Resistance and Support Zones MTF for MT4

$40 Original price was: $40.$29Current price is: $29.

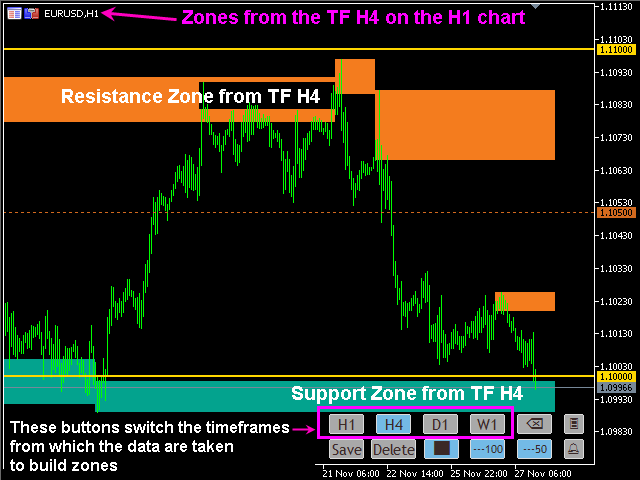

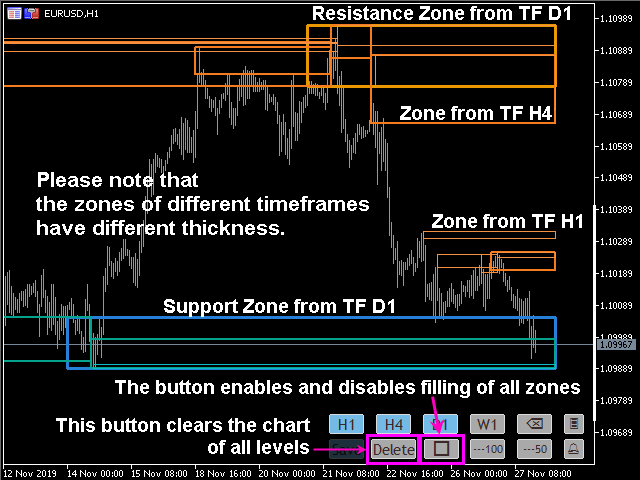

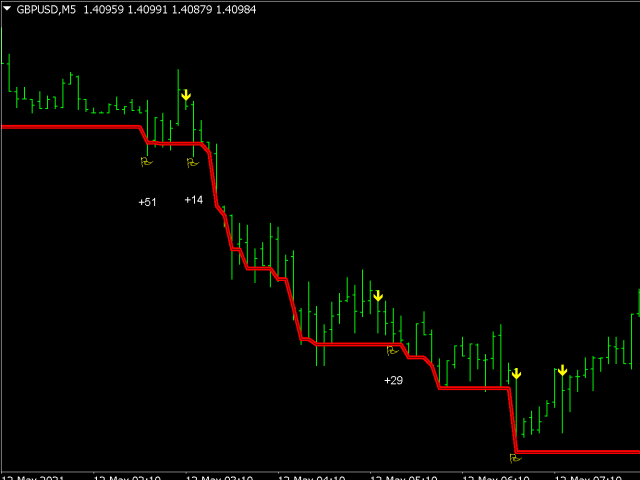

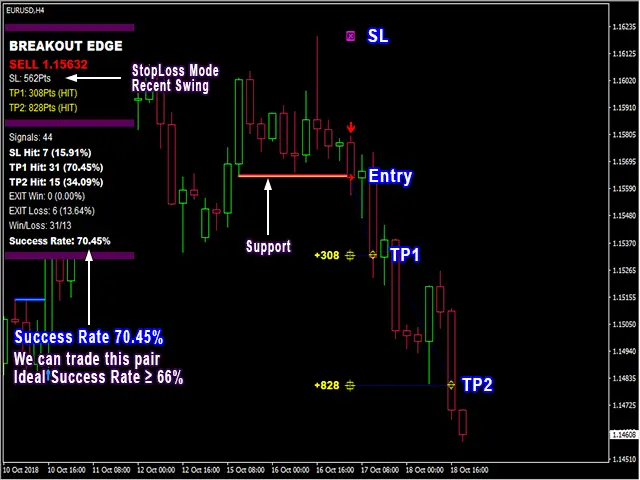

Resistance and Support Zones MTF for MT4 is an indicator that identifies and displays key support and resistance levels from multiple timeframes (H1, H4, D1, W1) on a single chart. It represents price ranges rather than strict lines, helping traders make informed decisions on entries, exits, and stop-loss placements for enhanced trading success.

Advantages of Resistance and Support Zones MTF for MT4

The Resistance and Support Zones MTF indicator for MetaTrader 4 (MT4) offers a multitude of advantages for traders seeking to enhance their trading strategies. Here’s a closer look at its benefits:

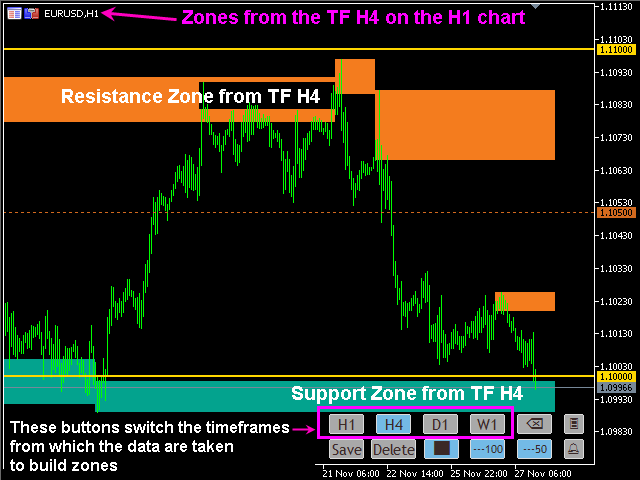

1. Comprehensive Analysis Across Timeframes

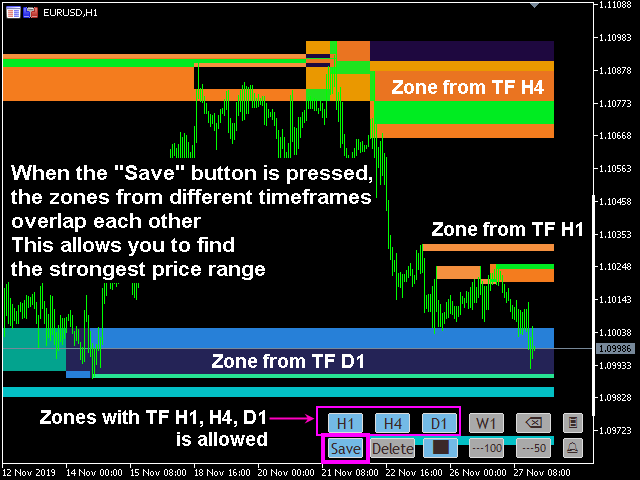

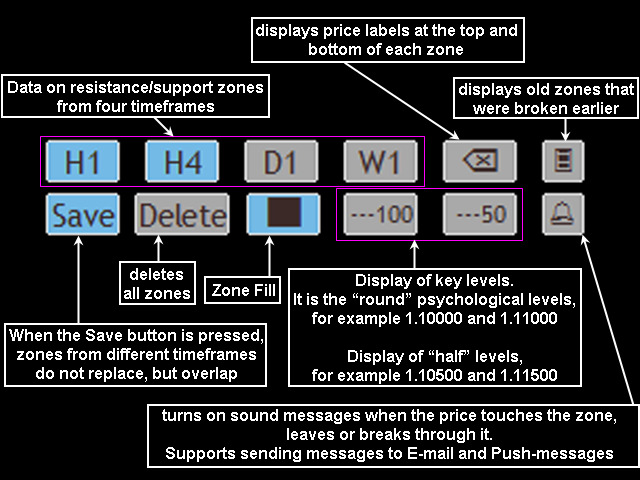

The indicator analyzes support and resistance zones across multiple timeframes—H1, H4, D1, and W1. By integrating data from these different timeframes into one chart, traders gain a holistic view of potential price movements. This multi-timeframe analysis increases the reliability of the identified zones, allowing traders to make more informed decisions.

2. Clear Visualization of Price Ranges

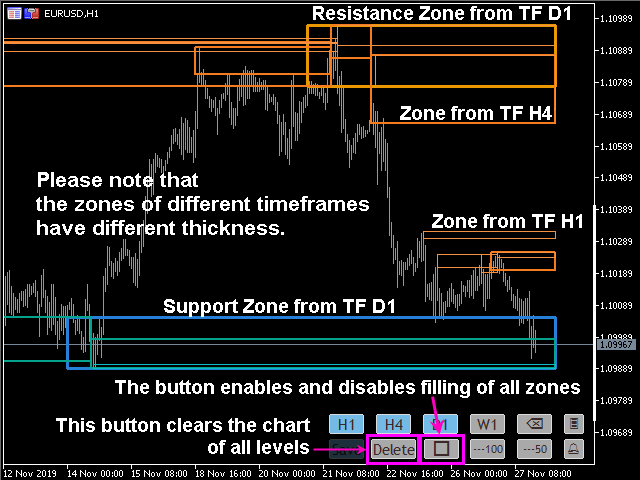

Unlike traditional support and resistance levels that focus solely on specific price points, this indicator identifies and visualizes support and resistance zones as price ranges. This feature acknowledges the reality that market participants operate within a range around these key levels, enhancing the accuracy of trading strategies based on these zones.

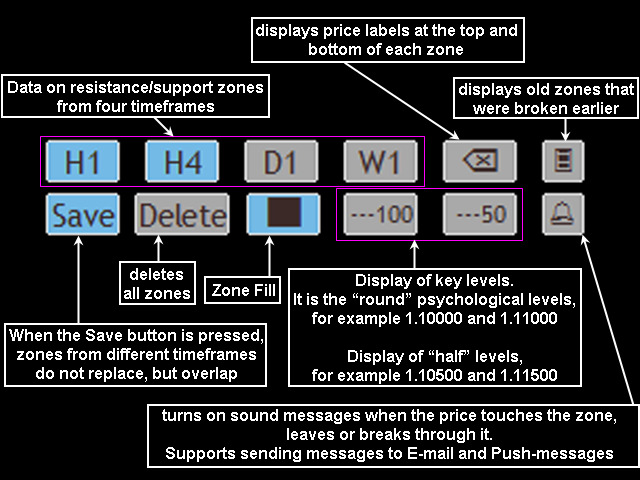

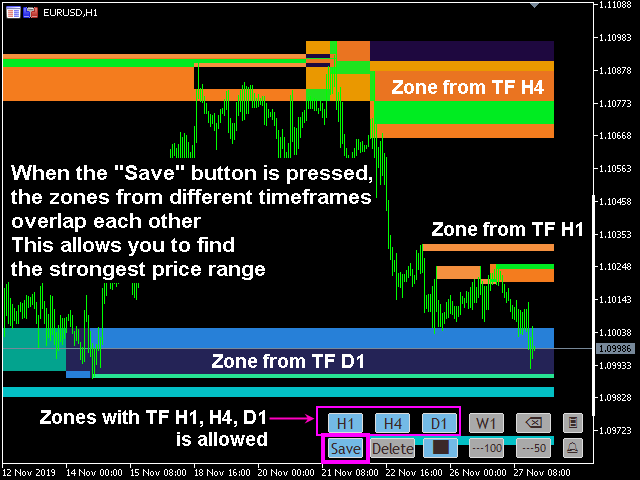

3. Flexible Zone Management

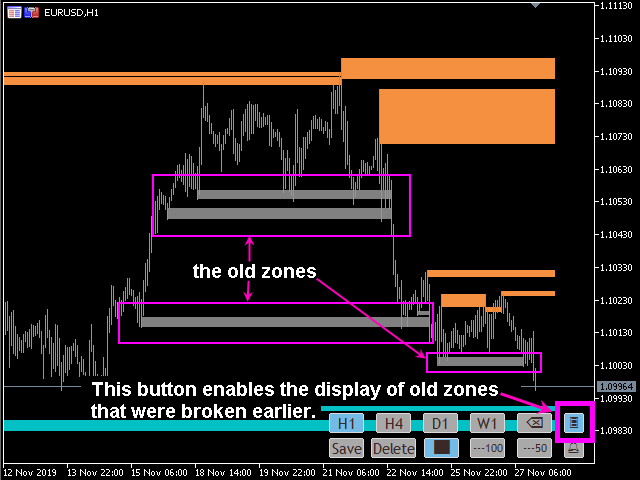

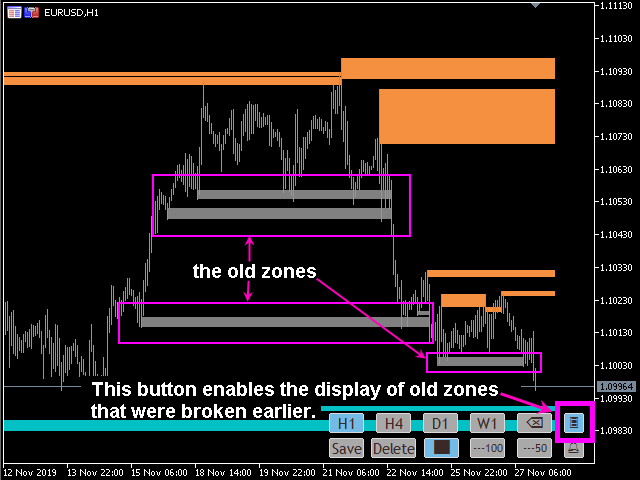

The ability to easily manipulate zones—examine overlapping areas, delete, display them filled or unfilled, and manage old zones—enables traders to adapt their strategy based on evolving market conditions. Users can quickly toggle visibility and attributes of zones, streamlining their analysis process.

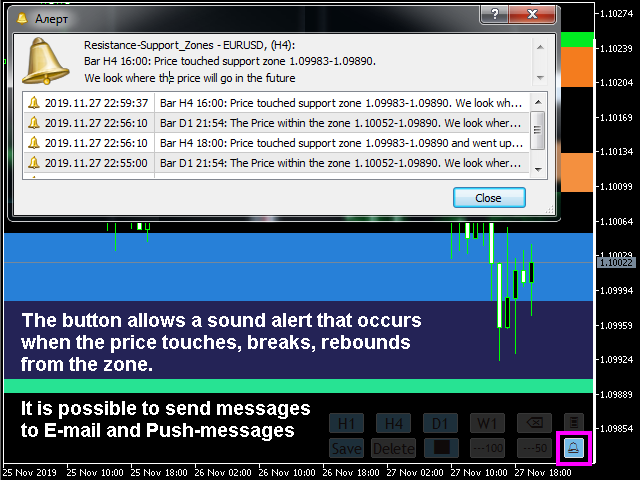

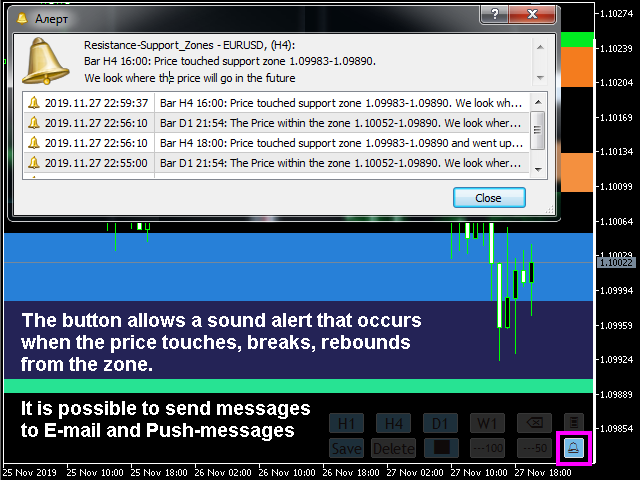

4. Enhanced Decision-Making with Alerts

Built-in sound alerts and notifications for price interactions with zones significantly enhance a trader’s ability to respond to the market. Traders can stay informed of critical touch points, breakouts, and rebounds directly through email and push notifications, allowing them to adjust their strategies swiftly.

5. Identification of Psychological Levels

By highlighting “round” psychological levels, such as 1.30000, along with intermediary levels like 1.31500, traders can make sense of trader psychology in action. Such levels often act as significant barriers or support points in the market, and recognizing these can improve entry and exit strategies.

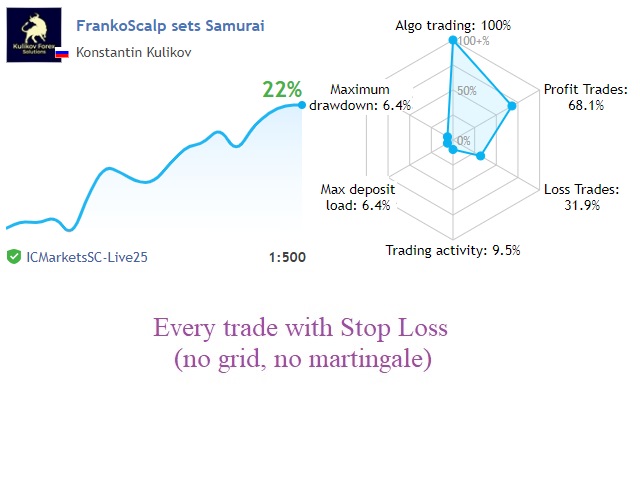

6. Improved Profit and Risk Management

The indicator provides excellent support in determining optimal take-profit and stop-loss levels. By aligning trades with strong support and resistance zones, traders can maximize profits and minimize risks. Opening positions based on signals at these zones increases the likelihood of favorable outcomes.

7. Compatibility with Other Trading Strategies

This indicator complements other analytical methods, including candle and price action analysis. By strengthening patterns like Hammer, Shooting Star, and Pin-bar, traders can enhance their overall trading strategy and decision-making process. The systematic combination of these elements leads to improved trading results.

8. Historical Zone Analysis

Incorporating old zones into the analysis allows traders to observe how the price has reacted to these levels previously. Understanding these historical interactions enhances predictive capabilities regarding future movements around these zones, adding another layer to the analysis.

Conclusion

Overall, the Resistance and Support Zones MTF indicator for MT4 is an essential tool for traders looking to elevate their trading proficiency. By offering extensive multi-timeframe analysis, flexible zone management, notification systems, and clear visualizations of price ranges, traders can bolster their strategies to navigate the market with confidence.

Reviews

There are no reviews yet.