Market Zones MT4

$30 Original price was: $30.$29Current price is: $29.

Market Zones MT4 is an indicator that utilizes Gaussian statistical levels to identify dynamic market zones where prices typically remain (70% of the time). It features color-coded lines to indicate high, low, and most traded prices, helping traders spot breakouts and trends while simplifying market analysis.

Advantages of Market Zones for MT4

The Market Zones indicator for MT4 provides traders with several key advantages that streamline the trading process and improve decision-making based on statistical data. Here are some of the primary benefits:

1. Statistical Edge

The Market Zones indicator utilizes a unique formula to identify dynamic zones where price movements statistically remain 70% of the time. This statistical analysis helps traders focus on relevant price action, filtering out noise and non-essential bar movements.

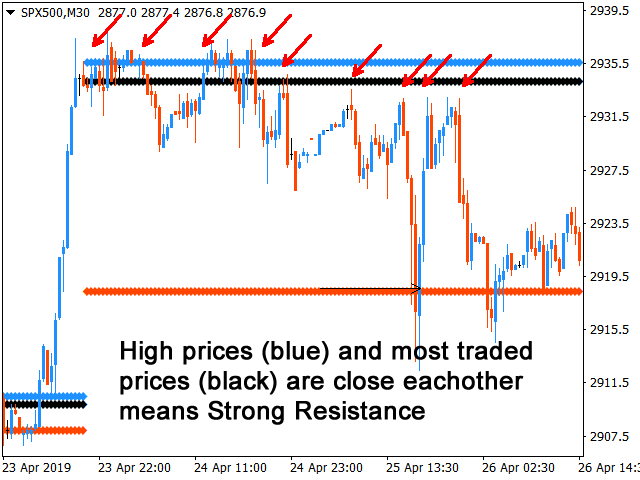

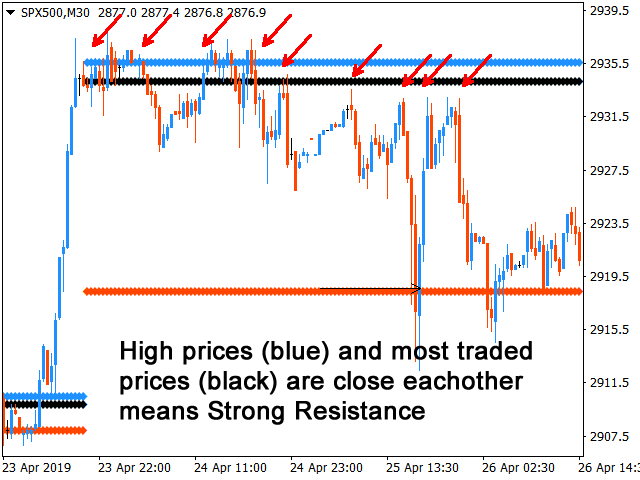

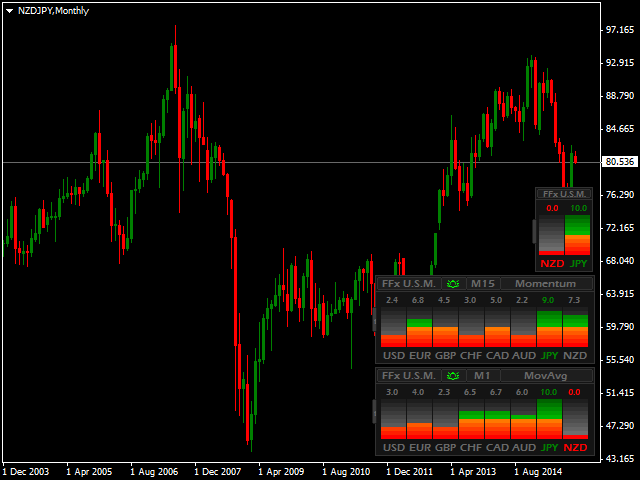

2. Clear Visual Representation

With three distinct lines representing the top, most traded, and bottom of the range, traders gain a clear visual of price behavior. This makes it easier to identify key support and resistance levels:

- Blue Line: Represents the highest price in the range.

- Black Line: Represents the most traded price within the range.

- Red Line: Represents the lowest price in the range.

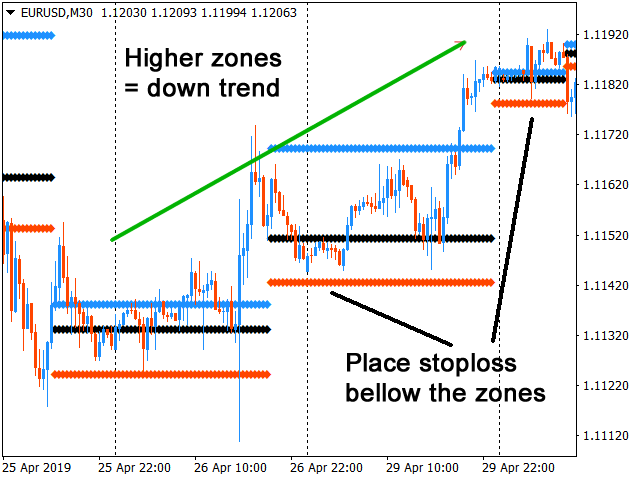

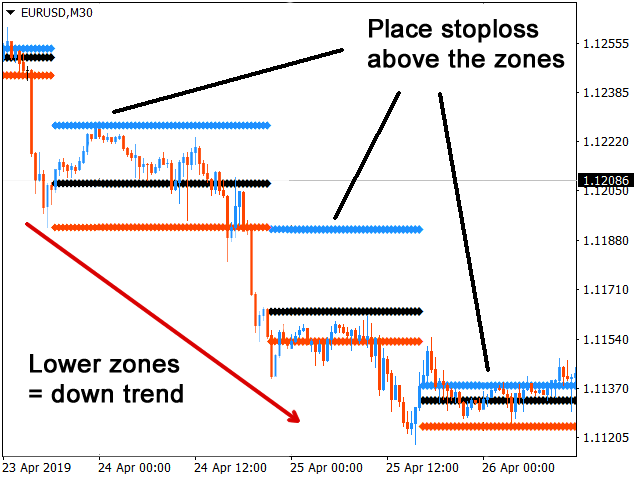

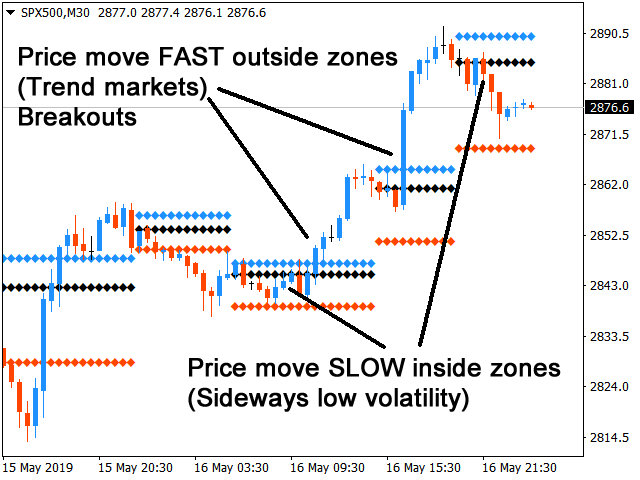

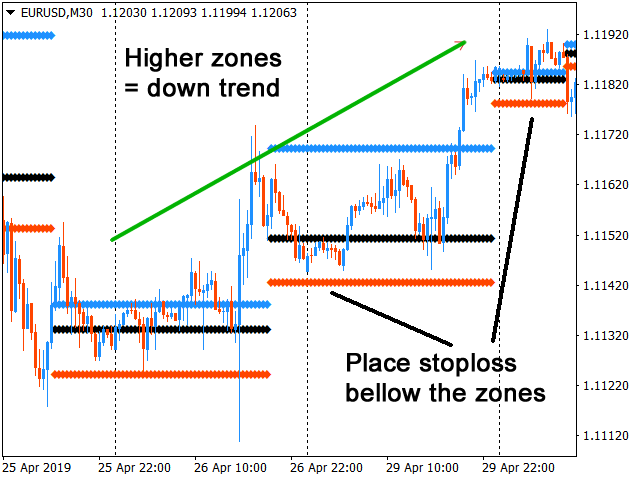

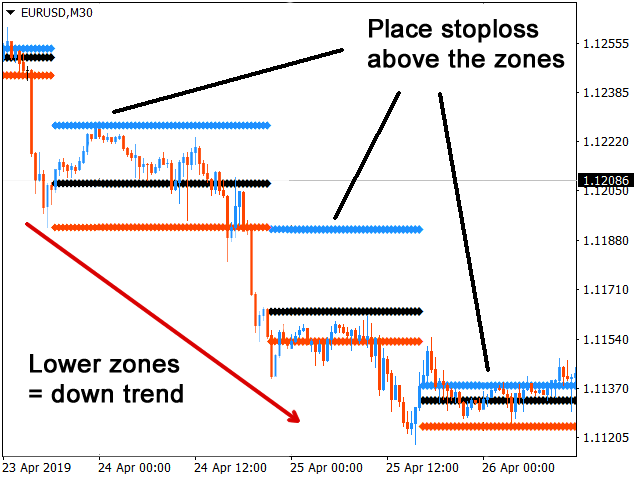

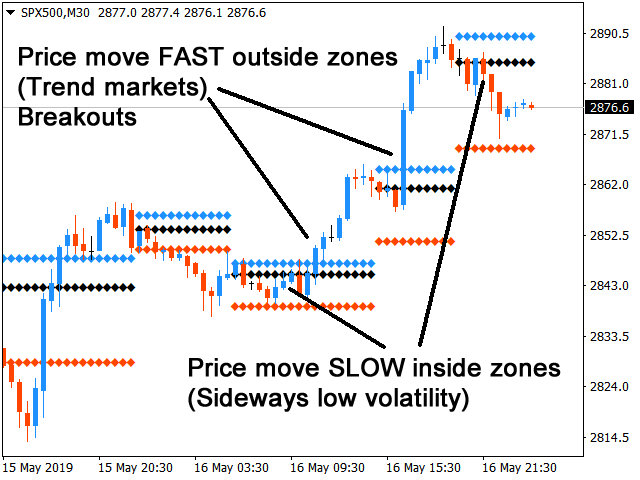

3. Adaptability to Market Conditions

The indicator adjusts to varying market conditions, with narrow zones indicating low volatility and wide zones suggesting high volatility. This adaptability enables traders to tailor their strategies effectively, whether in trending or sideways markets:

- Narrow zones signal potential consolidations.

- Wide zones indicate breakouts.

- Long zones highlight possible sideways movements.

- Short zones are indicative of price trends.

4. Enhanced Trade Strategies

Market Zones aids in optimizing trading strategies by providing clear signals for entry and exit points:

- A bullish breakout is likely when the price crosses above the blue line.

- A bearish breakout is likely when the price falls below the red line.

- When trading short, placing stop-loss orders above the blue line minimizes risk.

- When trading long, positioning stop-loss orders below the red line helps safeguard against losses.

5. Multi-Timeframe Trading

The Market Zones indicator allows traders to analyze multiple timeframes on the same chart. This flexibility provides a comprehensive outlook on market behavior, helping traders make well-informed decisions.

6. Volume Integration

By enabling broker volume to be factored into calculations, traders can gain insights based on actual market activity. This capability further refines the accuracy of zone predictions.

In conclusion, Market Zones for MT4 equips traders with the tools necessary for smarter trading decisions by harnessing statistical principles, providing clarity, and adapting to market dynamics. Whether you are an experienced trader or just starting out, this indicator can significantly enhance your trading strategy.

Reviews

There are no reviews yet.