire average every time a new element is added. This results in faster computations, essential for time-sensitive trading environments.

- Increased Efficiency with Large Data Sets: The algorithm’s constant-time operations make it well-suited for processing large volumes of data, ensuring that performance remains optimal even with extensive datasets typical in financial markets.

- Easy Implementation and Maintenance: The queue structure simplifies the codebase, making it easier to understand and maintain. By avoiding the complexity of iterating through the entire data window, developers can implement and adapt the algorithm with relative ease.

In summary, the Fast Sliding SMA algorithm significantly enhances data processing performance while maintaining a fixed window for calculating moving averages. As a result, it serves as a powerful tool for traders looking to optimize their strategies on the MT5 platform.

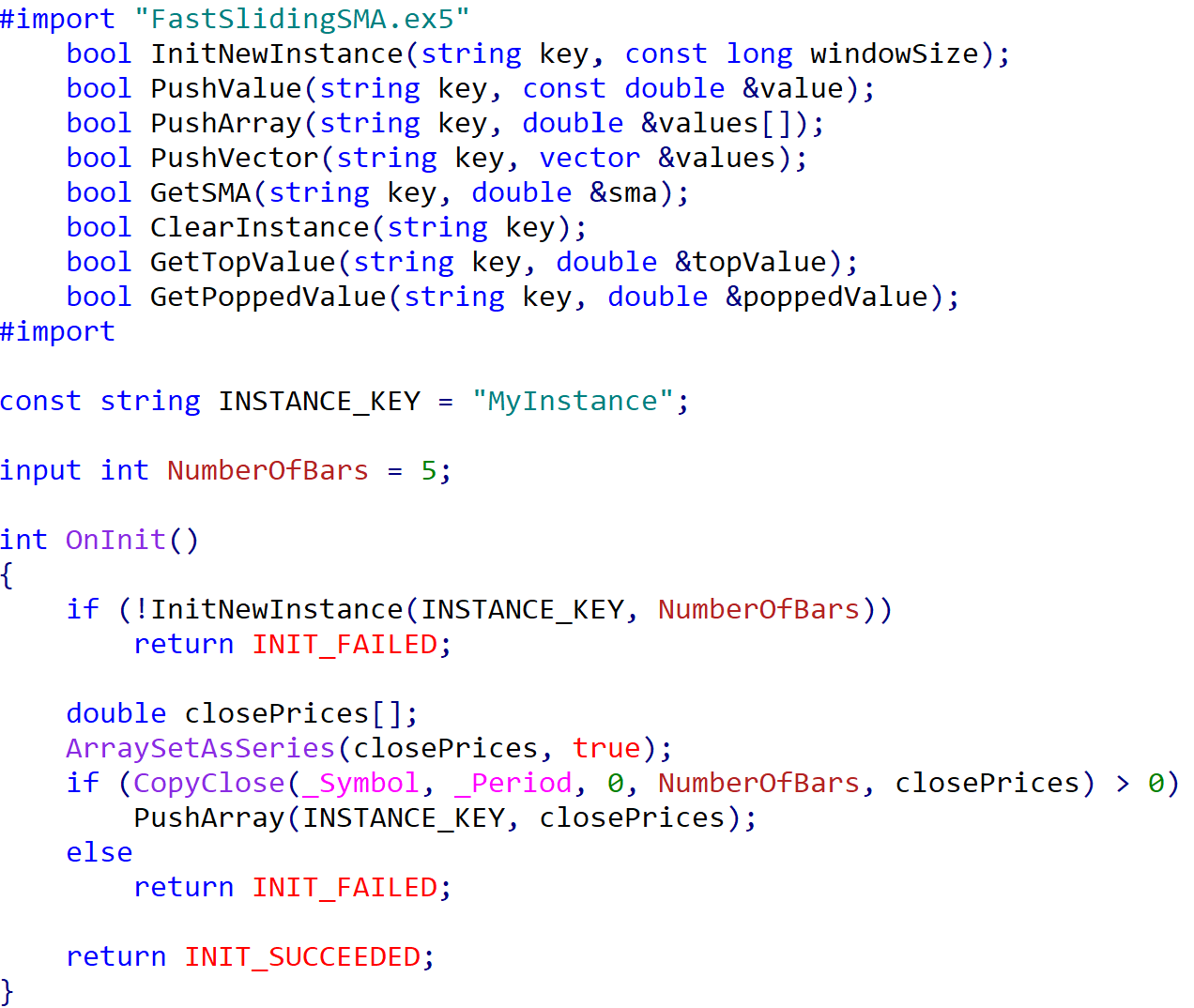

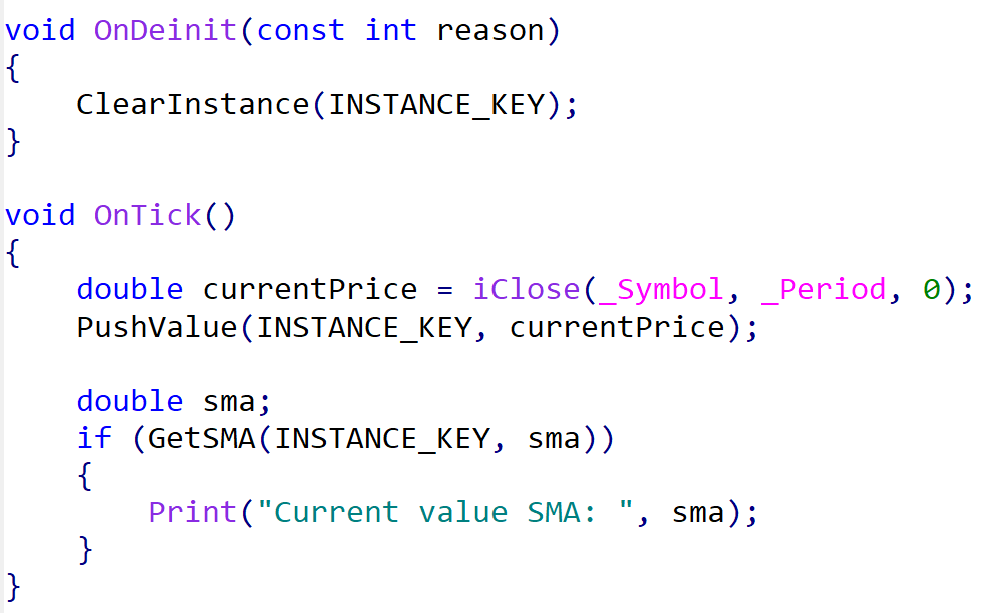

Implementation Example

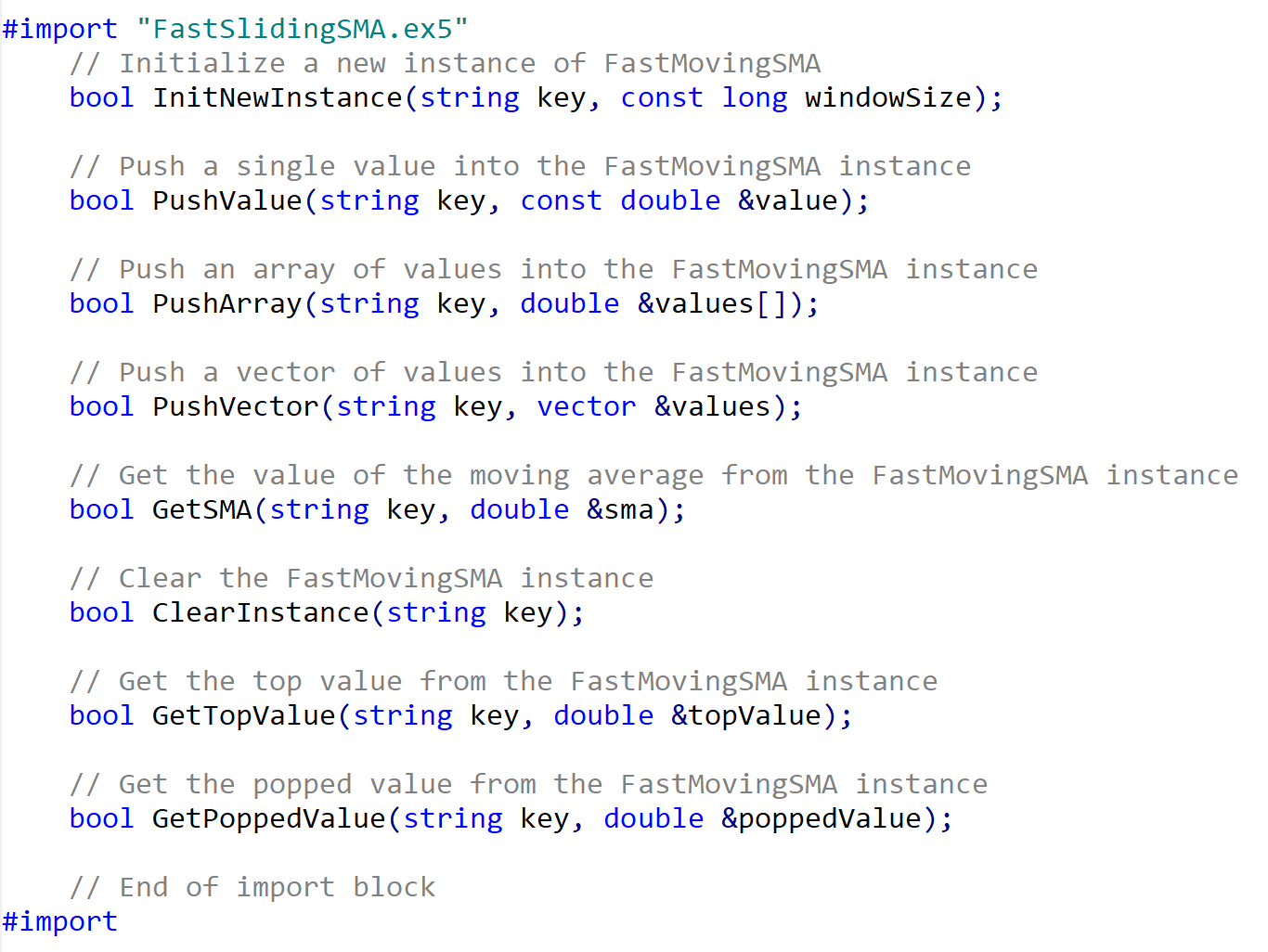

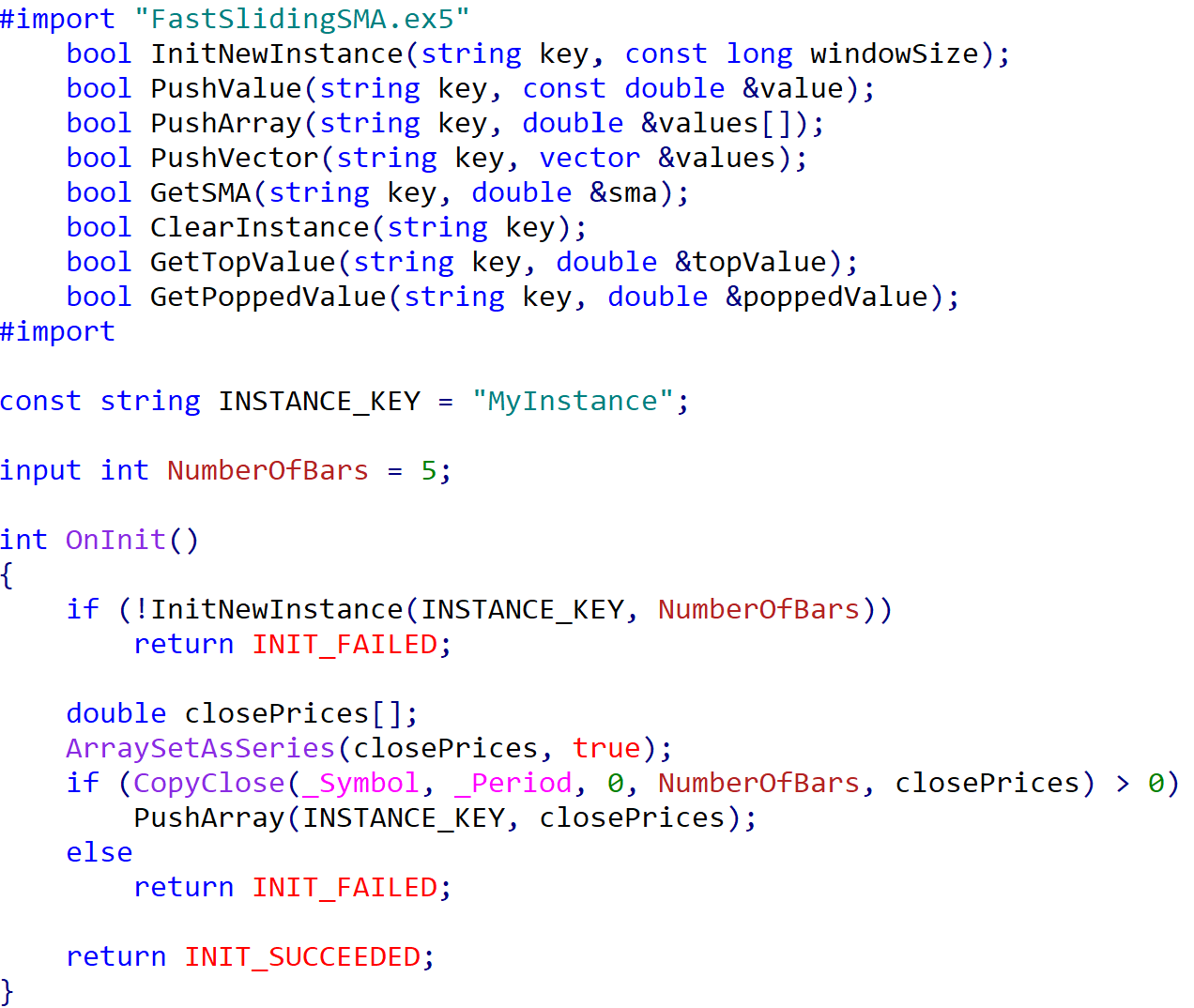

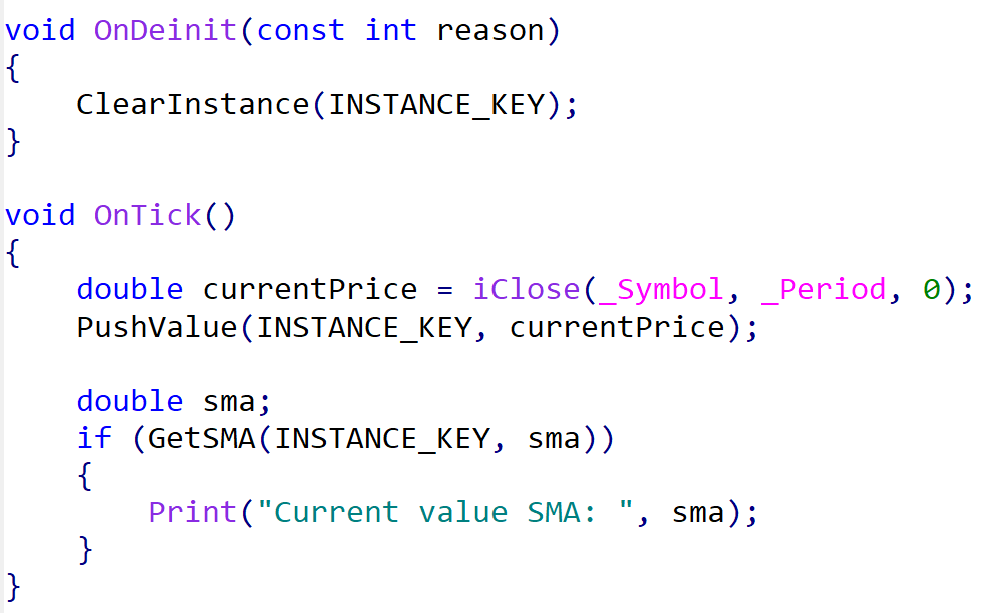

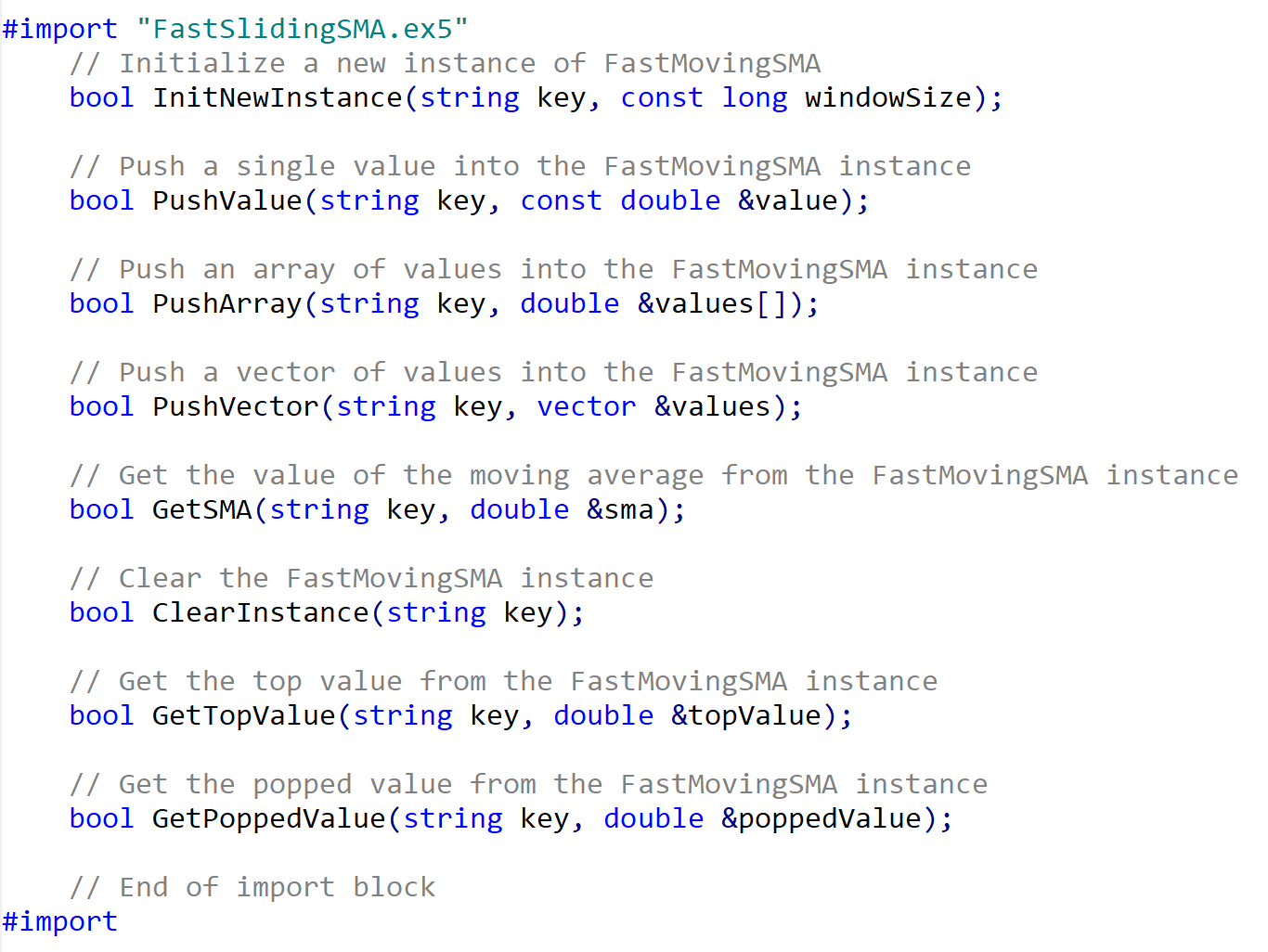

#import "FastSlidingSMA.ex5" bool InitNewInstance(string key, const long windowSize); bool PushValue(string key, const double &value); bool PushArray(string key, double &values[]); bool PushVector(string key, vector &values); bool GetSMA(string key, double &sma); bool ClearInstance(string key); bool GetTopValue(string key, double &topValue); bool GetPoppedValue(string key, double &poppedValue); #import const string INSTANCE_KEY = "MyInstance"; input int NumberOfBars = 5; int OnInit() { if (!InitNewInstance(INSTANCE_KEY, NumberOfBars)) return INIT_FAILED; double closePrices[]; ArraySetAsSeries(closePrices, true); if (CopyClose(_Symbol, _Period, 0, NumberOfBars, closePrices) > 0) PushArray(INSTANCE_KEY, closePrices); else return INIT_FAILED; return INIT_SUCCEEDED; } void OnDeinit(const int reason) { ClearInstance(INSTANCE_KEY); } void OnTick() { double currentPrice = iClose(_Symbol, _Period, 0); PushValue(INSTANCE_KEY, currentPrice); double sma; if (GetSMA(INSTANCE_KEY, sma)) { Print("Current value SMA: ", sma); } }

Reviews

There are no reviews yet.