Rsi Rd MT4

$30 Original price was: $30.$29Current price is: $29.

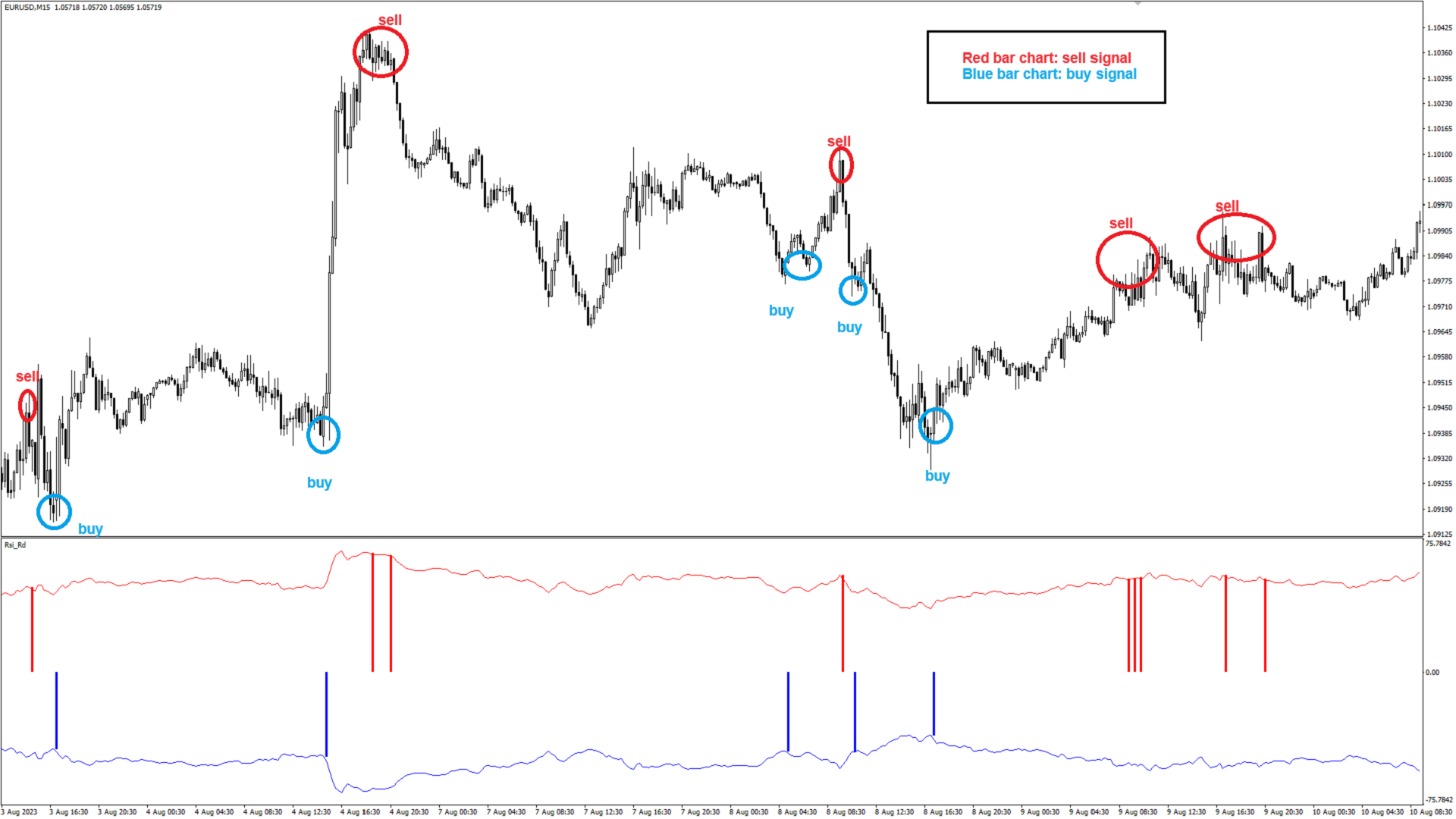

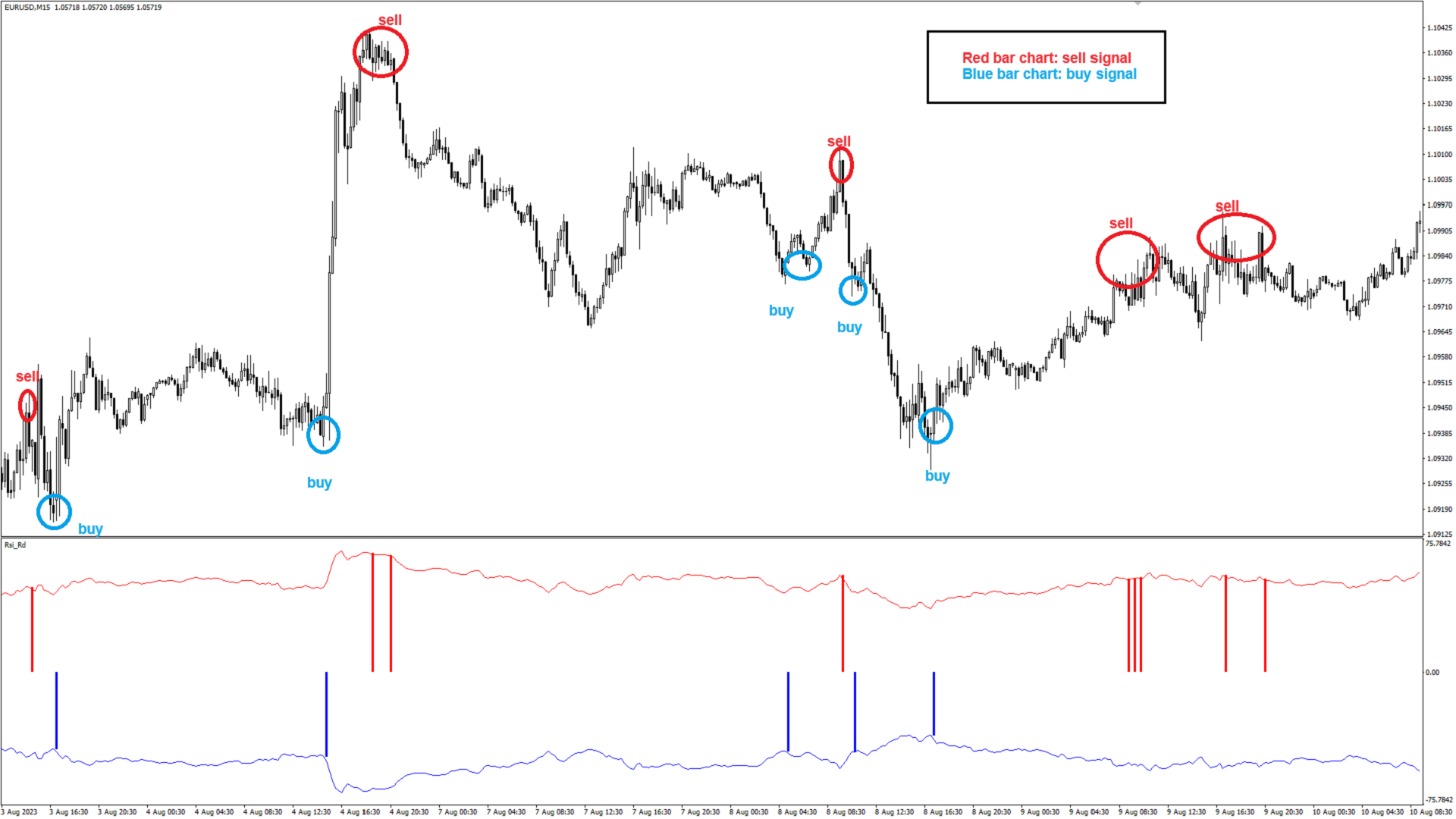

Rsi Rd MT4 is a versatile trading indicator based on the RSI and enhanced with candlestick patterns for improved signal accuracy. It works on all symbols and time frames, featuring user-friendly settings, including period, alert options, and alarm values to notify users of significant signals.

Advantages of Rsi Rd MT4

The Rsi Rd MT4 indicator offers a variety of benefits that make it a valuable tool for traders seeking to enhance their technical analysis. Here are some of the key advantages:

- Based on RSI: The indicator leverages the Relative Strength Index (RSI), a well-known momentum oscillator, providing a reliable basis for identifying potential overbought or oversold conditions.

- Incorporates Candlestick Patterns: By integrating candlestick patterns into its analysis, Rsi Rd MT4 helps traders identify stronger signals, enhancing the accuracy of entry and exit points.

- Universal Application: This indicator can be used with all symbols and on any time frame. Whether you’re trading forex, commodities, or indices, Rsi Rd MT4 adapts seamlessly to fit your trading strategies.

- User-Friendly: Rsi Rd MT4 is designed with ease of use in mind. Traders of all experience levels will find the interface intuitive, allowing for quick adoption and integration into their trading routine.

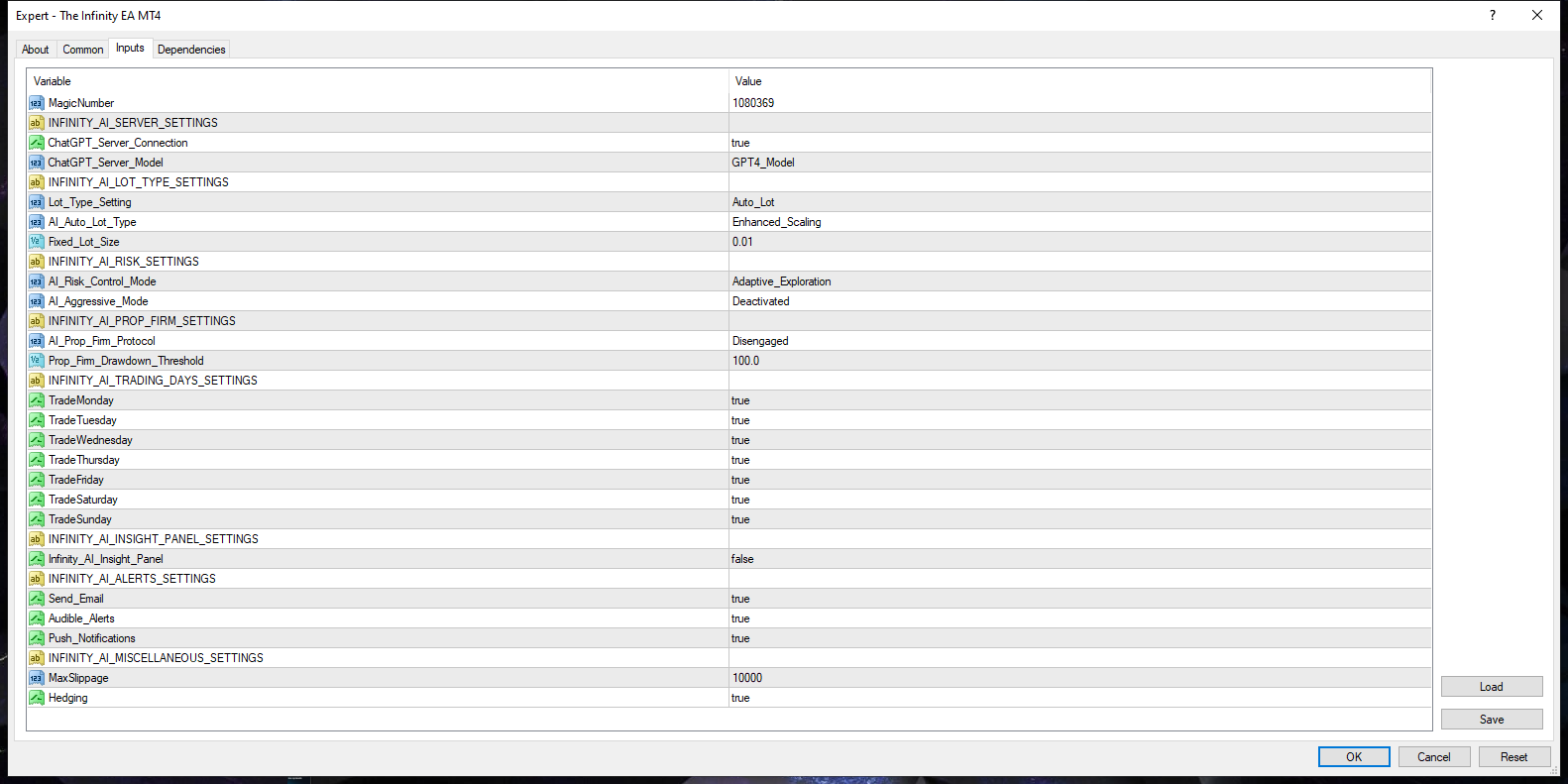

- Customizable Settings: The indicator features adequate settings that can be adjusted according to individual trading preferences, ensuring a personalized trading experience.

- Alert Features: Rsi Rd MT4 includes alert settings, enabling traders to receive notifications in Metatrader or on mobile devices when specific signals are triggered. This keeps traders informed and ready to act at critical moments.

Overall, the Rsi Rd MT4 indicator stands out as an effective tool that combines the power of the RSI with the insightful analysis of candlestick patterns. Its versatility, ease of use, and robust alert system make it an essential addition for traders looking to improve their market analysis and execution.

Reviews

There are no reviews yet.