Rolling VWAP MT4

$30 Original price was: $30.$29Current price is: $29.

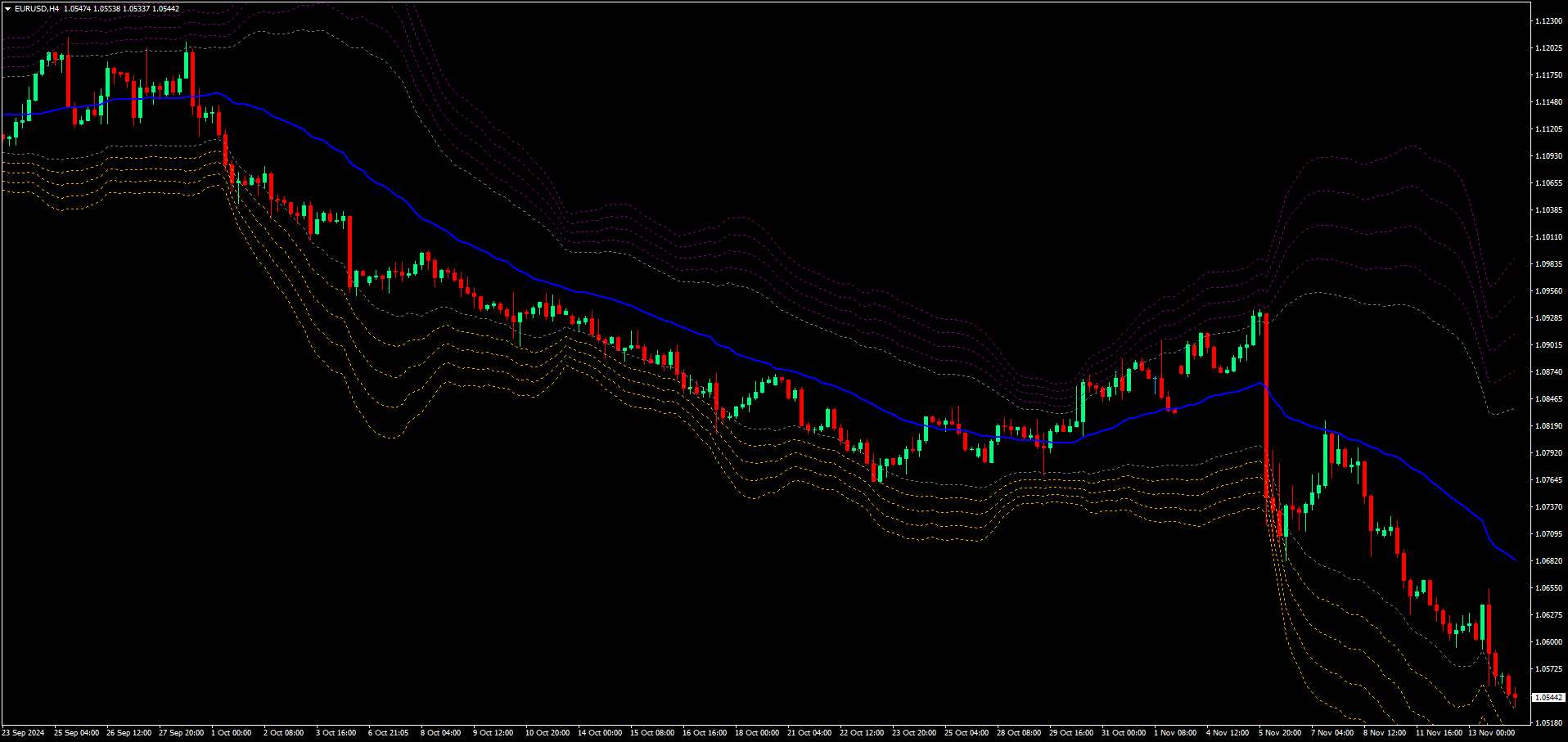

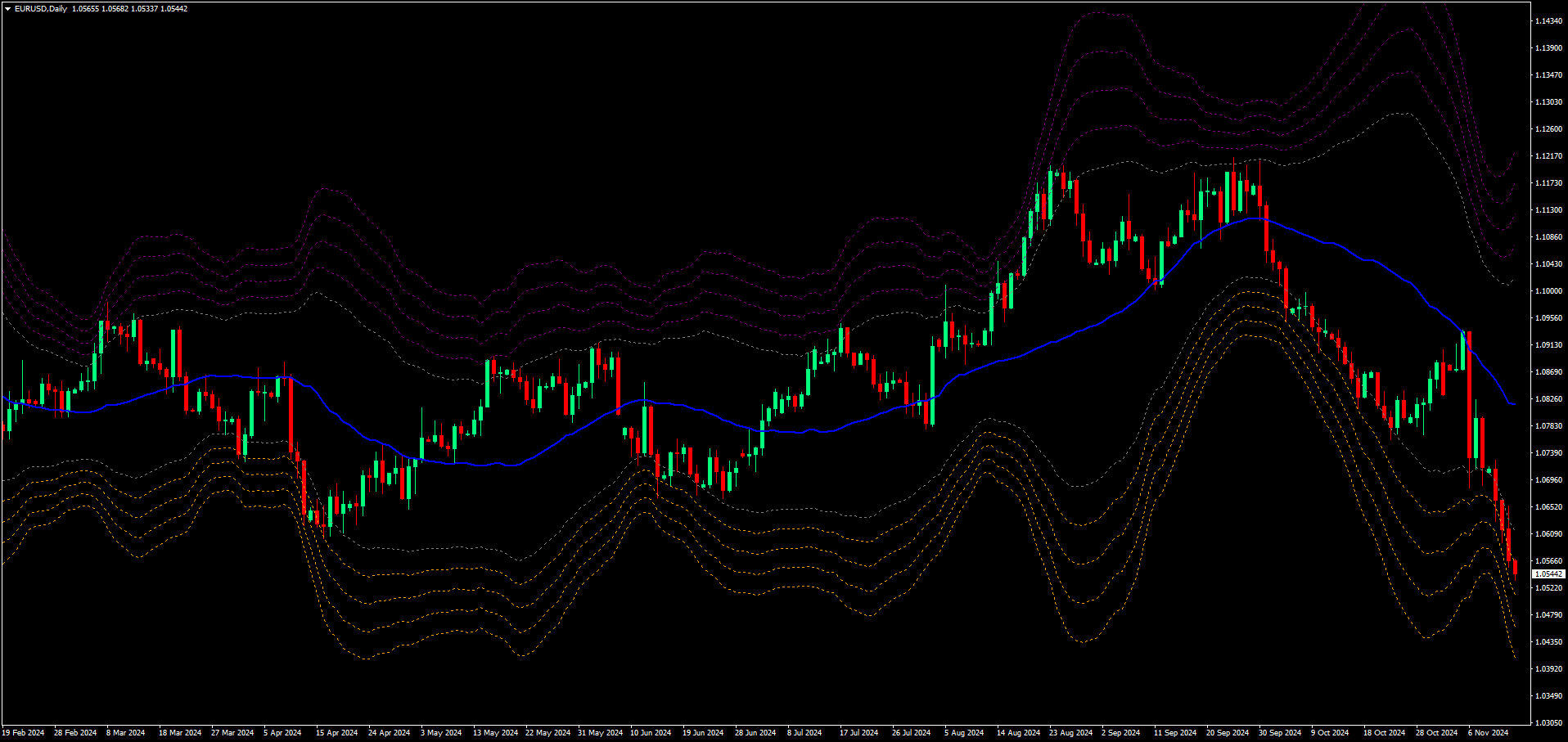

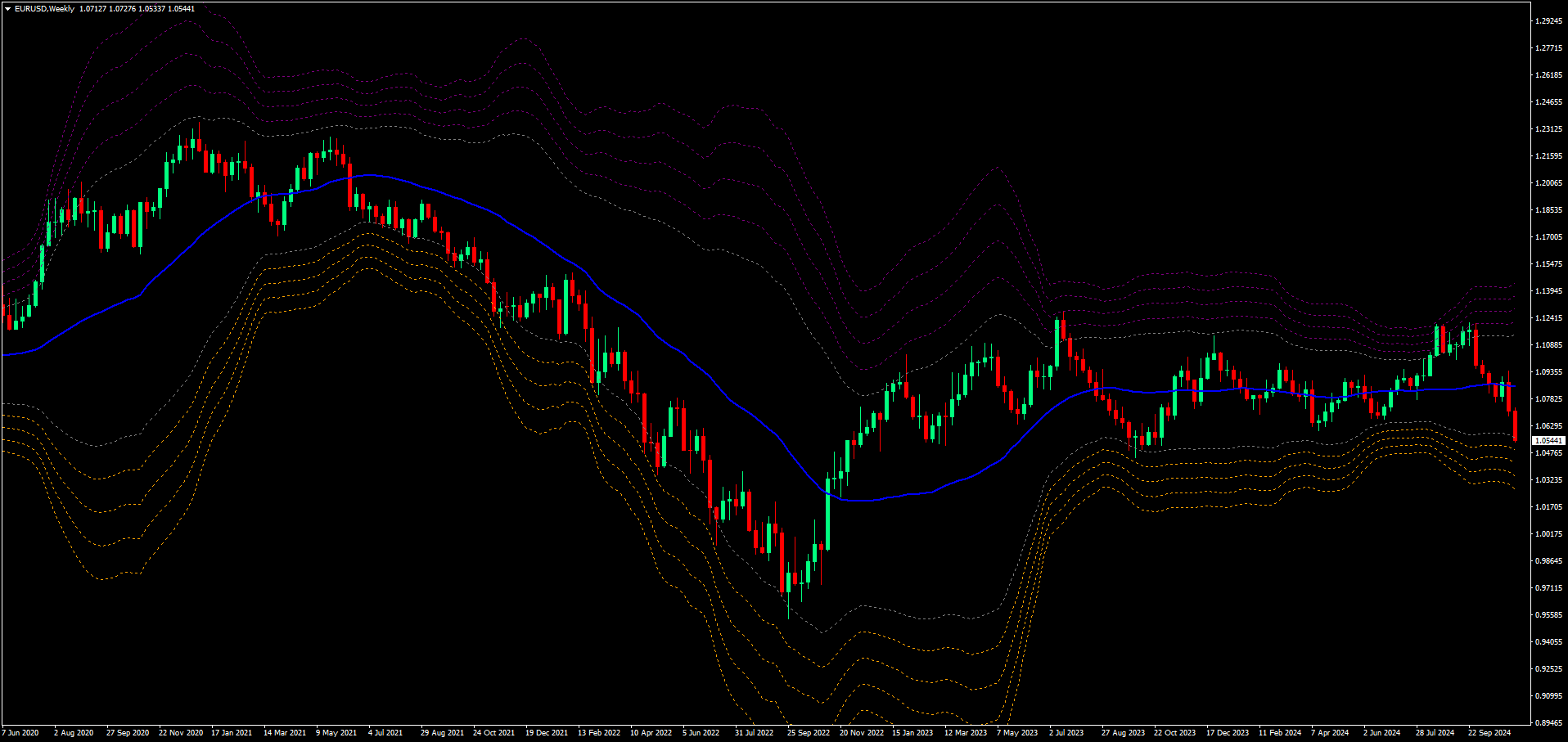

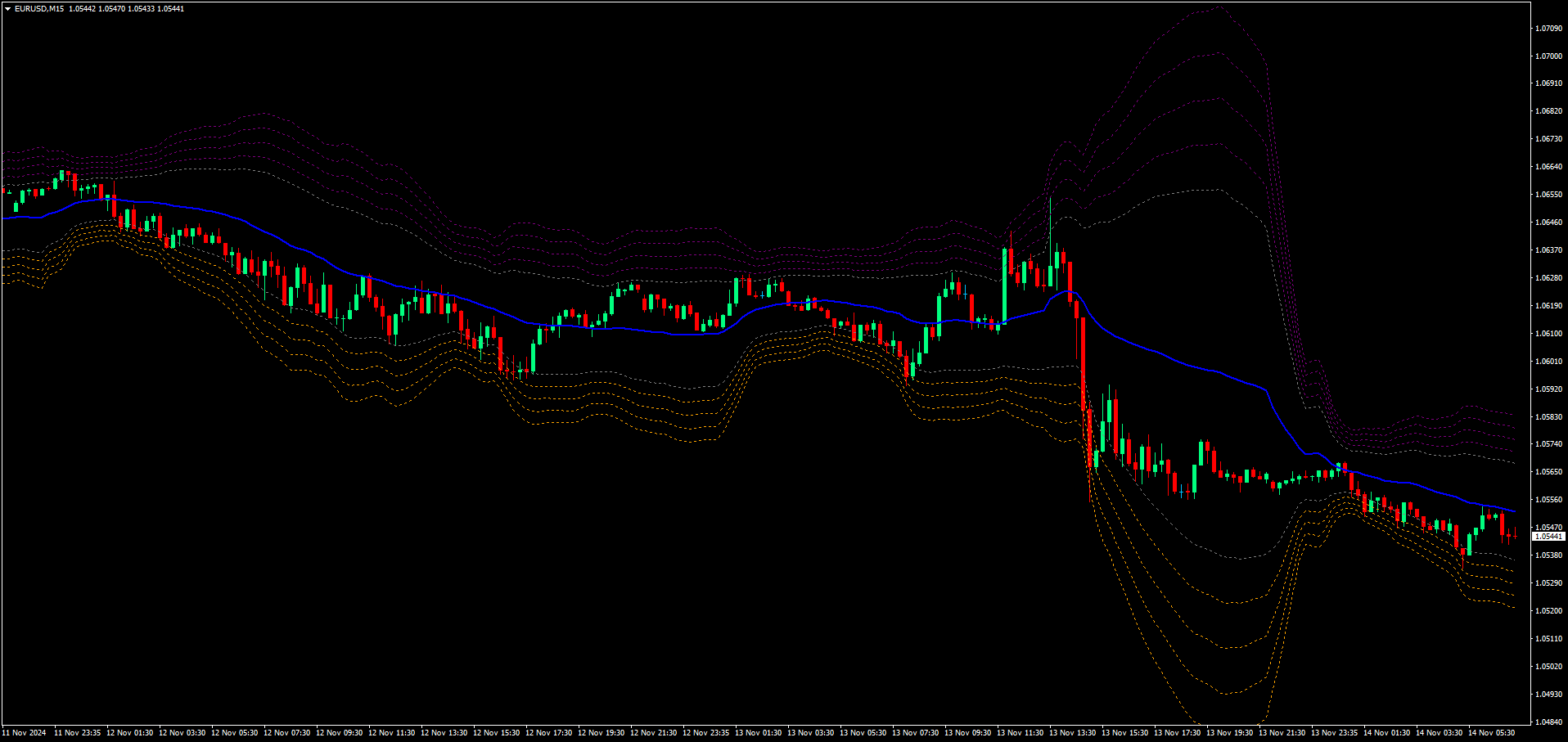

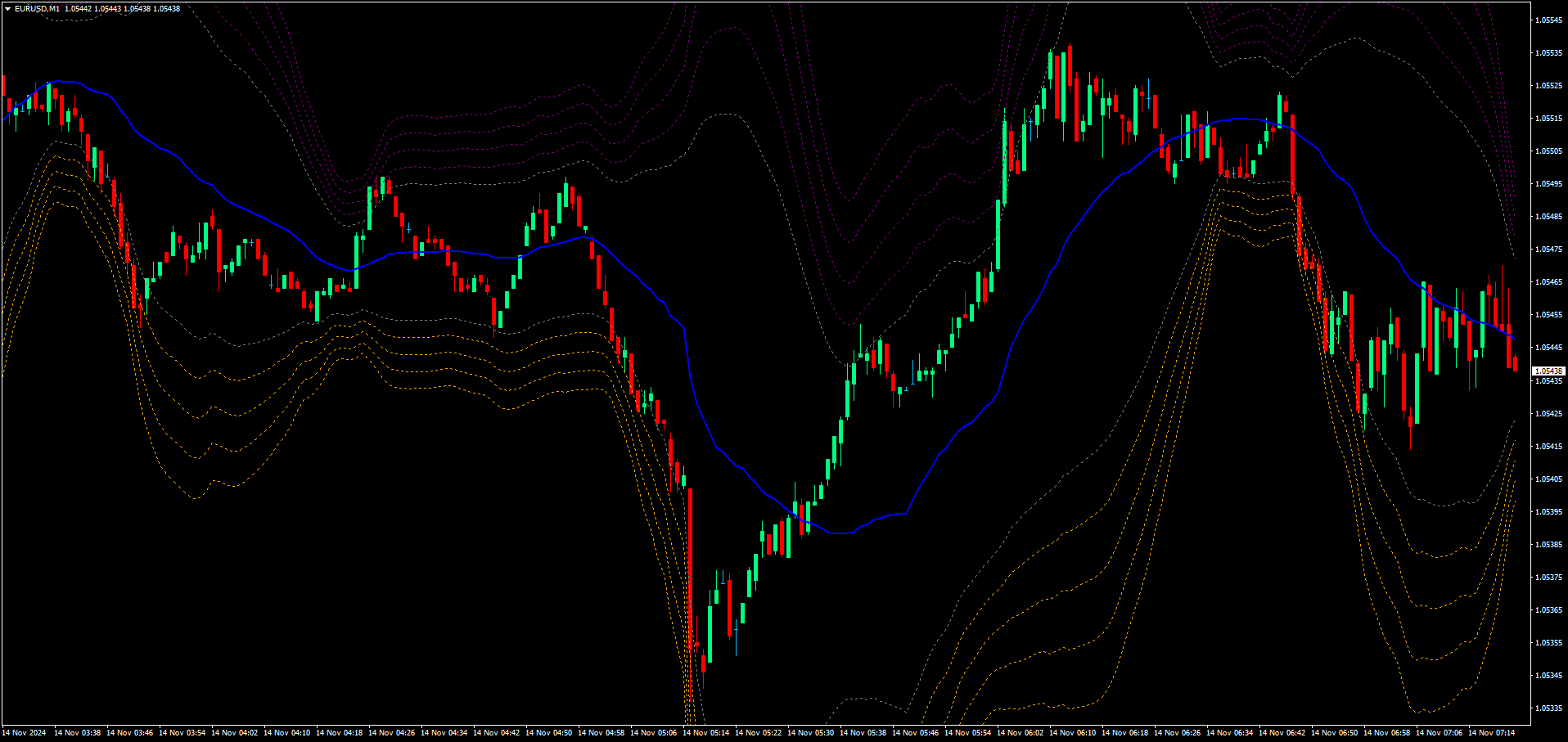

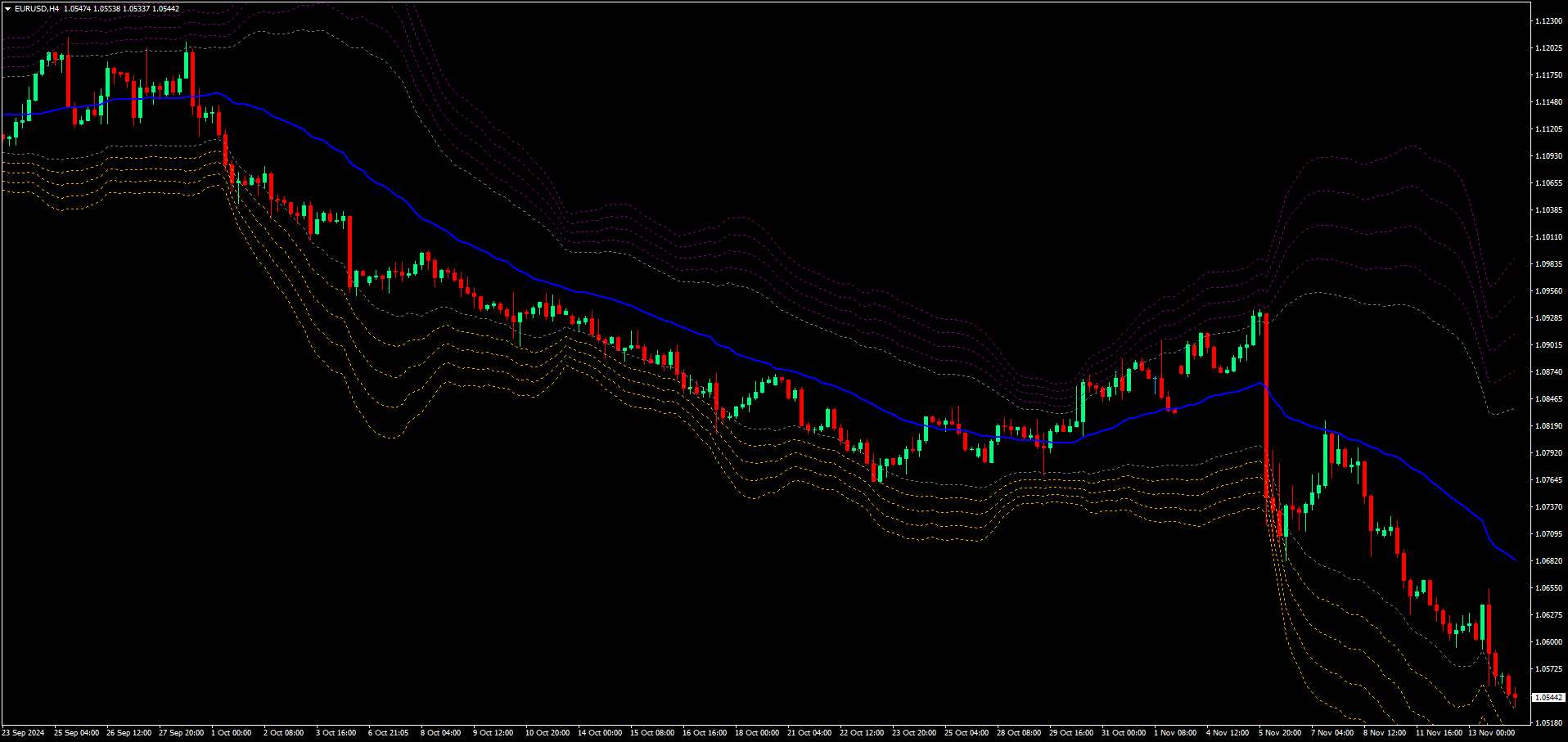

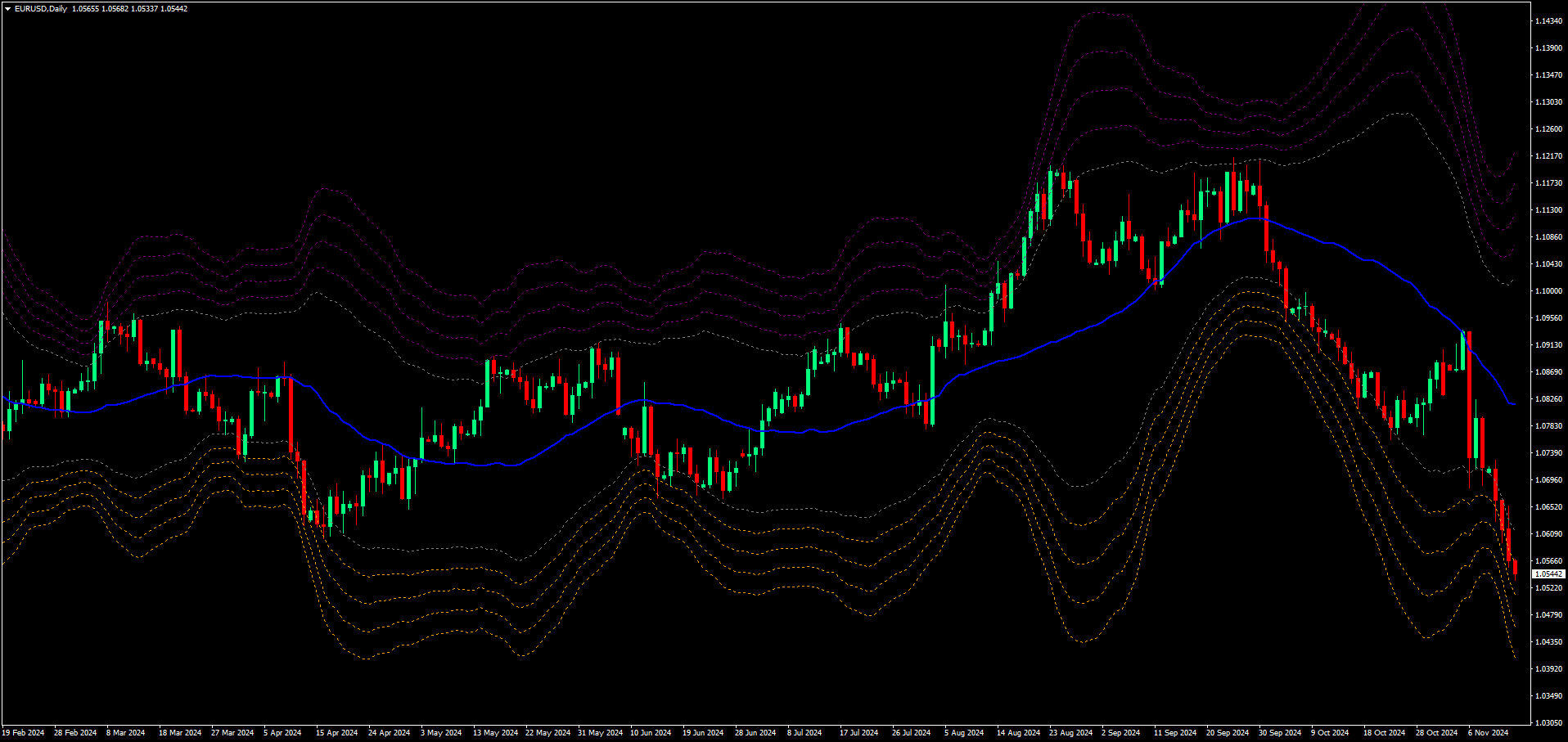

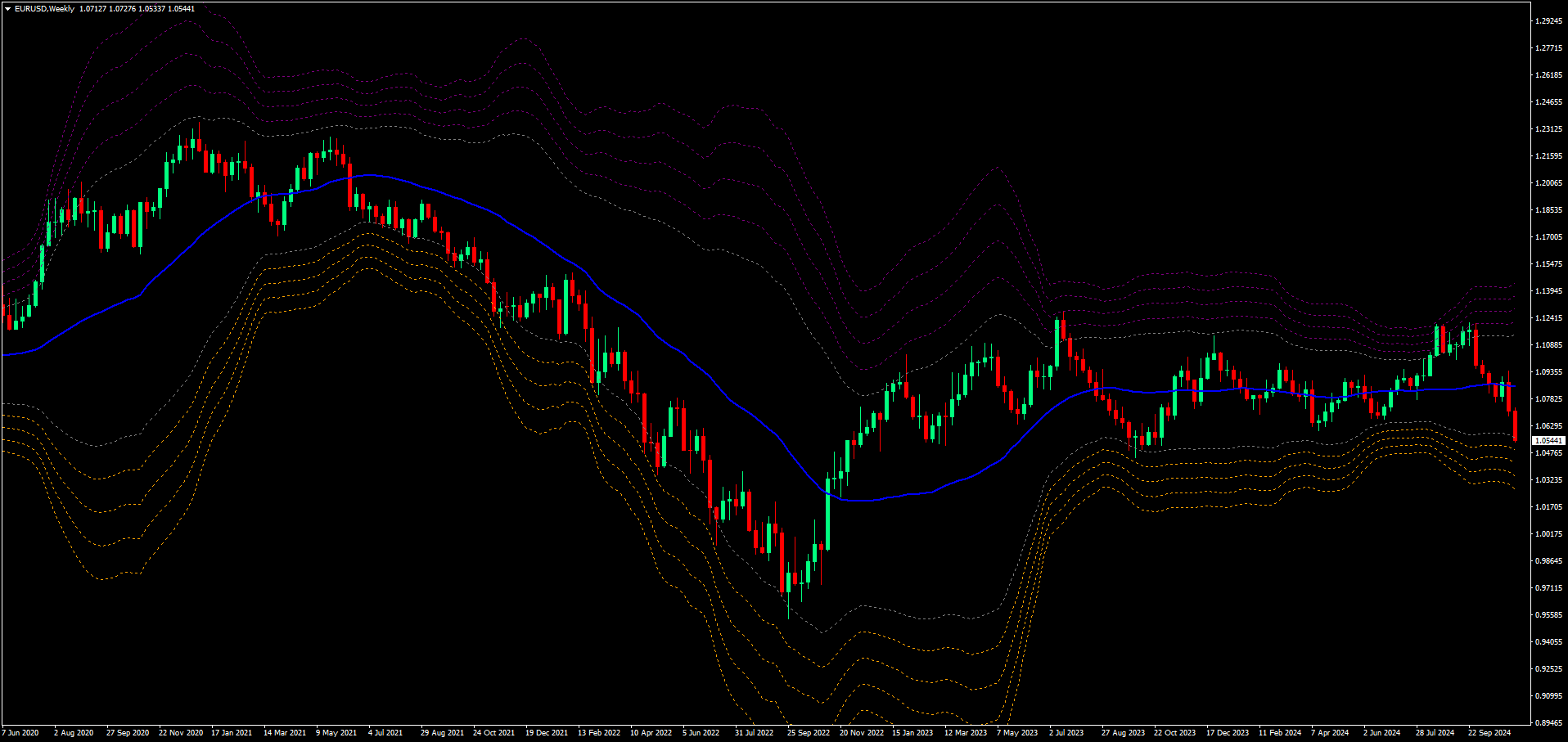

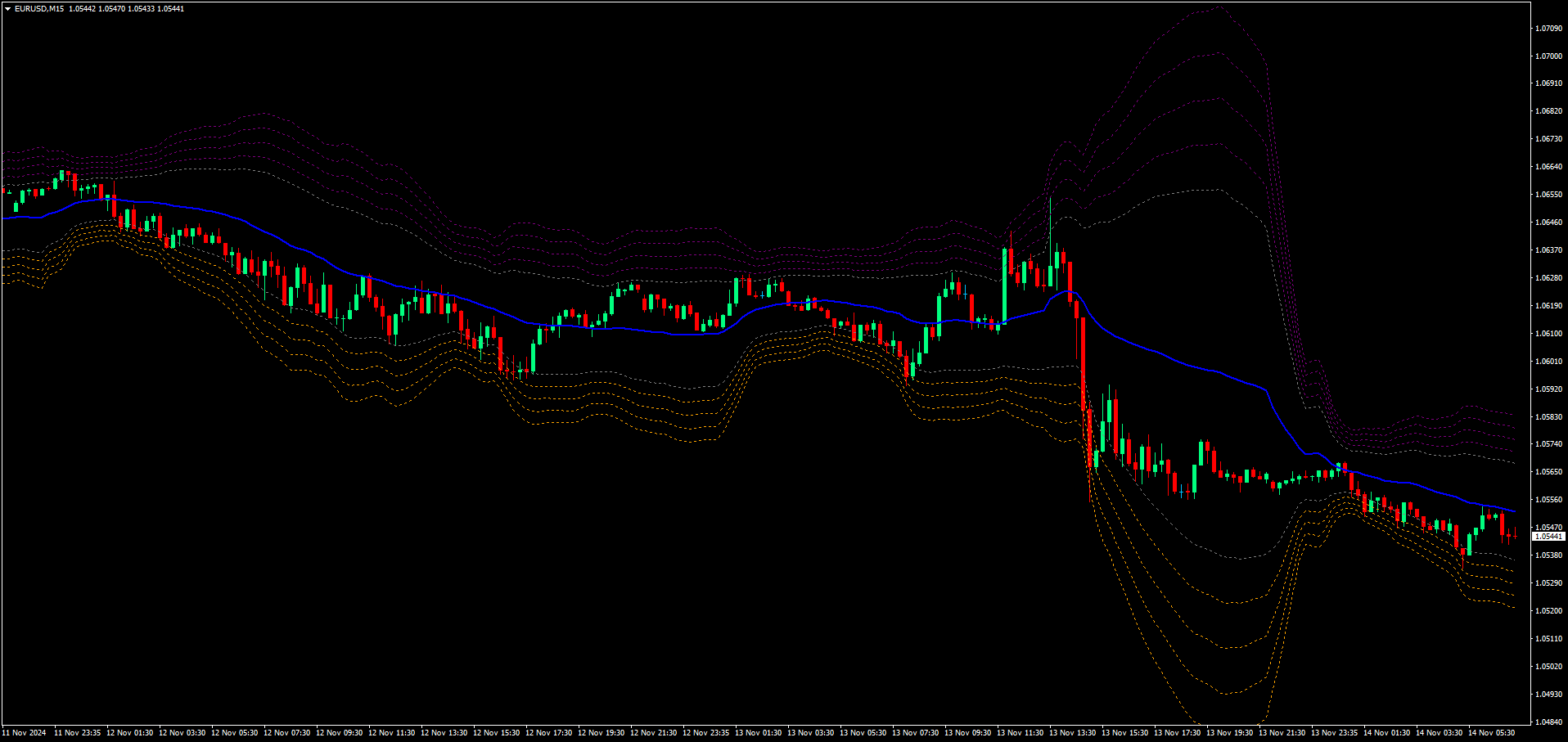

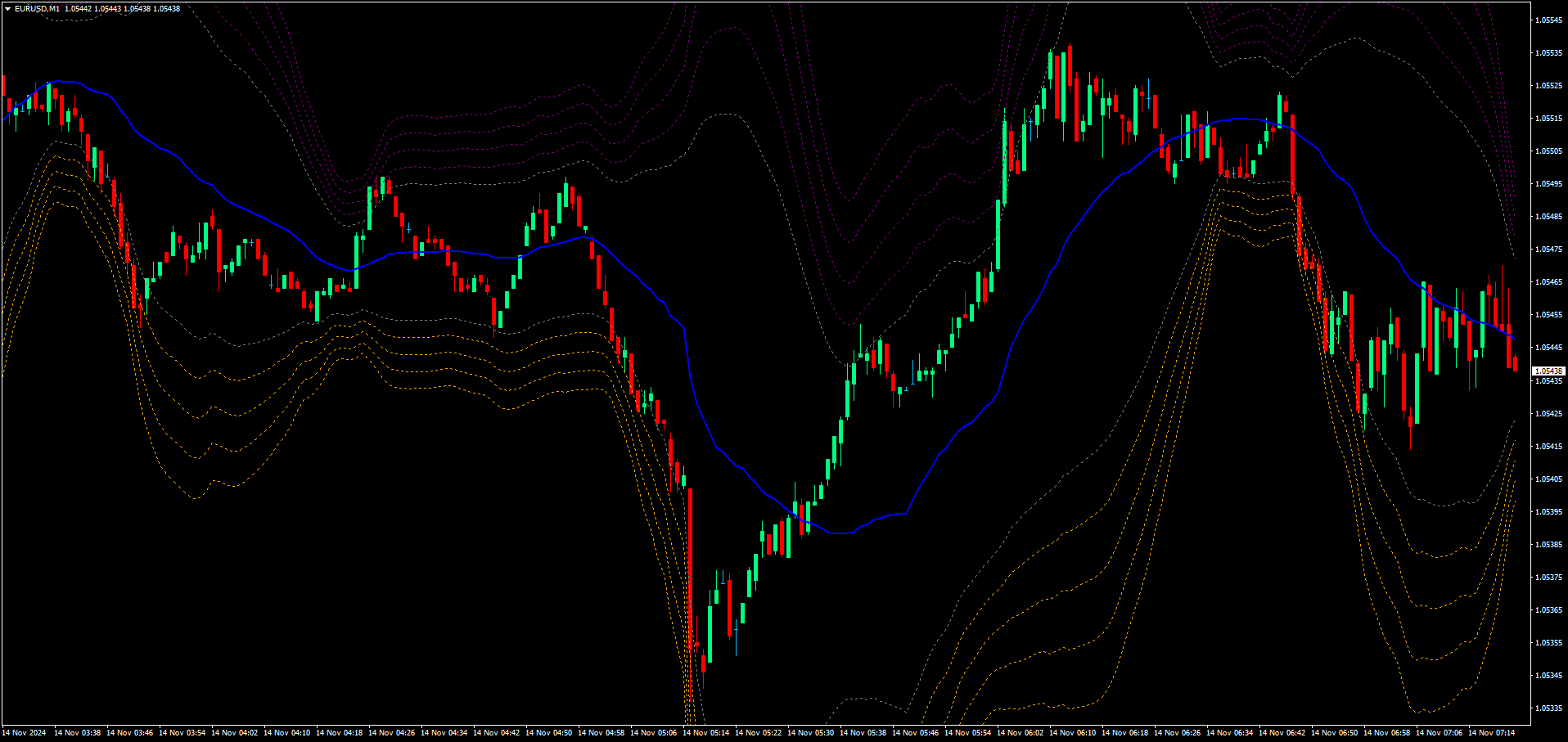

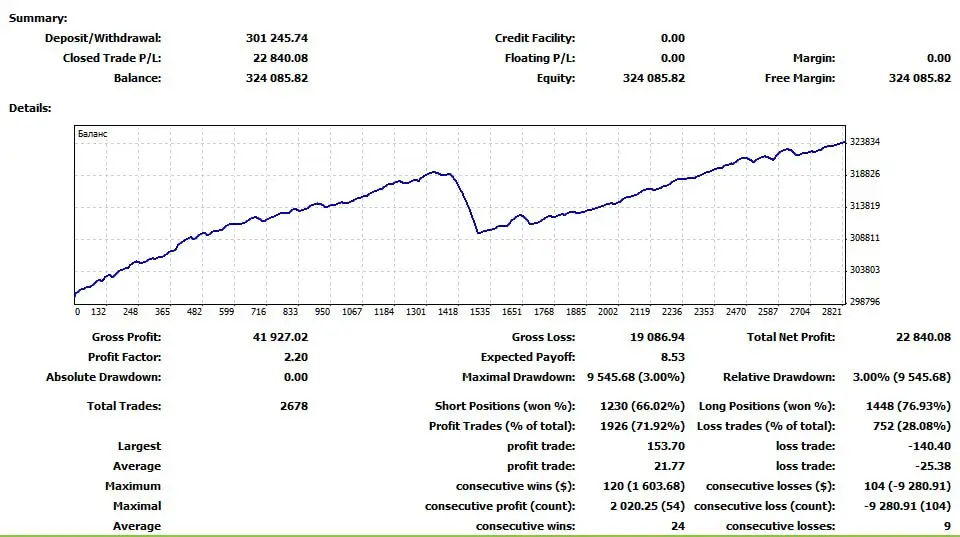

Rolling VWAP MT4 is a non-redrawing indicator that calculates the Volume Weighted Average Price based on tick volume over a defined number of candles. It features optional standard deviation bands for enhanced market analysis, helping traders identify trends and dynamic support/resistance levels. Customize settings for optimal use.

Advantages of Rolling VWAP MT4

The Rolling Volume Weighted Average Price (VWAP) indicator offers a range of advantages for traders looking to enhance their market analysis and decision-making processes. Below are some of the key benefits:

1. Accurate Price Levels

The Rolling VWAP calculates the average price of an asset, weighted by volume, over a defined number of candles. This provides traders with a precise gauge of average market price levels, helping to identify potential entry and exit points.

2. Non-Redrawing Indicator

As a non-redrawing indicator, the Rolling VWAP maintains its values after they are established, allowing traders to trust the signals generated without the bias of recalculating past prices. This reliability is crucial for effective trading strategies.

3. Dynamic Support and Resistance

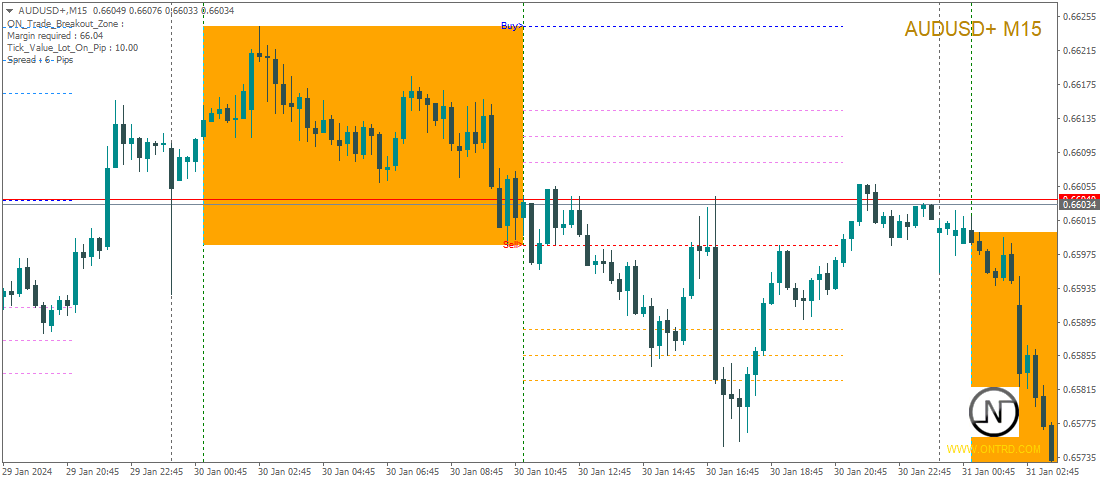

The addition of standard deviation bands creates dynamic support and resistance levels. The upper (lime) and lower (red) bands help traders visually identify volatility and potential reversal points, making it easier to formulate trading strategies around these levels.

4. Customization Options

Traders can tailor the Rolling VWAP settings to fit their own analytical styles. Customization options, such as adjusting the number of bars for VWAP calculation and the standard deviation multiplier, allow for greater flexibility and accuracy in different market conditions.

5. Enhanced Trend Identification

Utilizing the Rolling VWAP line provides a clear indication of market trends. When the price is situated above the VWAP line, it typically signals a bullish trend, while a price action below indicates a bearish trend. This straightforward interpretation aids traders in aligning their positions with prevailing market movements.

6. Effective for Intraday Analysis

Designed for intraday trading, the Rolling VWAP is particularly useful for traders who need to make quick decisions based on short-term price movements. This indicator can be combined with other technical tools to sharpen entry and exit signals, improving the overall trading strategy.

7. Visual Clarity

The clear graphical representation of the Rolling VWAP and its associated deviation bands on the chart aids in quickly interpreting the market environment. The colors (blue for VWAP, lime for the upper band, and red for the lower band) enhance visual analysis, making it easy for traders to spot relevant price levels.

8. Adaptability to Market Conditions

The Rolling VWAP can be adjusted for different volatility levels and timeframes, ensuring its relevance across various market conditions. Traders can modify the input settings based on their specific strategies, allowing for a tailored approach to market analysis.

The Rolling VWAP indicator is a powerful tool for traders seeking to improve their market assessments and decision-making processes. By leveraging its unique features, traders can gain a competitive edge in both identifying trends and understanding market behavior.

Reviews

There are no reviews yet.