Sale

Super Gold Arrow MT4

$100 Original price was: $100.$29Current price is: $29.

SKU:

4928999E5A9761ED

Categories: Trading Indicators

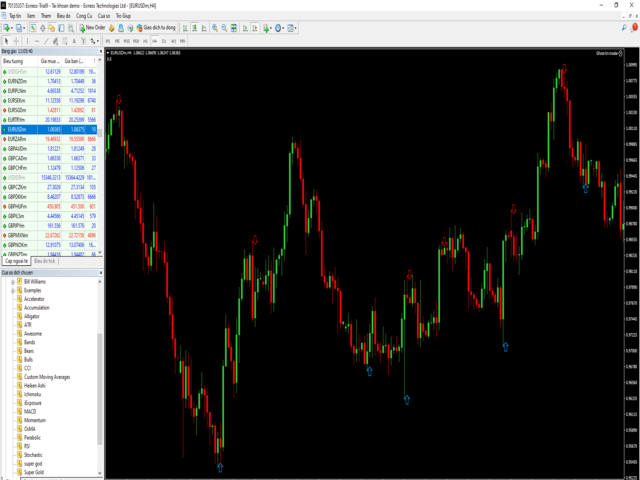

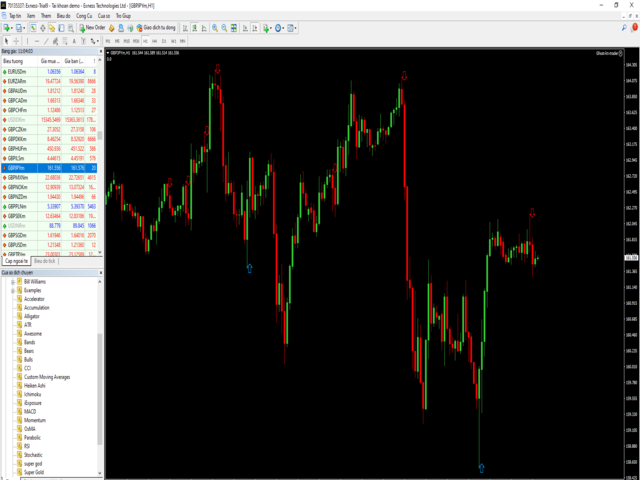

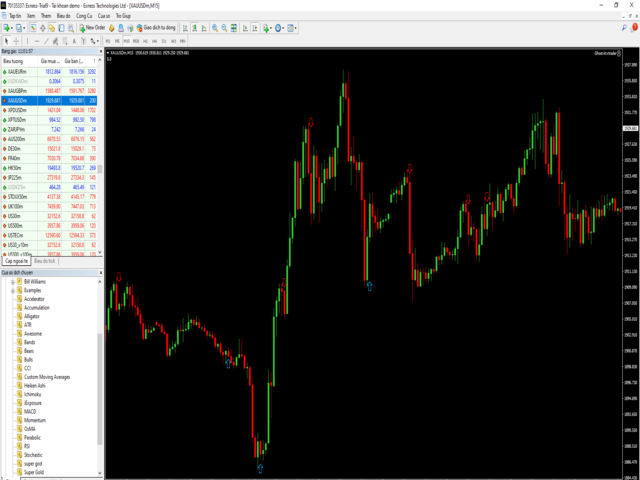

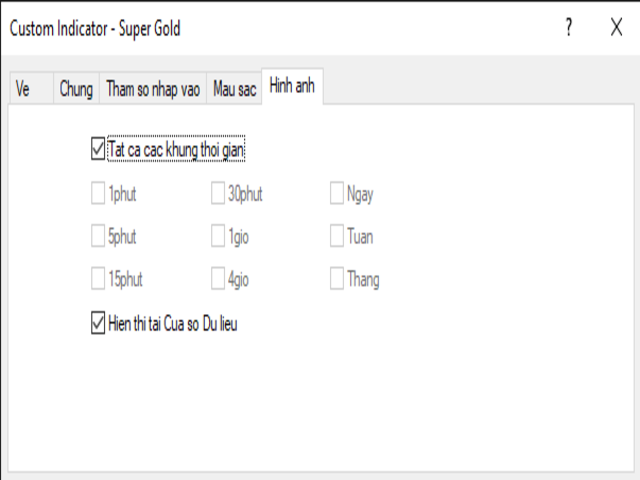

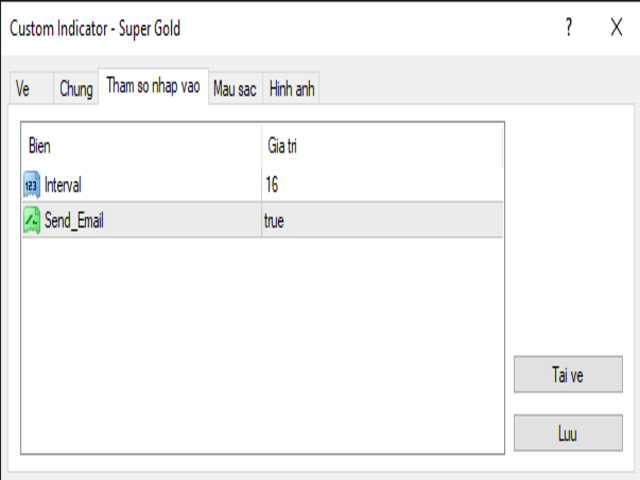

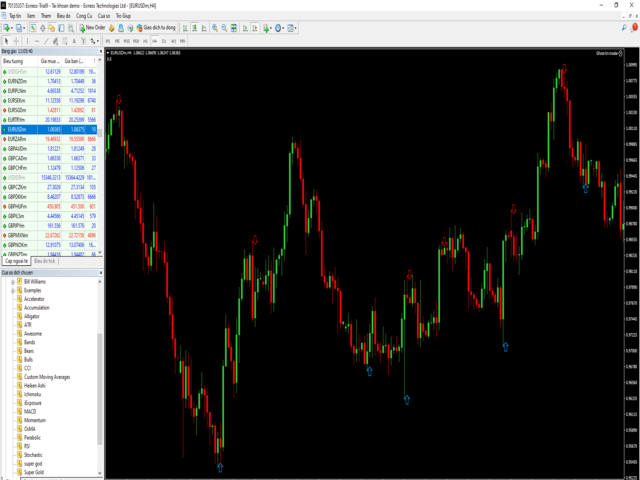

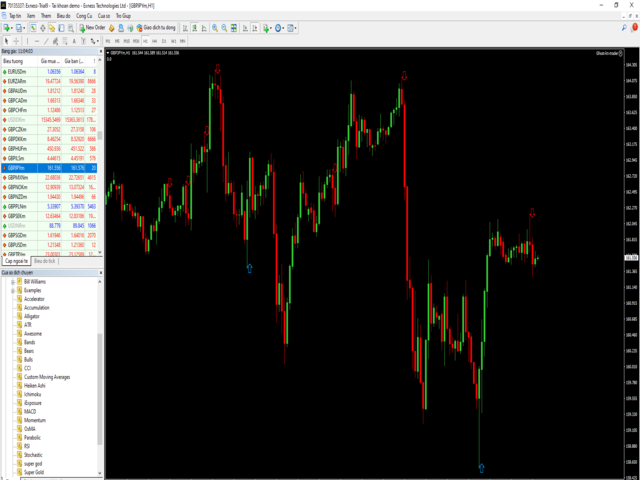

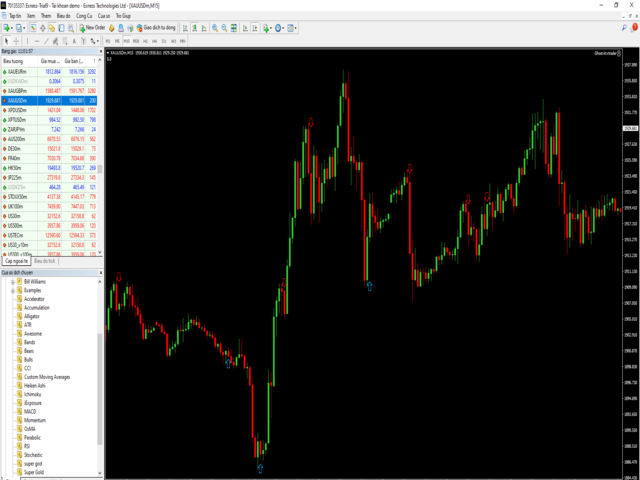

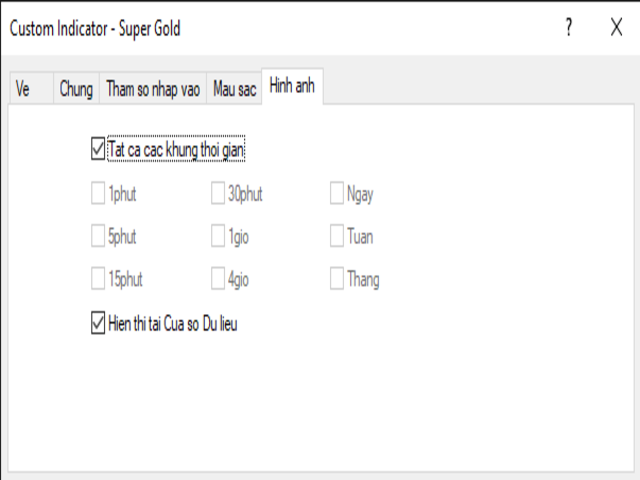

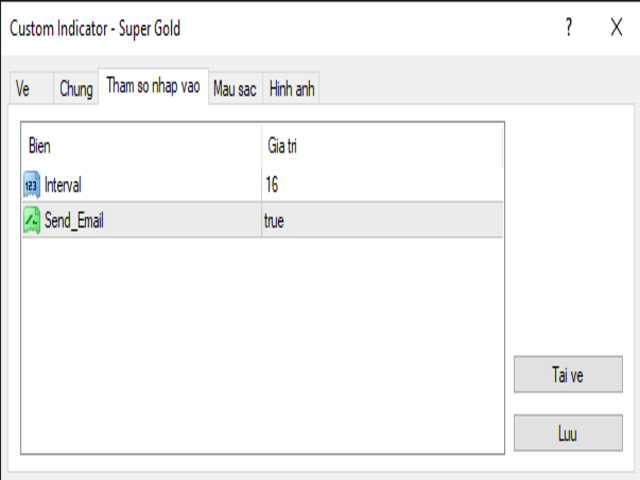

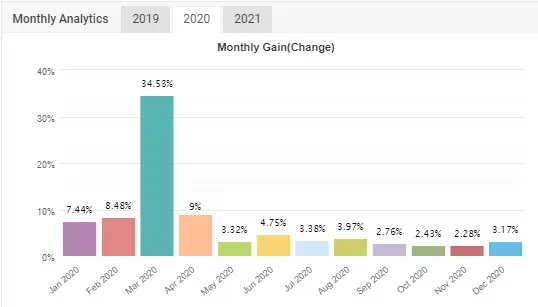

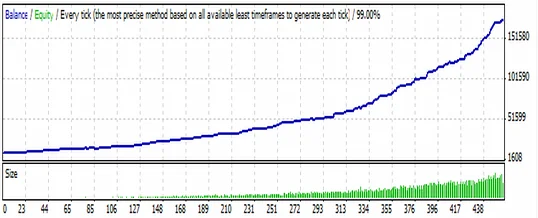

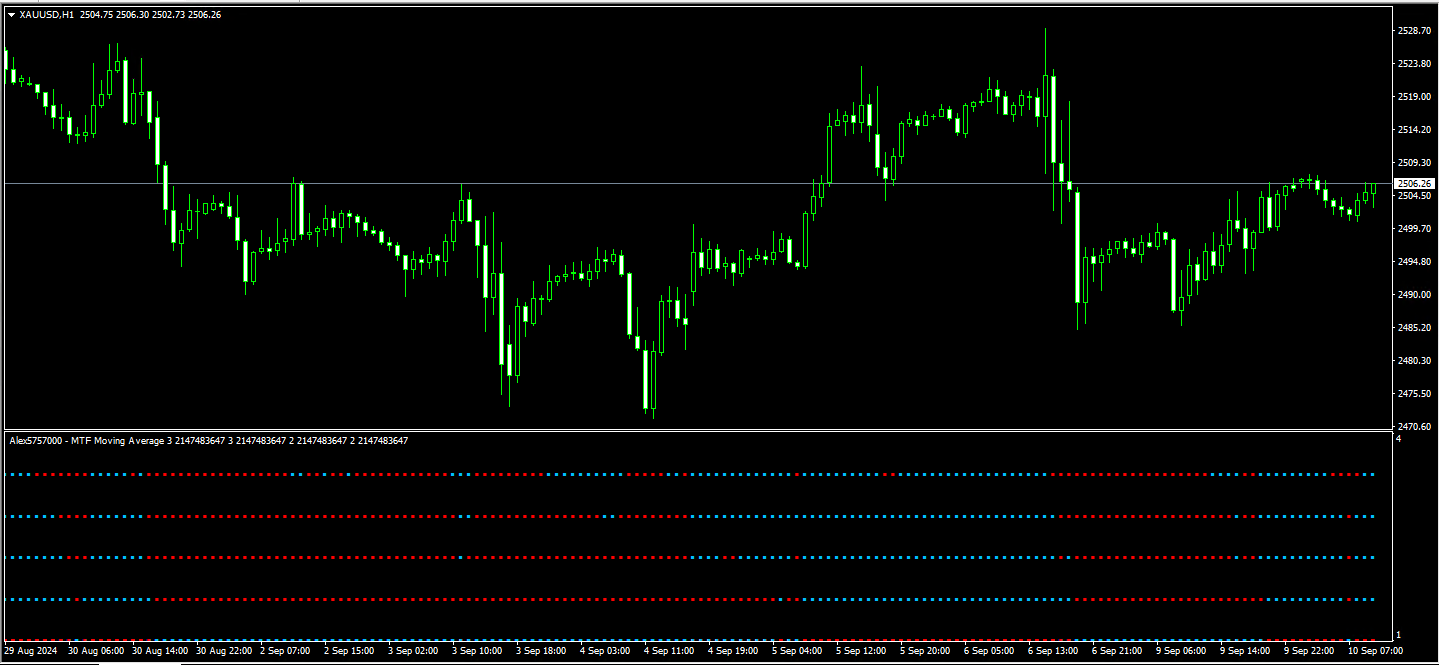

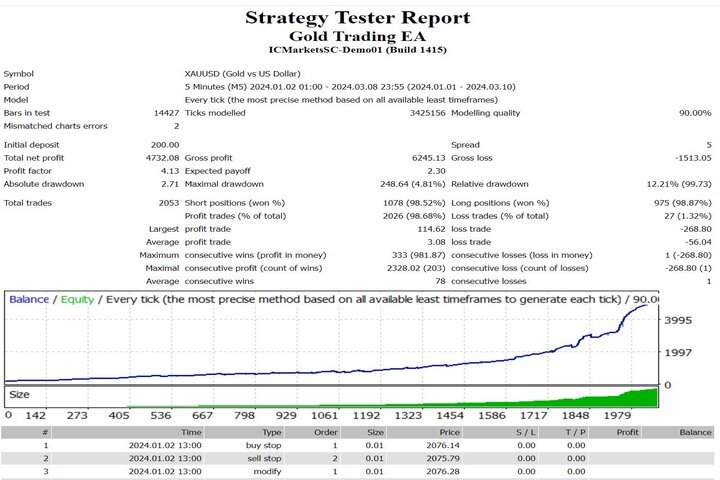

Super Gold Arrow MT4 is a non-repainting indicator designed for traders focusing on gold and currency pairs. It identifies strong reversal signals using candlestick patterns on multiple timeframes (M15 and above). With a success rate over 90%, it recommends placing stop-loss orders 20-30 pips behind the signal for optimal risk management.

Advantages of Super Gold Arrow MT4

- Strong Signal Generation: The Super Gold Arrow indicator is based on robust reversal candlesticks, making it a reliable tool for traders looking to identify potential reversals in the market.

- Multi-Time Frame Compatibility: This indicator can be effectively used across multiple time frames, from M15 and above for gold to H1 and above for currency pairs. It even allows M5 usage post volatile news events, making it adaptable to different trading strategies.

- Non-Repaint Qualities: The indicator is designed to be 100% non-repaint and non-repoint, providing traders with confidence that the signals displayed are accurate and reliable, thus ensuring integrity in trading decisions.

- High Success Probability: With a reported success probability of over 90%, traders can significantly improve their profit margins using the Super Gold Arrow, thereby enhancing their overall trading effectiveness.

- Low Stop Loss Levels: The recommended stop loss when entering trades is strategically placed behind the arrow, resulting in minimal risk exposure—typically only 20 or 30 pips in M15 time frames, allowing for efficient risk management.

How to Use Super Gold Arrow MT4

- Wait for Candle Confirmation: Always wait until the end of the candle to enter an order after the arrow appears to ensure the signal’s validity.

- Profit Ratio Management: Maintain a risk-to-reward ratio of 1:1, and once the trade moves favorably, adjust the stop loss to the entry point to lock in profits.

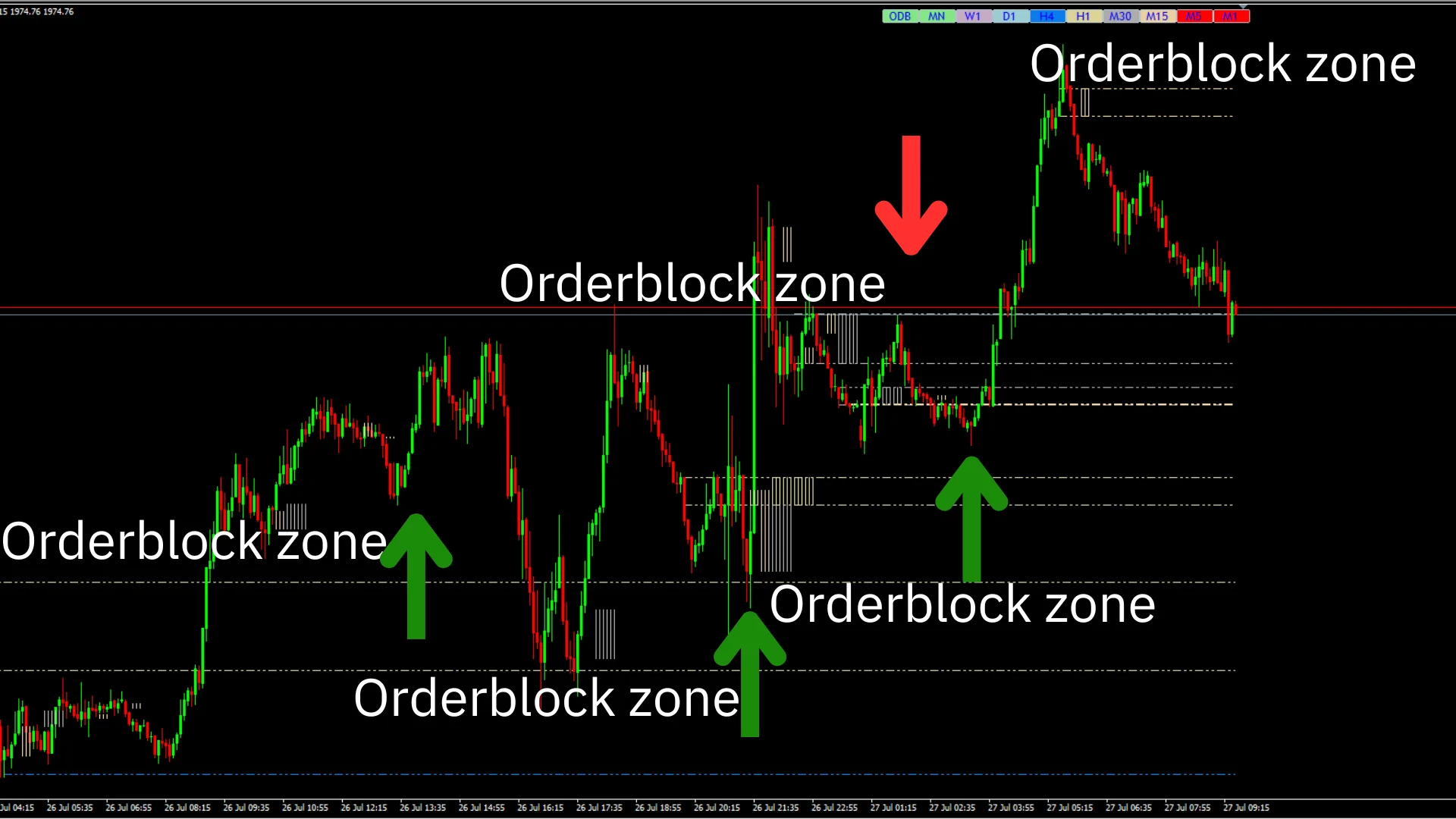

- Support and Resistance Consideration: Combine your strategies with support and resistance levels, as price is likely to move significantly when near these areas.

- Standard Stop Loss Strategy: Use a standard stop loss of 20 or 30 pips and avoid moving the stop loss after the trade is entered to minimize risks.

- Avoid High-Risk Entries: Do not enter trades when the price is far from the arrow to reduce the chances of incurring significant losses.

- Timing Your Entries: Wait for the price to be close to the arrow for a lower stop loss, optimizing your entry and risk levels.

- Maximize Profit Potential: Implement these strategies diligently to increase your chances of achieving substantial profits!

Be the first to review “Super Gold Arrow MT4” Cancel reply

Reviews

There are no reviews yet.