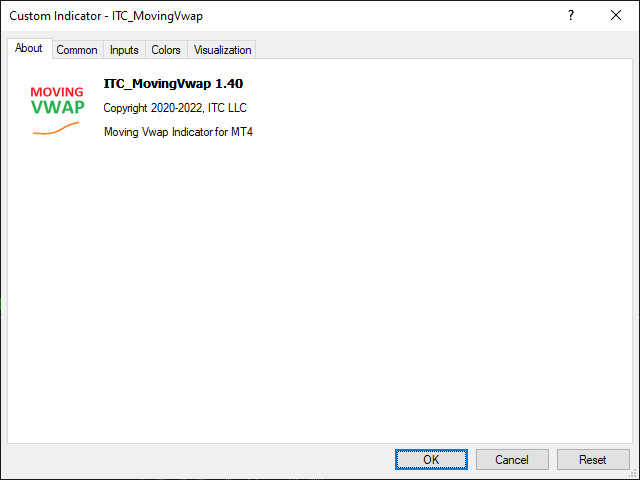

VWAP indicator for MT4

$127 Original price was: $127.$29Current price is: $29.

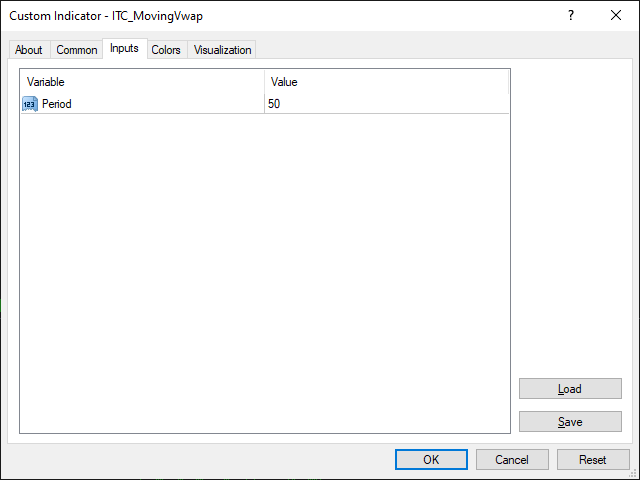

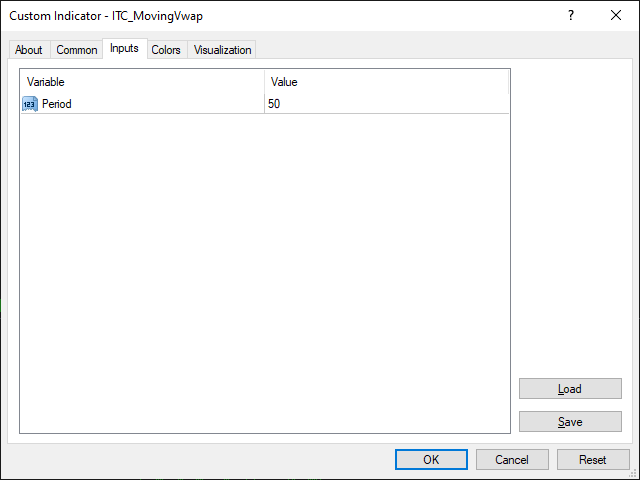

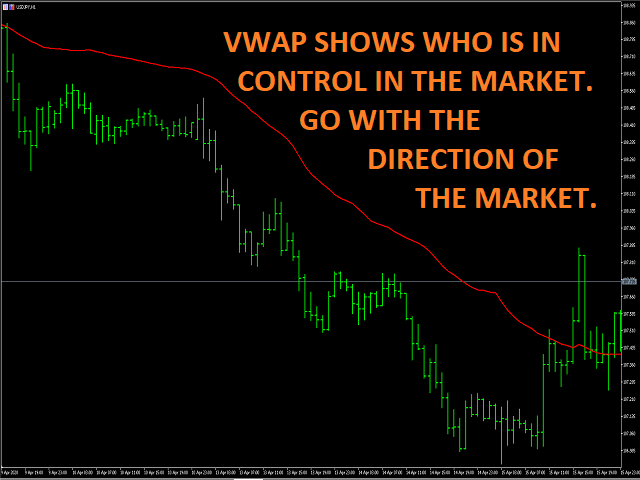

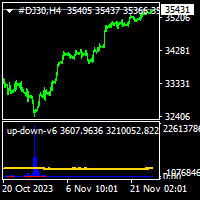

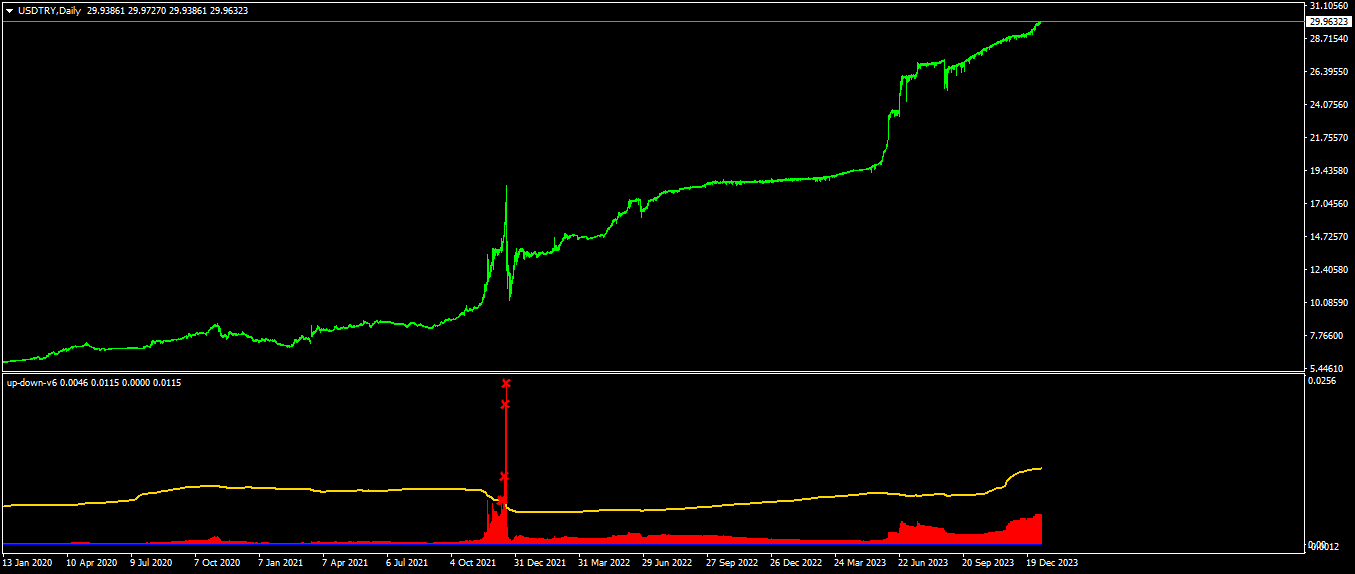

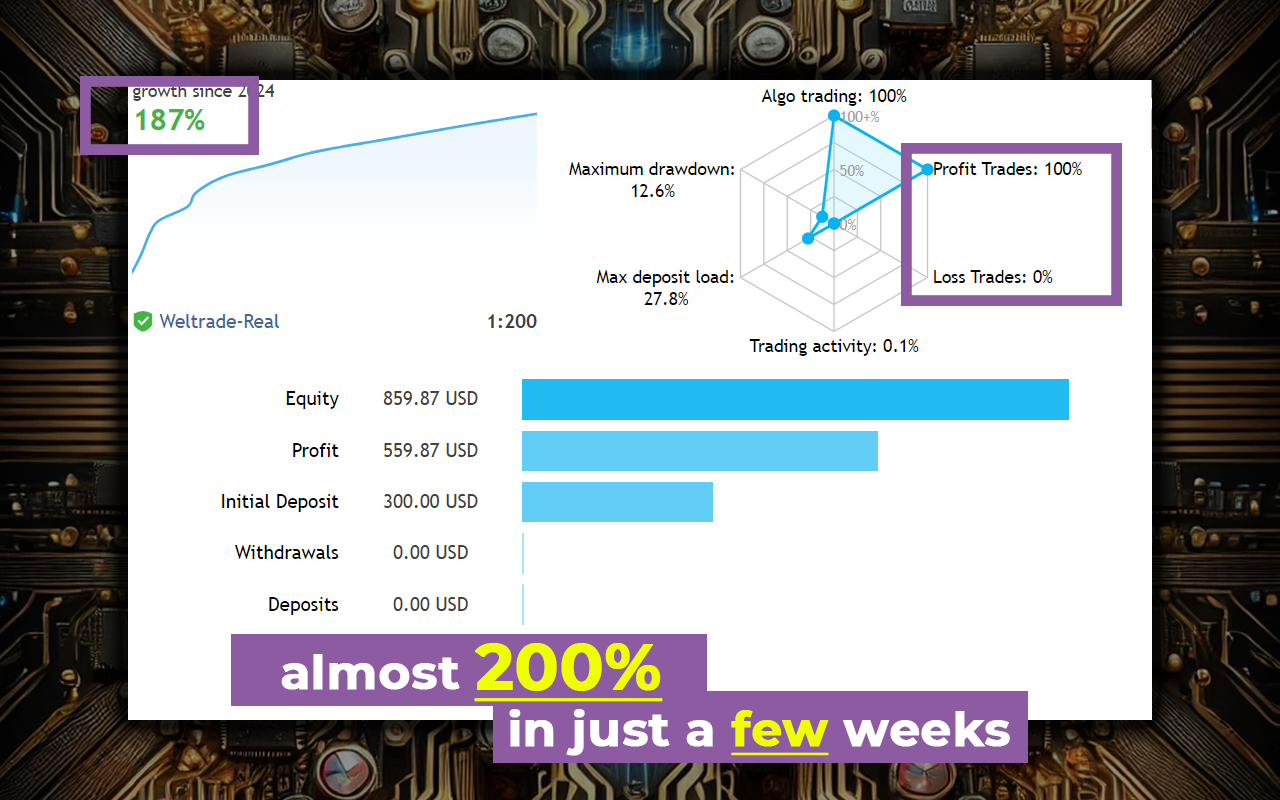

The Moving VWAP (Volume-Weighted Average Price) indicator for MT4 calculates an average price based on both price and volume, making it a crucial tool for traders. It indicates bullish or bearish market trends based on price position relative to VWAP and aids in low-risk market entries. Suitable for various asset classes.

Advantages of the VWAP Indicator for MT4

The Volume-Weighted Average Price (VWAP) indicator is a powerful tool for traders using MetaTrader 4 (MT4). Here are several key advantages of incorporating the VWAP indicator into your trading strategy:

1. Accurate Market Reference

The VWAP provides a more accurate representation of the mean price in the market by considering both price and volume. This allows traders to understand where the majority of trading activity has occurred, providing a strong reference point when assessing market trends.

2. Support and Resistance Levels

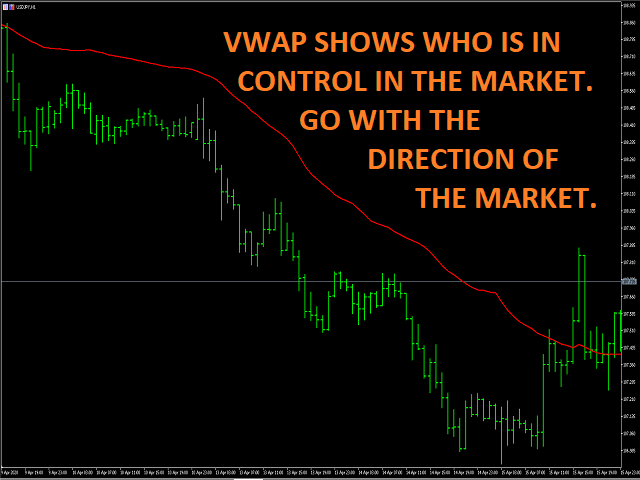

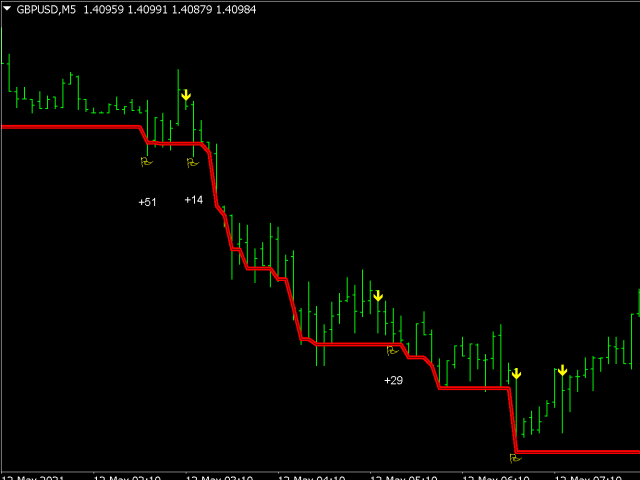

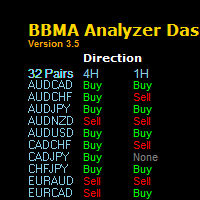

Institutional traders often use the VWAP as a level of support or resistance. When the price moves above the VWAP, it signifies a bullish market; conversely, a price below the VWAP indicates a bearish market. This dynamic allows traders to make informed decisions about entering or exiting positions.

3. Low-Risk Entry Points

The VWAP indicator is ideal for identifying low-risk entry points. Due to its nature as a mean price based on volume, entering the market near the VWAP can provide a better risk-to-reward ratio. Traders can position themselves strategically, taking advantage of market reversals or continuations.

4. Versatility Across Asset Classes

The Moving VWAP can be used with any asset class that provides volume data, including Forex, stocks, futures, commodities, and cryptocurrencies. This versatility makes it a valuable addition to any trader’s toolkit, regardless of their preferred investment vehicle.

5. Functionality Across Various Time Frames

Another significant advantage is the VWAP’s adaptability across different time frames. Whether you are a day trader looking for short-term signals or a long-term investor searching for larger trends, the Moving VWAP can be effectively utilized in your trading strategy.

6. Enhanced Decision Making

By analyzing price movements in relation to the VWAP, traders can enhance their decision-making processes. It provides insights into market momentum and can help traders determine whether they should be taking a long or short position based on the price’s relationship to the VWAP.

Conclusion

In summary, the Moving VWAP indicator for MT4 is a multifaceted tool that offers several advantages, including accurate price representation, identification of support and resistance levels, low-risk entry points, and versatility across asset classes and time frames. Incorporating the VWAP into your trading strategy can provide a significant edge in understanding market dynamics and making informed trading decisions.

Reviews

There are no reviews yet.