Market Sessions Pre MT4

$30 Original price was: $30.$29Current price is: $29.

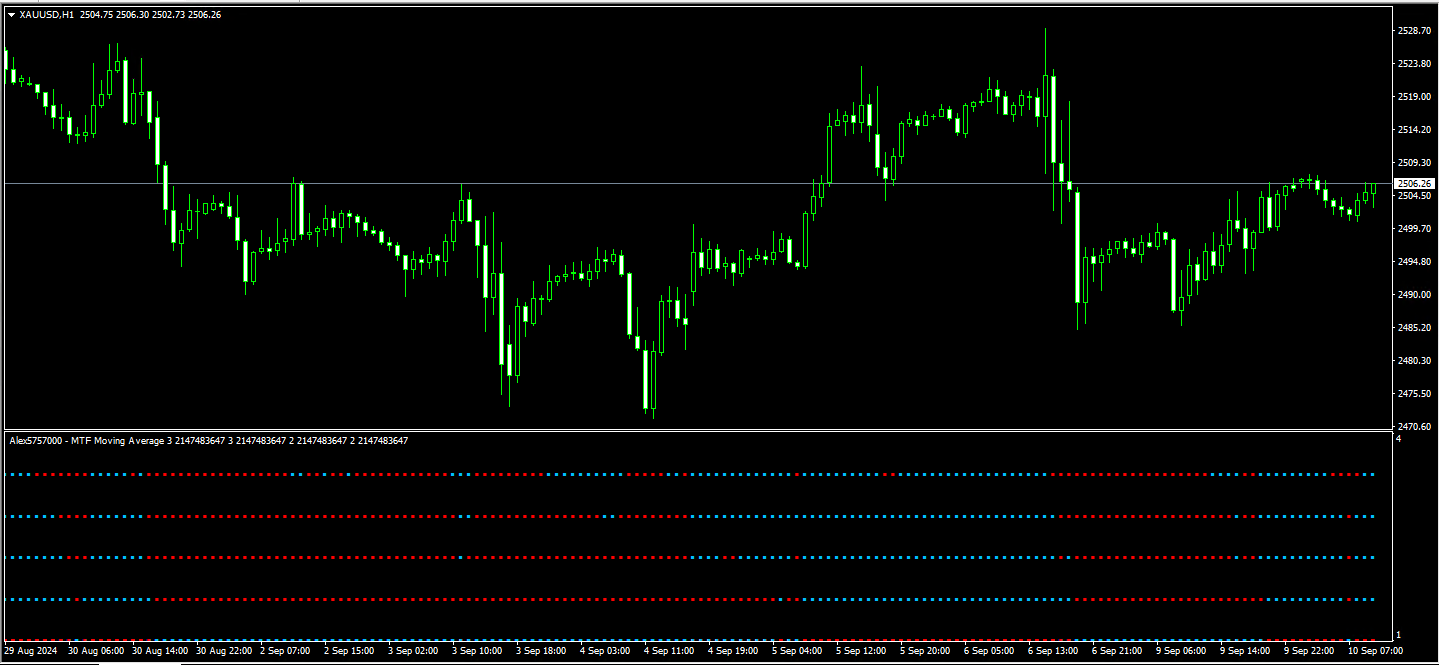

The Market Sessions Pre MT4 indicator visually represents global trading sessions on price charts, highlighting periods for the Asian, European, and American markets. It helps traders identify session timings and overlaps, enhancing decision-making and strategy development based on the unique characteristics of each session.

Advantages of the Market Sessions Pre MT4 Indicator

The Market Sessions indicator is an invaluable tool for forex and stock traders, providing a visual representation of global trading sessions directly on price charts. Here are the key advantages of using this indicator:

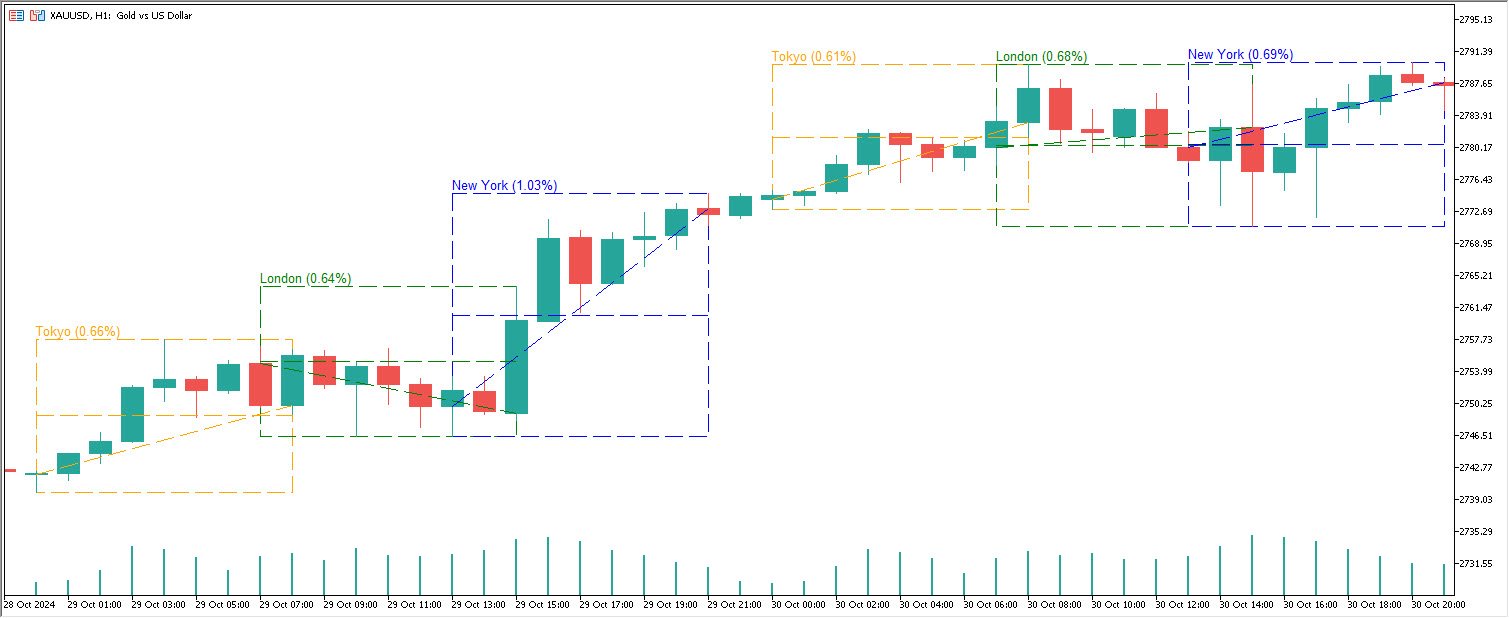

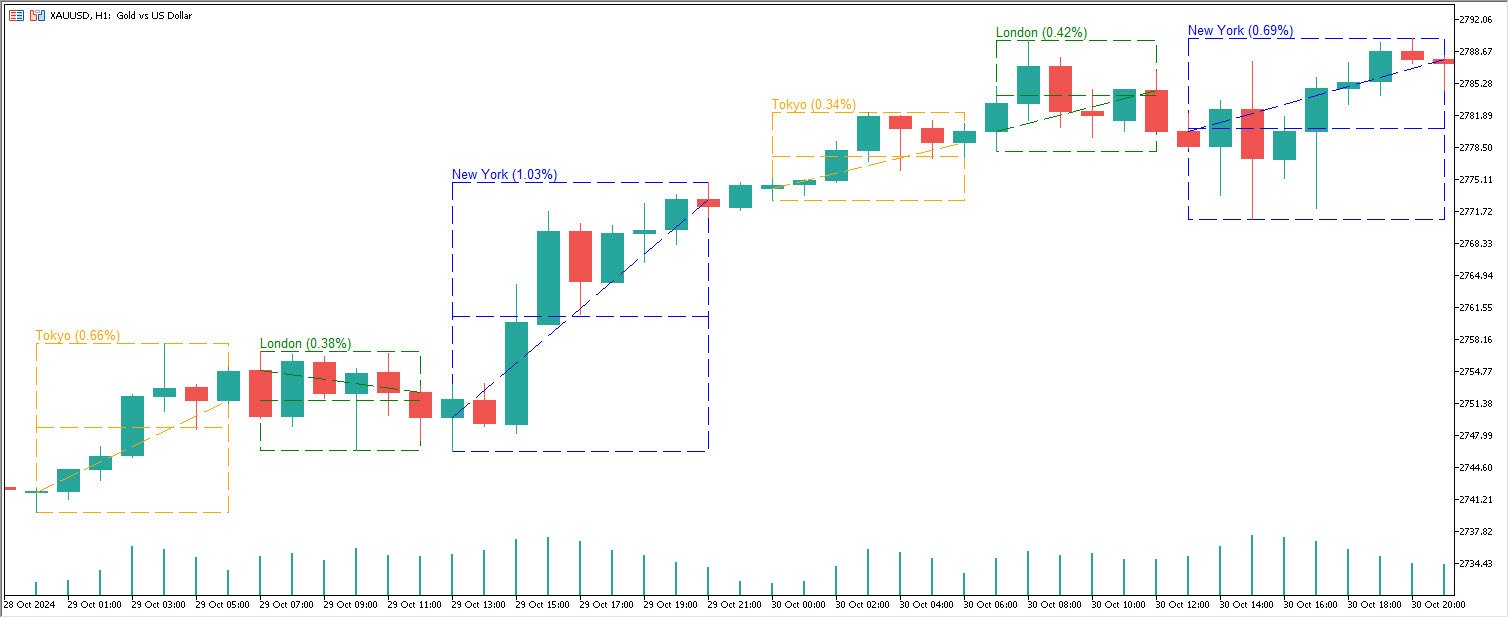

1. Visual Clarity of Trading Sessions

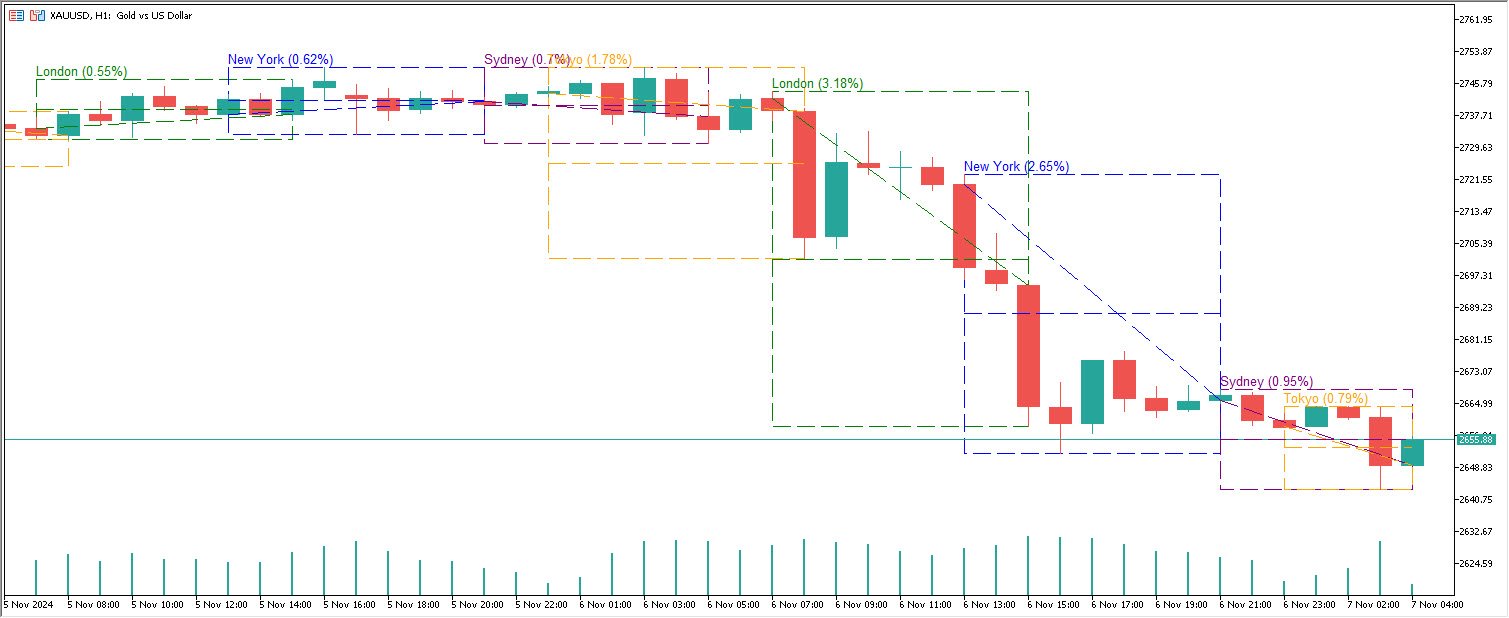

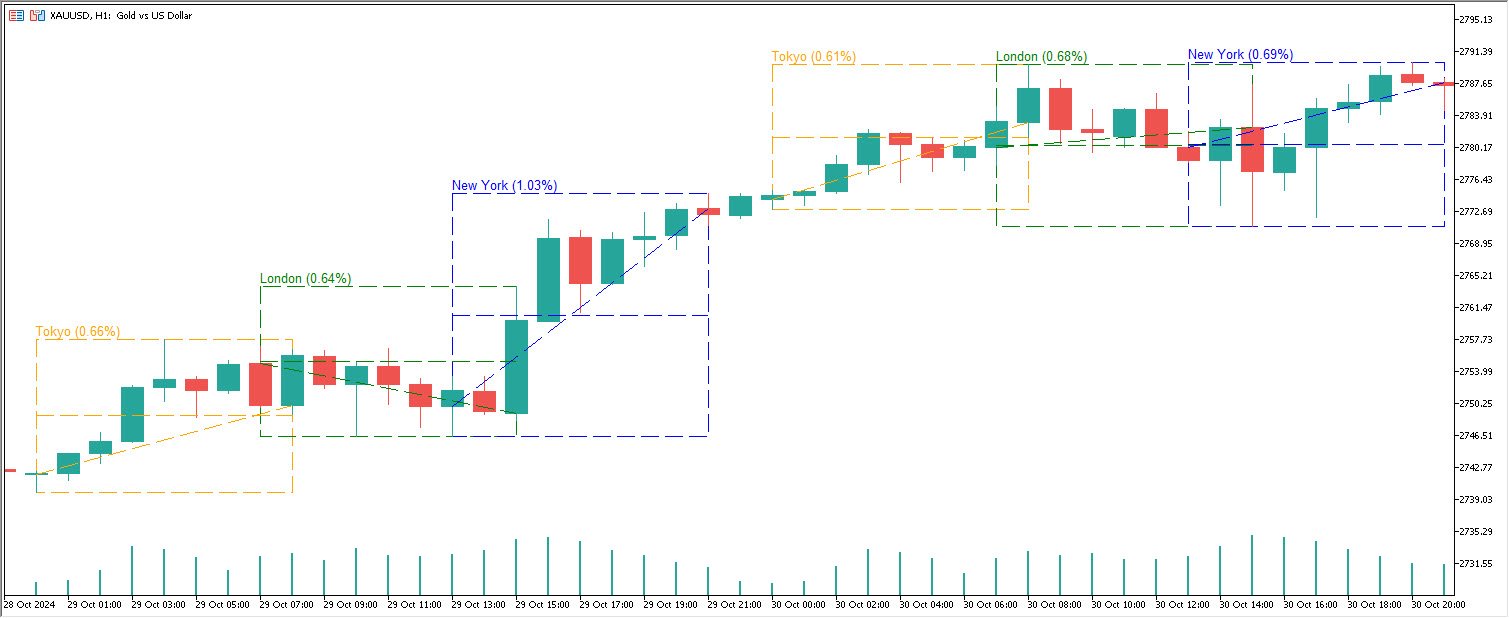

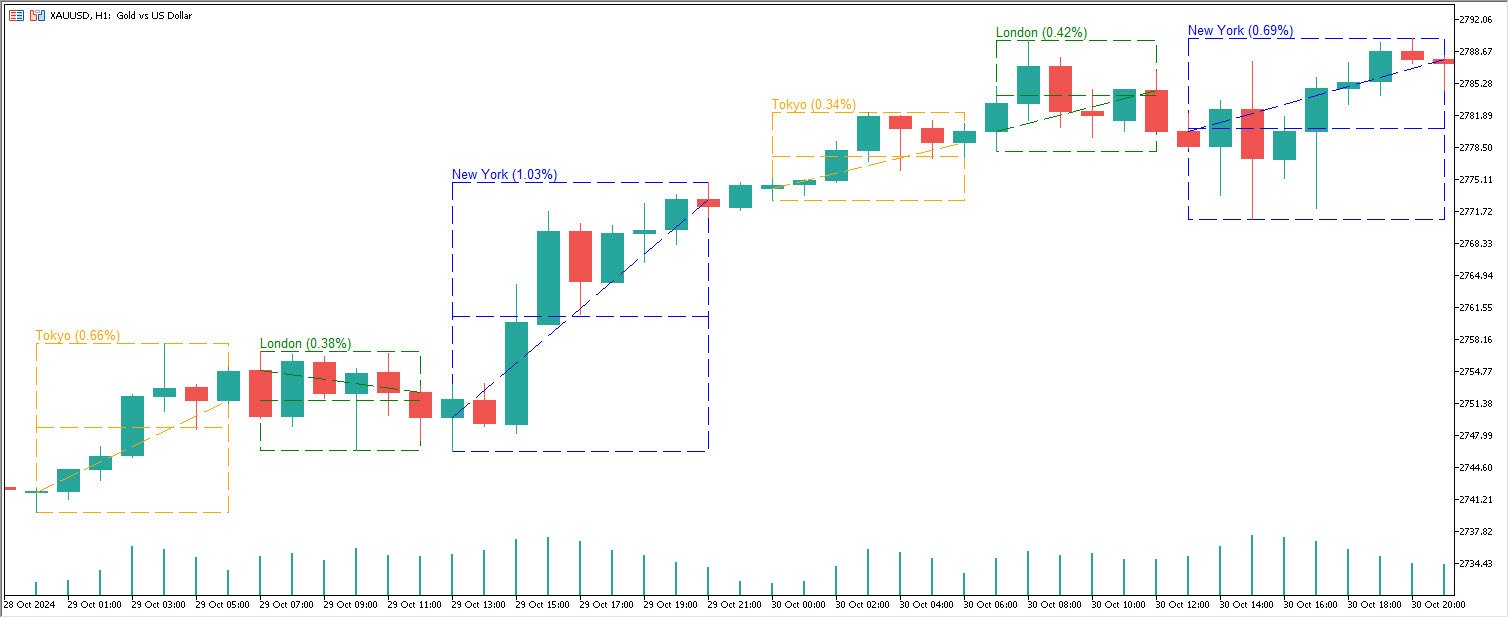

By highlighting the major trading sessions—Asian (Tokyo), European (London), and American (New York)—the indicator allows traders to easily identify when each session starts and ends. This visual representation aids in understanding the unique characteristics of each market session, leading to more informed trading decisions.

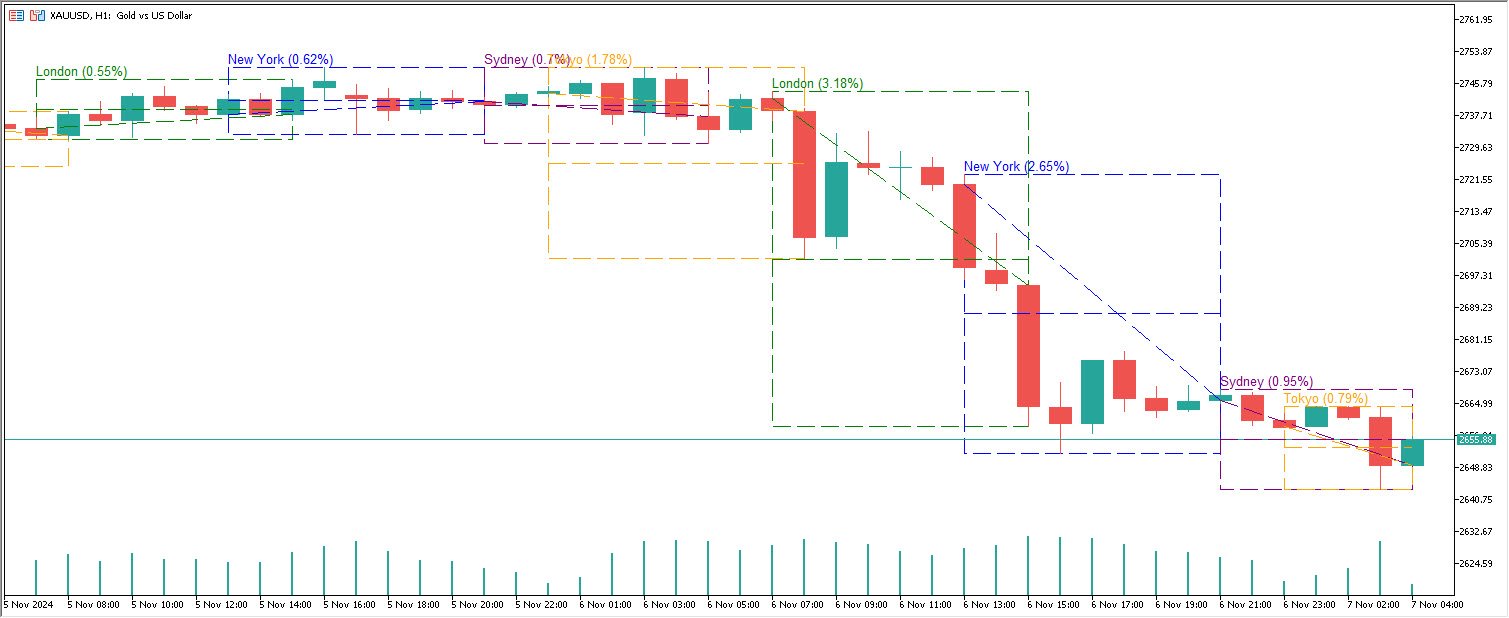

2. Session Timing and Overlaps

The indicator not only marks the beginning and end of each session but also highlights overlaps between them. This is particularly beneficial because overlapping sessions often feature higher liquidity and activity, allowing traders to strategize their trades around these peak times.

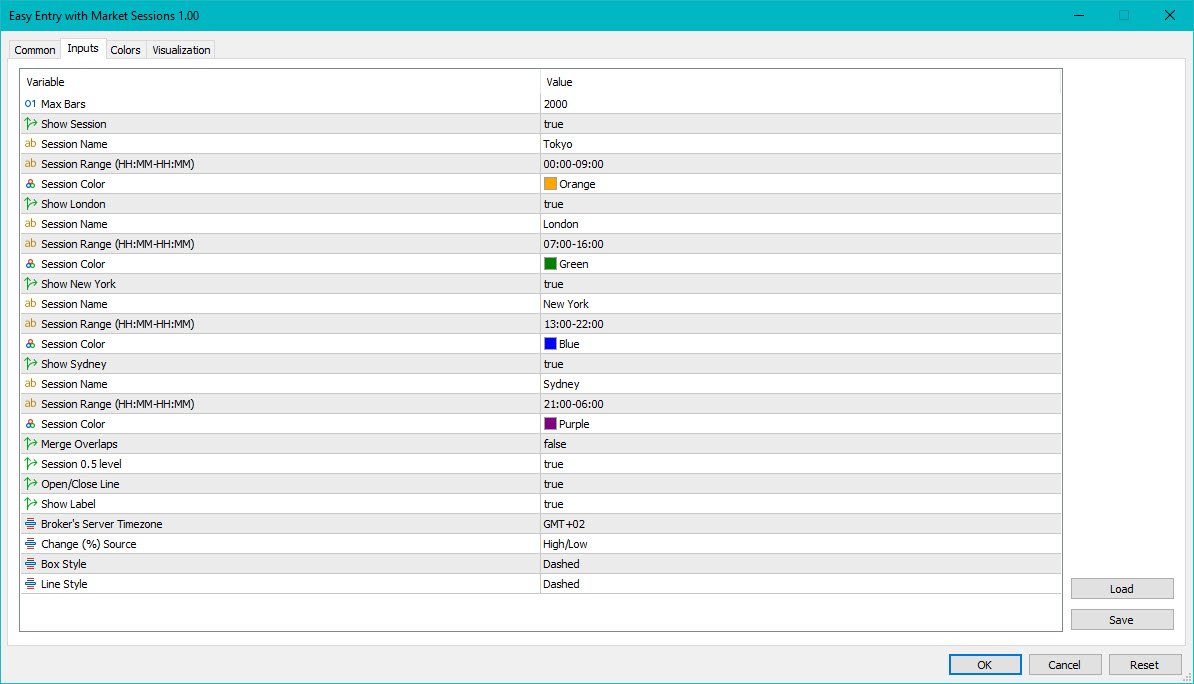

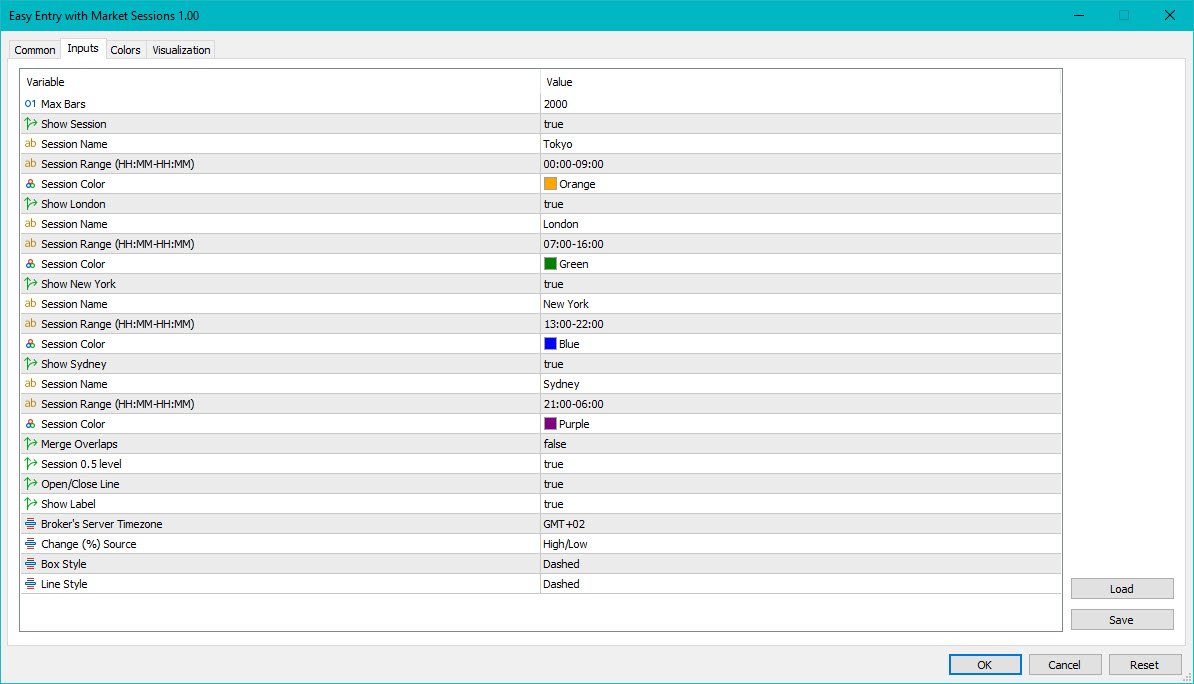

3. Customizable and User-Friendly

With customizable session colors, traders can easily distinguish between different sessions, tailoring the appearance to their preferences. This personalization enhances clarity and helps traders focus on the sessions that align with their trading strategies.

4. Adjustable Time Zones

Given the global nature of trading, the ability to adjust time zones ensures that session timings align with a trader’s local time. This feature is particularly advantageous for those trading from regions outside the major financial hubs.

5. Strategy Development Based on Session Characteristics

Different trading sessions exhibit unique behaviors. For instance, the London session is typically more volatile, presenting breakout opportunities, while the Asian session may favor range trading strategies. Understanding these distinctions allows traders to develop session-specific trading strategies.

6. Enhanced Trade Timing

Knowing which session is active helps traders optimize their trade timing, taking advantage of varying levels of market volatility and liquidity. This strategic adjustment can lead to improved trading outcomes.

7. Improved Price Analysis

The visual marking of session times on the chart enables traders to analyze price behavior specific to each session. This analysis can lead to the refinement of trading strategies that leverage session characteristics for more effective trading.

8. Anticipation of Market Volatility

Volatility is often heightened during session openings, closings, and overlaps. By using the Market Sessions indicator, traders can better anticipate these fluctuations, reducing the risk of being caught off-guard by abrupt market movements.

Example Use Case

Consider a trader aiming to capitalize on volatility: the London-New York overlap period often represents a peak in market movement. By utilizing the Market Sessions indicator, the trader can plan their entries and exits to align with this high-activity timeframe, increasing the potential for significant profits.

Conclusion

The Market Sessions indicator is essential for traders who wish to make informed and strategic decisions based on time-specific market behaviors. Its clarity, customizable features, and emphasis on market volatility support more effective trading strategies, ultimately contributing to a trader’s success.

Reviews

There are no reviews yet.