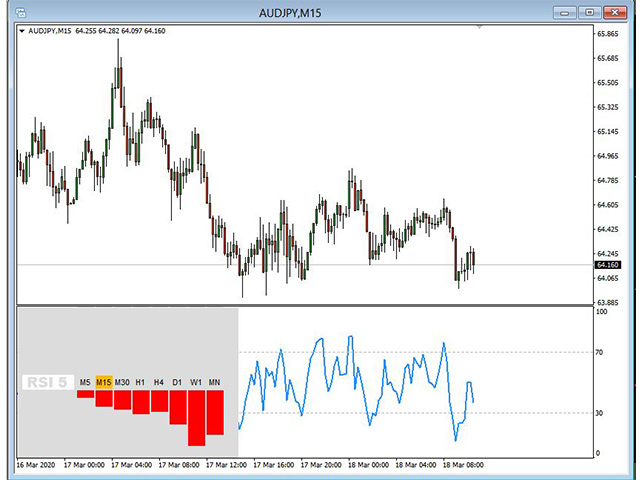

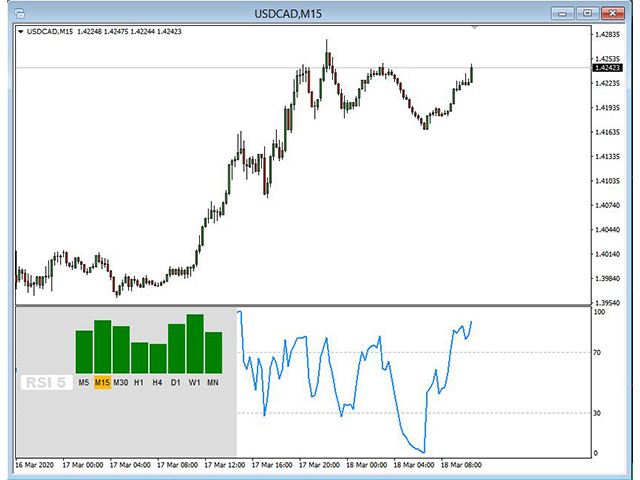

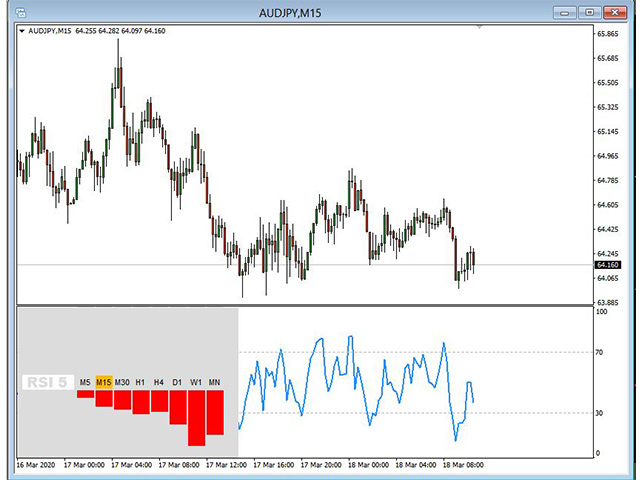

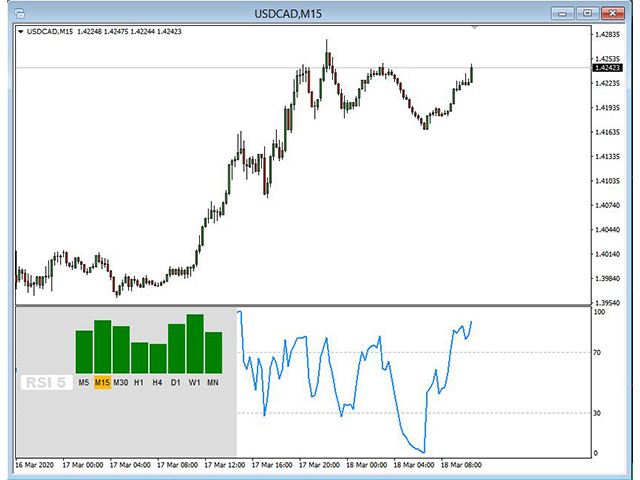

RSI Multi Timeframe MT4 is a versatile indicator that displays the Relative Strength Index (RSI) across multiple timeframes, from 5 minutes to monthly. Users can customize settings, with green histograms indicating values above 50 and red below. Clickable timeframe labels allow for easy chart adjustments, enhancing price strength analysis.

Advantages of RSI Multi Timeframe MT4

The RSI Multi Timeframe indicator for MetaTrader 4 brings several key advantages to traders seeking to gain deeper insights into market dynamics across various timeframes:

1. Comprehensive Market Analysis

This indicator allows traders to assess the Relative Strength Index (RSI) from 5-minute to monthly timeframes, providing a holistic view of market momentum. By understanding the RSI readings across multiple timeframes, traders can make more informed decisions based on the overall market trend.

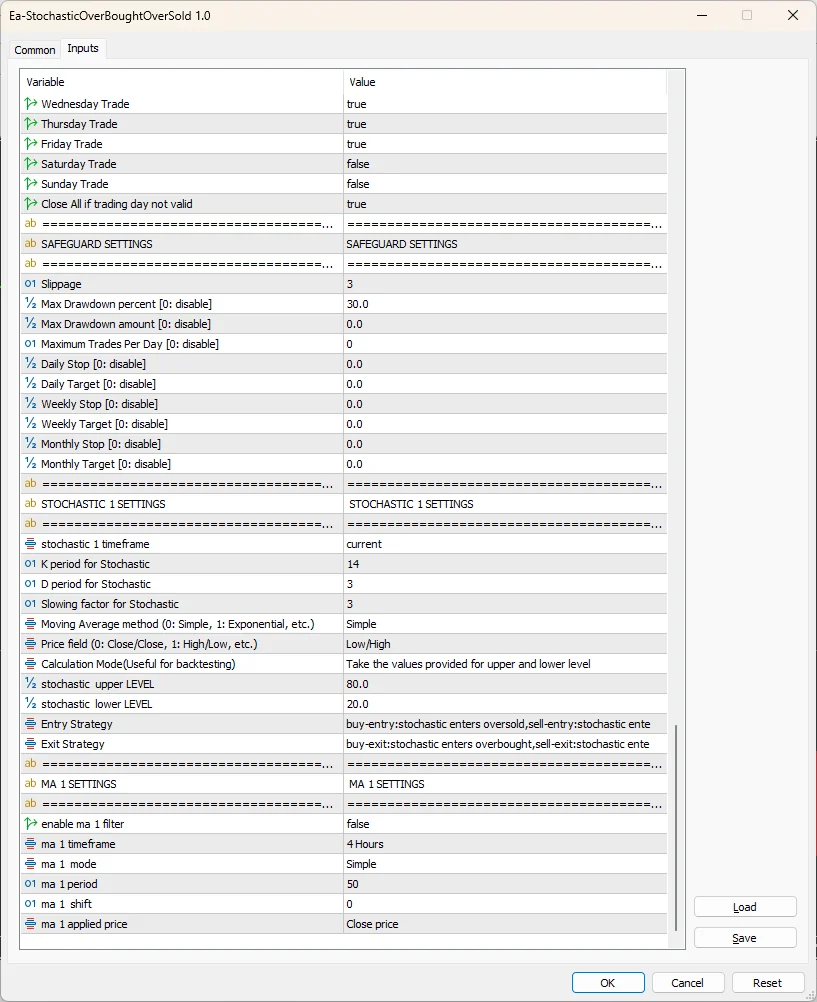

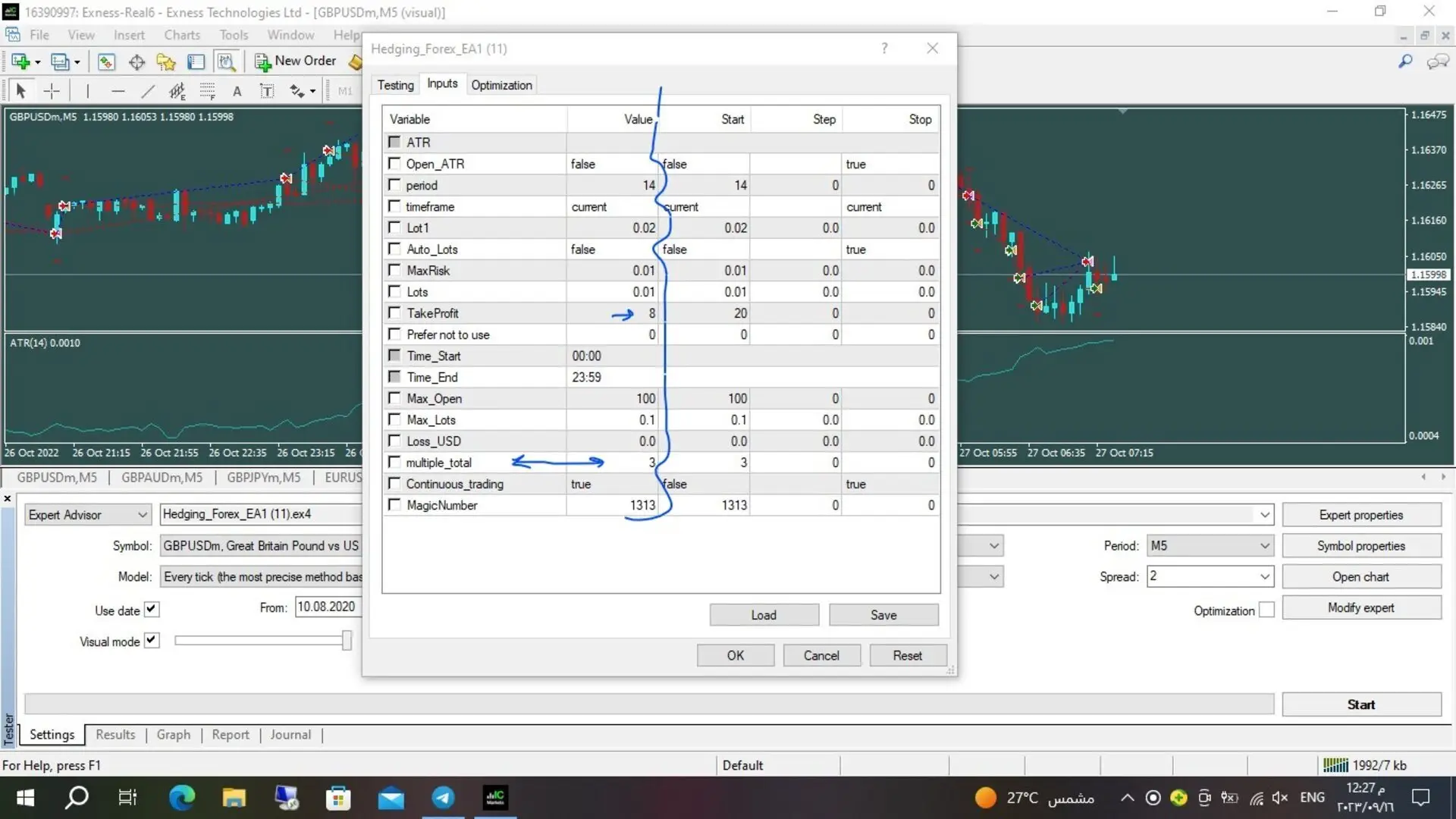

2. Customizable Settings

With the ability to input preferred settings that apply to the entire indicator, traders can tailor the RSI calculations to fit their unique trading strategies. Whether you prefer a standard or a customized RSI period, the flexibility ensures that the indicator works to meet individual needs.

3. Easy Visualization

The use of a histogram for visual representation facilitates quick decision-making. A green histogram indicates bullish momentum, while a red histogram signals bearish conditions. This intuitive visualization allows traders to quickly appreciate the strength of price movements across different timeframes.

4. Enhanced Timeframe Switching

Traders can easily switch timeframes by clicking on the timeframe label associated with the indicator. This seamless navigation allows for quick adjustments and analysis, saving time and enhancing the trading experience.

5. Recognizing Divergence

By analyzing RSI across multiple timeframes, traders can identify potential divergences that may not be visible on a single timeframe. Such insights can signal potential trend reversals or continuations, providing valuable trading opportunities.

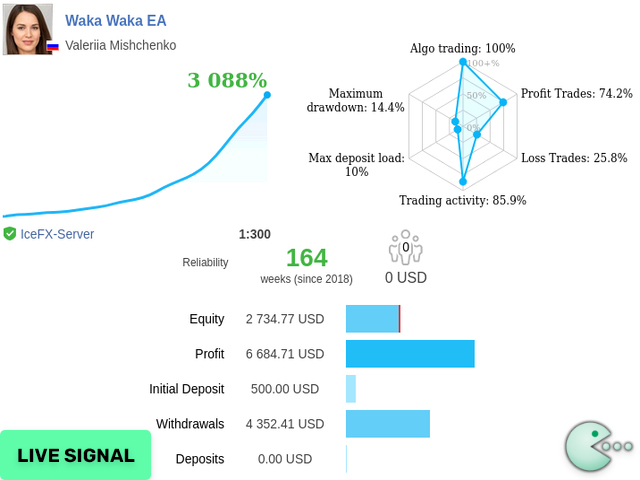

6. Better Risk Management

Understanding RSI levels in conjunction with different timeframes can aid in setting more accurate stop-loss and take-profit levels. Traders can assess the strength and reliability of ongoing price movements, enhancing overall risk management practices.

Conclusion

By leveraging the RSI Multi Timeframe MT4 indicator, traders can achieve a comprehensive understanding of market dynamics. This unique viewpoint not only informs trading decisions but also enhances overall trading strategies, making it an indispensable tool for traders of all levels.

Reviews

There are no reviews yet.