Fibonacci Confluence Toolkit Multi Timeframe MT4

$35 Original price was: $35.$29Current price is: $29.

Fibonacci Confluence Toolkit Multi-Timeframe for MT4 is a professional trading tool that identifies potential price reversal zones. It features multi-timeframe analysis, automatic Fibonacci retracement application, and engulfing candle pattern detection, allowing traders to make precise, informed decisions and optimize their trading strategies efficiently.

Advantages of Fibonacci Confluence Toolkit Multi-Timeframe MT4

The Fibonacci Confluence Toolkit Multi-Timeframe is a powerful technical analysis tool that provides several advantages for traders looking to improve their market analysis and decision-making processes:

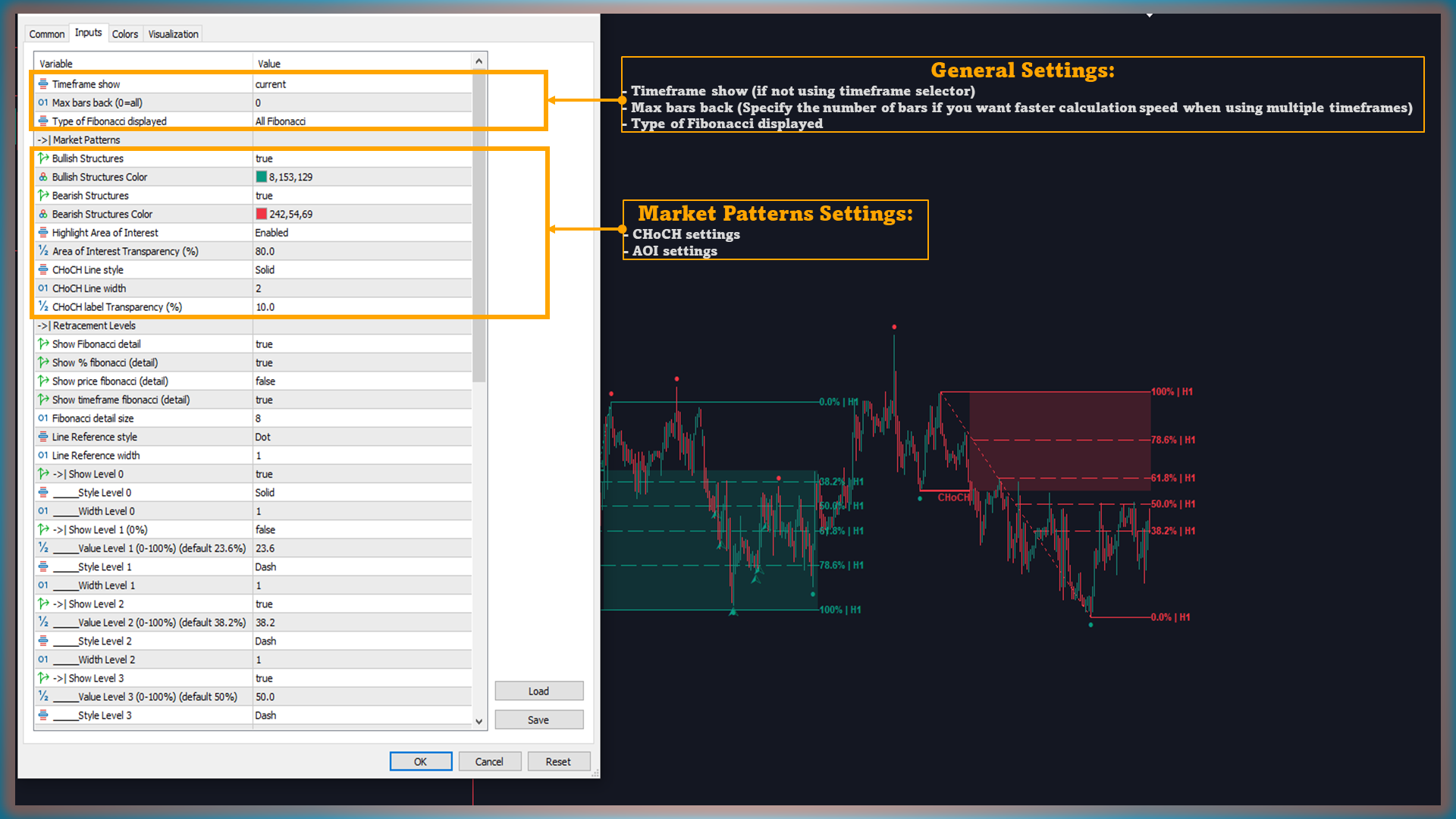

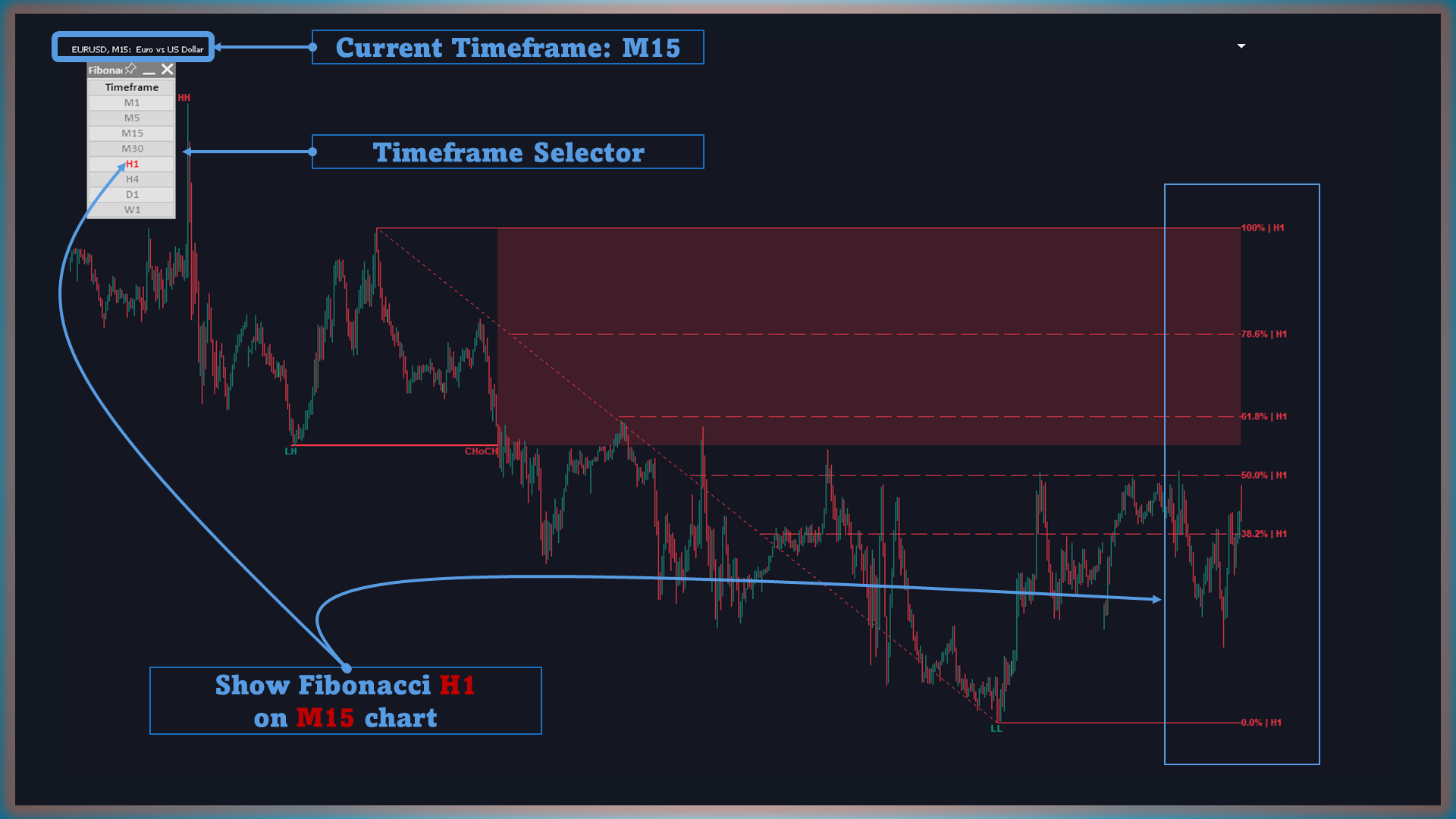

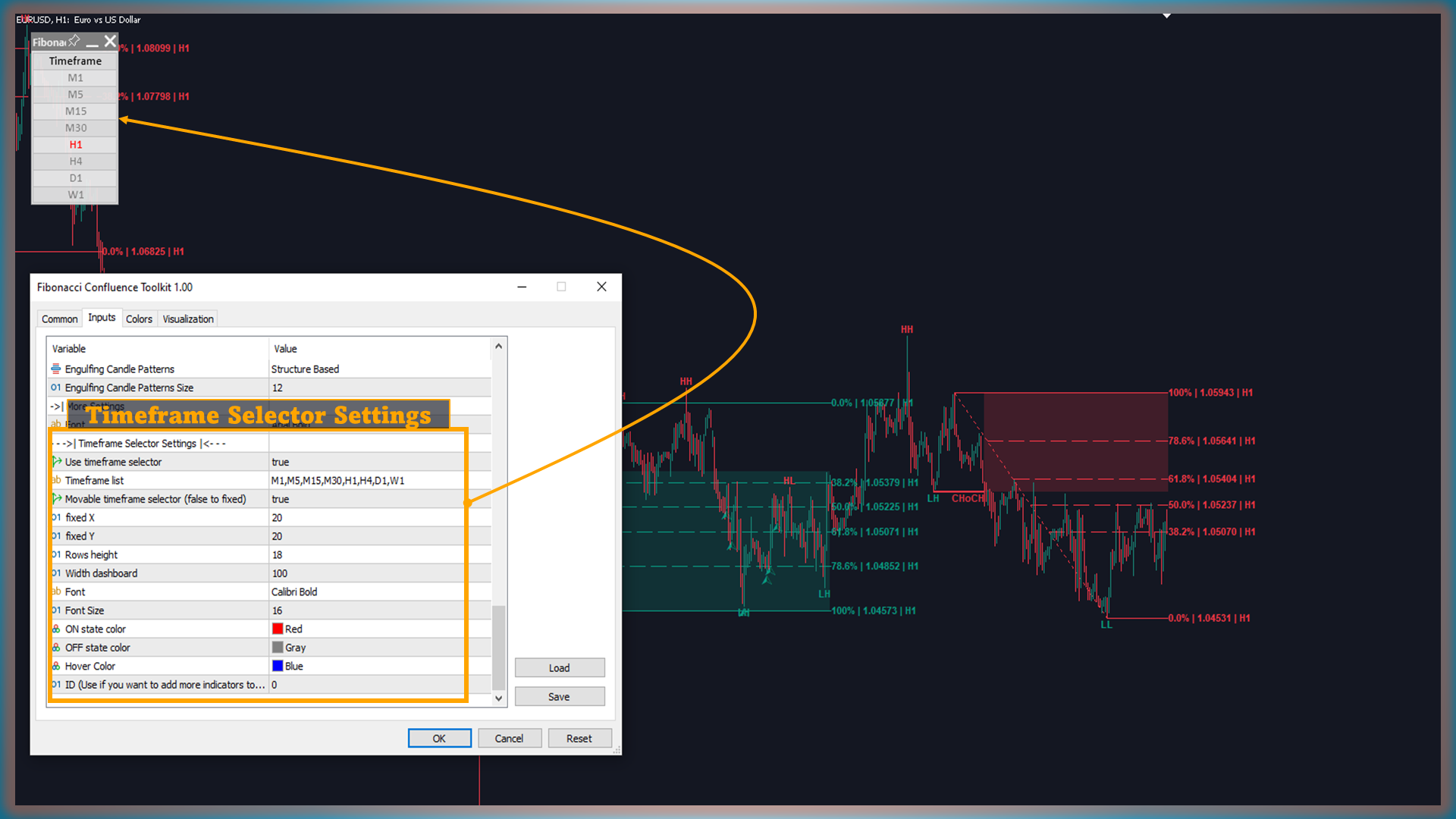

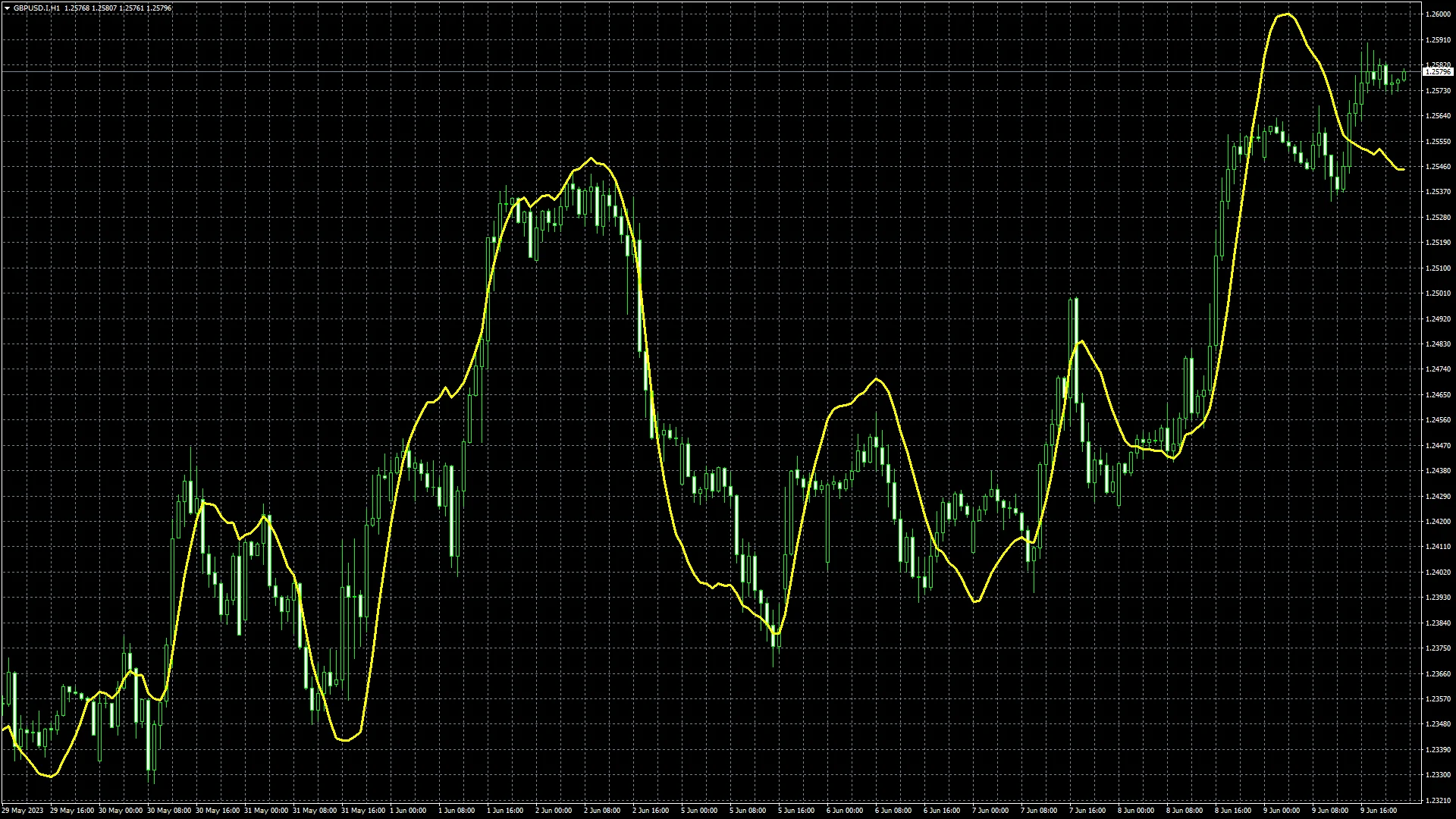

1. Multi-Timeframe Analysis

This toolkit offers the ability to monitor and analyze signals across various timeframes via an intuitive dashboard. This multi-timeframe approach allows traders to gain a comprehensive view of market trends, ensuring that trading decisions are made with a thorough understanding of both short-term and long-term market dynamics.

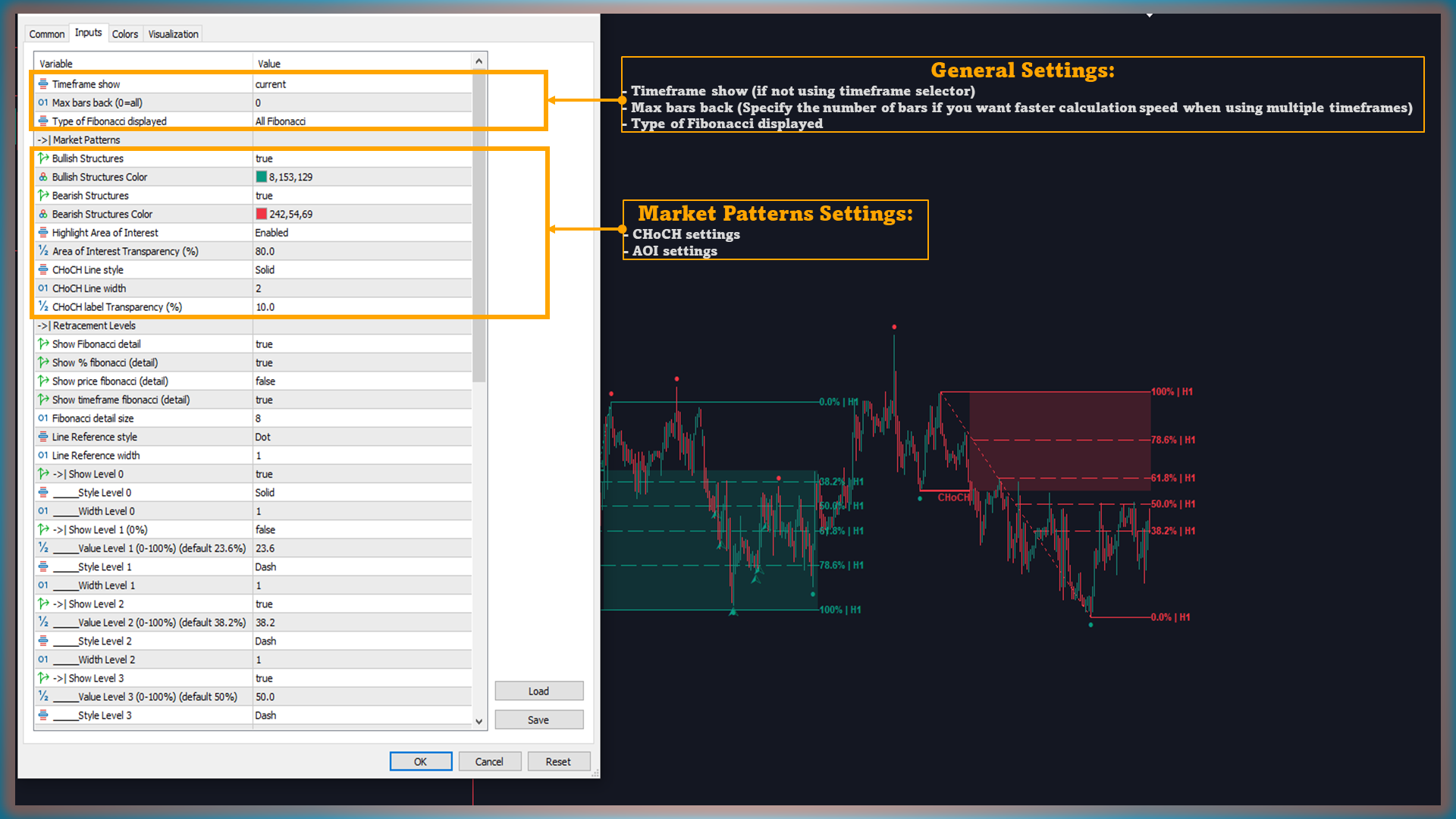

2. Price Reversal Zone Identification

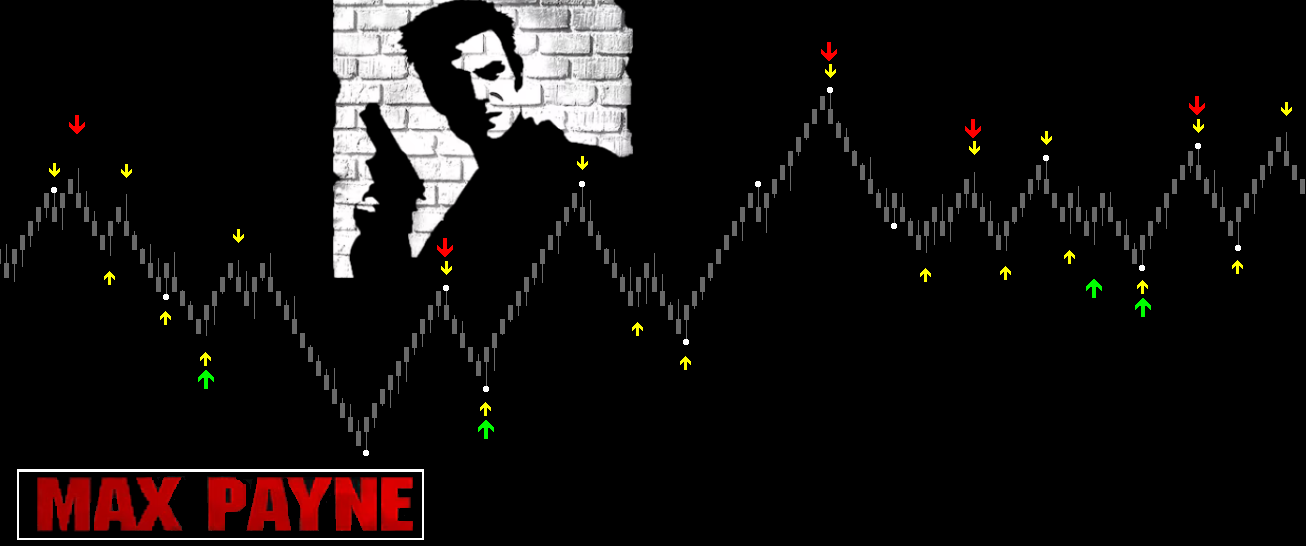

One of the standout features is the automatic detection of CHoCH (Change of Character) points. These crucial indicators signal potential shifts in market direction and help identify Areas of Interest (AOI), where significant price movements are expected. This functionality aids traders in pinpointing key market reaction zones.

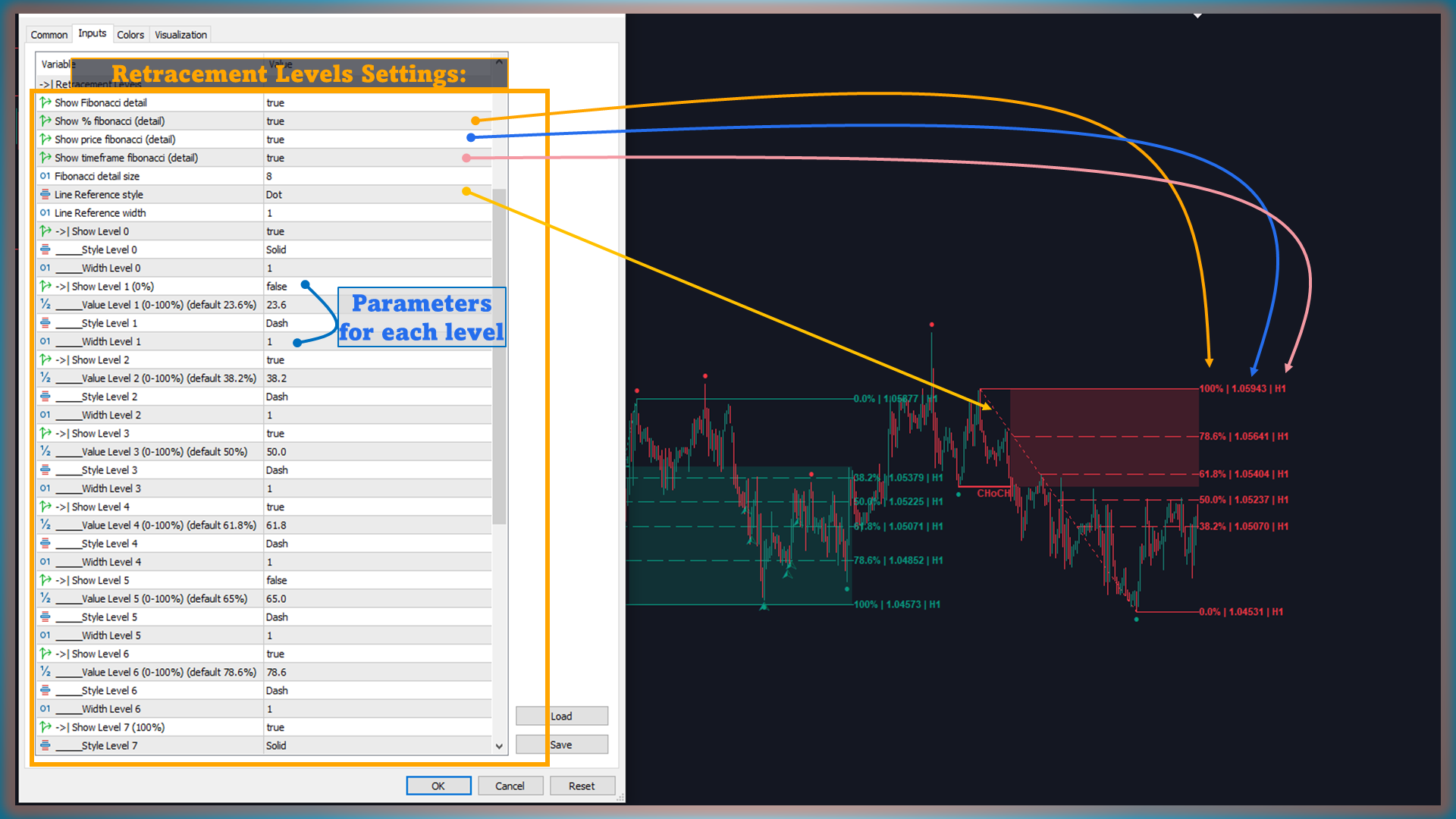

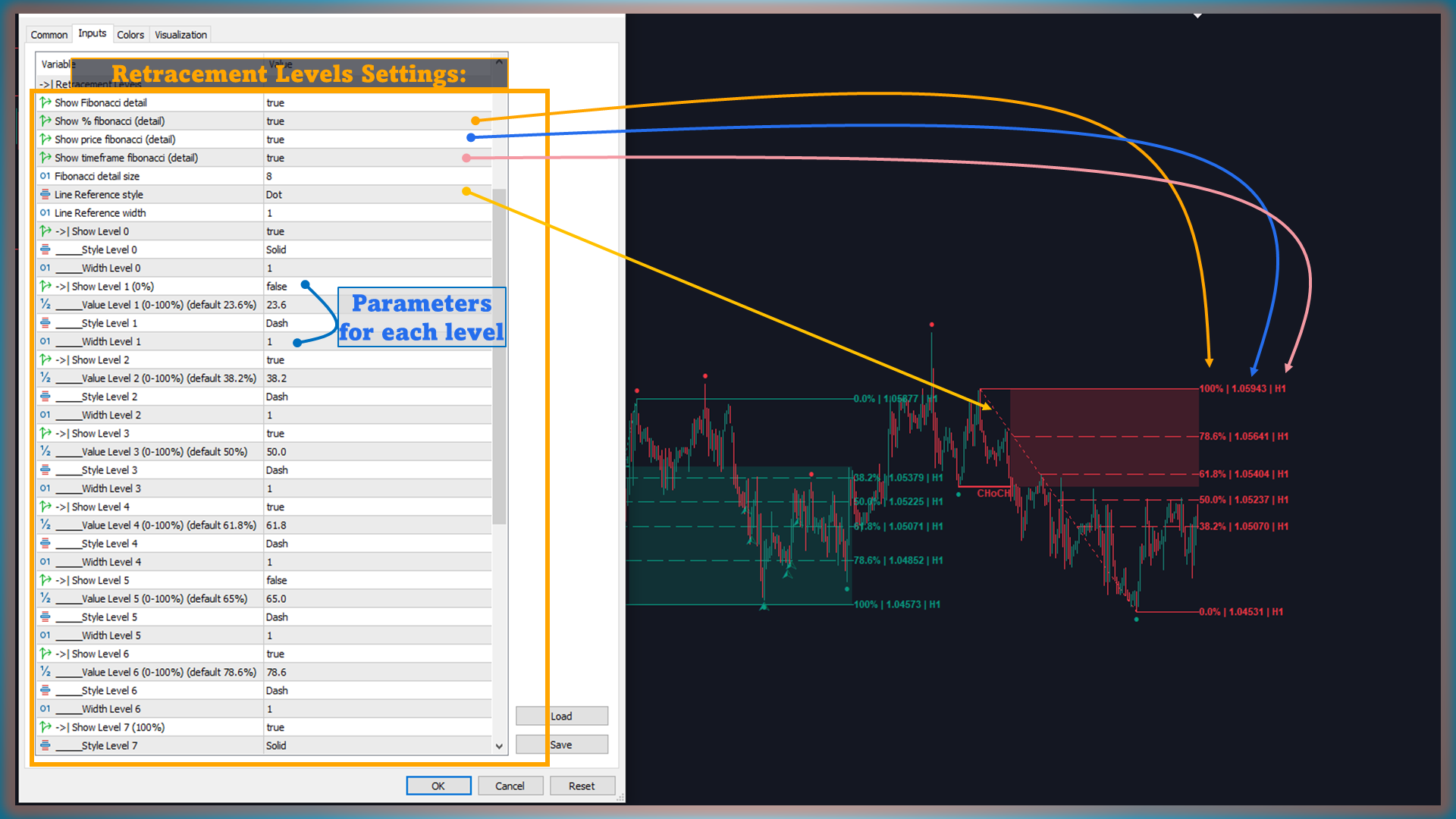

3. Automatic Fibonacci Retracement Application

The toolkit’s automation allows it to promptly apply Fibonacci retracement levels when new swing highs or lows occur within the defined AOI. This not only simplifies the identification of pullback zones but also provides quick and actionable entry points for traders, making it easier to capitalize on price movements.

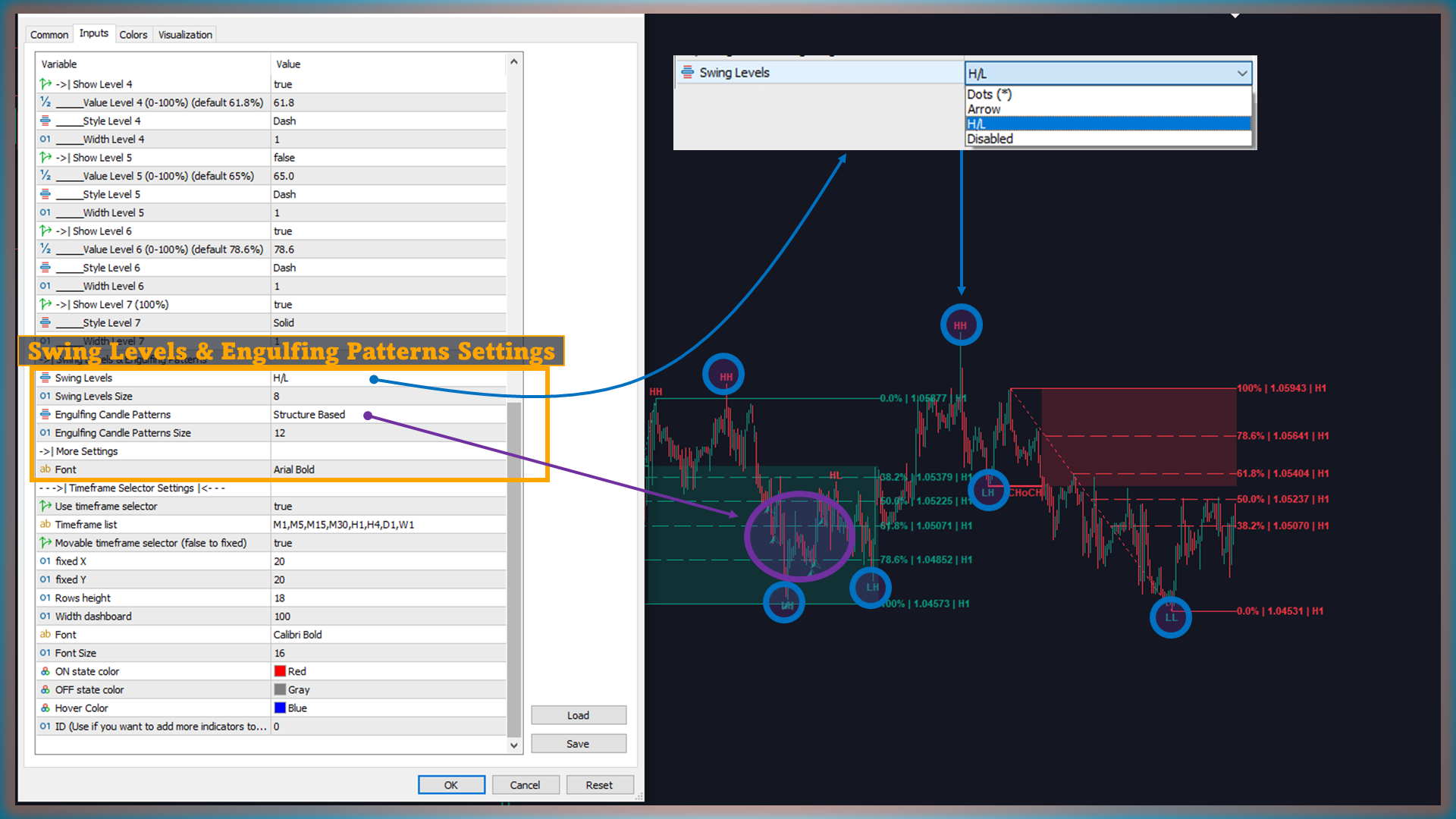

4. Engulfing Candle Pattern Detection

With automatic detection of engulfing candle patterns within the AOIs, traders are better equipped to refine their entry points, enhancing confluence and overall decision-making quality. This feature leverages real-time trend dynamics to maximize trading effectiveness.

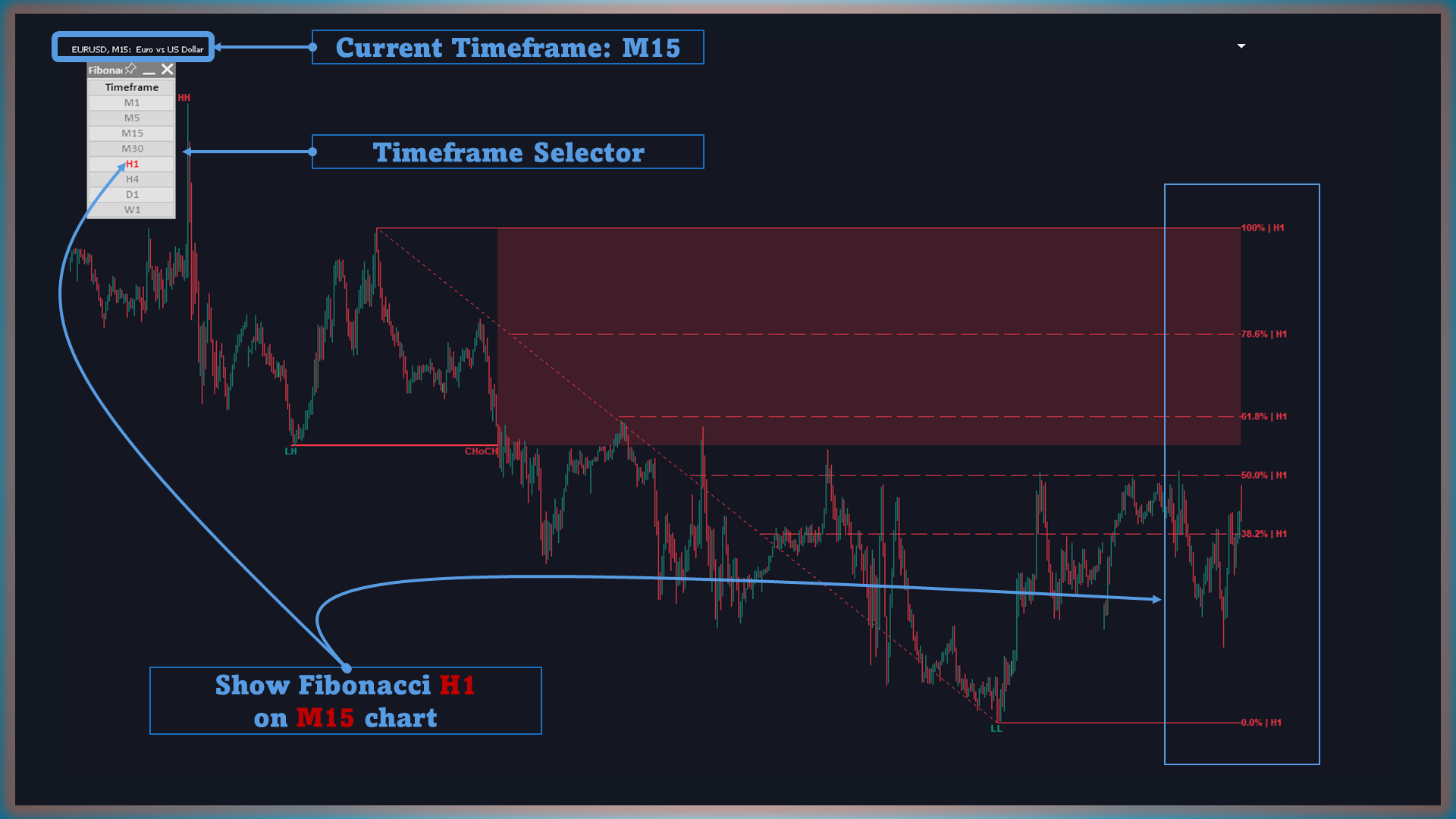

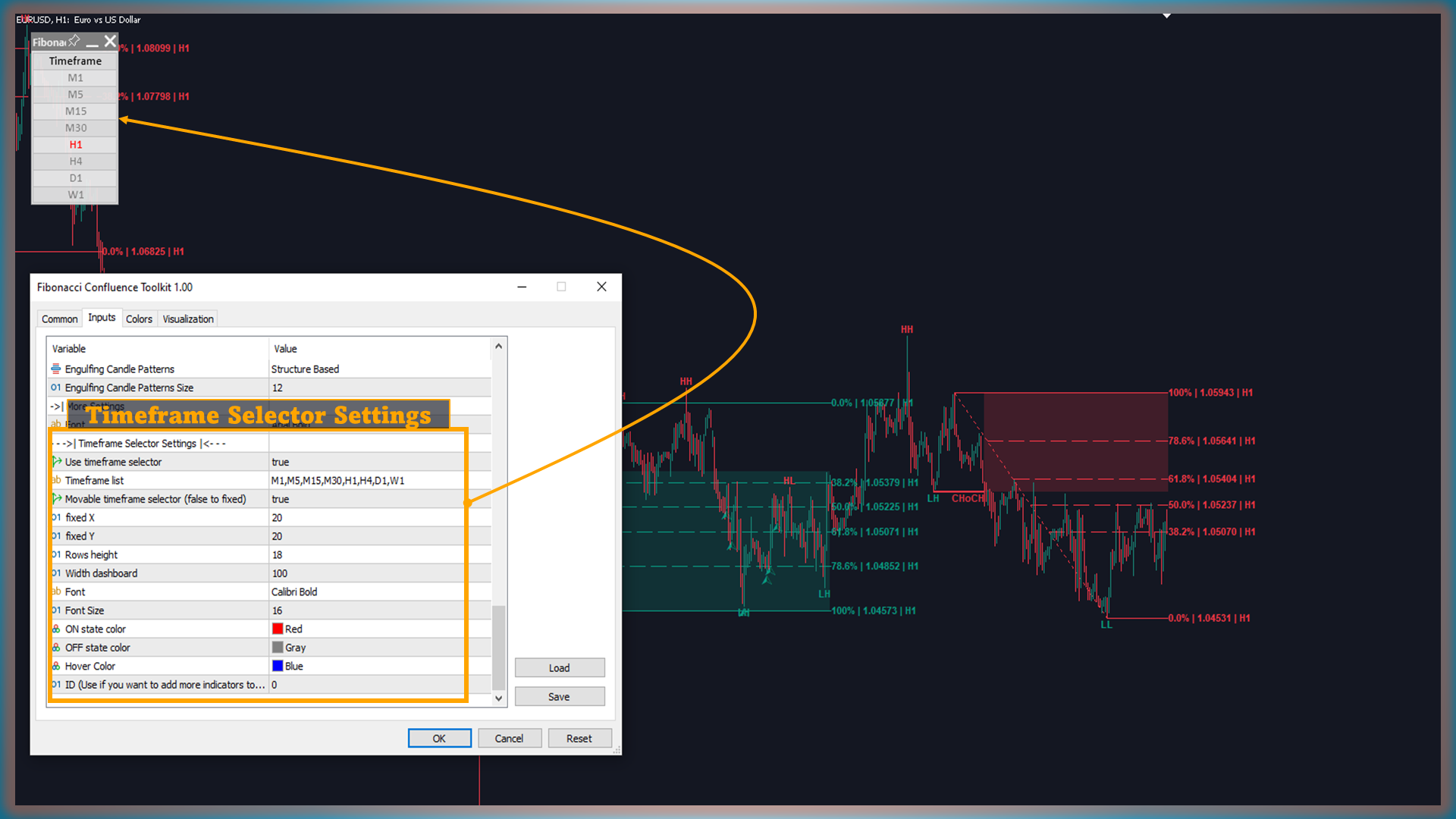

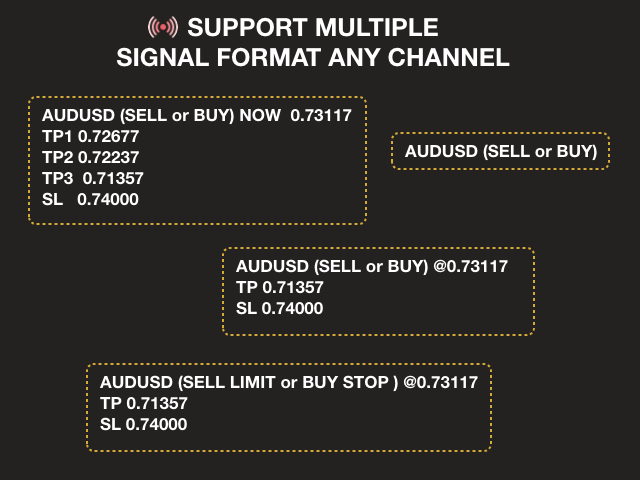

5. Timeframe Selector Dashboard

The enhanced Timeframe Selector dashboard is a significant improvement, enabling users to switch between different timeframes seamlessly. This time-saving feature allows traders to quickly identify opportunities without the hassle of adjusting settings manually, making the trading process more efficient.

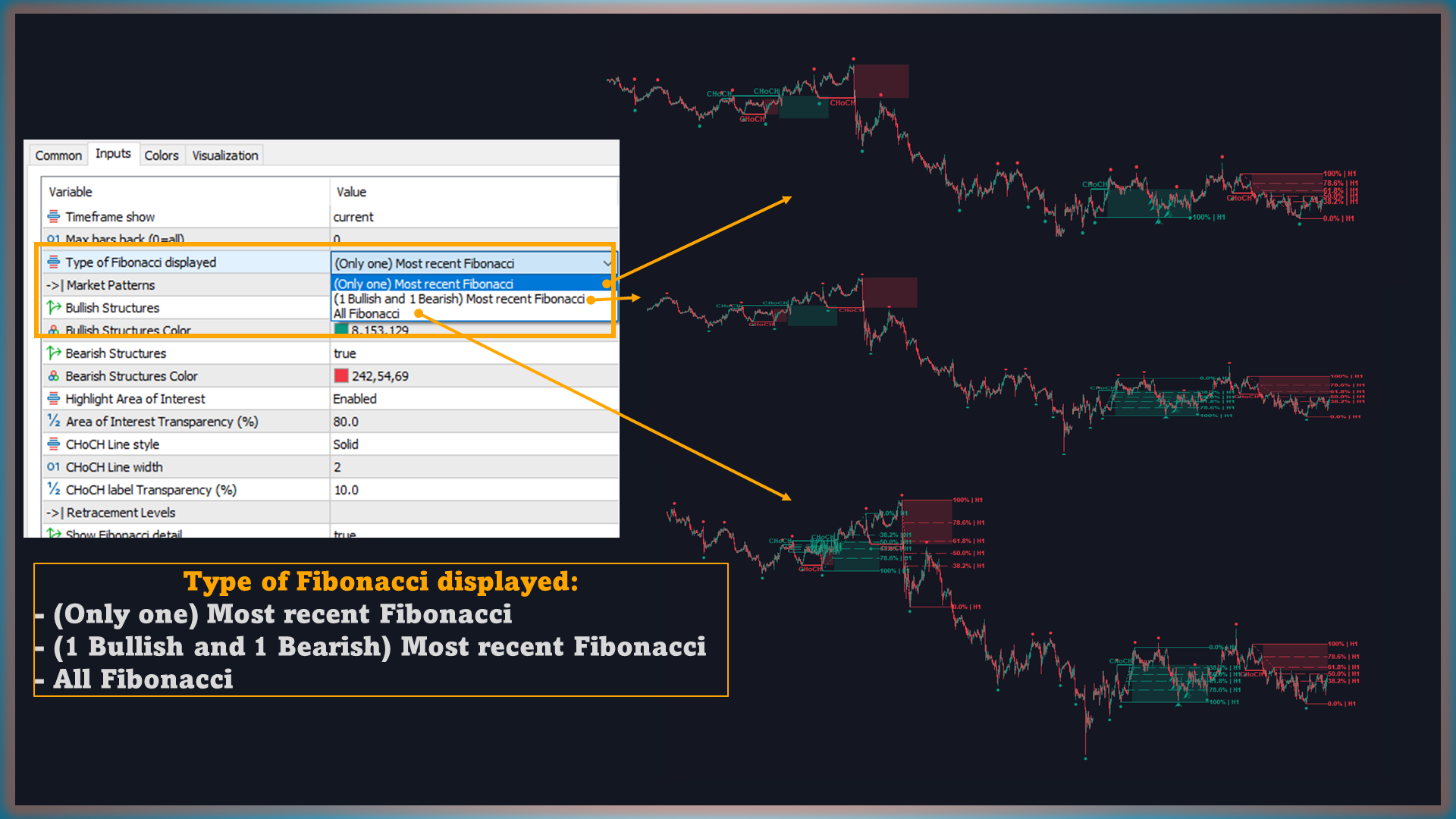

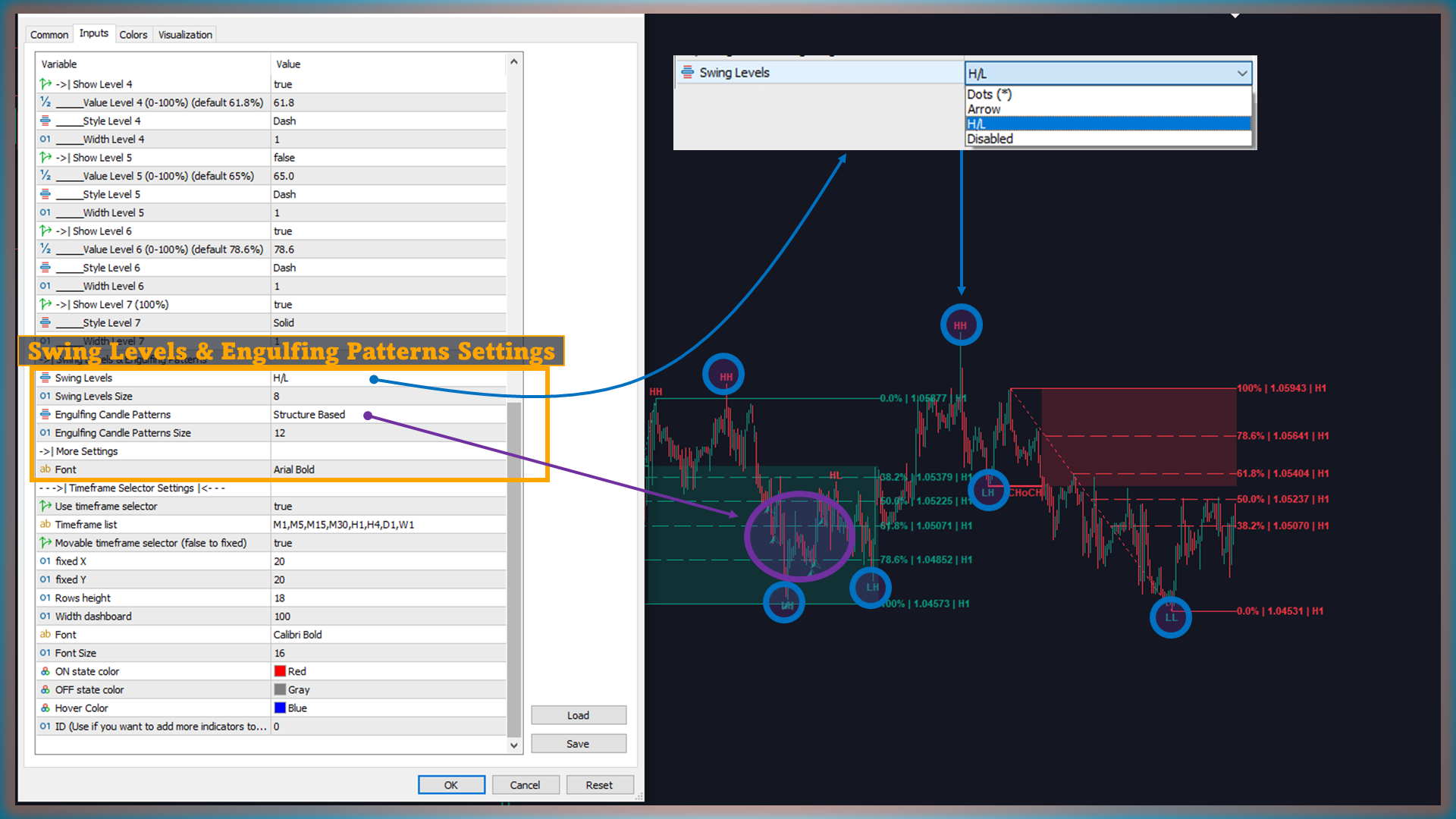

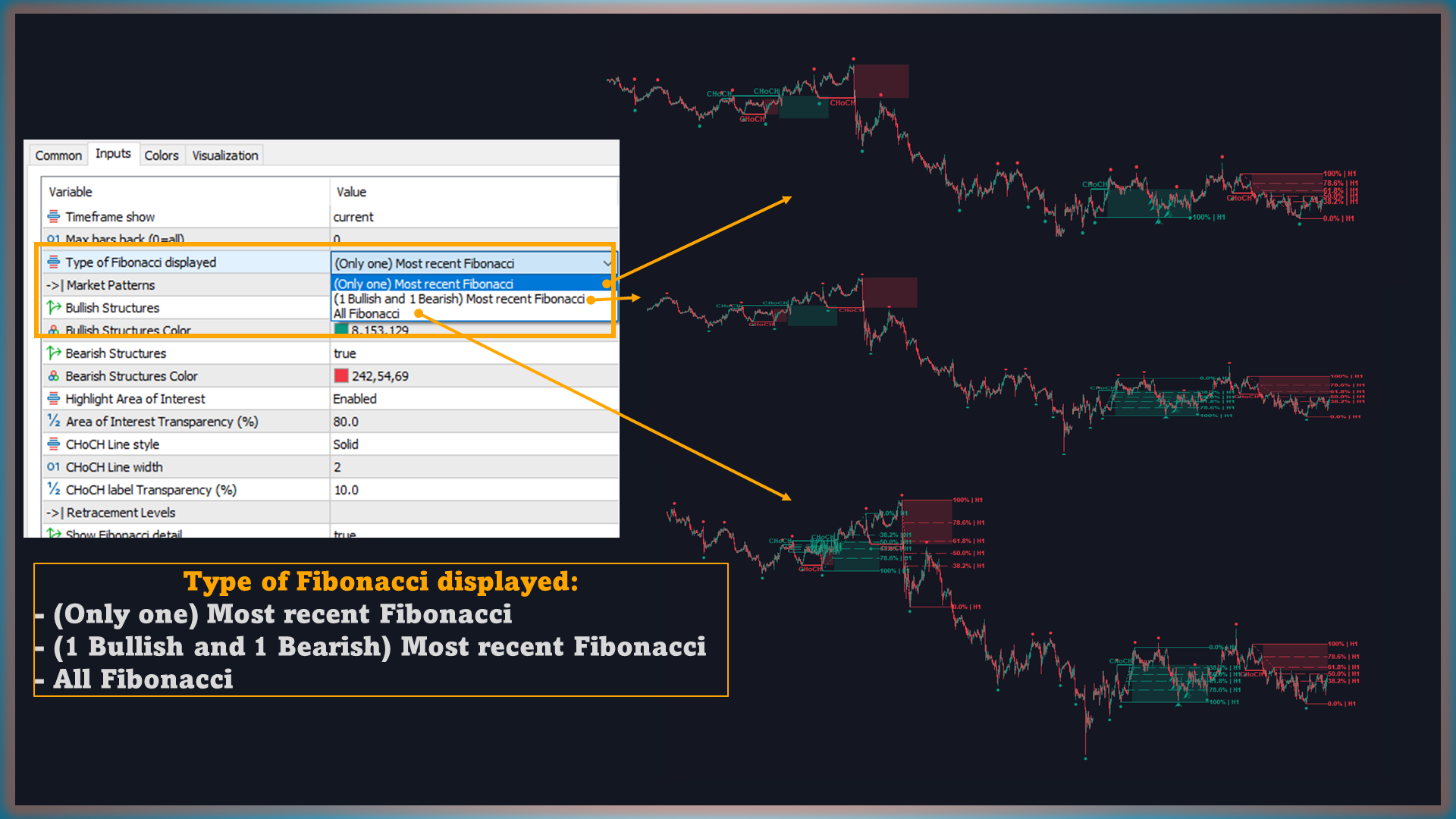

6. Detailed Settings Customization

The toolkit provides a range of customizable settings that allow users to tailor their analysis. Whether focusing on bullish or bearish structures, choosing which Fibonacci levels to display, or customizing how swing levels and engulfing patterns are marked, traders can create a workspace that suits their individual trading style.

7. Objective and Accurate Analysis

The focus on pure price patterns eliminates the need for subjective user-defined inputs, ensuring that the market analysis remains objective and robust. As a result, traders can trust the signals generated by the toolkit, leading to improved decision-making.

8. Strategy Diversification

By supporting multiple timeframes and various signals, the Fibonacci Confluence Toolkit accommodates different trading styles, allowing traders to diversify their strategies and adapt to changing market conditions.

9. Enhanced Confluence for Increased Accuracy

The combination of Fibonacci elements and candle patterns helps traders identify more precise entry and exit points. This reduces risk exposure and optimizes profit potential, making trading strategies more effective.

Conclusion

The Fibonacci Confluence Toolkit Multi-Timeframe is a vital asset for traders seeking to elevate their analytical capabilities and refine their trading strategies. With advanced features such as multi-timeframe analysis, automatic Fibonacci retracement applications, and engulfing candle pattern detection, traders will gain a distinctive edge in navigating volatile markets.

Reviews

There are no reviews yet.