Sale

Rsi Decoder MT4

$39 Original price was: $39.$29Current price is: $29.

SKU:

92E343BA90DE1409

Categories: Trading Indicators

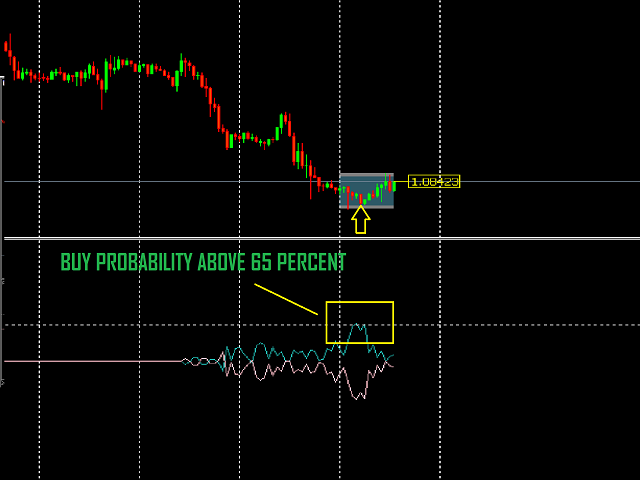

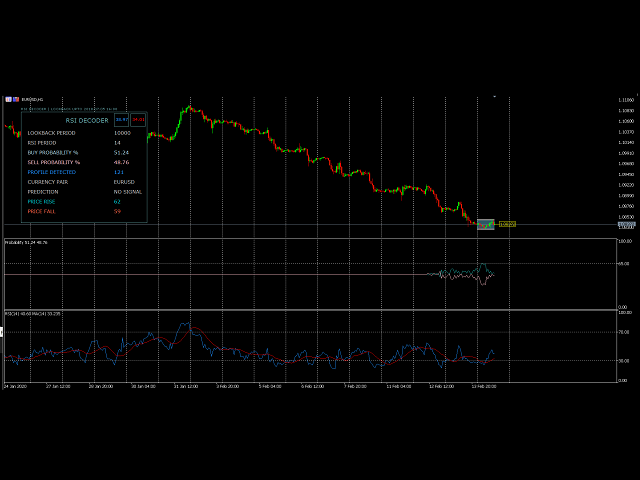

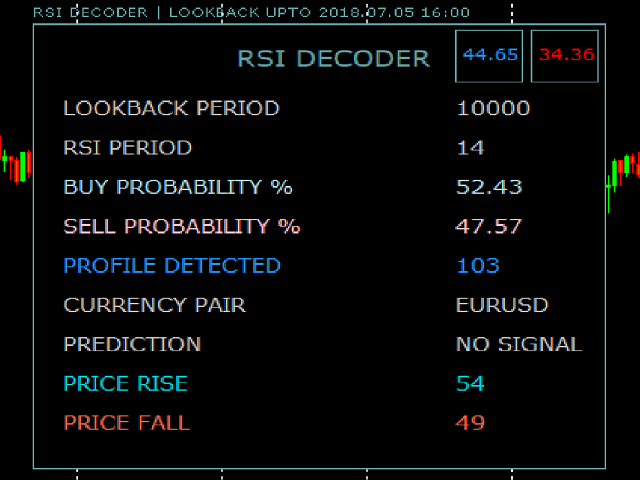

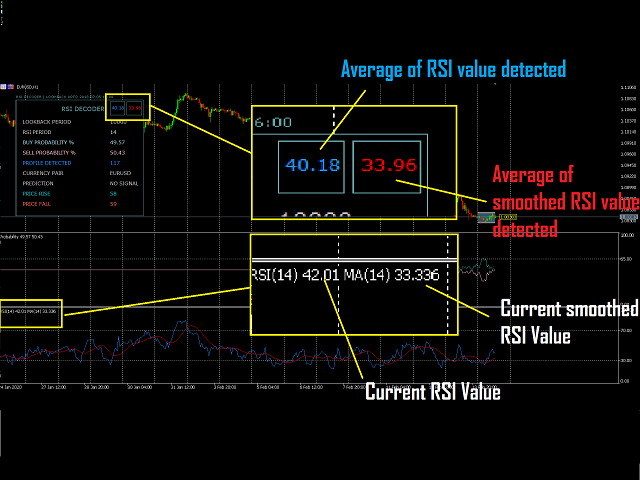

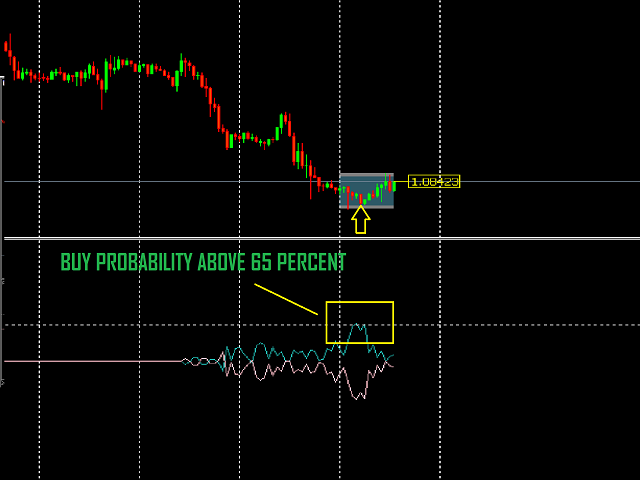

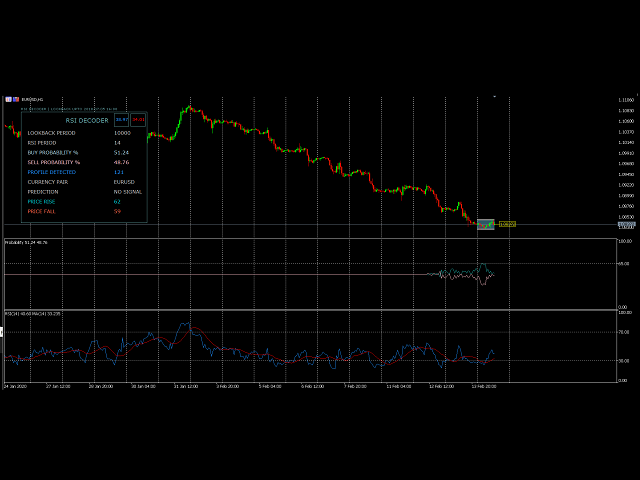

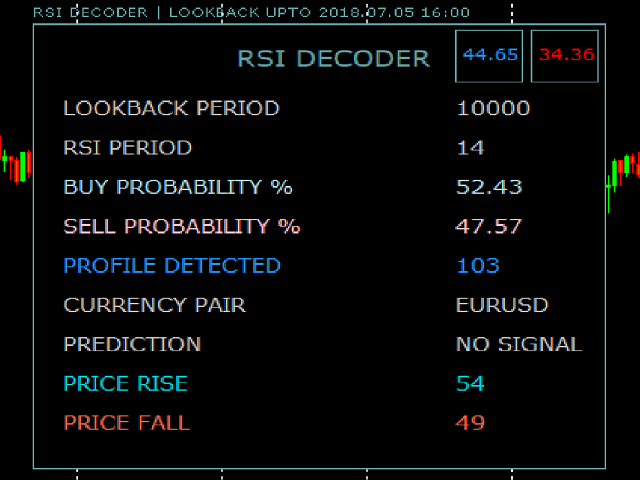

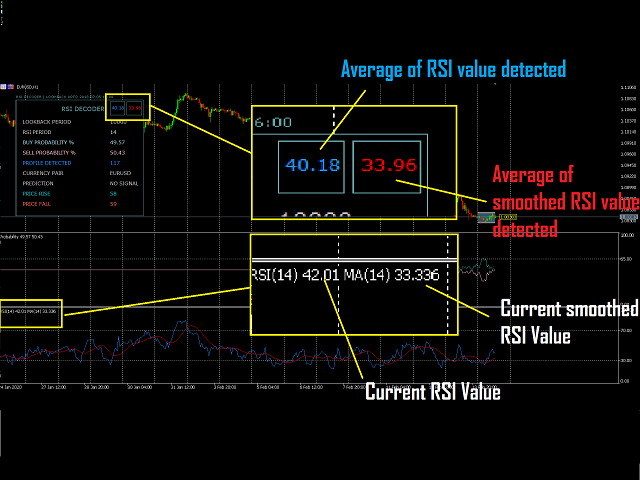

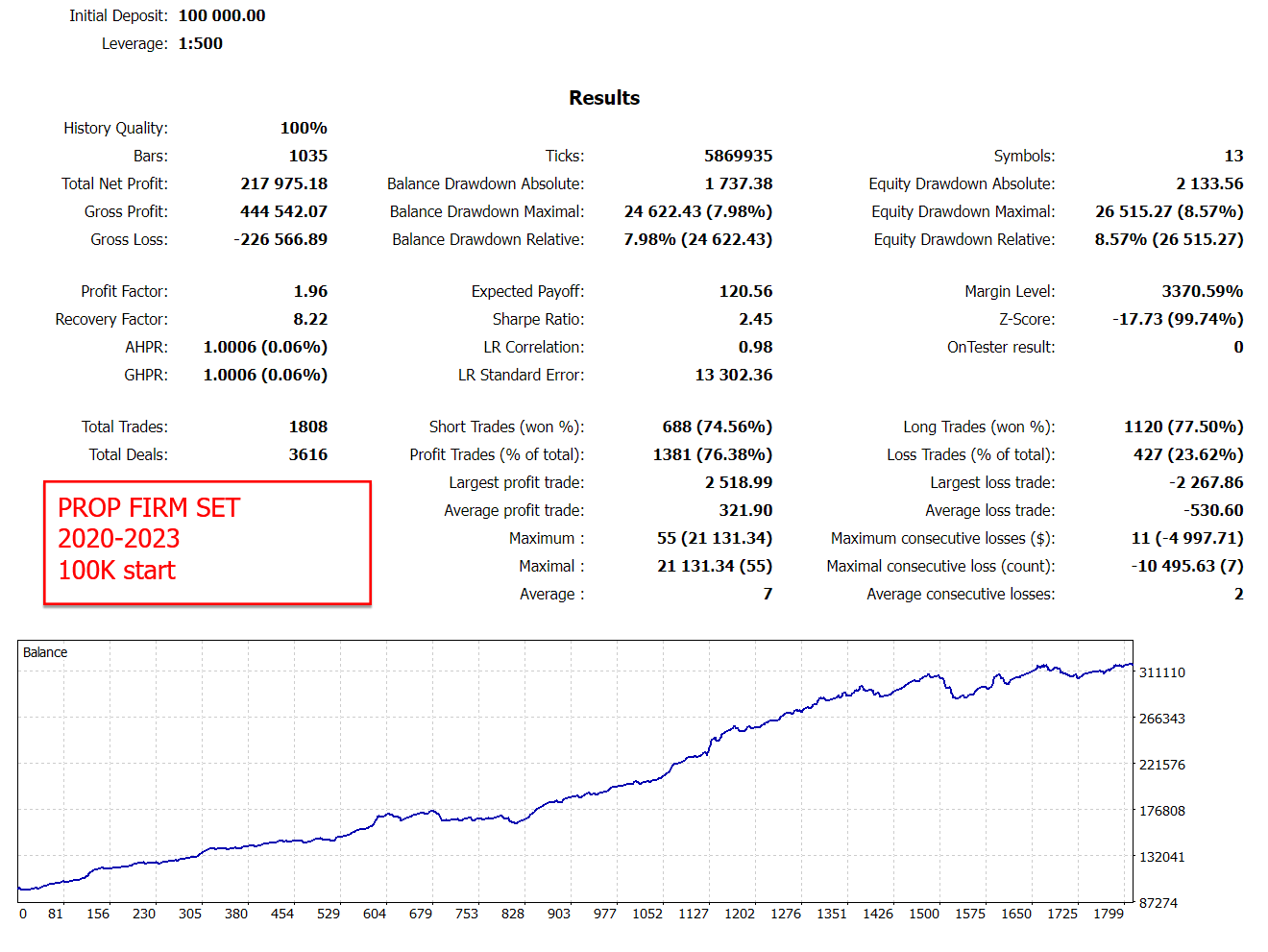

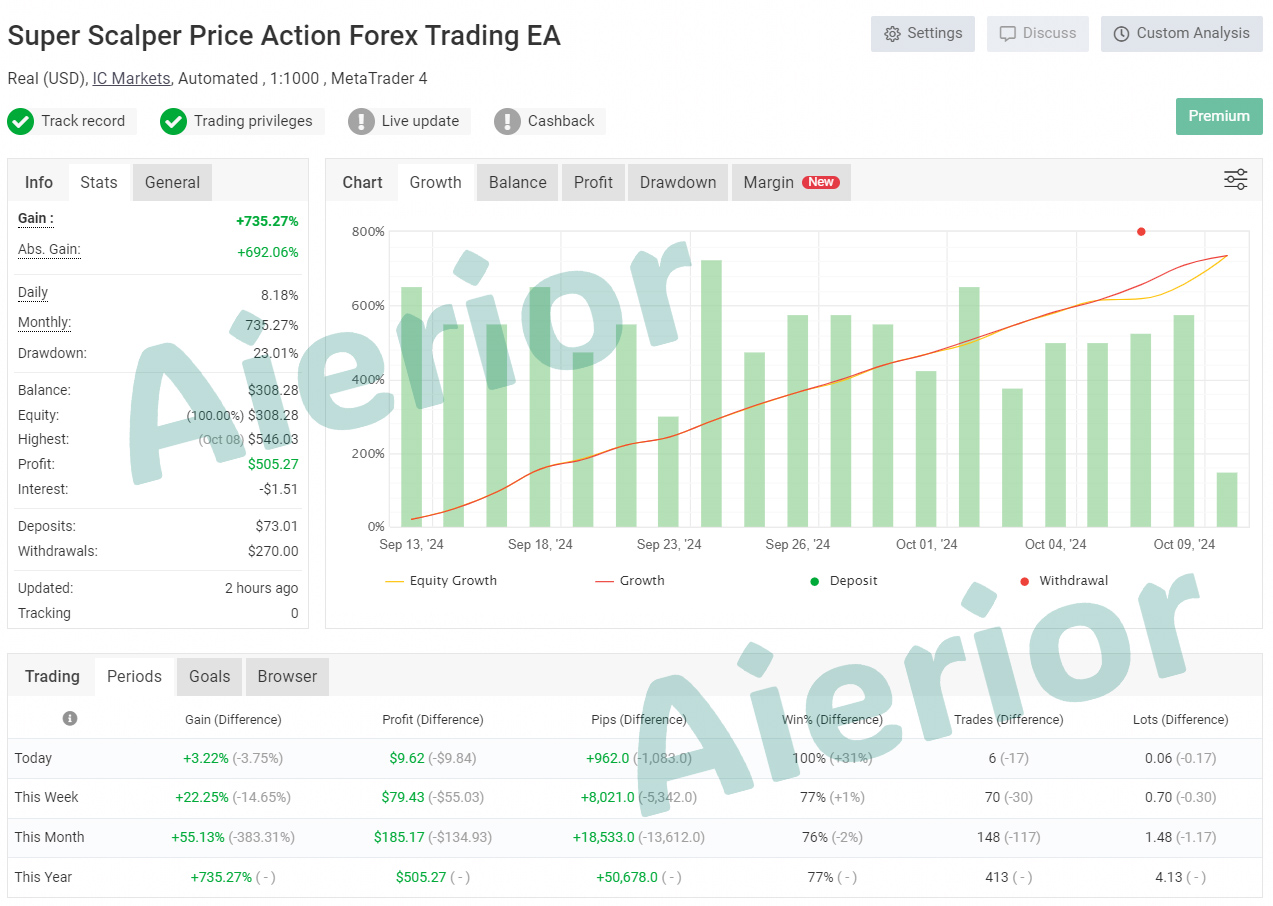

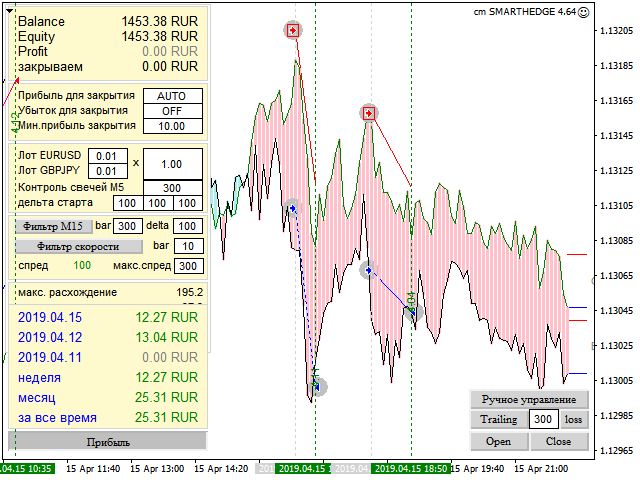

RSI Decoder MT4 is a powerful trading tool that analyzes historical price data to forecast future price movements using the Relative Strength Index (RSI). It identifies price patterns and probabilities of buy/sell signals, offering faster, more accurate predictions. Ideal for experienced traders seeking deeper market insights, it enhances trading strategies with a self-learning algorithm and customizable alerts.

Advantages of Using RSI Decoder MT4

- Self-Learning Algorithm: The RSI Decoder MT4 utilizes a self-learning mechanism that constantly improves its predictive capabilities as new market data becomes available.

- Superior Speed: Its performance is notably faster compared to traditional machine learning models such as Neural Networks, Regressions, Support Vector Machines (SVM), Decision Trees, and Random Forests, allowing for quicker analysis and decision-making.

- Enhanced Responsiveness: RSI Decoder MT4 showcases a rapid response rate when switching between different timeframes, ensuring users can adapt to market changes without delay.

- Precision-Based Profile Detection: The tool excels in minimizing noise and focusing on the most relevant market patterns, tailored to user specifications for optimal trading insights.

- Expert Advisor (EA) Integration: It seamlessly integrates with automated trading strategies, enhancing the efficiency of trade execution based on its predictions.

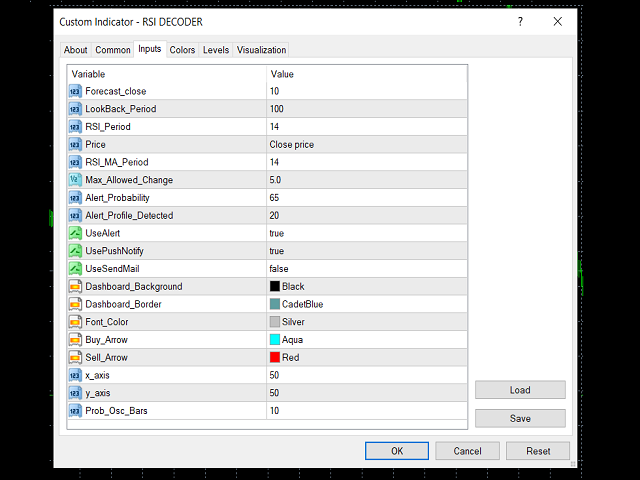

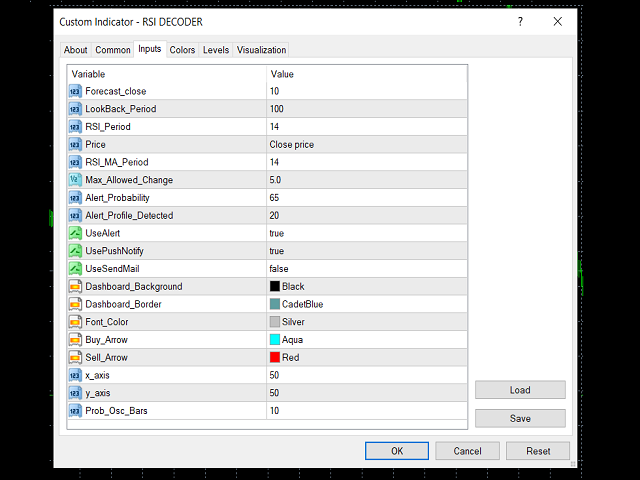

- Custom Precision Settings: Traders can define a custom precision percentage (Max_Allowed_Change) to align the tool’s outputs with their risk tolerance and trading style.

- Alerts and Notifications: Users can set up custom email and push notifications to stay informed of potential trade setups or critical market events instantly.

- Comprehensive Market Insight: The RSI Decoder MT4 provides detailed information about current market patterns and their anticipated behavior, enhancing traders’ ability to make informed choices.

- Reversal and Continuation Identification: It effectively detects potential reversals or trend continuations when the RSI indicator indicates overbought or oversold conditions, assisting traders in timing their entries and exits.

- Extensive Historical Data Utilization: The tool operates smoothly over a lookback period of up to 20,000 bars, which is significantly faster than conventional methods, providing deep historical insights for better forecasting.

Be the first to review “Rsi Decoder MT4” Cancel reply

Reviews

There are no reviews yet.