Quick Funding in Prop Trading Firms EA MT4

$50 Original price was: $50.$29Current price is: $29.

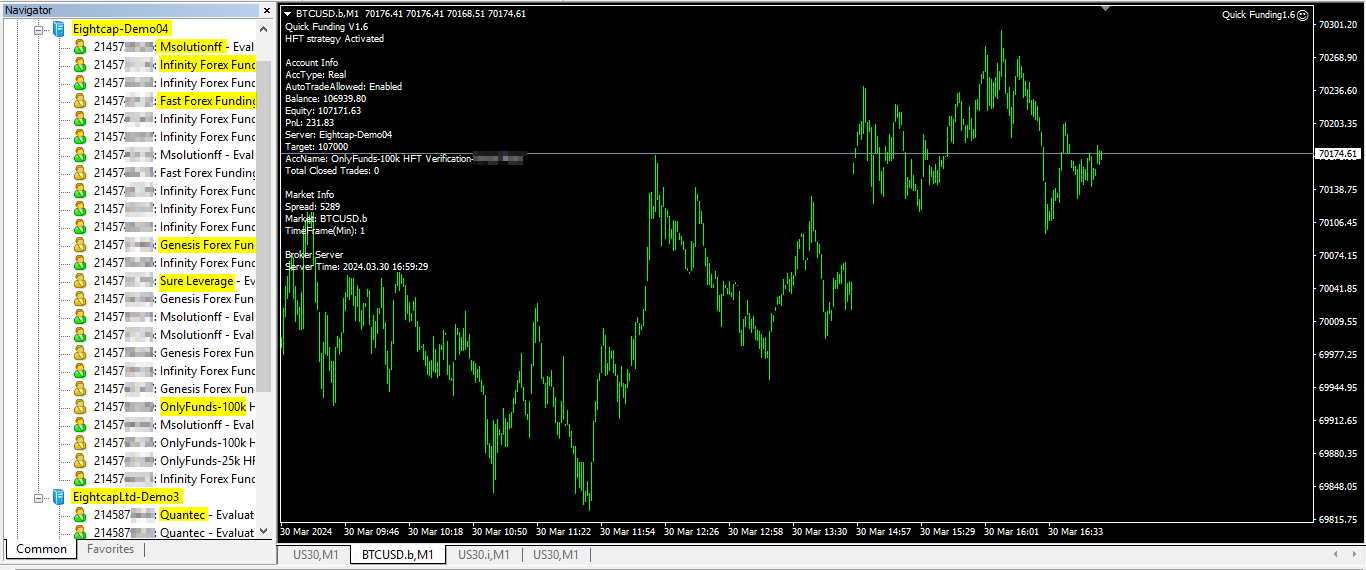

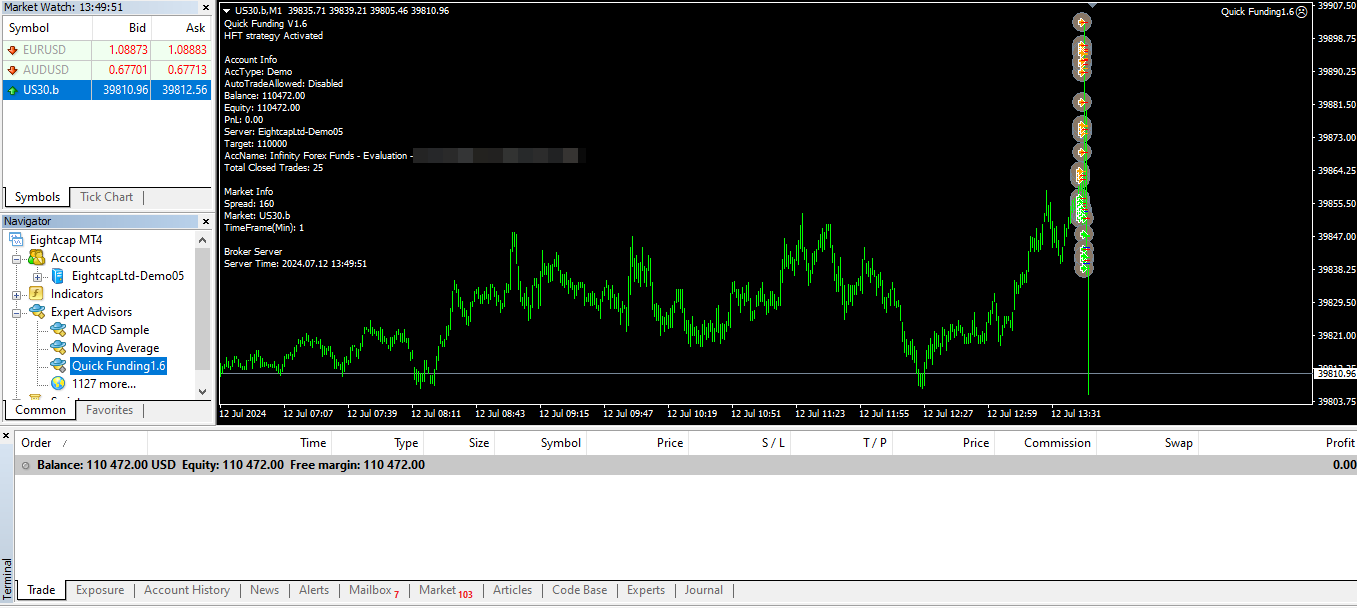

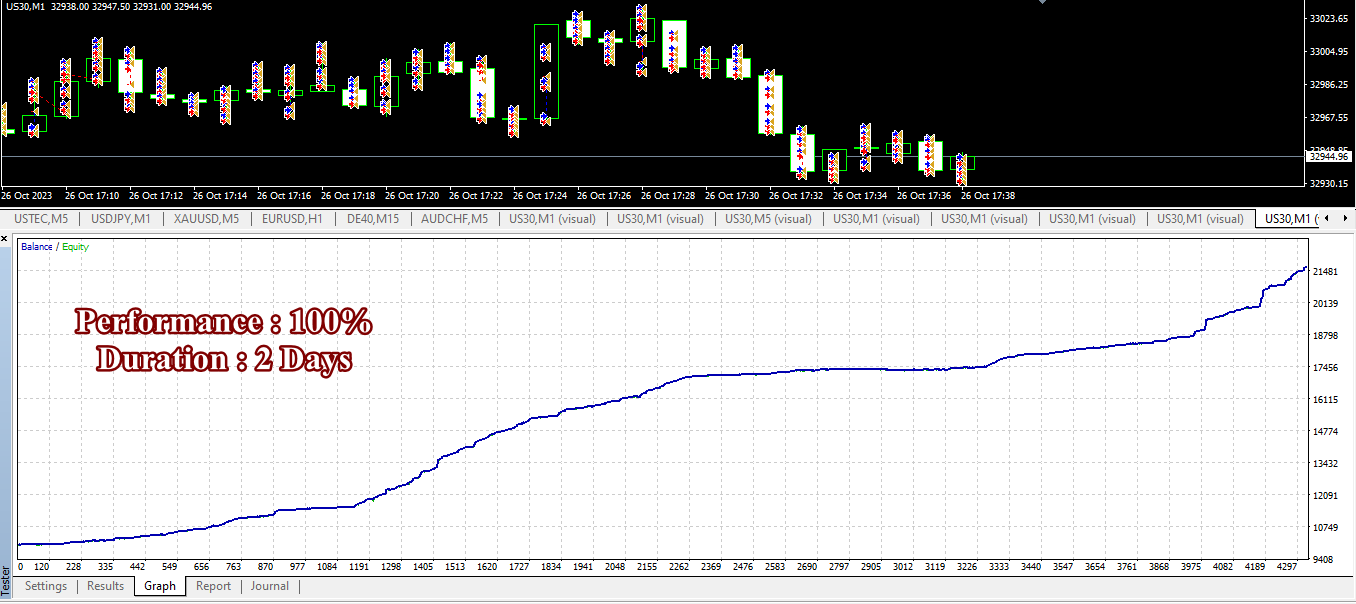

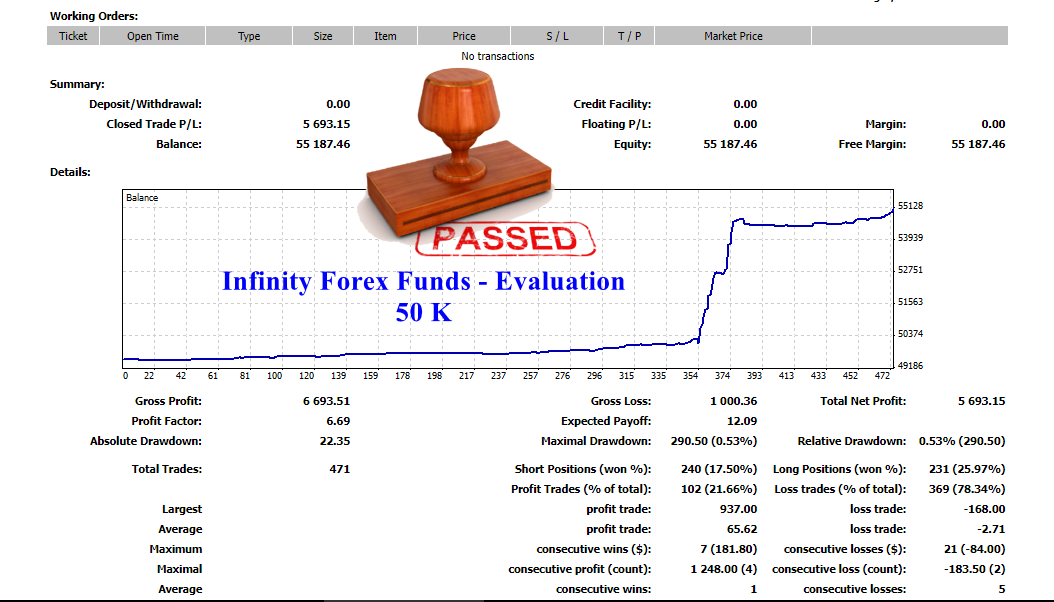

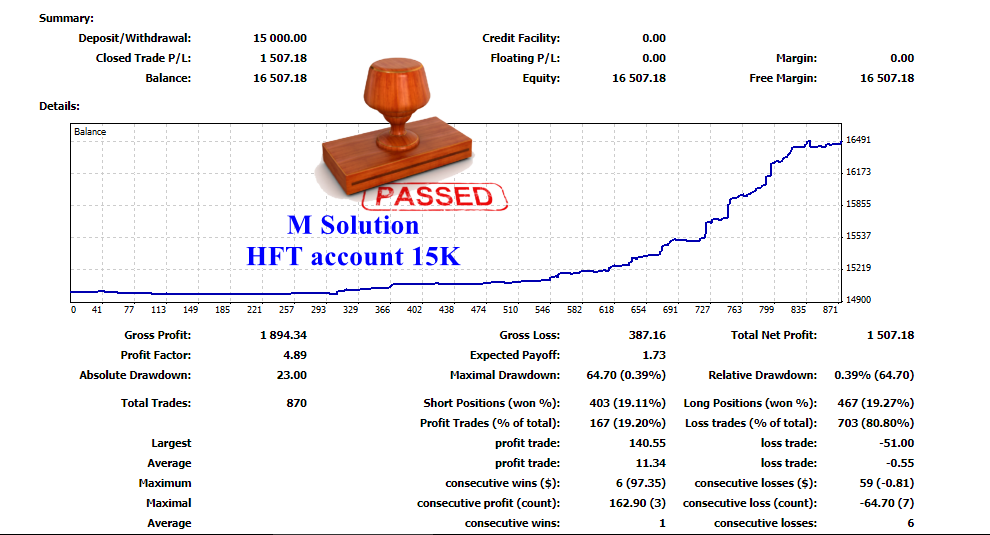

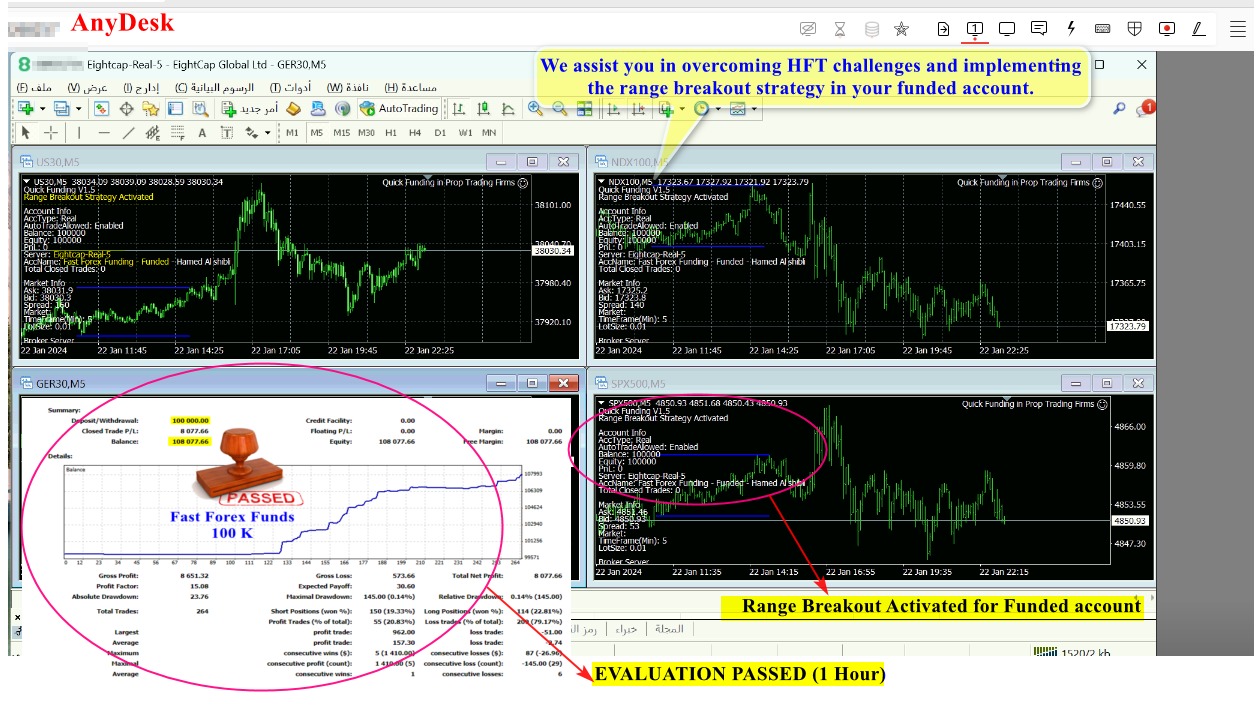

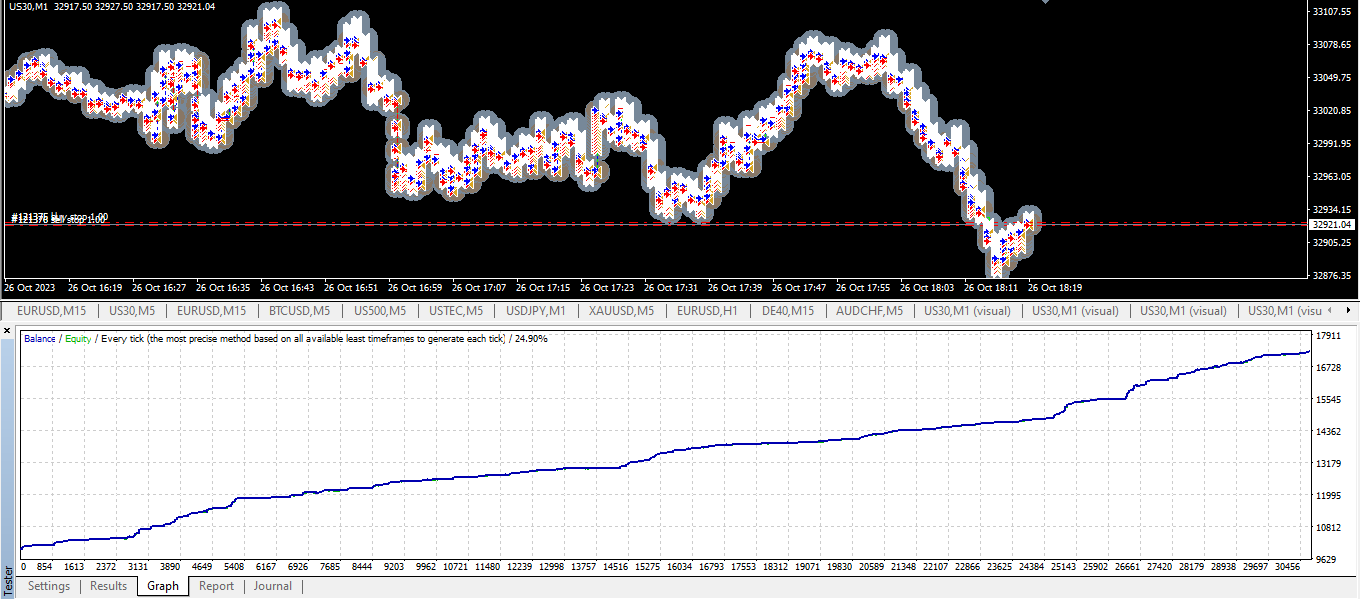

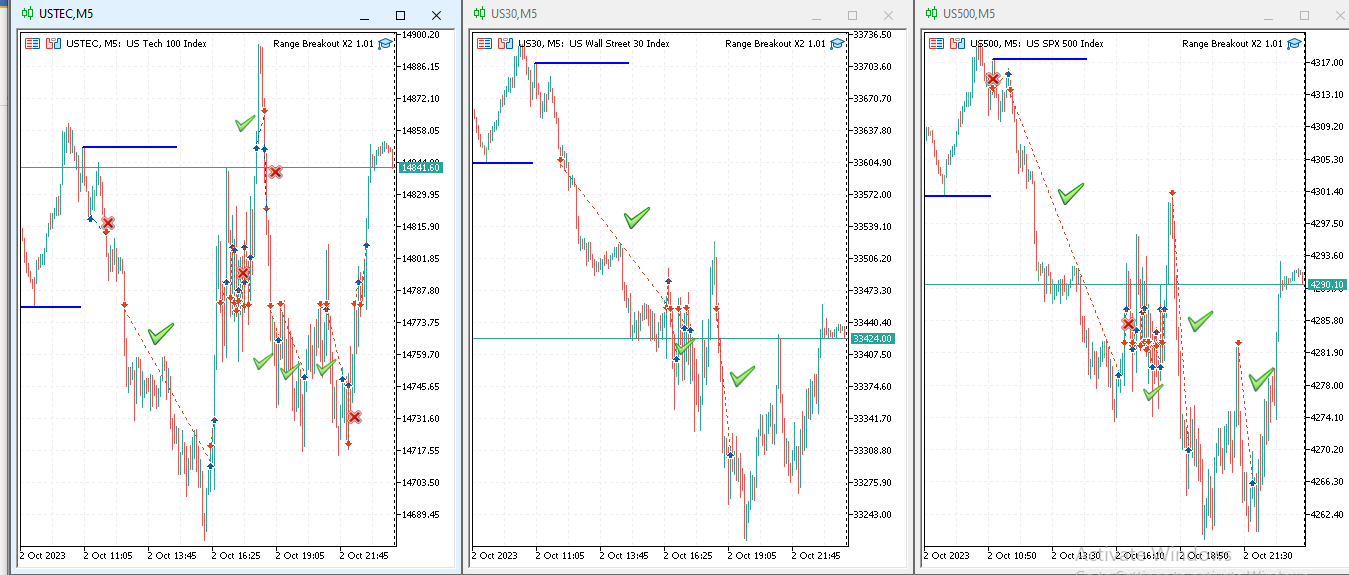

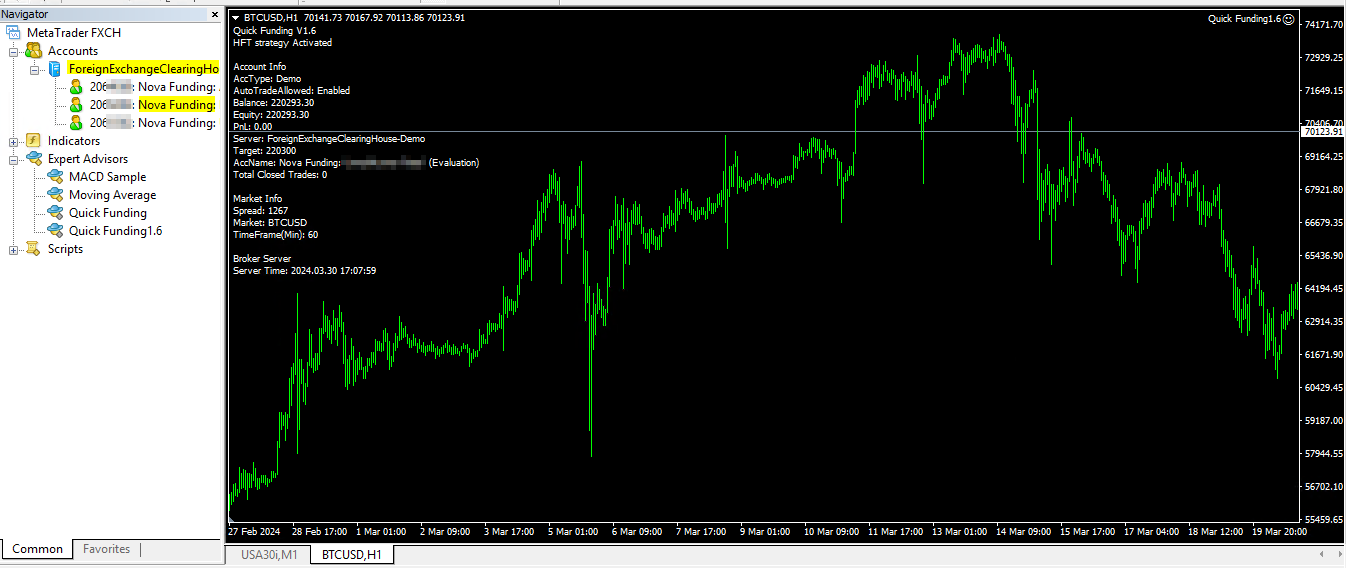

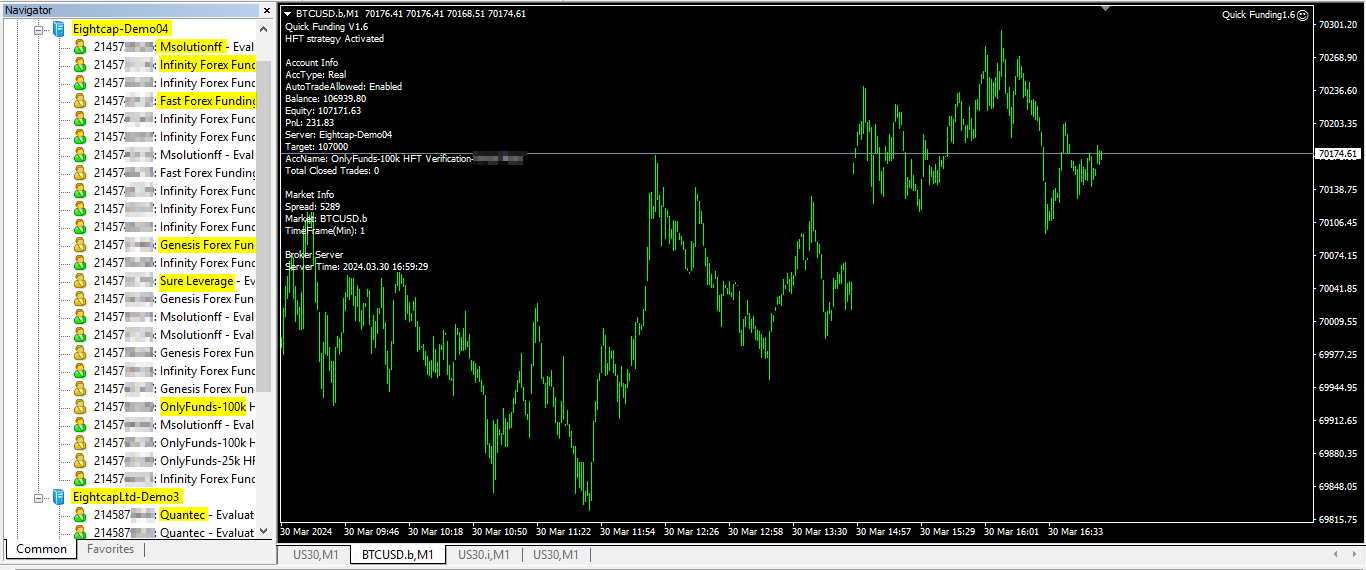

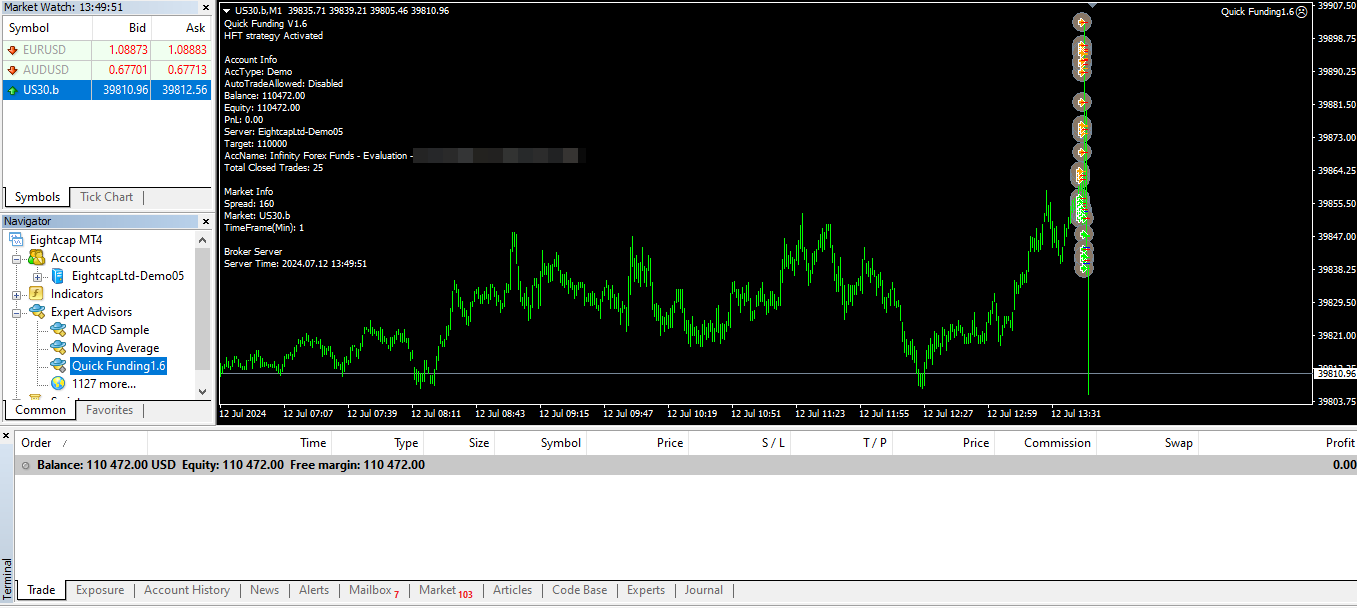

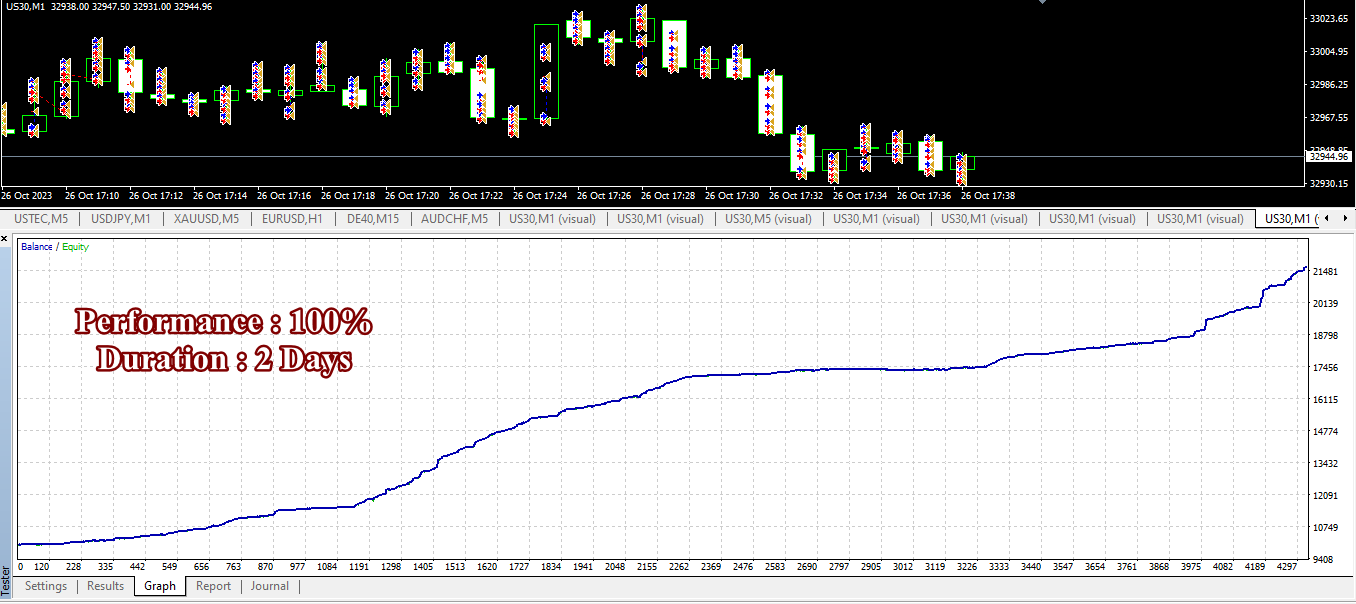

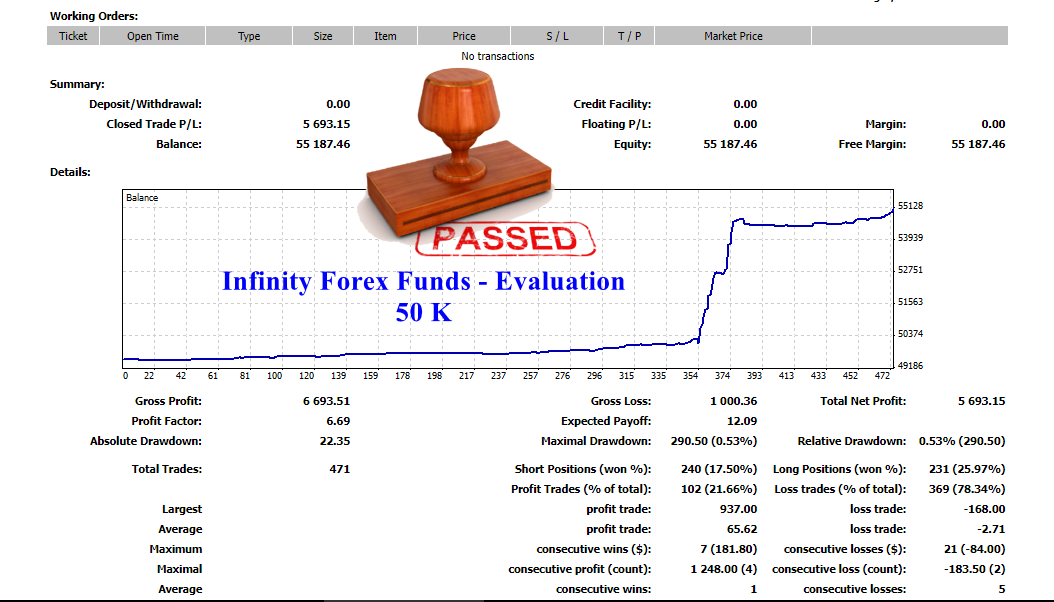

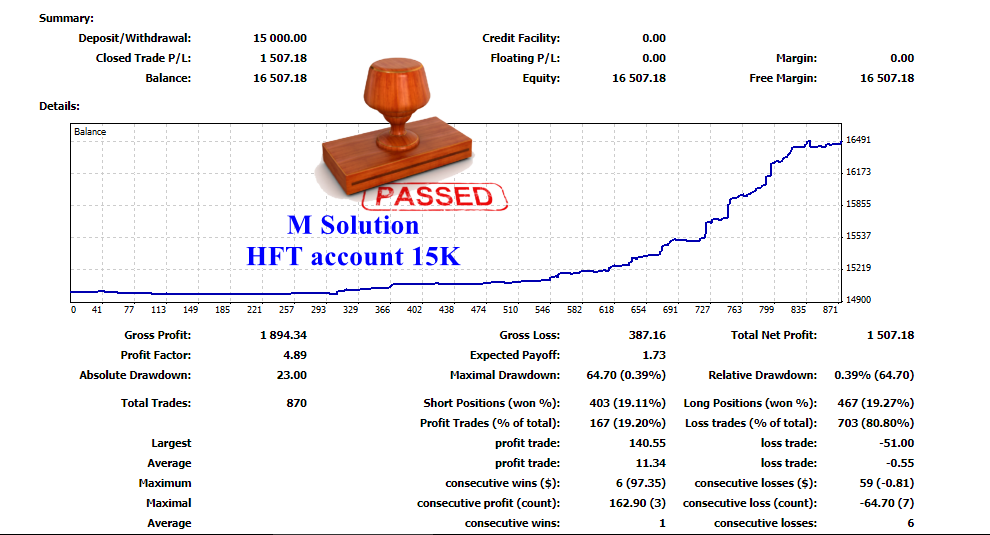

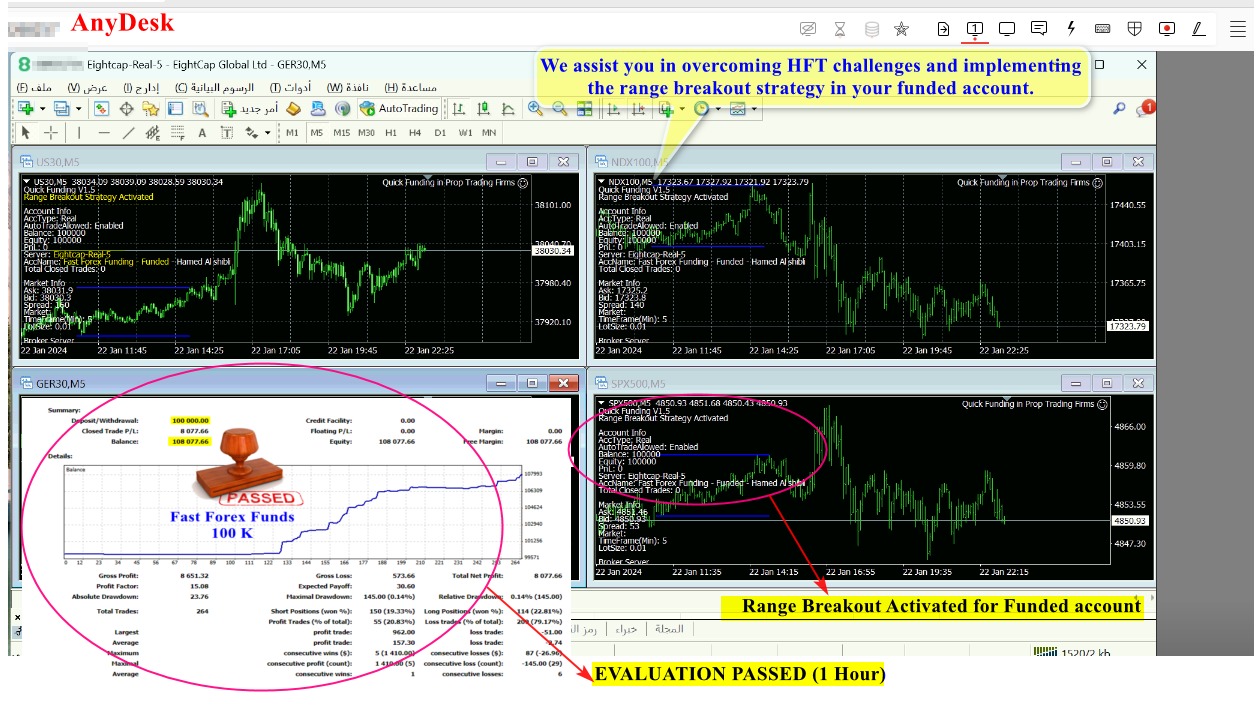

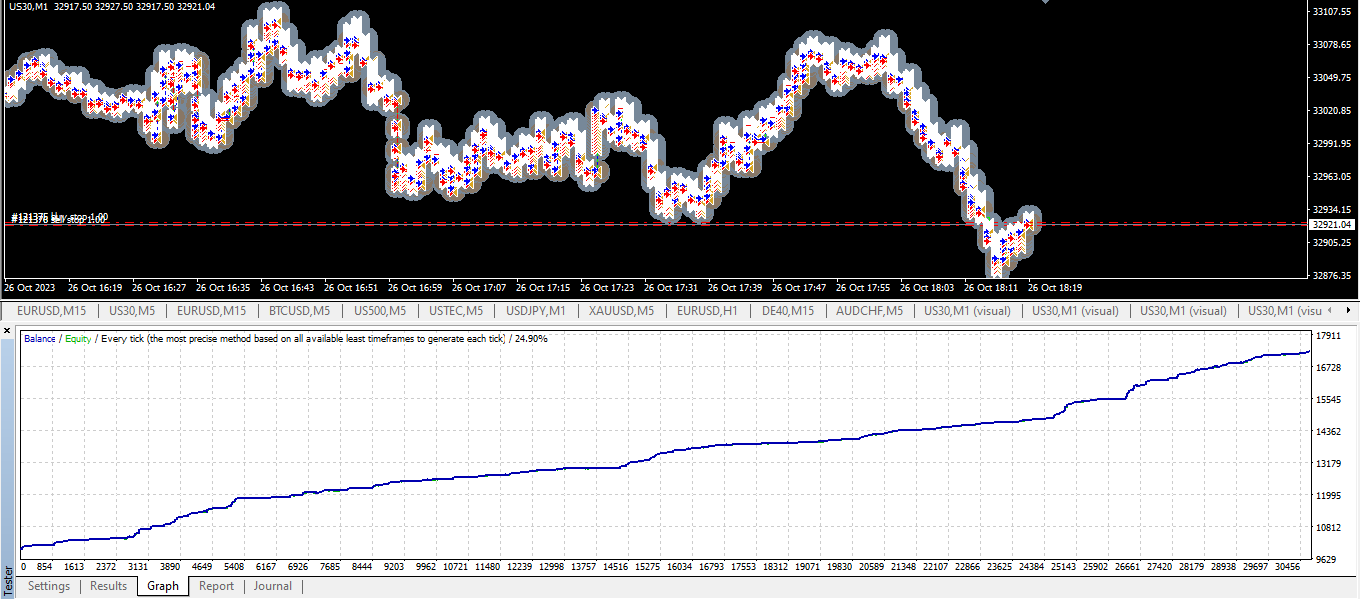

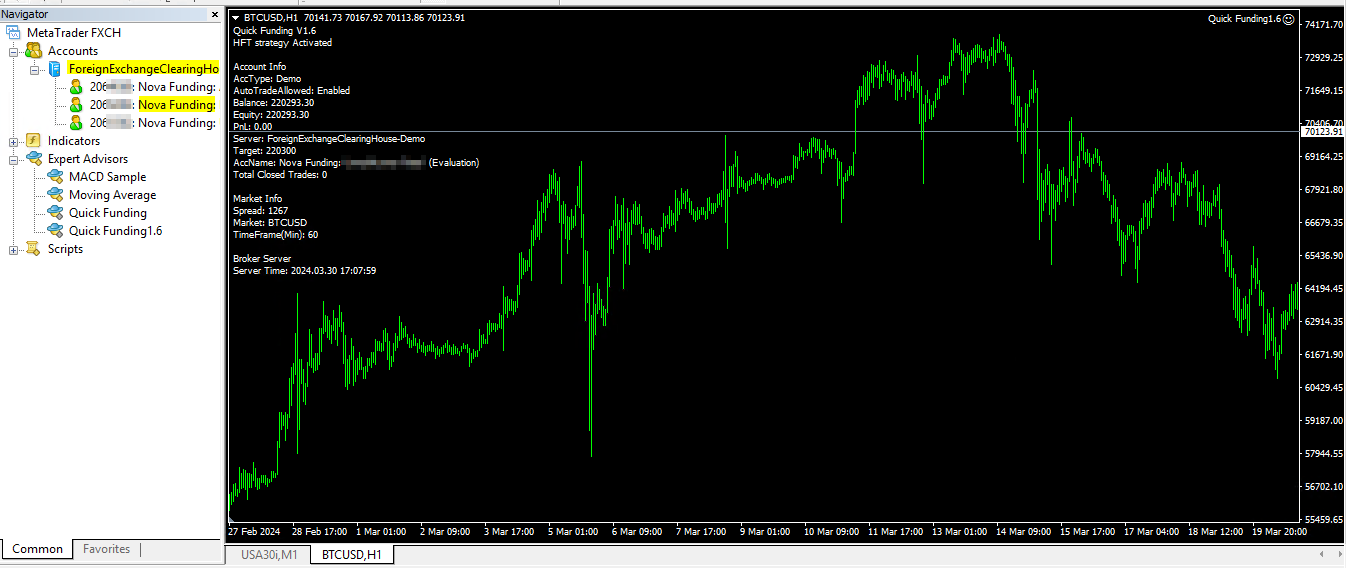

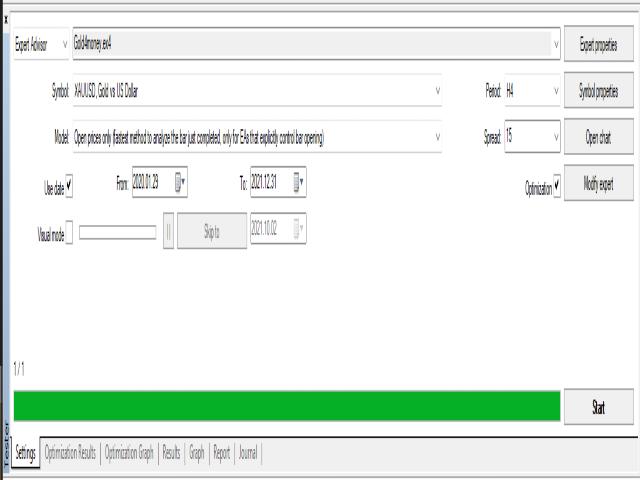

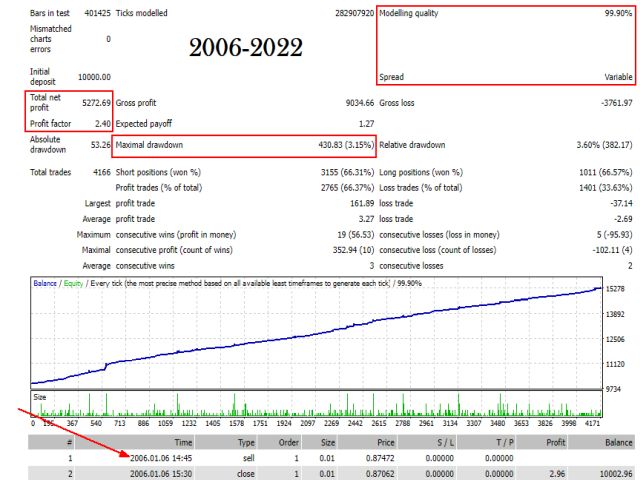

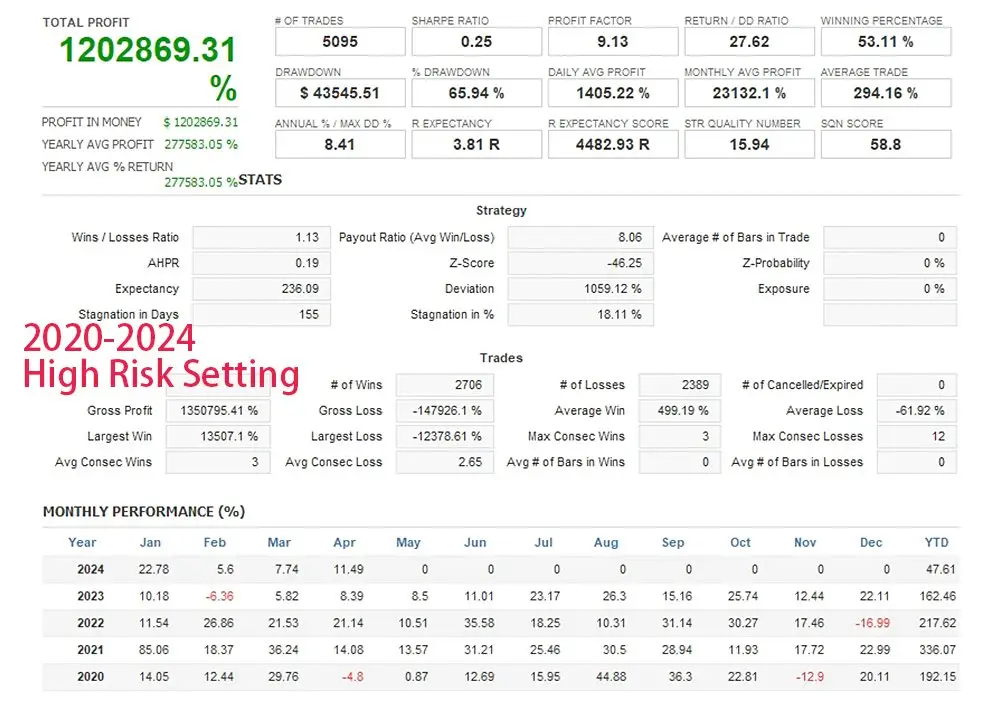

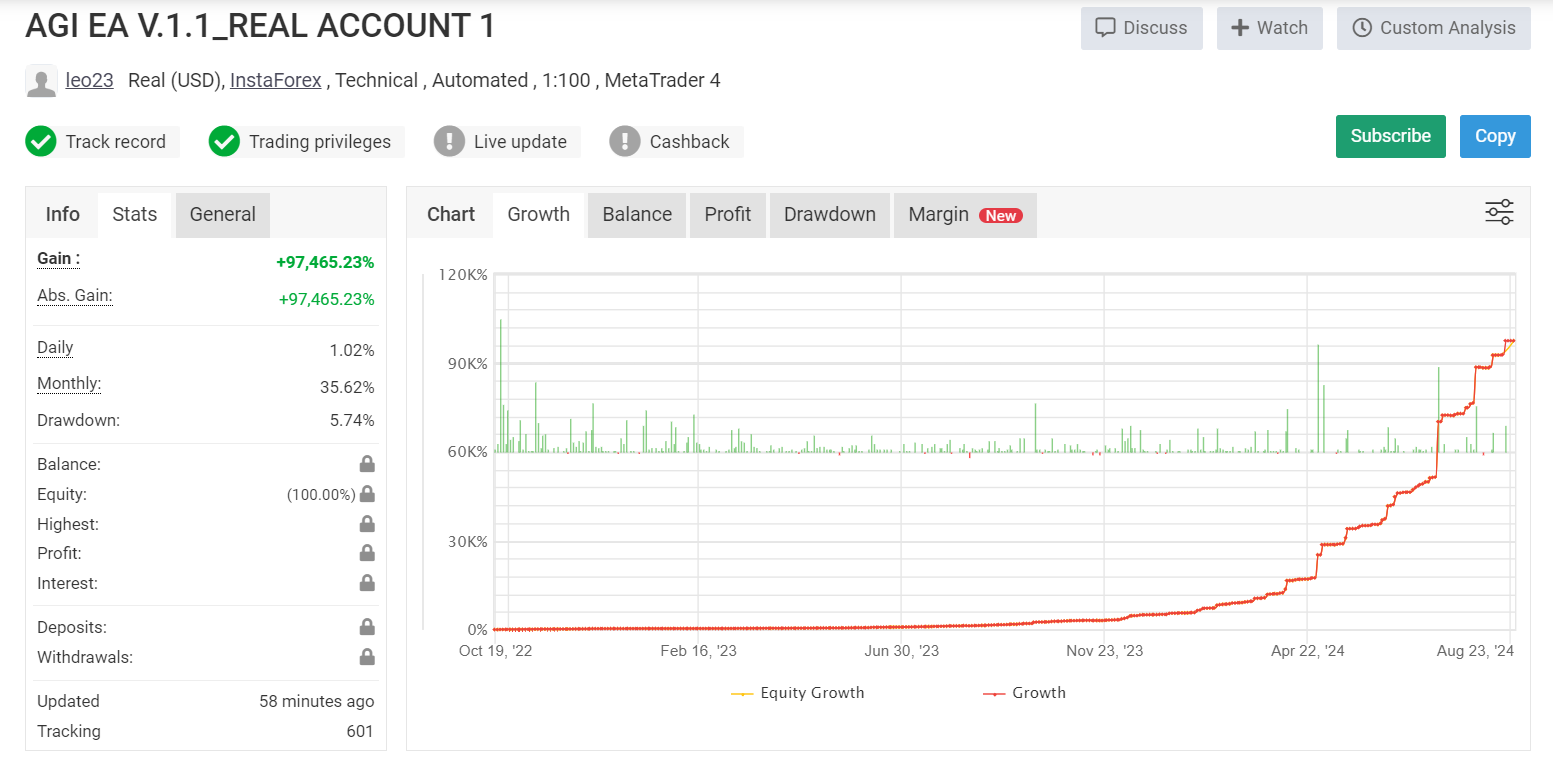

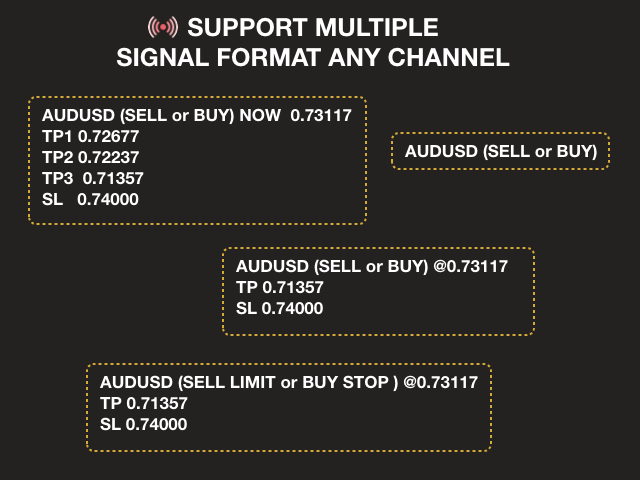

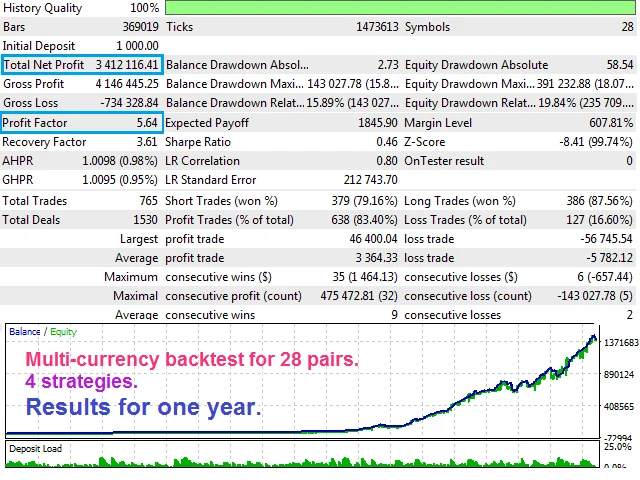

Quick Funding in Prop Trading Firms’ EA for MT4 is designed to help traders pass proprietary trading challenges using high and low-frequency trading strategies. It automates trades based on daily support and resistance levels, employing built-in equity protection. Included are setfiles for specific accounts and ongoing support post-purchase.

Advantages of Quick Funding in Prop Trading Firms Using EA MT4

Quick funding options provided by proprietary trading firms (prop firms) allow traders to gain rapid access to trading capital. This is particularly advantageous for those utilizing automated trading strategies such as the Expert Advisor (EA) built for MetaTrader 4 (MT4). Below are some key benefits of quick funding in the context of prop trading firms:

1. Fast Capital Access

Quick funding enables traders to start trading almost immediately after passing evaluation challenges. This swift access to capital can accelerate the trading journey, allowing proficient traders to leverage their strategies without prolonged waiting periods.

2. Enhanced Trading Opportunities

With quick funding, traders can capitalize on market opportunities right away. This is particularly important in the fast-paced environment of high-frequency trading (HFT), where every moment counts for making profitable trades.

3. Focus on Strategy Execution

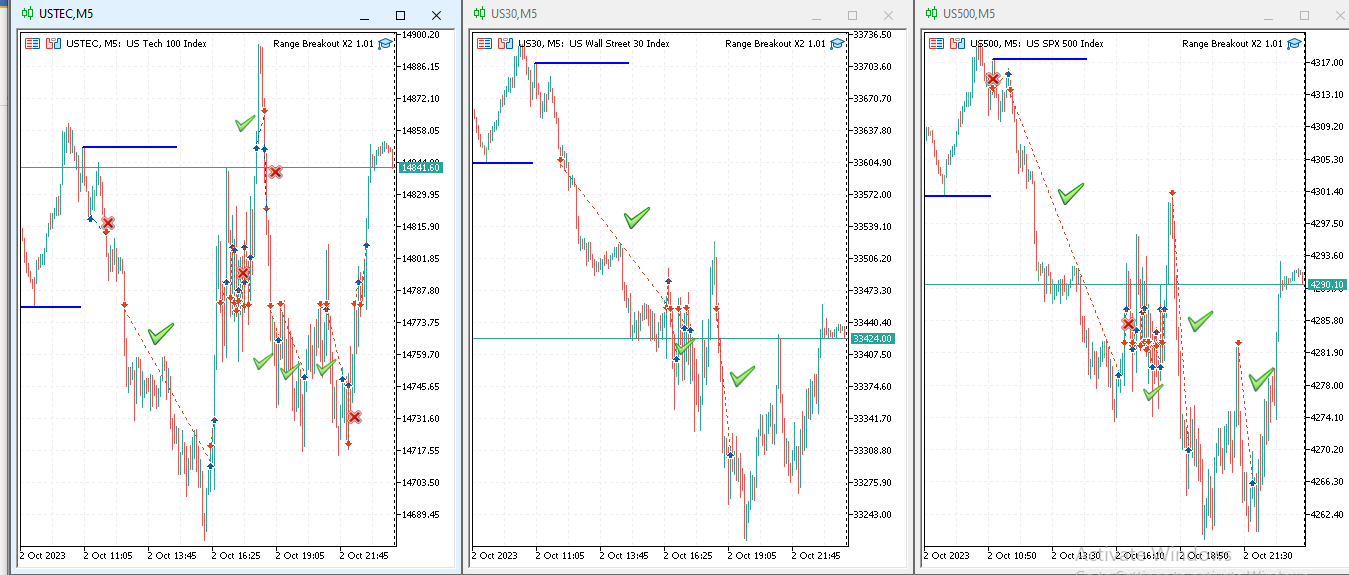

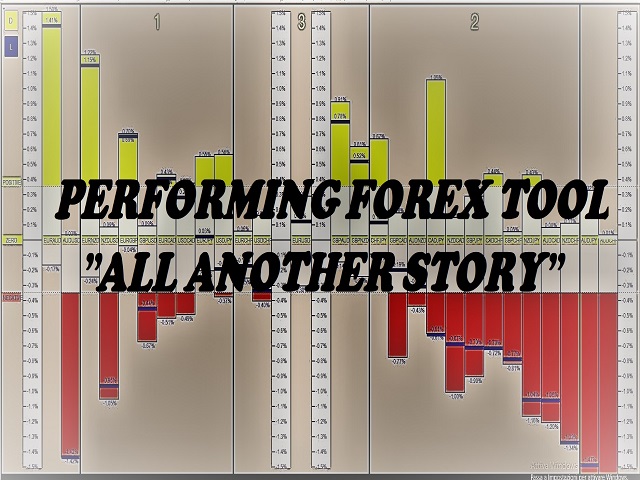

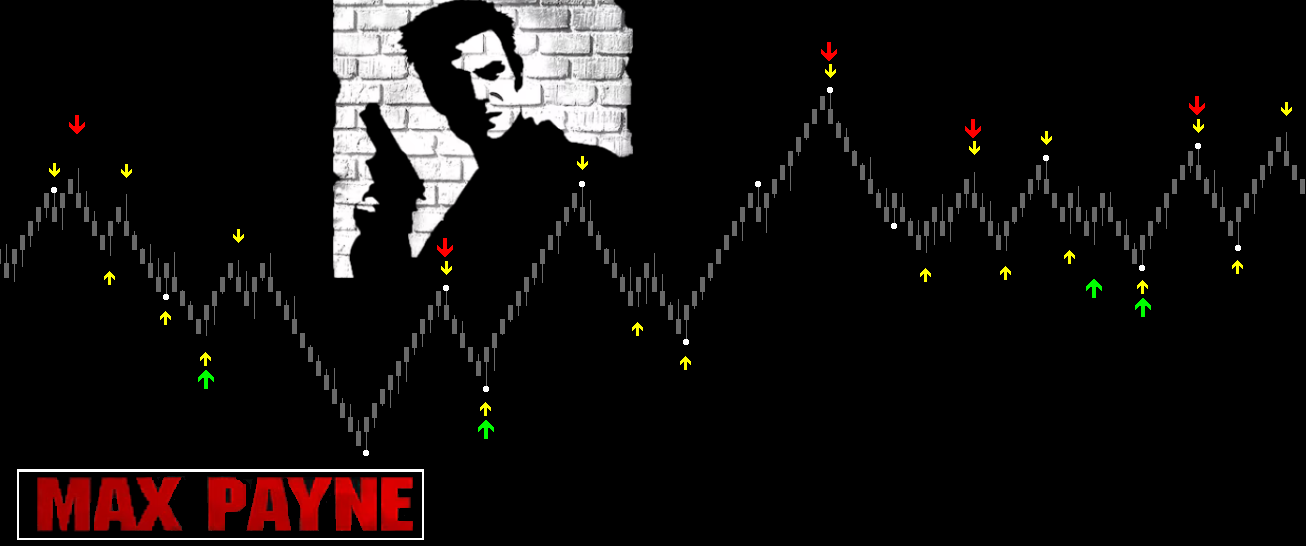

When traders don’t have to wait for funding, they can focus more on executing their trading strategies effectively. For instance, the included Range Breakout strategy in this EA provides automated trade signals based on key support and resistance levels, allowing traders to execute their plans without delay.

4. Use of Advanced Trading Tools

The integration of EAs like the one mentioned here enhances trading efficiency. The EA can execute trades automatically, manage risk with stop-loss orders, and protect equity, allowing traders to concentrate on strategy refinement rather than on manual execution.

5. Support for High-Frequency Trading

Quick funding options often cater to traders who wish to employ high-frequency trading strategies. The EA is specifically designed to meet the requirements of various prop firms’ challenges and can adjust to different trading conditions, thereby maximizing the potential for profits.

6. Built-in Risk Management

The smart risk management features in the EA ensure that traders’ equity is protected while pursuing aggressive trading strategies. By using tools like equity protection and stop-loss orders, traders can manage their investments effectively, aligning with prop firm requirements.

7. Flexibility in Trading Accounts

Traders can request specific setfiles for different account sizes, offering customization and flexibility in their trading approach. Quick funding allows access to various types of evaluations, catering to different trader profiles and preferences.

8. Ongoing Support and Resources

Upon purchasing and engaging with the EA, traders benefit from ongoing support, including remote configuration assistance. This ensures a smooth trading experience and helps improve overall trading performance.

Conclusion

Utilizing quick funding from prop trading firms in combination with advanced trading EAs like the one designed for MT4 opens up a world of possibilities for traders. With Fast access to capital, effective trading strategies, and a focus on risk management, traders can maximize their potential in the markets.

Reviews

There are no reviews yet.