TD Sequence MT4

$30 Original price was: $30.$29Current price is: $29.

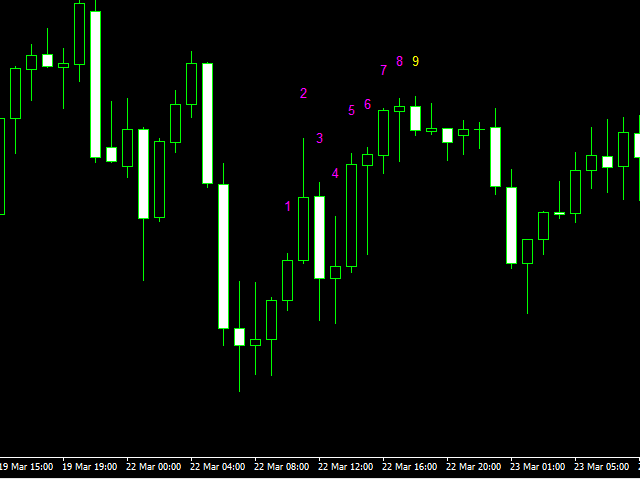

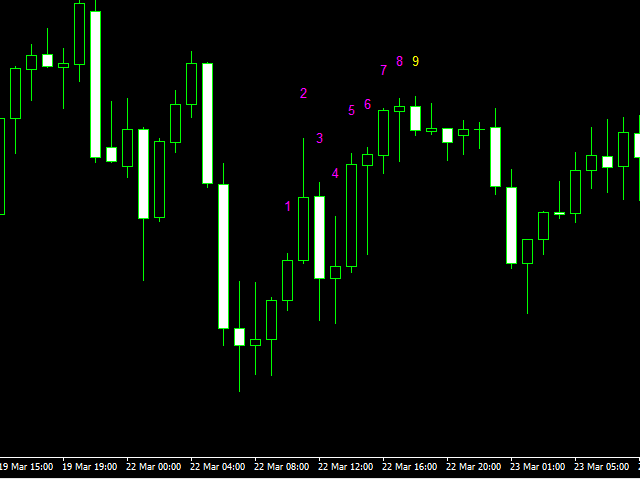

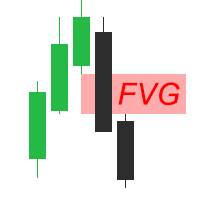

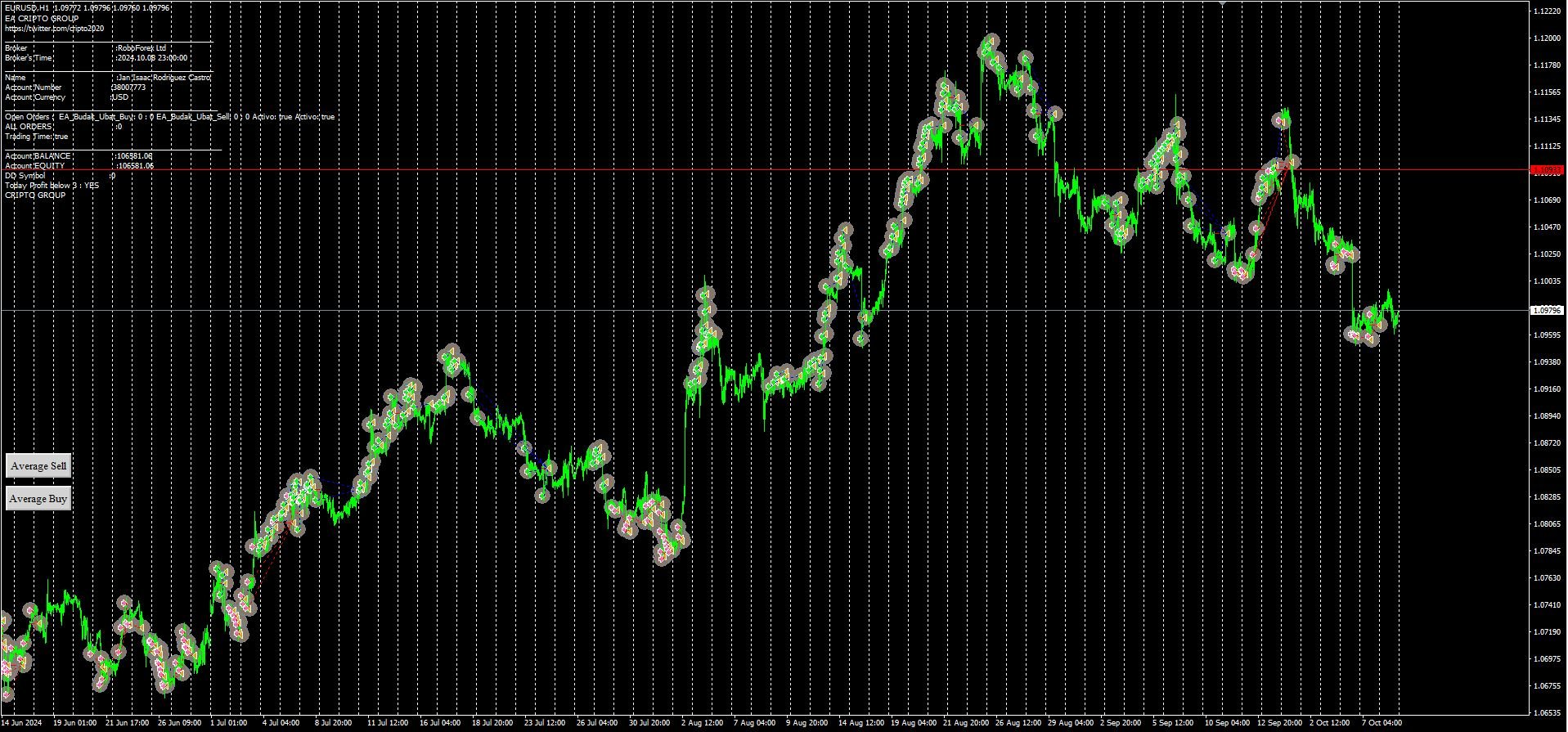

TD Sequence MT4, derived from Tom DeMark’s technique, focuses on identifying price reversals based on a series of nine candlestick closes. It includes two structures: the “High Nine” for sell signals and the “Low Nine” for buy signals. While it aids in predicting market turns, it should complement other indicators rather than serve as the sole basis for trading decisions.

Advantages of TD Sequence (九转序列) in MT4

The TD Sequence, also known as the Nine Count Sequence, derives its name from Tom DeMark’s method of analyzing the closing prices over a span of nine days. This powerful technical analysis tool offers several advantages for traders using MT4.

1. Price Reversal Signal

The TD Sequence provides clear signals for potential price reversals. The structure consists of two main setups: the High Nine Sell Structure and the Low Nine Buy Structure. When the high nine structure appears, it indicates a probable shift in market direction, allowing traders to make more informed decisions.

2. Objective Evaluation of Market Action

This sequence offers an objective way to evaluate price movements based on closing prices of each candle relative to previous candles. The clear criteria for counting help minimize emotional decision-making, promoting disciplined trading practices.

3. Effective in Various Market Conditions

The TD Sequence can be effectively used in trending and ranging markets. It is particularly useful for identifying entry and exit points during price fluctuations. In a trending market, the Low Nine structure can signal ideal buy opportunities during pullbacks, while the High Nine can suggest sell points at market peaks.

4. Improved Accuracy with Combinations

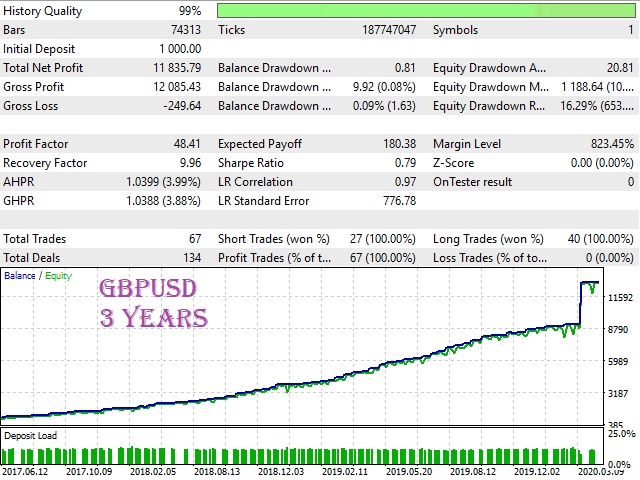

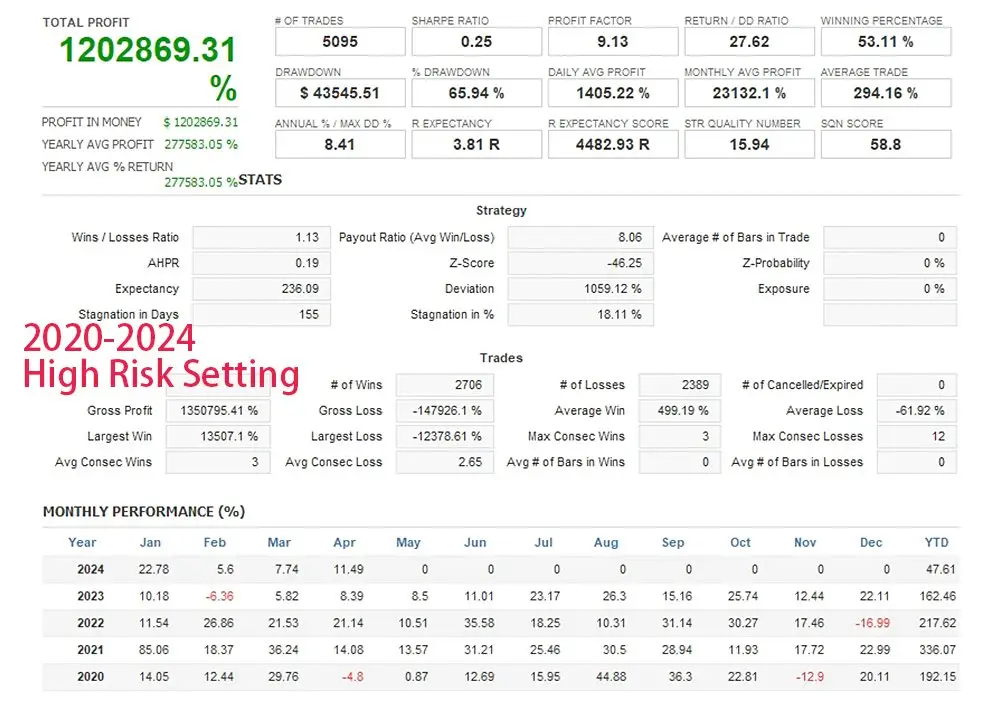

Combining the TD Sequence with other indicators such as MACD enhances the accuracy of price reversal predictions. By using multiple indicators, traders can confirm signals and reduce the likelihood of false alarms.

5. Time and Space Structure Analysis

TD Sequence emphasizes the importance of time and price levels in its structure analysis. This dual focus aids traders in assessing price action in different time frames, thereby increasing the robustness of their trading strategies.

6. Assistance in Risk Management

By analyzing both broader market indices and individual stocks, the TD Sequence provides valuable insights for risk management. Traders can optimize their position sizing and entry points based on the identified structures, thus improving overall portfolio management.

7. Guidance for Entry Timing

The TD Sequence helps traders identify favorable entry zones without being the sole basis for trading decisions. This allows for a more balanced approach to trading, where the sequence informs but does not dictate actions.

8. Adaptability to Different Time Frames

The versatility of the TD Sequence allows it to be applied across different time frames. Observing the occurrences of the Nine Count can yield different insights in short-term vs. long-term trading scenarios, making it a powerful tool for multi-time frame analysis.

9. Enhanced Performance in Volatile Markets

In volatile or choppy markets, the TD Sequence can be particularly useful. Traders can leverage the sequence to identify potential reversals amidst price fluctuations, effectively maximizing profits in uncertain conditions.

In summary, the TD Sequence (九转序列) in MT4 is a valuable asset for traders seeking to gain an edge in market prediction and price structure analysis. By incorporating this tool into their trading strategies, individuals can improve their decision-making process and enhance their overall trading success.

Reviews

There are no reviews yet.