Market Structure w Inducements and Sweeps NDH MT4

$49 Original price was: $49.$29Current price is: $29.

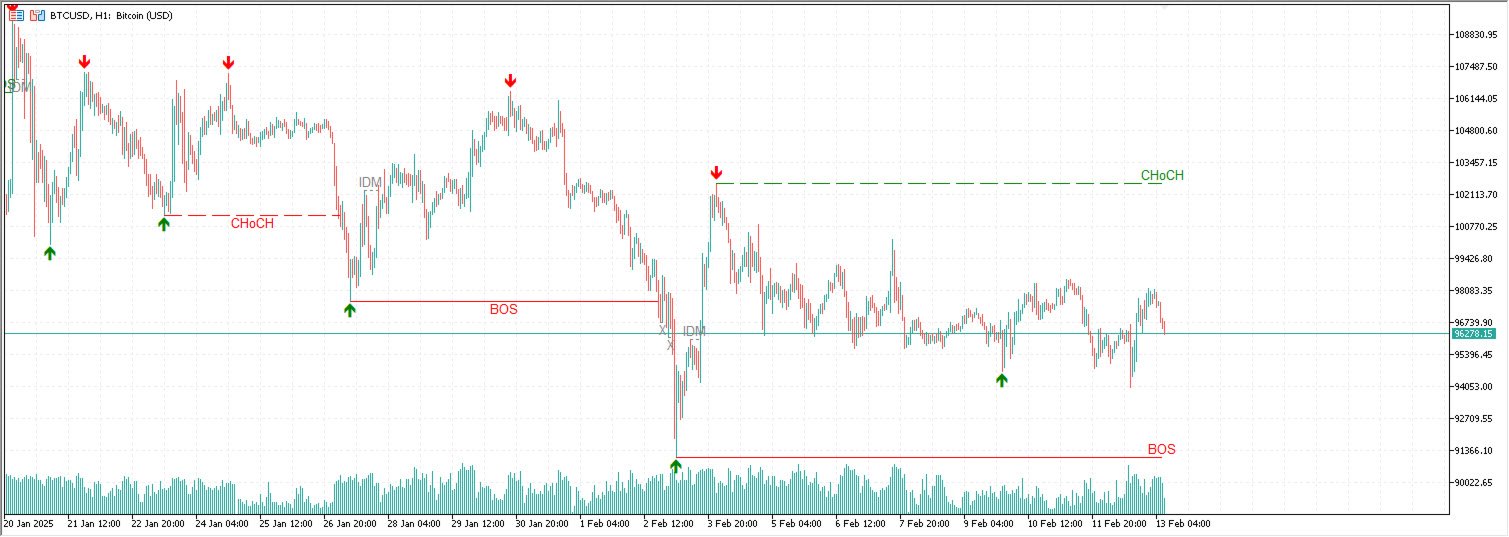

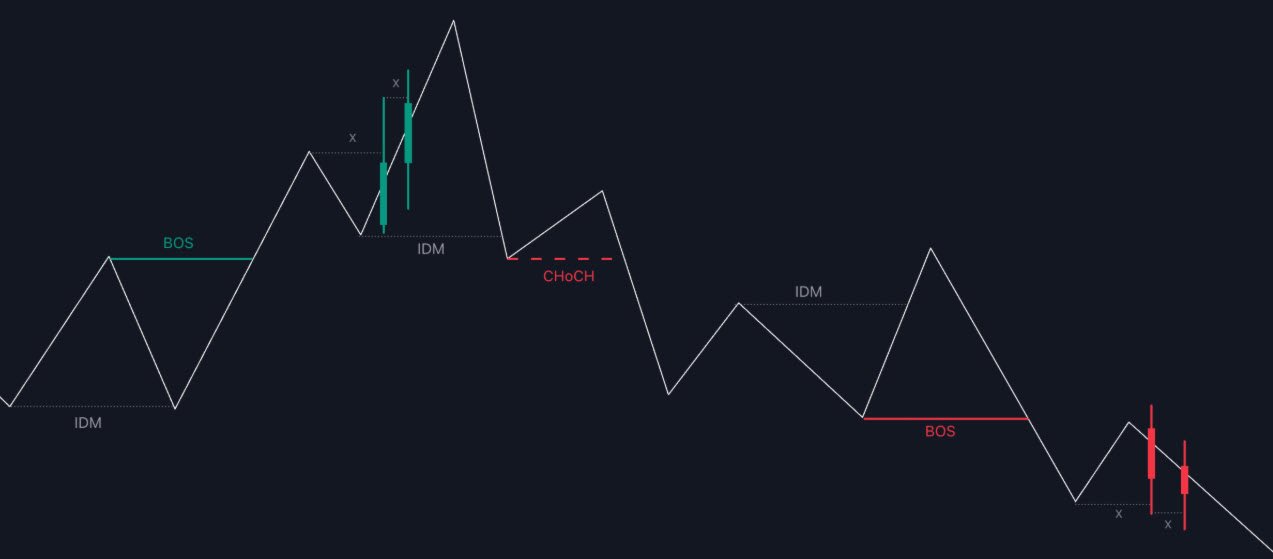

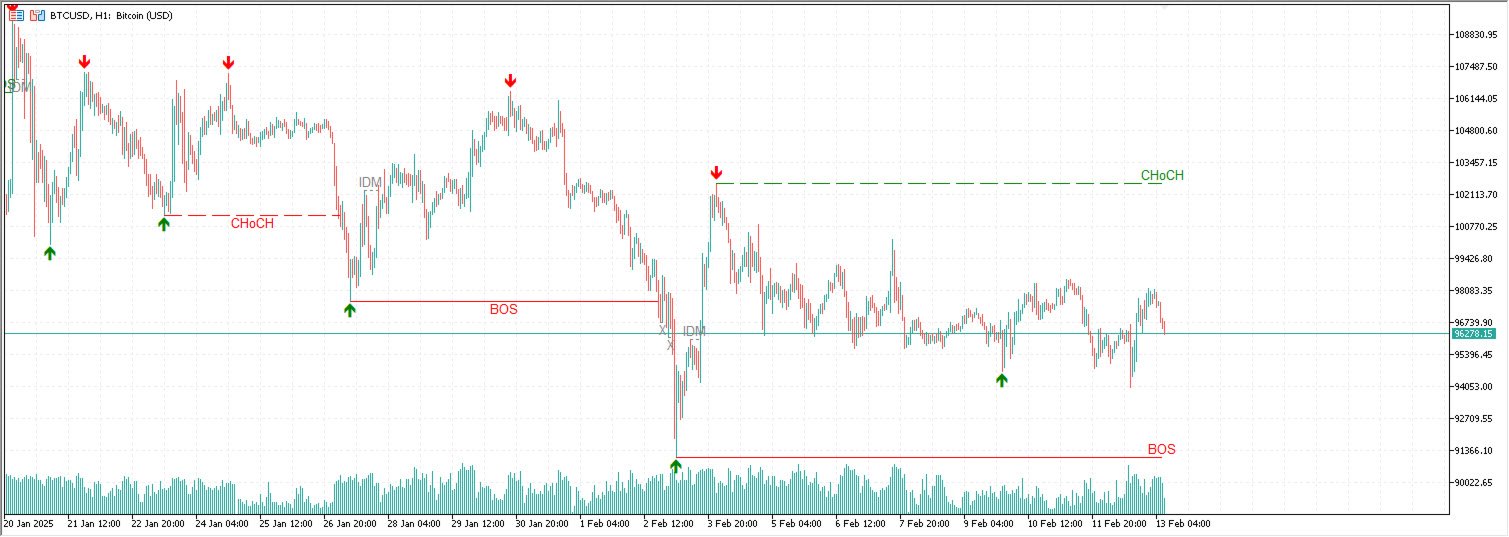

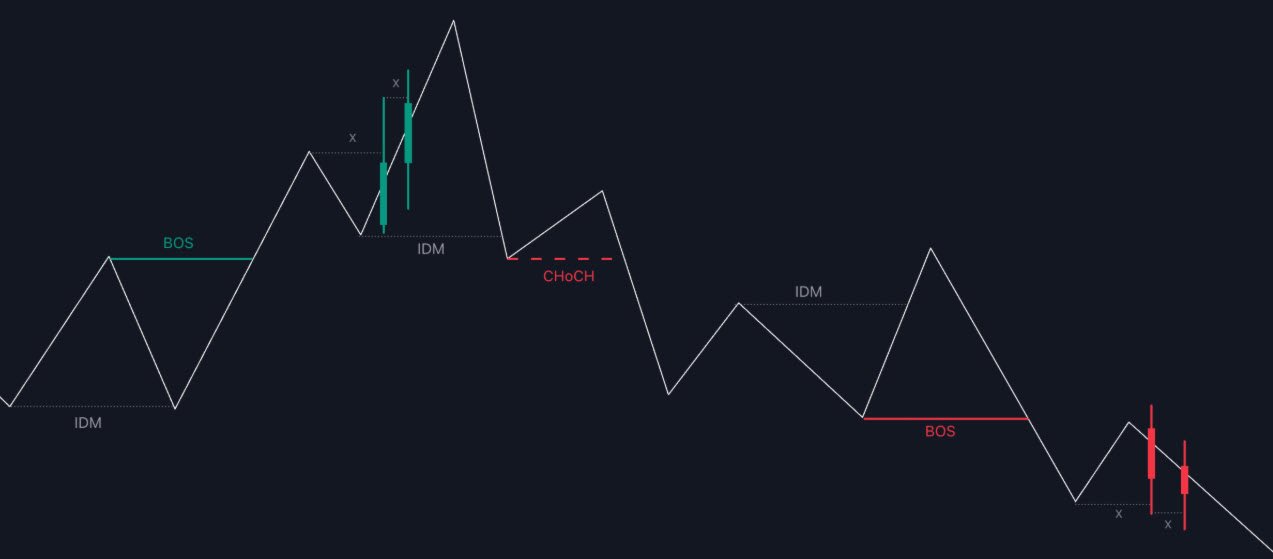

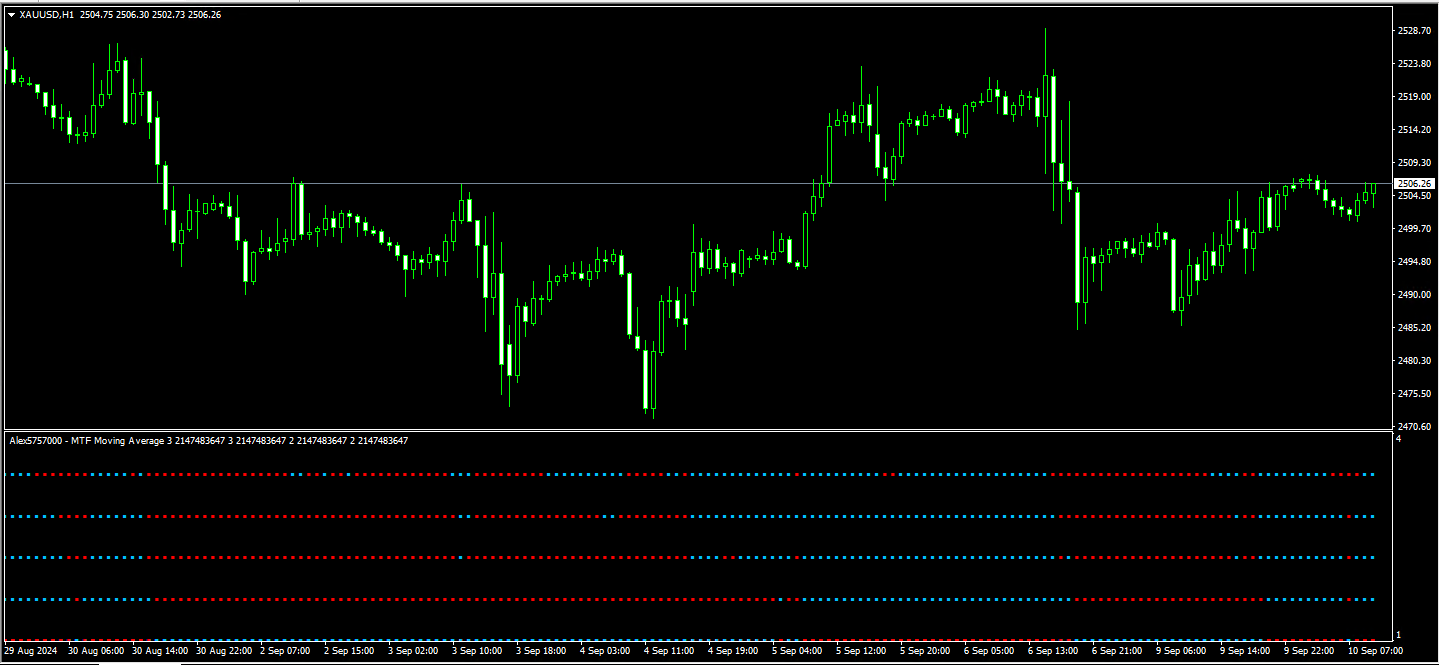

Market Structure with Inducements and Sweeps on MT4 is an advanced indicator that enhances traditional Smart Money Concepts. It identifies Change of Character (CHoCH), Break of Structures (BOS), along with Inducements (IDM) and liquidity sweeps. This allows traders to avoid false signals and analyze market dynamics more accurately.

Advantages of Market Structure with Inducements and Sweeps NDH MT4

The Market Structure with Inducements & Sweeps indicator provides a comprehensive and innovative approach to understanding market dynamics, particularly for traders interested in Smart Money Concepts (SMC). Here are some key advantages:

1. Enhanced Market Structure Interpretation

This indicator integrates the concept of Inducements (IDM) and Liquidity Sweeps alongside traditional aspects like Change of Character (CHoCH) and Break of Structures (BOS). This multifaceted analysis helps traders gain a nuanced view of market trends and potential reversals, allowing for better-informed decisions.

2. Increased Accuracy in Trend Analysis

By including IDM in the assessment, traders can effectively reduce the chances of being misled by false breakouts. This precision is particularly valuable in volatile markets where swift price movements can often deceive traders into making premature decisions.

3. Dynamic Evaluation of Market Conditions

The indicator continuously assesses market structure through a dynamic evaluation of trailing maximum and minimum prices. This allows traders to recognize changing market conditions and adapt their strategies accordingly, whether they are focusing on long-term trends or short-term scalping opportunities.

4. Confirmation of Market Structures

Understanding the significance of liquidity sweeps helps traders identify confirmed market structures as opposed to mere wicks. This distinction allows for more reliable entry and exit points, ultimately enhancing overall trading performance.

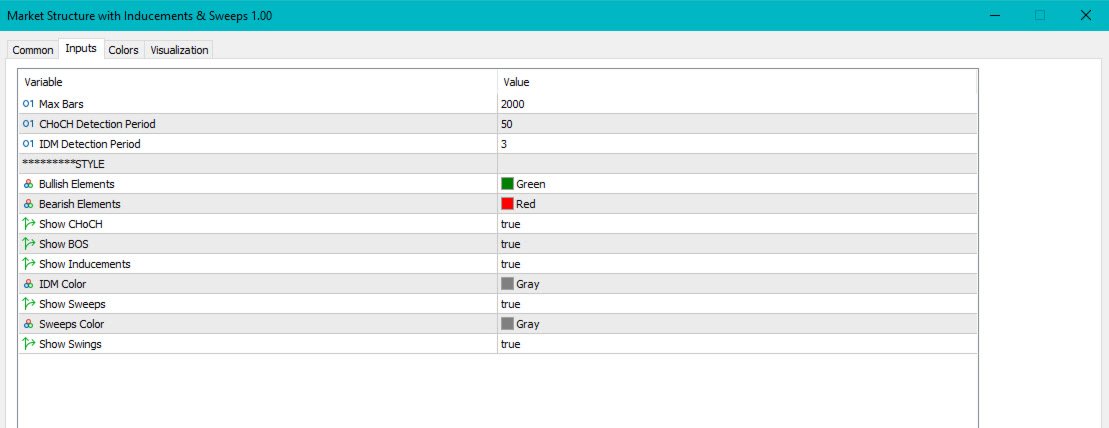

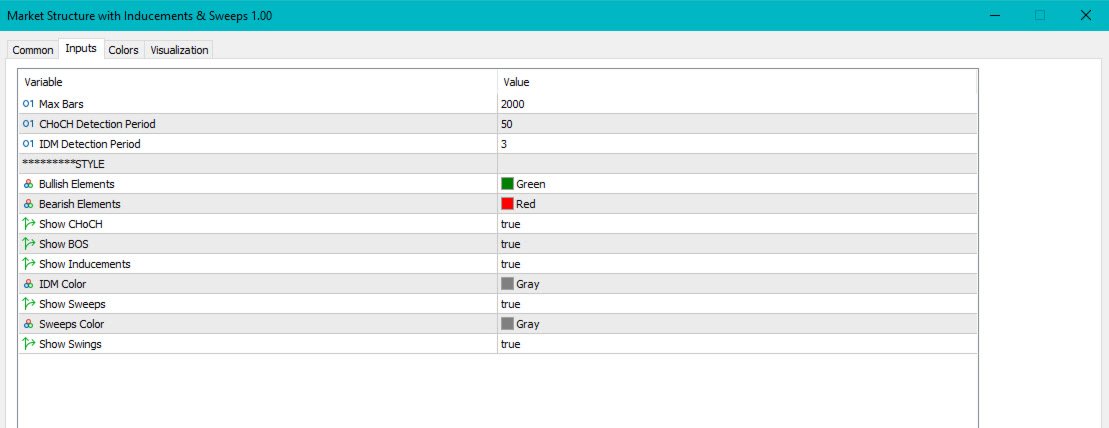

5. Flexible Settings for Customization

The Market Structure with Inducements and Sweeps indicator offers adjustable settings for CHoCH and IDM detection periods. Traders can customize these parameters based on their trading style and preferences, allowing for a personalized trading experience that aligns with individual strategies.

6. Better Risk Management

With the ability to anticipate price movements through the understanding of inducements and liquidity sweeps, traders can implement more effective risk management strategies. By identifying key levels of support and resistance, they can set more precise stop-loss orders and take-profit targets.

In conclusion, the Market Structure with Inducements and Sweeps NDH MT4 indicator offers traders an advanced tool for market analysis that enhances accuracy, risk management, and adaptability in their trading strategies.

Reviews

There are no reviews yet.