FX TradingBot EA MT4

$590 Original price was: $590.$29Current price is: $29.

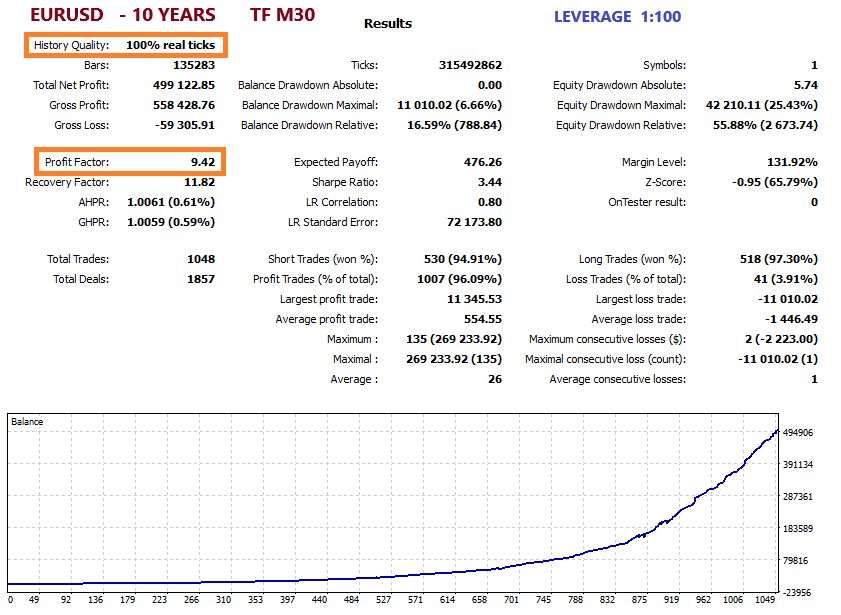

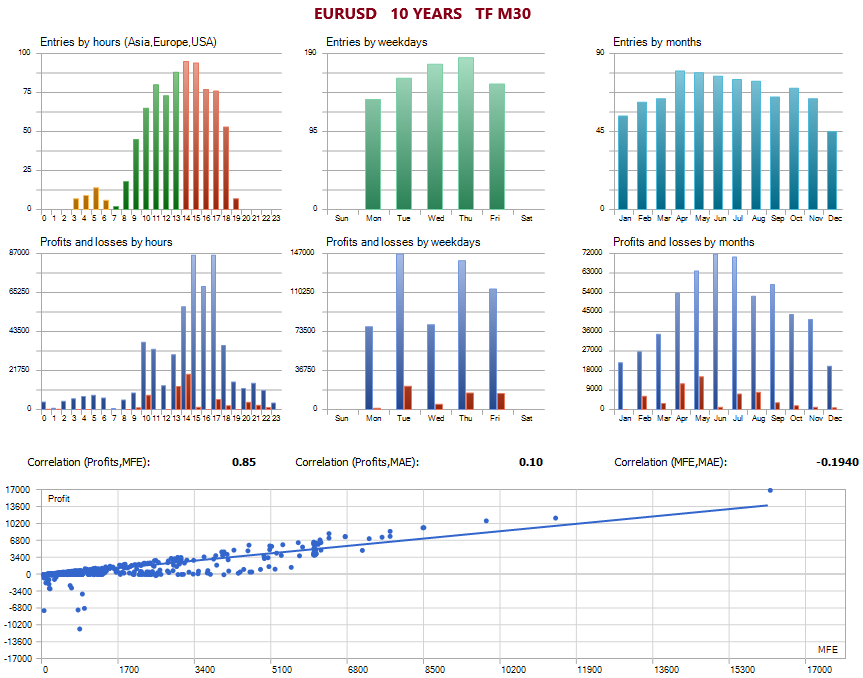

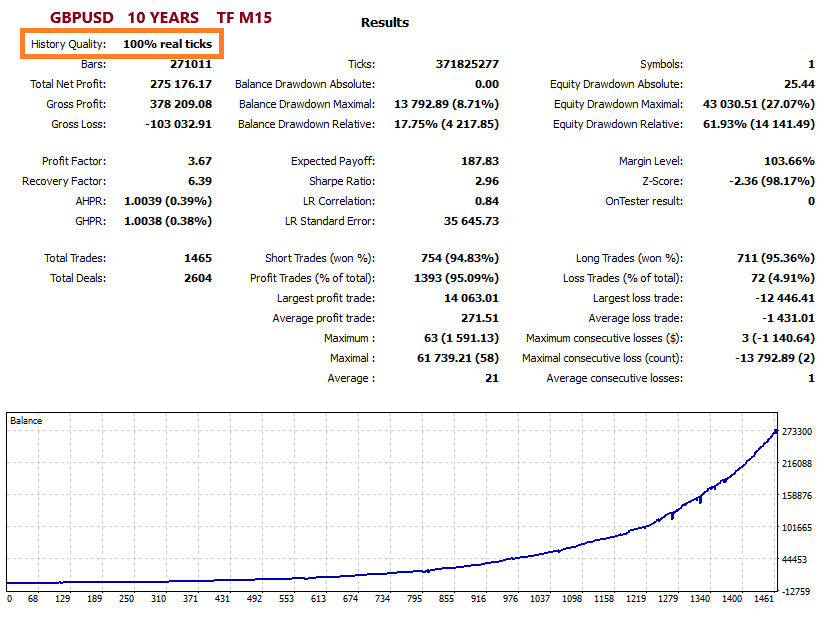

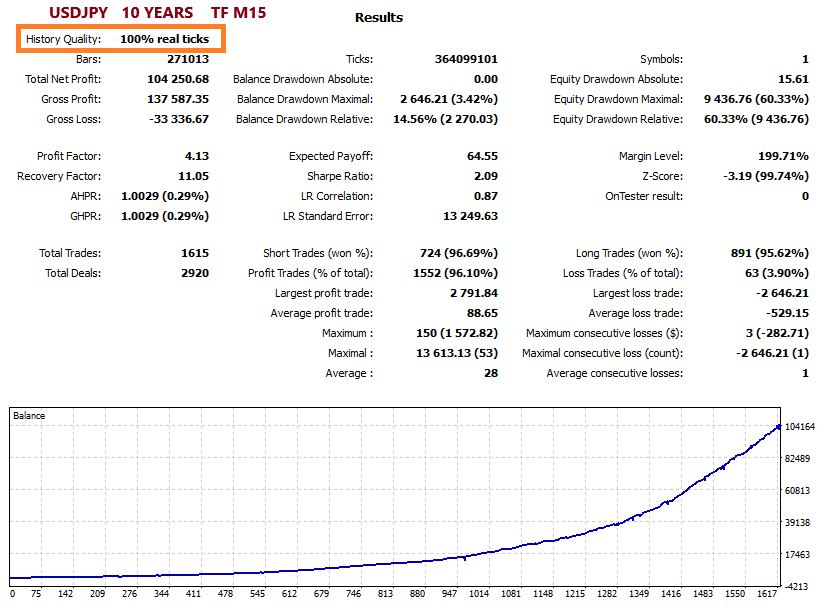

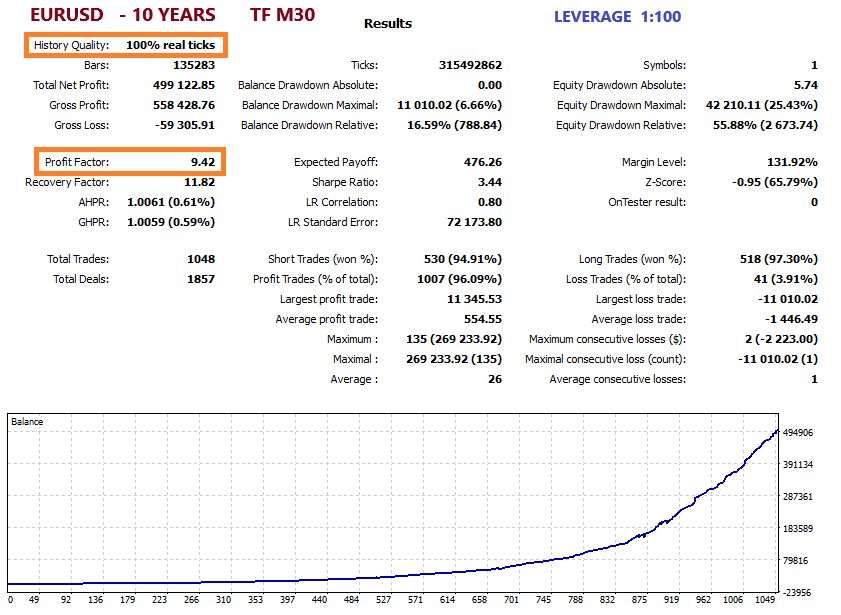

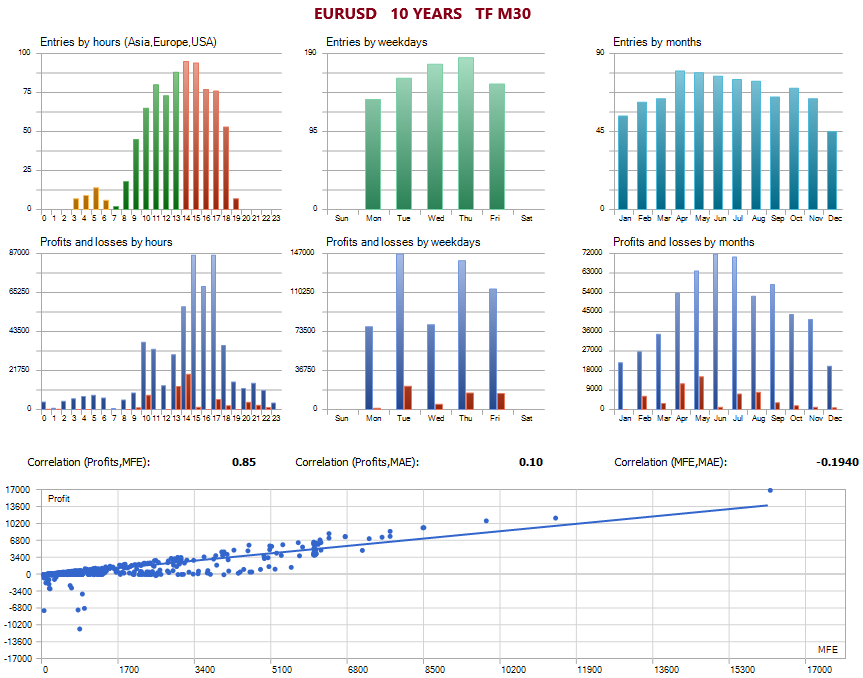

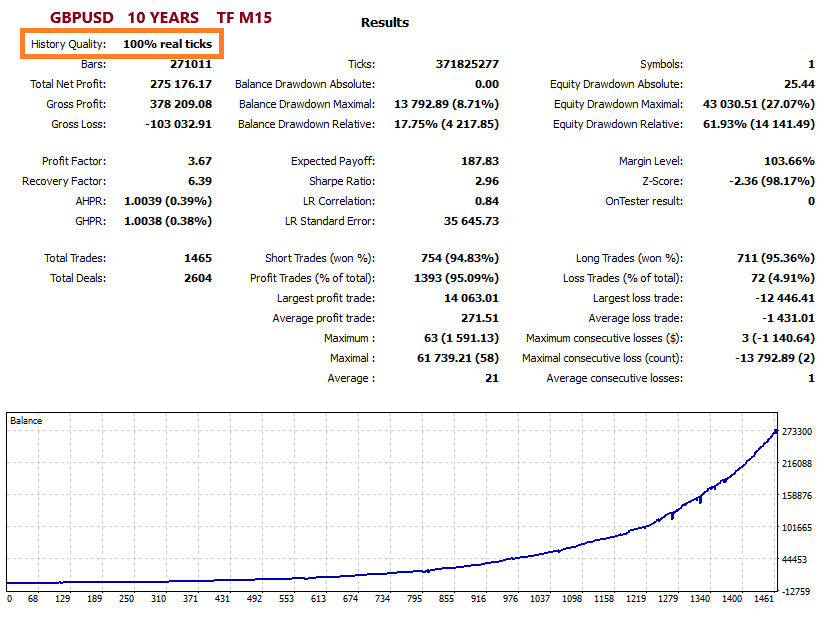

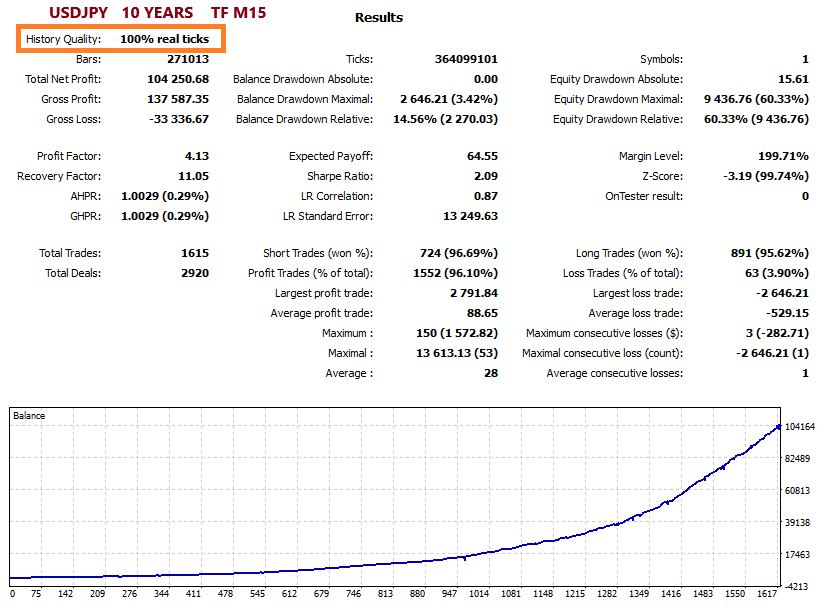

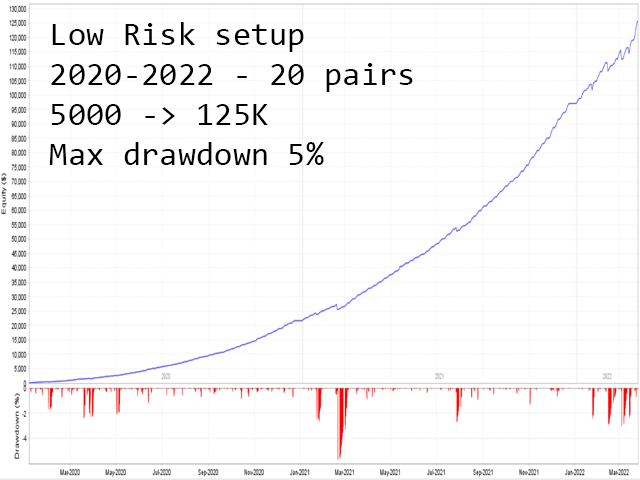

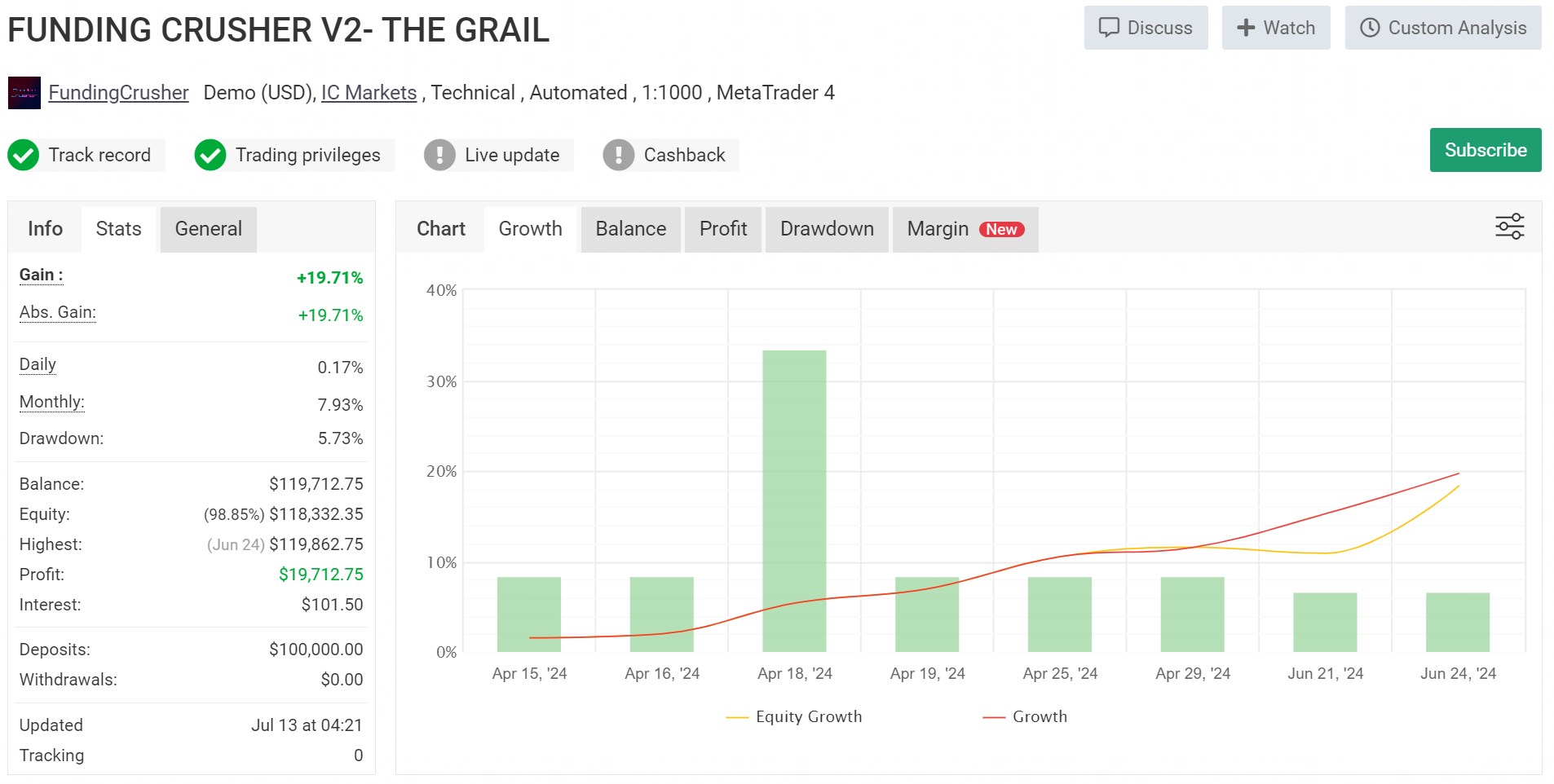

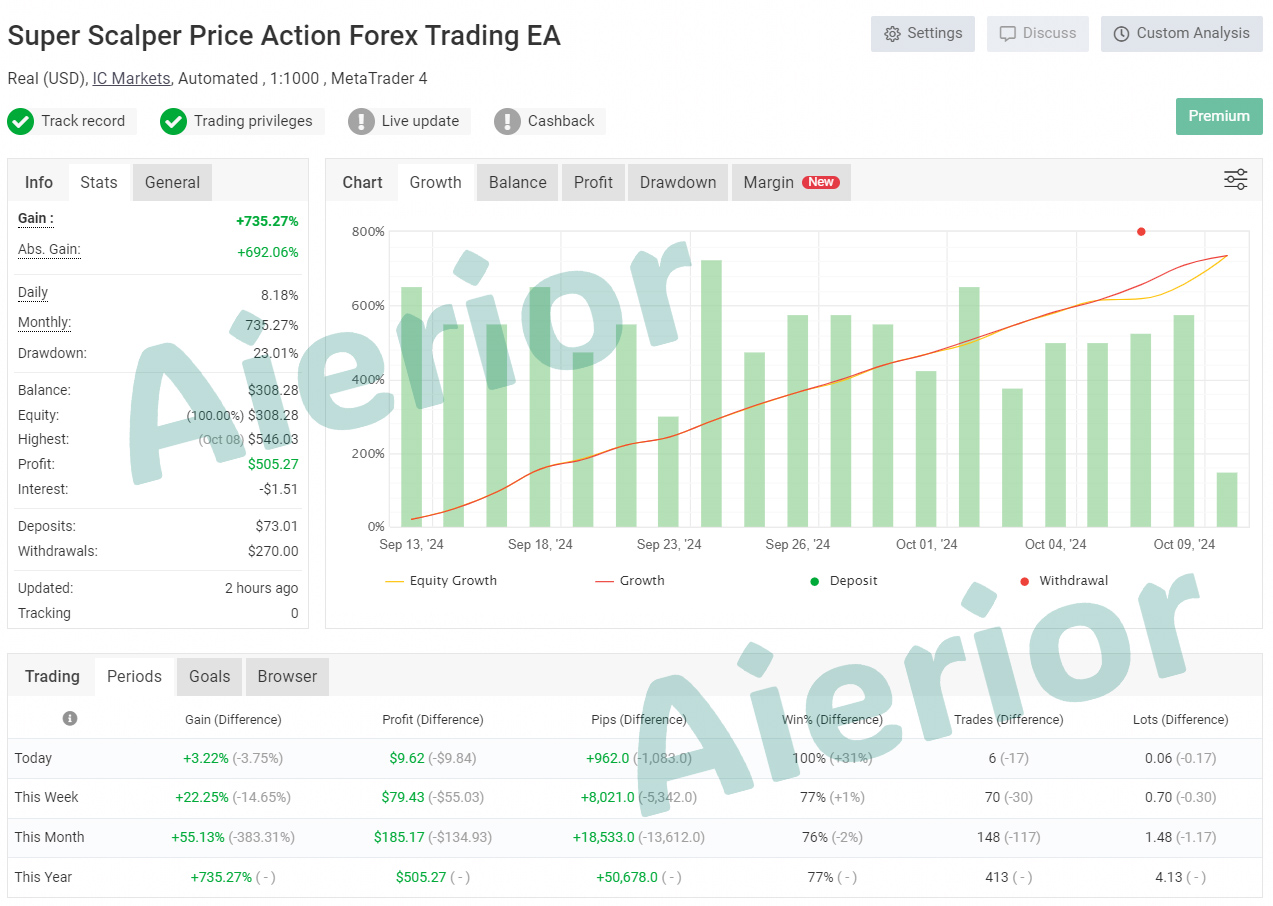

FX TradingBot EA MT4 is a fully automated trading robot designed for major currency pairs, leveraging support, resistance, and indicators for trade opportunities. Tested with 100% accuracy on MetaTrader 5 over ten years, it features customizable settings for trade size, stop loss, and time management, ideal for stable accounts.

Advantages of FX TradingBot EA MT4

The FX TradingBot EA MT4 is designed to provide numerous benefits for traders looking to optimize their forex trading experience. Here are some key advantages:

1. Fully Automated Trading

This trading robot operates entirely on its own, reducing the need for constant monitoring and manual intervention. By automatically analyzing market conditions and executing trades based on predefined criteria, traders can save time and effort.

2. Advanced Analysis Techniques

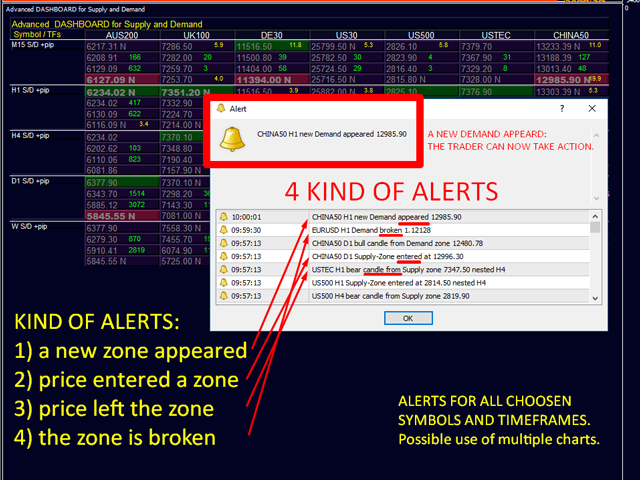

Utilizing sophisticated methods like support and resistance levels, swing trading, and gap detection, the FX TradingBot effectively identifies potential trading opportunities. It employs various indicators combined with back analysis of daily and monthly trends, ensuring a comprehensive approach to market analysis.

3. Proven Accuracy

Having been rigorously tested on real data with an impressive 100% accuracy over the past ten years, users can trust in the reliability of this trading robot. Its performance is continually refined to adapt to changing market conditions.

4. Flexible Trading Settings

Traders have the flexibility to customize various settings, including trading hours, spread limits, and maximum open trades. This personalization allows for a tailored trading strategy that aligns with individual risk preferences and objectives.

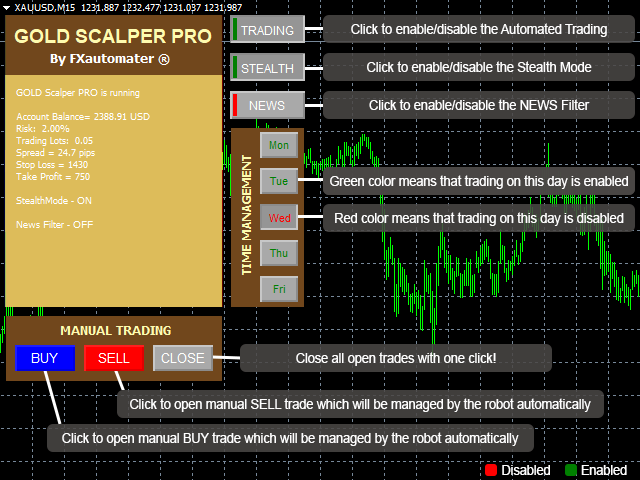

5. User-Friendly Interface

The EA comes with a practical information panel on the chart, along with various buttons to facilitate the opening of manual trades. This user-friendly interface enhances the trading experience, making it accessible even for less experienced traders.

6. Non-Scalping and Low-Spread Sensitivity

This trading bot is not a scalping robot, which means it is less sensitive to slippage and spread fluctuations. Traders can operate with more peace of mind regarding their execution quality, especially when using leverage of 1:100 or higher.

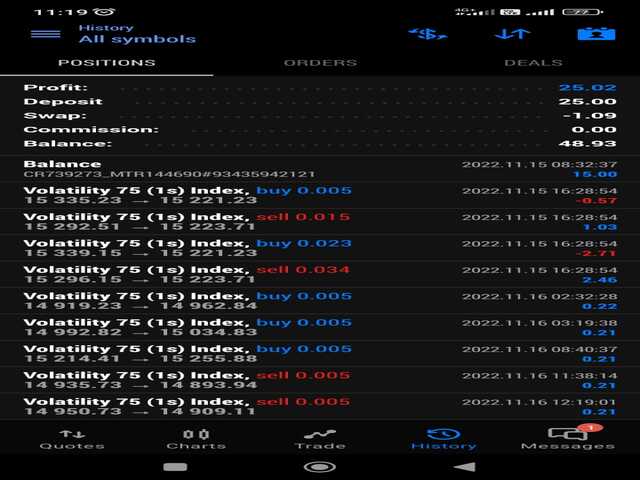

7. Comprehensive Risk Management

The EA offers robust risk management options, such as setting Stop Loss for each trade, partial trade closures, and trailing stop losses. Additionally, traders can enable functions to close all trades during significant drawdowns, ensuring a proactive approach to risk management.

8. Time-Based Trade Closure

The option to activate a time closing security function adds an extra layer of protection. This feature allows trades that are not hedged against a loss to be closed after a specified duration, helping to mitigate potential losses and improve overall trading performance.

Reviews

There are no reviews yet.