Stochastic EA MT5

$30 Original price was: $30.$29Current price is: $29.

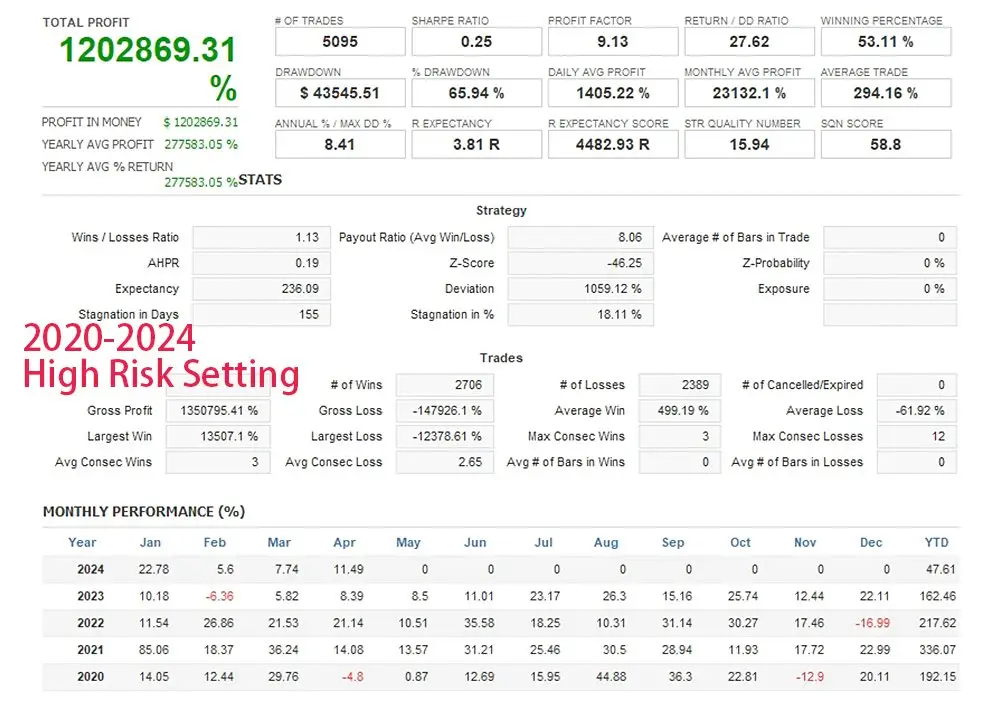

Stochastic EA for MT5 is an advanced trading tool that automates trades using the Stochastic indicator, focusing on overbought and oversold conditions. It offers versatile features, including reverse trading, customizable settings for risk management, and support for Martingale and grid strategies, optimizing trading activity for users.

Advantages of Stochastic EA for MetaTrader 5

1. Automation of Trading Decisions:

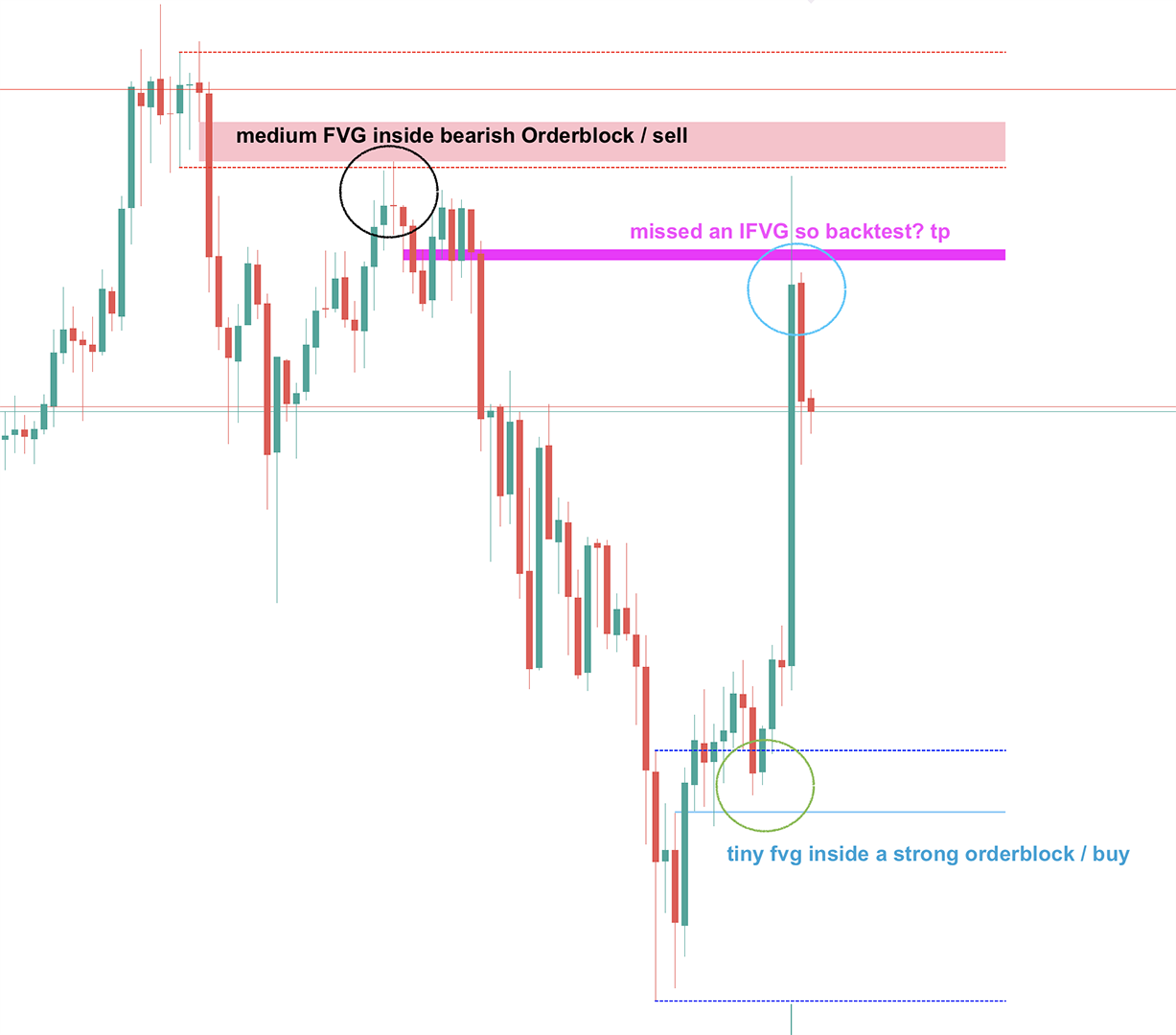

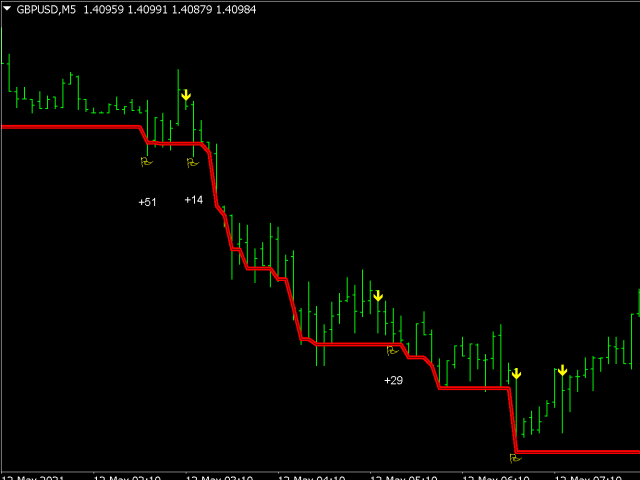

The Stochastic Trader Expert Advisor automates the process of identifying overbought and oversold conditions. By utilizing the well-known Stochastic indicator, it facilitates timely trade entries and exits, minimizing the emotional and psychological toll that often comes with manual trading.

2. Versatility with Trade Setups:

With its capability to facilitate reverse trading setups, this EA offers traders a flexible approach to managing their trades. It allows for exploitation of market conditions beyond just standard buy and sell signals, enhancing potential profitability.

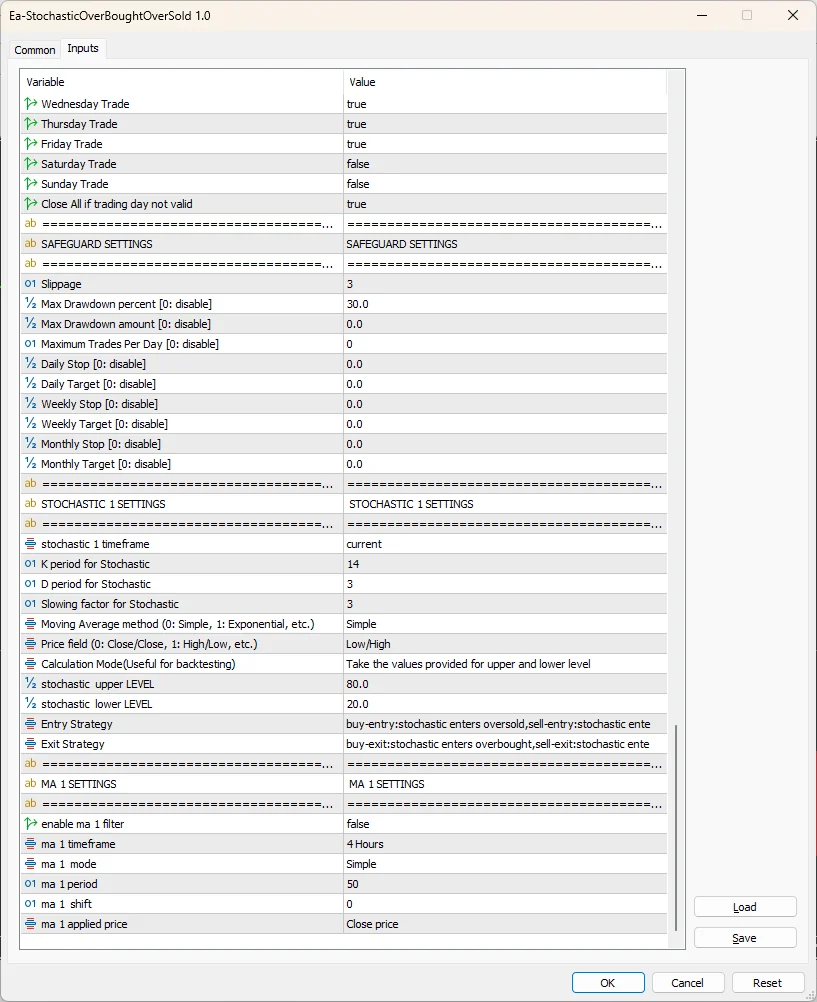

3. Comprehensive Customization:

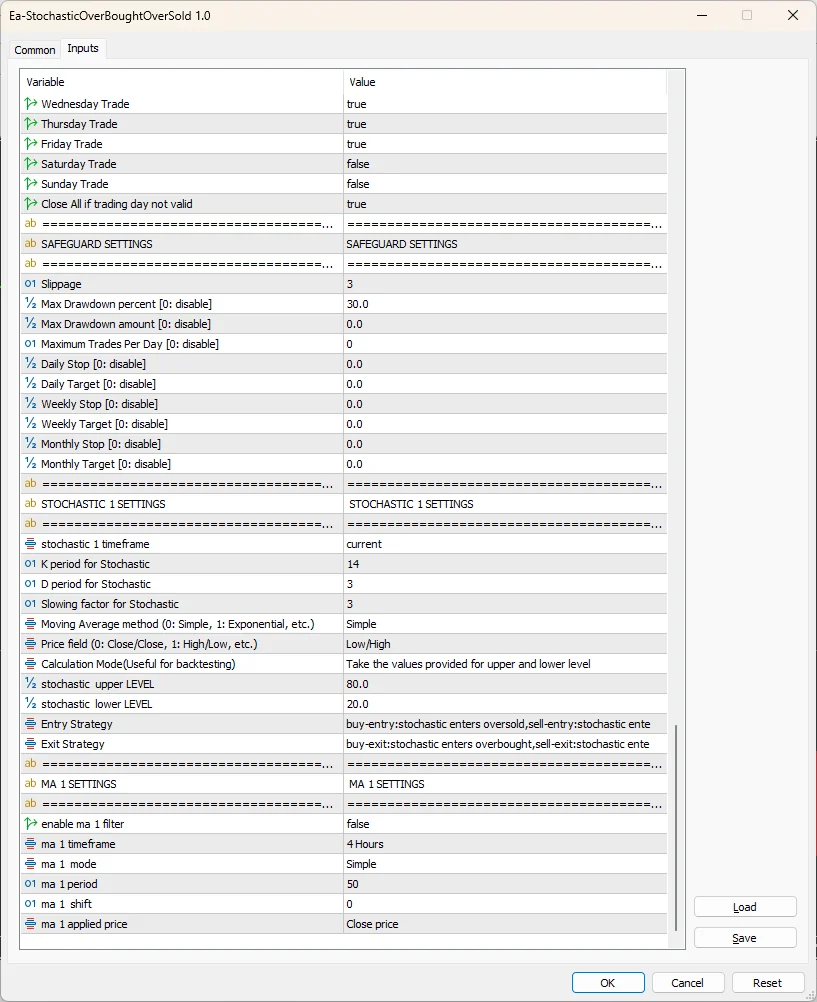

The Stochastic EA is equipped with a multitude of settings, allowing traders to finely tune parameters such as lot size, stop loss, take profit, and trade direction according to their unique trading strategies and risk appetites. The ability to adjust these settings empowers users to craft their own trading experience.

4. Advanced Safety Features:

Safeguard settings, like maximum drawdown limits and daily stop features, help prevent excessive losses by automatically closing positions once specific thresholds are reached. This aids in maintaining capital and protecting trades from unexpected market shifts.

5. Integration of Risk Management:

The expert advisor includes various risk management options including risk-to-lot calculations and customizable profit and loss percentages. These features enable traders to manage their risk effectively, aligning with their broader trading goals.

6. Flexibility in Trading Times:

Traders can dictate whether the EA should operate 24/7 or only during specific trading sessions (Asian, European, or American). Options also exist to customize trading days, offering a tailored trading experience that aligns with individual schedules.

7. Logging and Alerting Mechanisms:

Enhanced logging capabilities allow users to troubleshoot and refine their trading strategies while alert settings enable notifications for trading actions. These features ensure that traders are always informed about their trading activity without needing to monitor charts continuously.

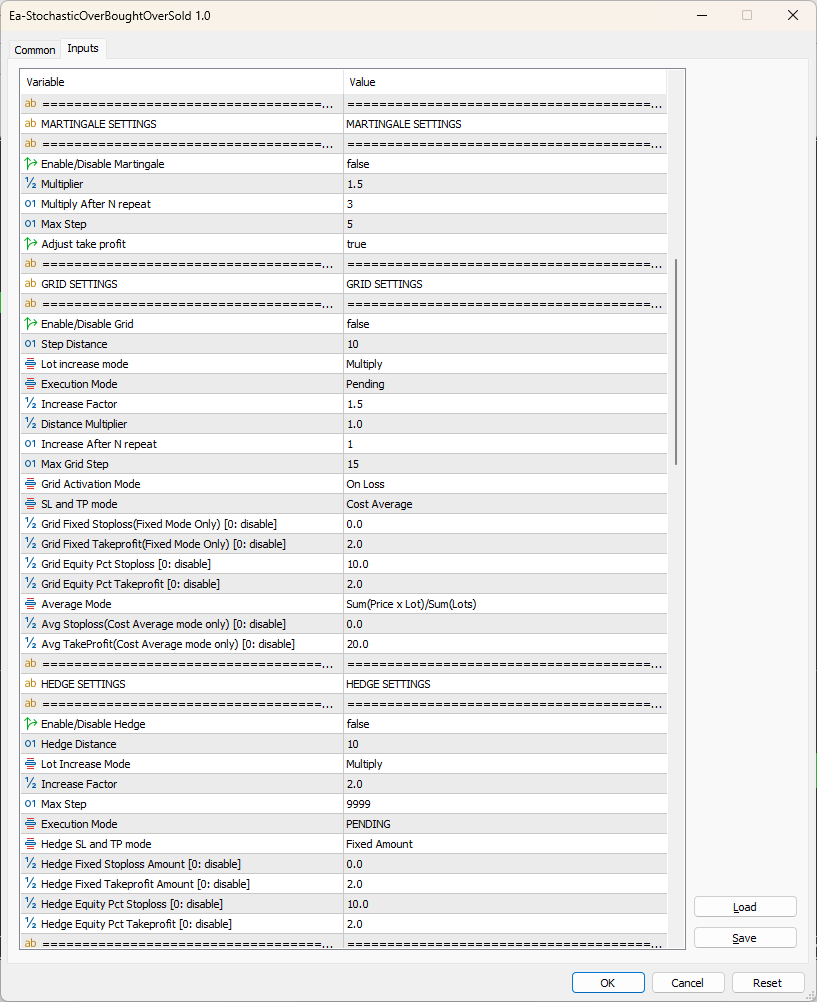

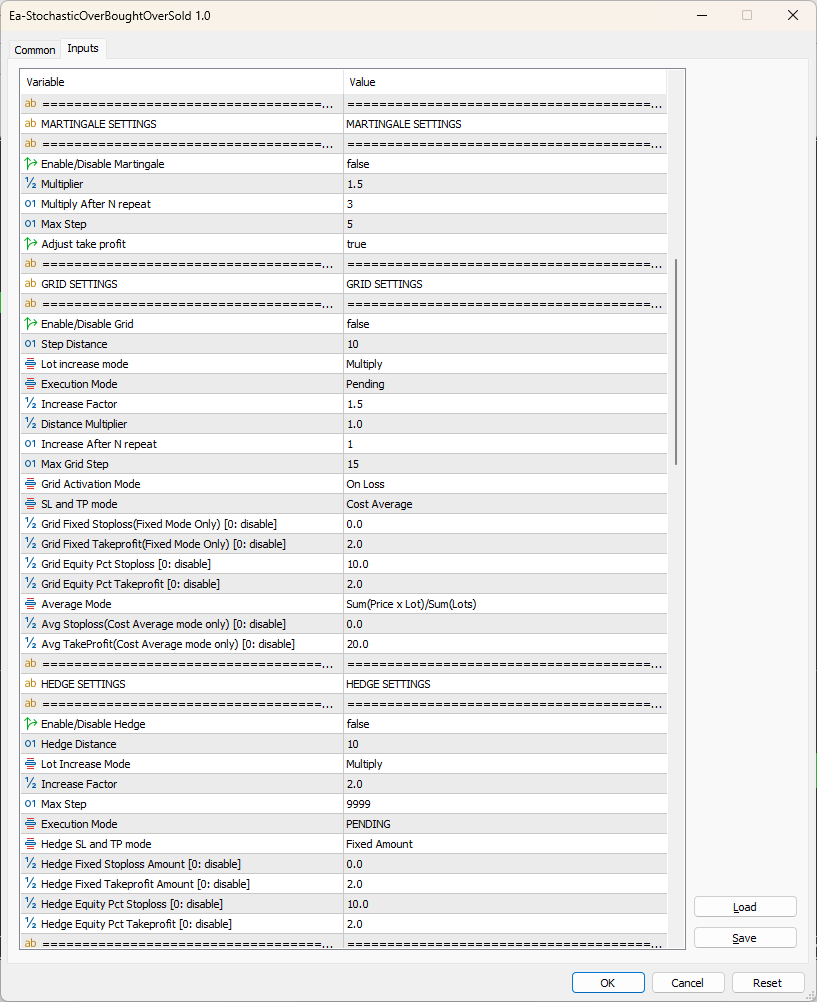

8. Support for Advanced Strategies:

The Stochastic EA includes support for both Martingale and Grid trading strategies, giving traders multiple avenues to pursue depending on their individual strategies and market conditions. This added flexibility can provide a strategic edge in varying market environments.

9. User-Friendly Interface:

The EA offers adjustable display settings for better visualization, ensuring that users can manage their trades efficiently and effectively without feeling overwhelmed by complexity.

10. Pre-Live Testing Recommendation:

Users are encouraged to test the EA thoroughly via a demo account before going live. This practice ensures that traders can assess the advisor’s performance and make drastic adjustments if necessary, further safeguarding their capital.

In conclusion, the Stochastic EA for MetaTrader5 offers significant advantages that cater to both novice and experienced traders, enhancing the trading experience through automation, customizability, and robust risk management. Embracing this advanced tool could be a game changer for adaptability in various market conditions.

Reviews

There are no reviews yet.