Order direction MT4

$99 Original price was: $99.$29Current price is: $29.

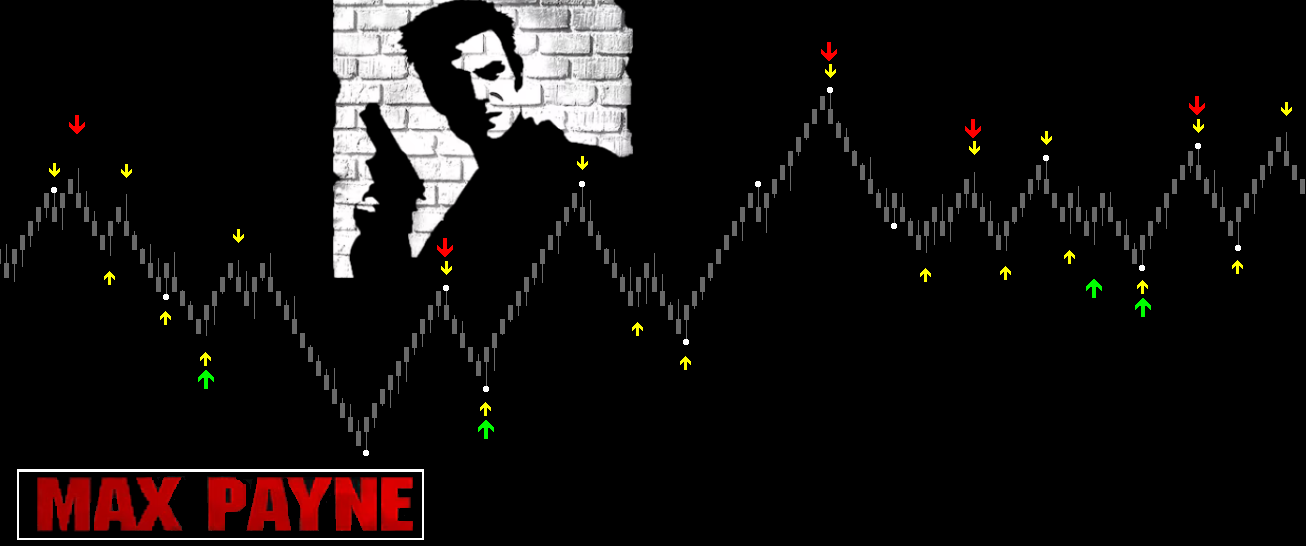

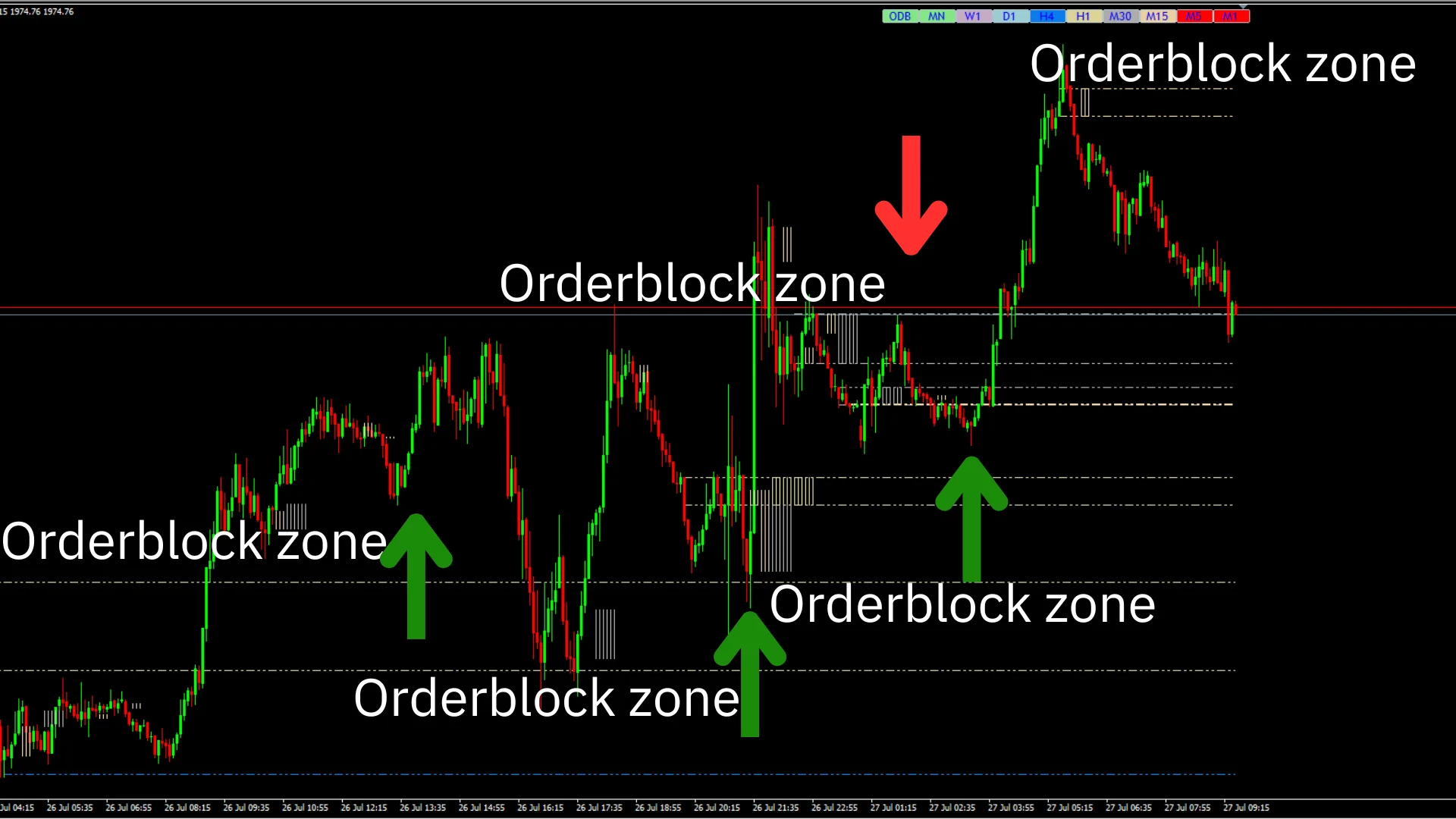

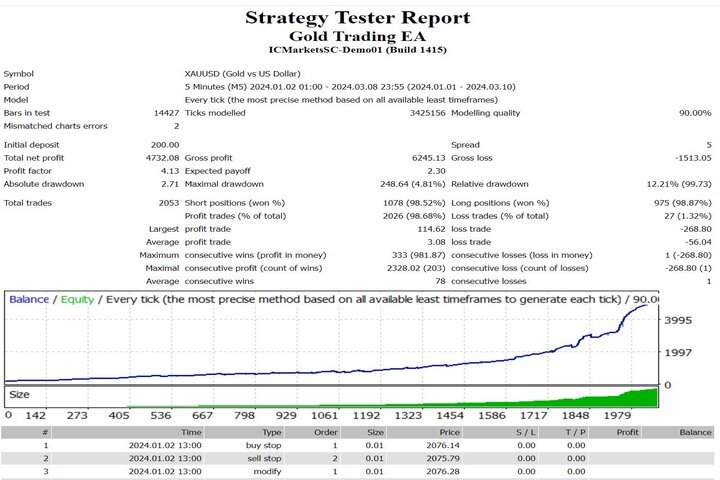

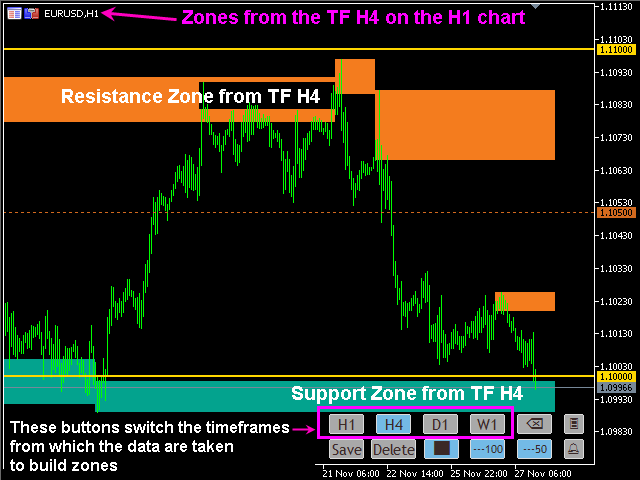

Order Direction in MT4 refers to the market’s trend assessment, guiding traders on when to enter or exit positions. Indicators signal bullish trends for buying and bearish trends for selling. Observing longer 4-hour charts for trends and shorter 15-minute charts for entry points can enhance trading outcomes across various currency pairs.

Advantages of Order Direction MT4

1. Market Assessment: The Order Direction MT4 tool allows traders to evaluate the market’s current state effectively. When the market is offline, it indicates a wait-and-see posture. This feature encourages traders to pause before making decisions, waiting for additional information or trend confirmation to ensure they make informed choices.

2. Bullish Market Opportunities: When there is a clear upward trend, the Order Direction MT4 signals bullish potential. Investors can leverage this feature to identify and capitalize on opportunities for market entry during periods of expected price increases, maximizing potential profits.

3. Caution in Online Markets: In scenarios where the market situation shifts back to online, Order Direction prompts caution. This functionality advises investors to be vigilant and avoid impulsively chasing upward trends, especially when a market peak appears imminent.

4. Short Selling Indicators: The tool provides critical insights when the market surpasses the upper limits, indicating a transition to short selling. Traders can utilize this indicator to adopt bearish strategies, anticipating potential price declines to realize profits.

5. Versatile Compatibility: Order Direction MT4 is designed to be adaptable across various currency pairs, with particular recommendations for AUDCAD, AUDNZD, and NZDCAD. Its user-friendly nature requires no extensive configuration, making it accessible for traders of all levels.

6. Time Frame Strategy: For enhanced trading decision-making, it is advisable to observe the 4-hour chart for a comprehensive view of market direction. This approach helps traders grasp long-term trends, facilitating informed entry points found in the shorter 15-minute proximity. Such frequent monitoring accommodates dynamic market fluctuations, enhancing the potential for timely and profitable trading opportunities.

Reviews

There are no reviews yet.